Pension update - August 17, 2023

In this Pension eBlast

New processes, updates and reminders

- A pensions success story

- Providing clarity to administrators

- “Mark”ing a tremendous career

- Making your life easier!!

- Setting the record straight about the PBGF

- Seeking your help

- CAPSA seeking feedback

- CAPSA information session on risk management

- Leadership changes

Introduction

During this period of global economic volatility, it’s more important than ever to ensure Ontario’s pension plans remain strong and sustainable and that pension members are protected. Without question, this is a top priority of the pensions team at FSRA. Over the past quarter, the team has made steady progress in a variety of areas which is highlighted in this latest e-blast. Please take a few minutes to review and share with colleagues.

FSRA Reports

DB plans achieve another all-time high in Q2

The financial health of Ontario’s defined benefit pension plans continues to improve. In the Q2 2023 Solvency Report, the median projected solvency ratio reached another new all-time high at 116%, a 1% increase from last quarter. This quarter’s percentage of defined benefit pension plans projected to be fully funded on a solvency basis remained unchanged at 86%.

To learn more, access the report.

DB plans perform well in 2022

FSRA’s 2022 annual report found that most DB plans performed well and remained financially strong. The report includes investment and actuarial information and trend analysis.

Learn more in our 2022 DB Funding Report.

New processes, updates and reminders

A pension success story

FSRA is here for you when you run into difficulties with your pension entitlements. This can be seen in the case of an employee who left his organization as it was being acquired. He then deferred receiving his pension. In 2010, his pension plan was wound up. Years later, in 2022, when he inquired if he could start drawing his monthly entitlement, his former employer told him they had no record of his pension. The member then contacted FSRA for help. FSRA reviewed his documentation, contacted the employer and custodian, and found that the member’s employer had mistakenly not purchased an annuity for him as part of the wind-up process back in 2010. FSRA investigated and found that the member’s monthly entitlement was almost $2,000, starting in 2021. FSRA required the employer to purchase an annuity, ensuring the member would receive the pension they were entitled to and to pay a lump sum to address the missing payments since 2021. The member started receiving his pension in March 2023 and received a lump sum of around $41,000. Kudos to FSRA staff for their hard work on locating the member’s pension. Want to learn more about the importance of records management? We’ve added a new section on it in our Guidance consultation below.

Providing clarity to administrators

We’re proposing updates to our Pension Plan Administrator Roles and Responsibilities Guidance to include the following new sections:

- managing and retaining records

- responding to complaints and inquiries

- communicating information to plan members clearly, accurately, and timely

FSRA is now seeking public feedback on the new sections. The consultation closes on September 28, 2023.

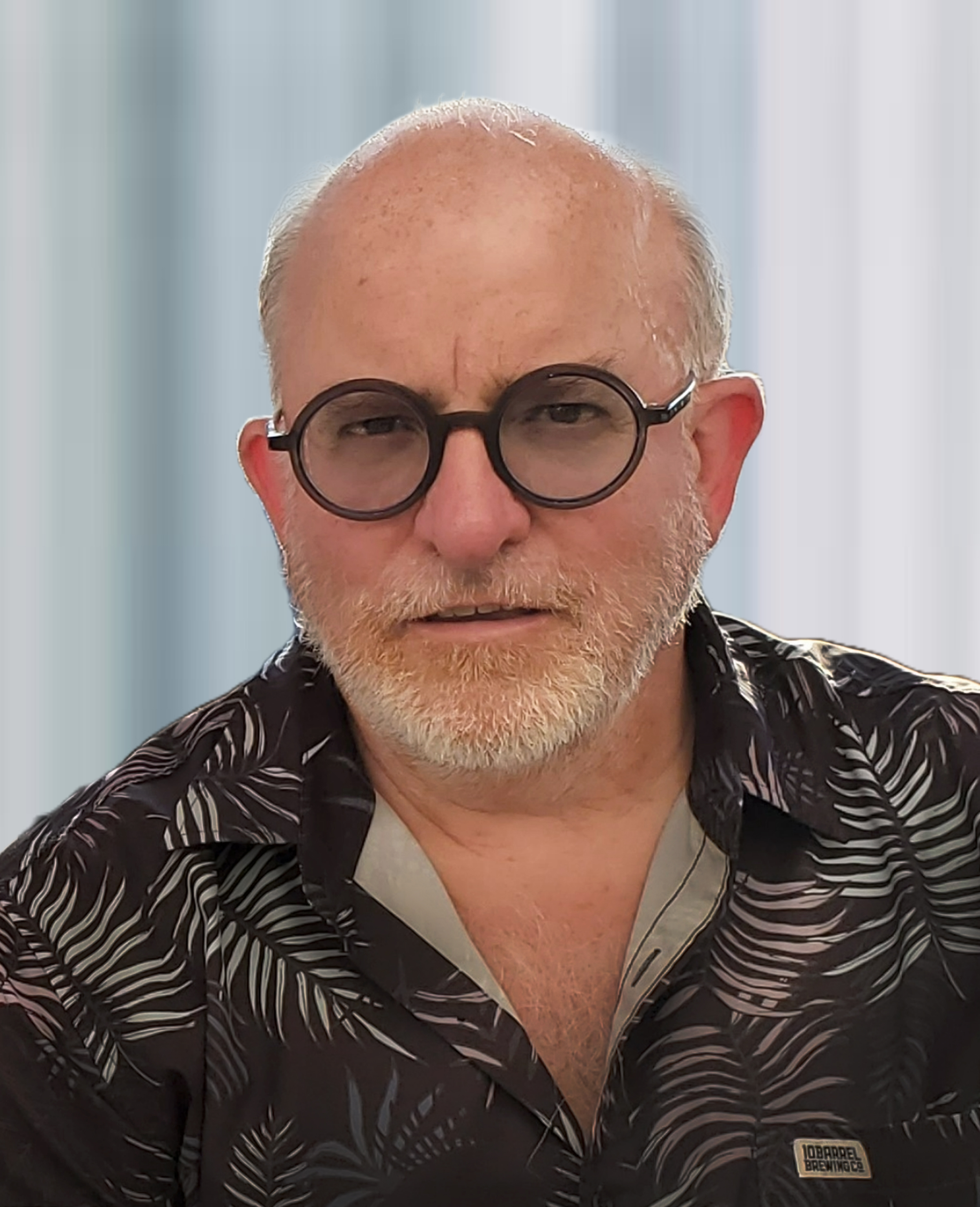

“Mark”ing a tremendous career

At the end of August, Mark Eagles, Director of Advisory Services, will retire from FSRA. Mark has spent over 32 years of his career in the pensions sector.

During his time at FSRA (and FSCO before that), Mark helped develop industry Guidance and create our Technical Advisory Committees. He also helped reform FSRA’s approach to plan wind ups and asset transfers. Mark’s goal was to help FSRA be an effective and efficient regulator, focused on member outcomes.

We, along with many in the pension industry, will miss having Mark on the Pensions team! He has been a constant source of pension information, expertise, and perspectives. He has provided steady guidance and wisdom on current and historical trends and observations on the pensions sector.

Thank you, Mark, for your countless contributions to FSRA’s Pensions team! We wish you a happy retirement and all the best in your new adventures!

Making your life easier!!

We’ve produced instructional videos to help you navigate and use the PSP with ease:

- How to accept/reject a delegated role

- How to activate your account

- How a Primary Administrator can delegate or revoke access to the PSP

- Filing a pension plan amendment

More videos coming soon – stay tuned. Detailed instructions on additional topics are also available on the FSRA website.

Setting the record straight about the PBGF

The Pensions Benefits Guarantee Fund (PBGF) protects pension plan members by providing certain guarantees to Ontario beneficiaries of single employer DB pension plans when the sponsoring entity becomes insolvent. In the interest of providing insight and transparency into the financial status of the PBGF, FSRA is pleased to release a brief infographic report setting out key information relating to the PBGF as at March 31, 2023.

The recent passage of the federal Pension Protection Act, when fully implemented in 2027, will provide a super priority that applies to pension liabilities of PBGF-eligible plans upon bankruptcy of a sponsoring employer. The implications of this new legislative development for the PBGF are being evaluated and are therefore not reflected in the Report.

Access the report to learn more about the status of the PBGF.

Seeking your help

We are seeking new members for our standing Technical Advisory Committees. These committees advise FSRA on proposed pension regulatory guidance and identify issues arising out of existing pension legislation. Committee members will be selected based on their pension knowledge, areas of expertise and level of experience, ensuring that each committee has diverse perspectives and representation from unions, plan members and retirees. If you are interested in joining a committee, please send your biography or CV to Jennifer Mullen. Please indicate which committee you would like to join. Terms for new members may begin in the fall or winter – selected individuals will be notified of their appointment term.

CAPSA seeking feedback

The Canadian Association of Pension Supervisory Authorities (CAPSA) is seeking feedback on its draft Pension Plan Risk Management Guideline. The Guideline’s purpose is to support plan administrators in fulfilling their fiduciary obligations, including appropriate consideration of their applicable standard of care. The deadline for feedback is September 30, 2023. Please send your feedback to [email protected], with the subject line, “Attention: CAPSA Secretariat.”

CAPSA information session on risk management

The Canadian Association of Pensions Supervisory Authorities (CAPSA) is hosting an information session to inform stakeholders about the CAPSA Pension Plan Risk Management Guideline. Attendees will have an opportunity to ask questions.

Date: Wednesday, September 6, 2023

Time: 2 – 3 p.m. EST

Leadership changes

Recently, FSRA made some leadership changes that included welcoming Andrew Fung as Acting Executive Vice President, Pensions. Andrew has over 35 years of experience in the pension industry. He joined the Financial Services Commission of Ontario (FSCO) as its chief actuary (pensions) in 2018 and transitioned to FSRA in 2019 as head of relationship management and prudential supervision.

Our commitment to our operational priorities for the 23/24 year remains. We are committed to maintaining the highest standards of regulatory oversight and fostering a stable financial services environment for stakeholders, consumers and pension beneficiaries.

We would like to express our sincere thanks to former Executive Vice President, Caroline Blouin. Caroline made valuable contributions that were instrumental in the launch of FSRA and the development of our regulatory approaches. We wish Caroline all the best in her future endeavours.