Why is FSRA interested?

Effective July 1, 2021, regulatory oversight of Non-Qualified Syndicated Mortgage Investments (NQSMIs) in Ontario is shared between FSRA, under the Mortgage Brokerages, Lenders and Administrators Act, 2006 (“MBLAA”) and its regulations, and the Ontario Securities Commission (OSC), under the Securities Act and related Rules and Instruments.

The OSC now oversees NQSMIs sold to non-Permitted Client investors/lenders (i.e., less sophisticated investors). This provides SMI investors with protections that are consistent with other securities sold to the public.

FSRA continues to regulate NQSMIs sold to Permitted Client investors/lenders.

What we did and how we did it

As of July 1, 2021, mortgage brokerages were required to file a quarterly report on NQSMI transactions with Permitted Clients. The deadline to file the NQSMI Quarterly Report is 10 business days after the end of the quarter. More information is available in the FSRA approach guidance for NQSMI transactions.

As per the Guidance, mortgage brokerages are required to confirm in the NQSMI Quarterly Report whether they dealt or traded in NQSMIs in the previous quarter. If so, they are required to provide details about these transactions. Quarterly reporting on NQSMI transactions must be submitted by all licensed mortgage brokerages.

This new reporting replaced the requirement to file the Disclosure Form 3.2 for each new NQSMI transaction within 5 days of the form being submitted to the consideration of a potential investor/lender and the related $200 payment per form submitted. The requirement to use the FSRA Forms 3.0, 3.1 and 3.2 was also removed. Data collected in the new quarterly reports does not duplicate data collected about NQSMI transactions in the Annual Information Return (“AIR”).

These changes significantly increase regulatory efficiency for the industry. Industry stakeholders welcomed these changes to reporting requirements during formal and informal consultations.

The NQSMI Quarterly Report is intended to cover all newly funded loans during that quarter, as well as some legacy transactions data. The form for the report is made available for completion on Licensing Link one month prior to the end of the current quarter. FSRA sent advance notifications to industry.

What we found and how it was addressed

The first NQSMI Quarterly Report, for the period from July 1 to September 31, 2021, was due on October 14, 2021. The due date was extended to October 29, 2021, as this was a new filing.

Below are the first NQSMI Quarterly Reporting highlights:

- 815 (68%) mortgage brokerages filed the report. As this was a first and new report, FSRA waived regulatory actions for non-filers as a one-time exception

- 42 (of the 815) mortgage brokerages reported dealing in NQSMIs:

- 184 NQSMI transactions were reported

- total committed amount was $2.1 billion, out of which $1.5 billion was advanced

Data breakdown

Below is the breakdown of the data obtained from the first quarterly report. FSRA will continue to monitor and share the data, as well as any implication of trends noted to our supervision, if applicable.

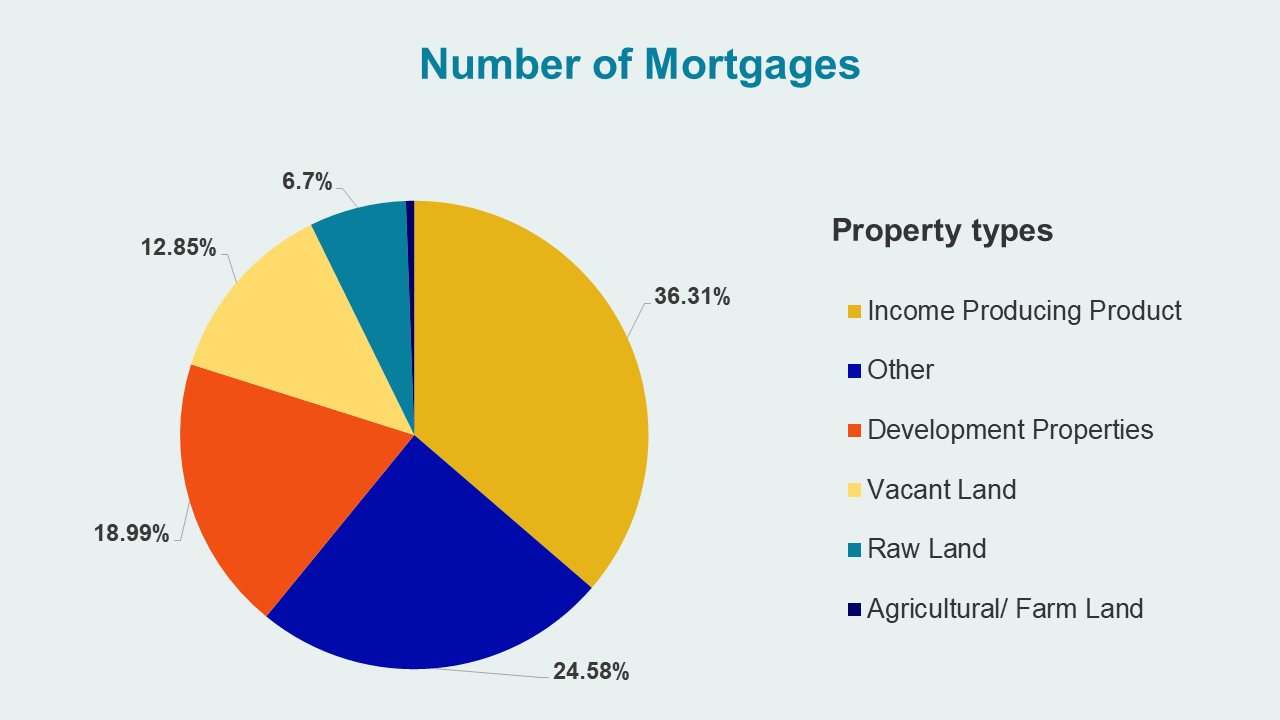

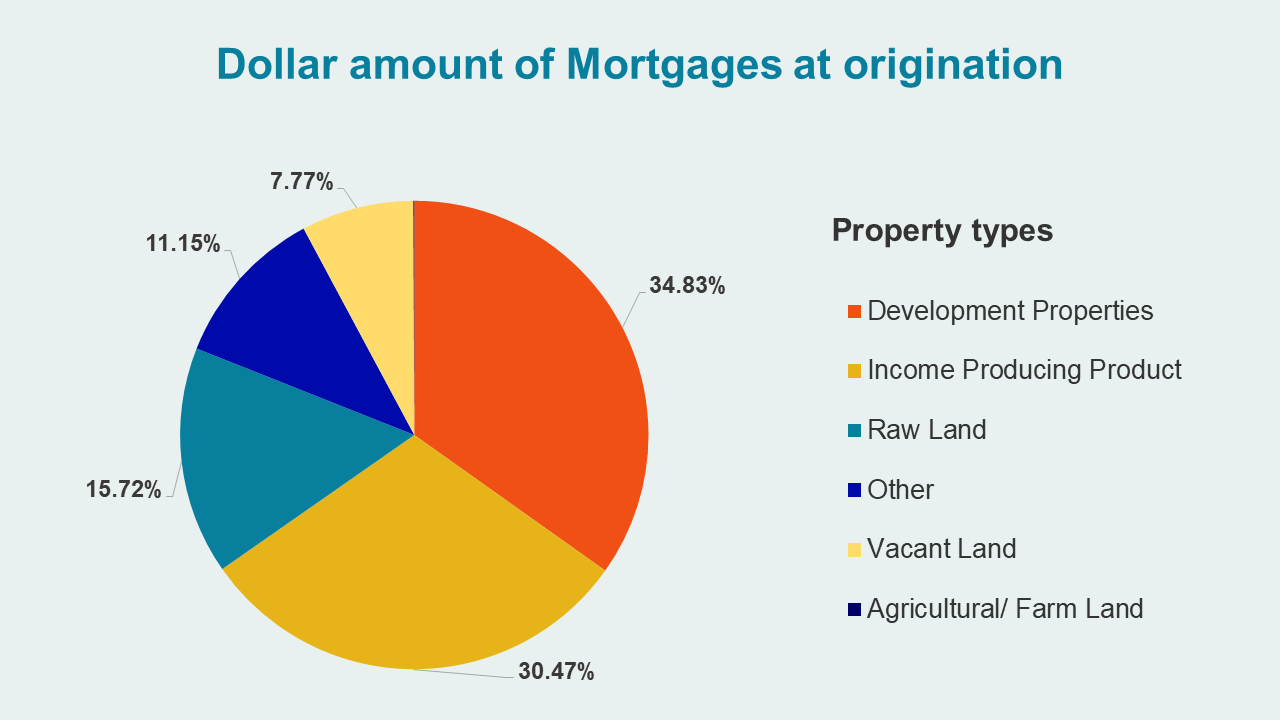

Type of properties1

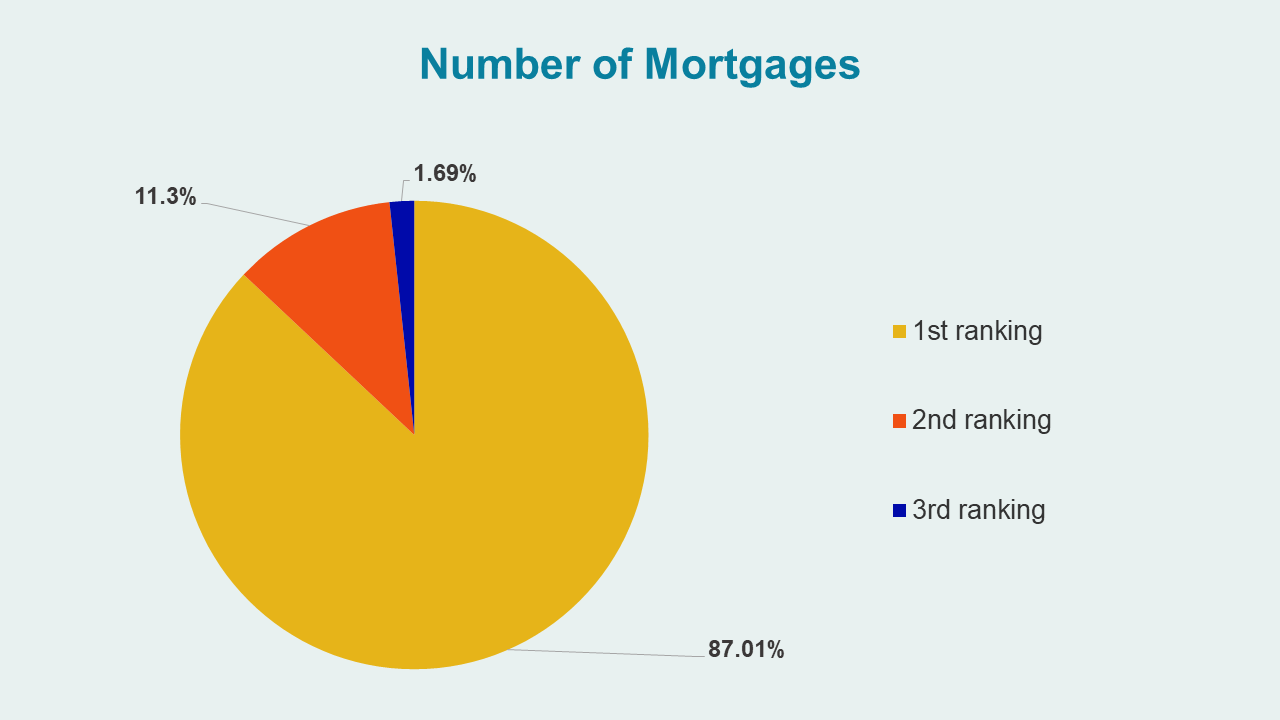

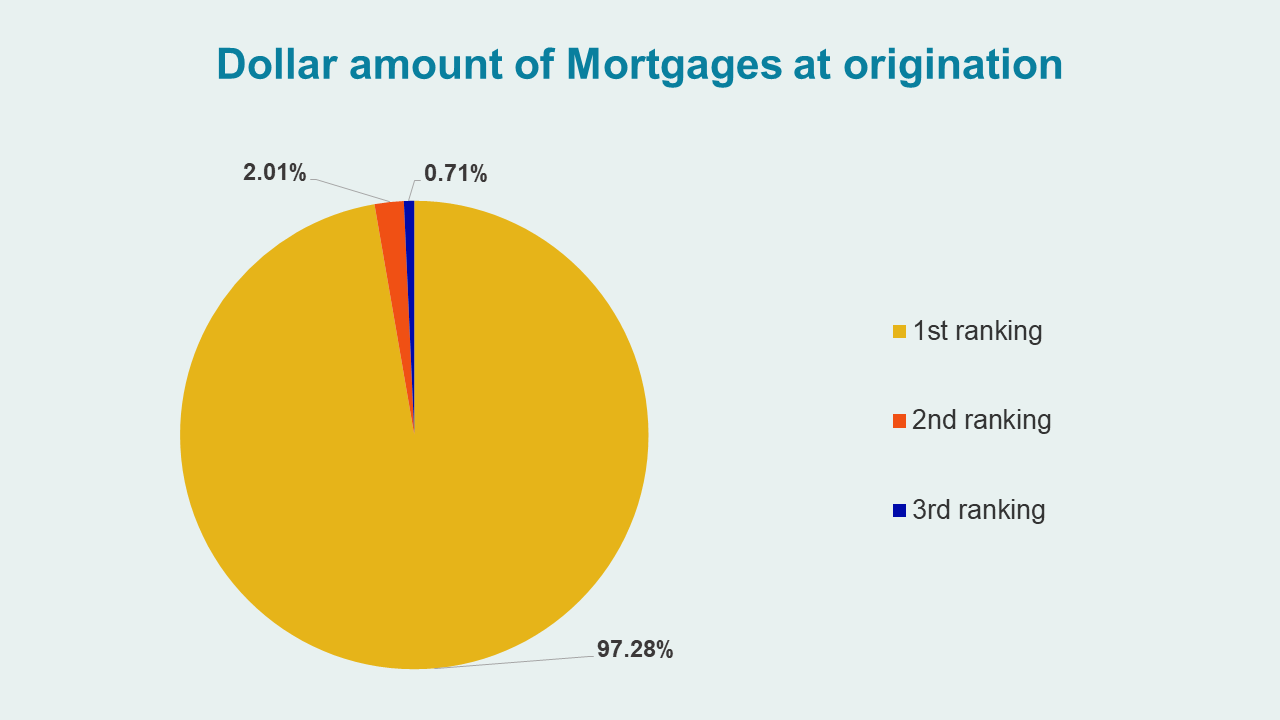

Mortgage ranking

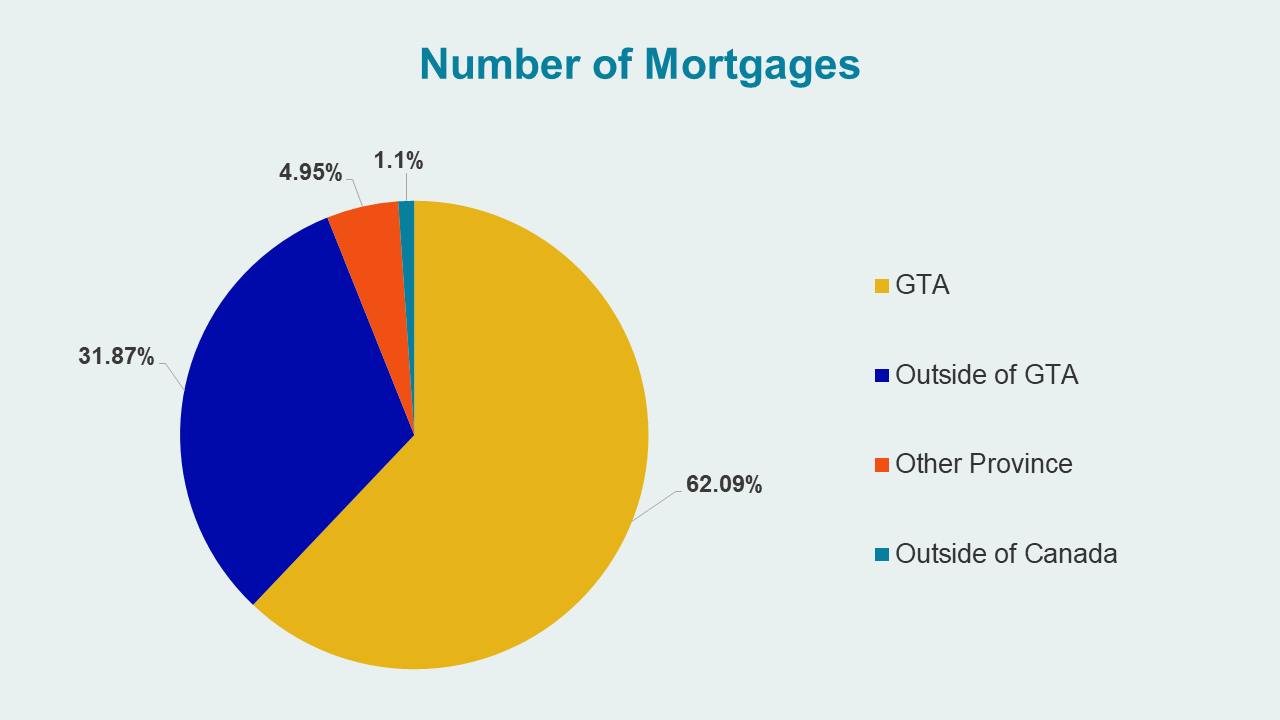

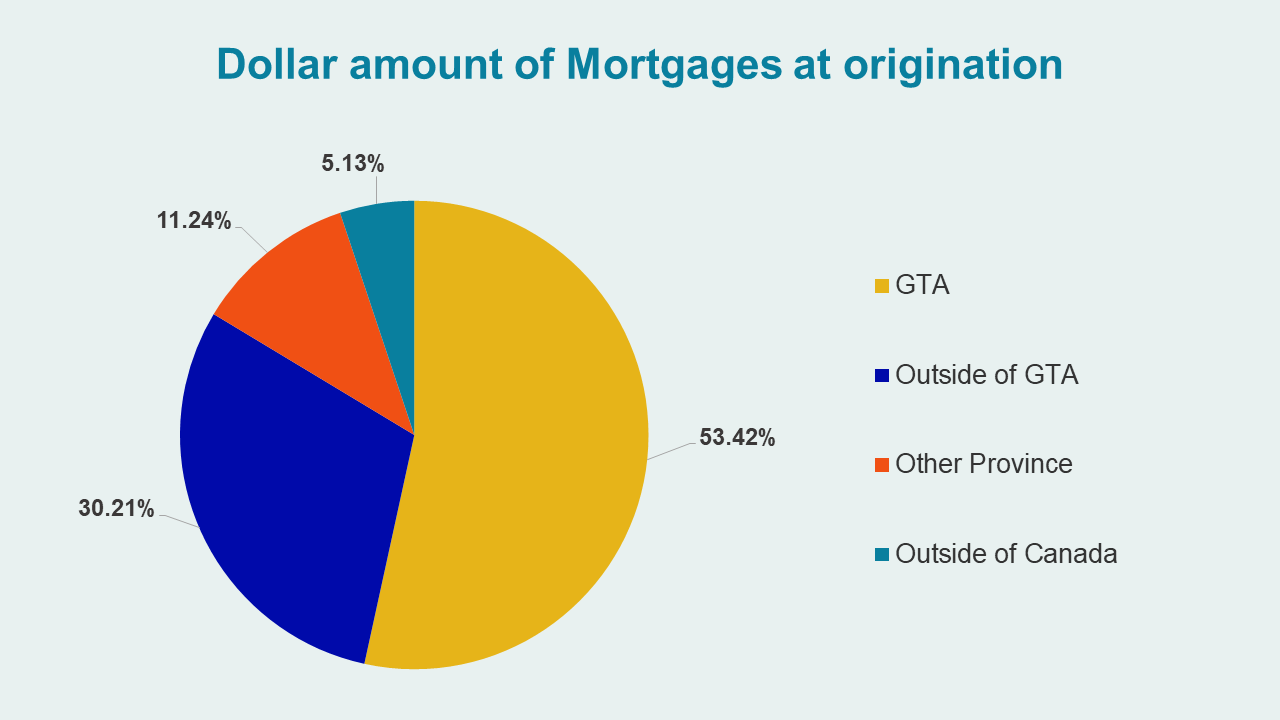

Geographical locations

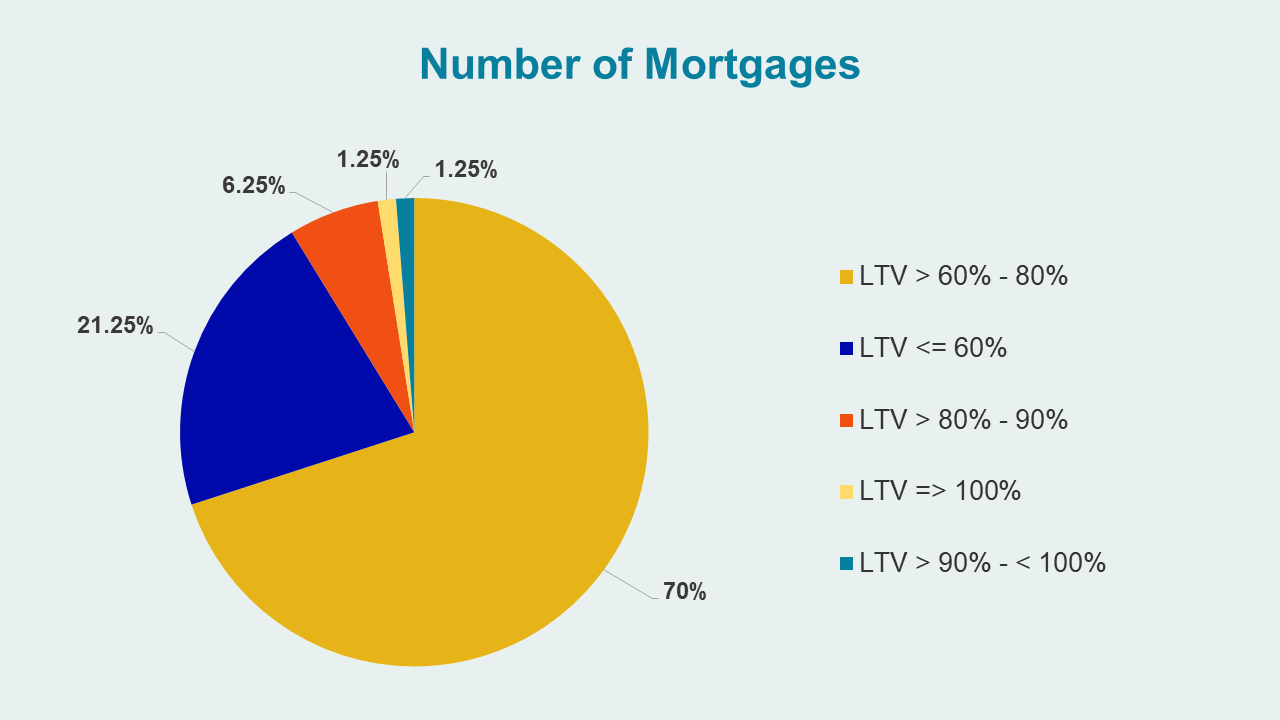

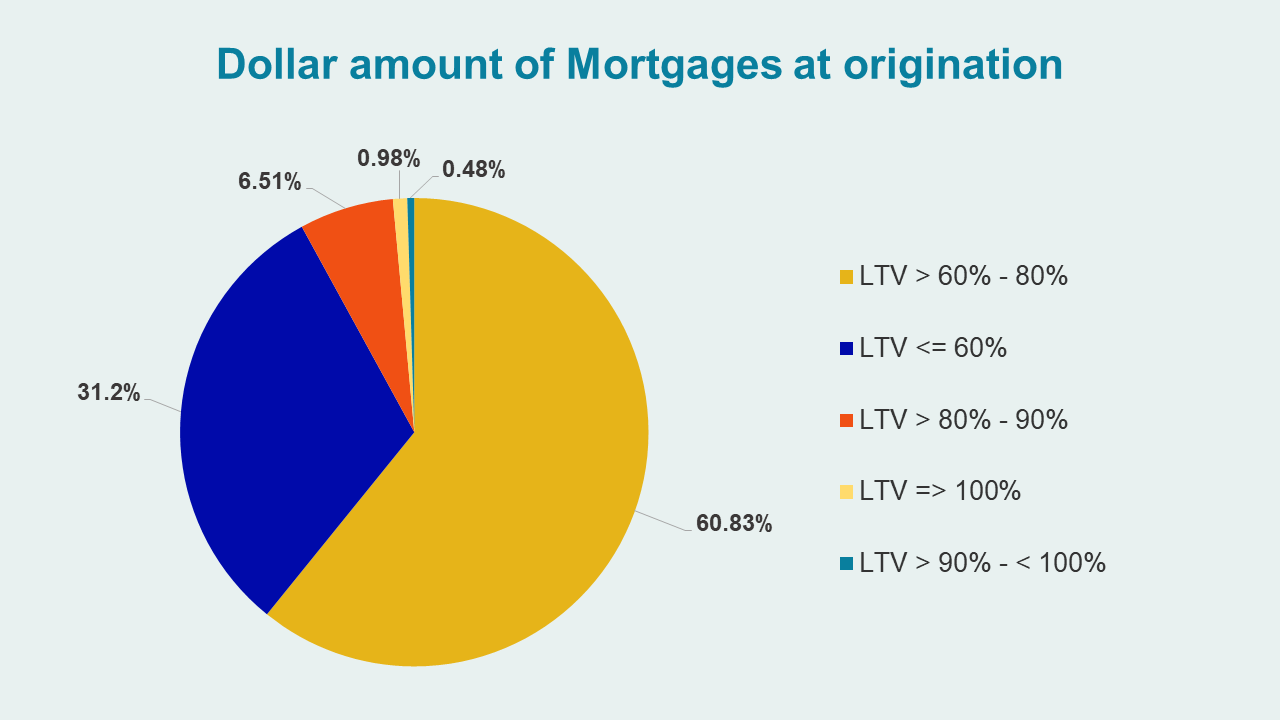

Loan-to-value for income producing properties

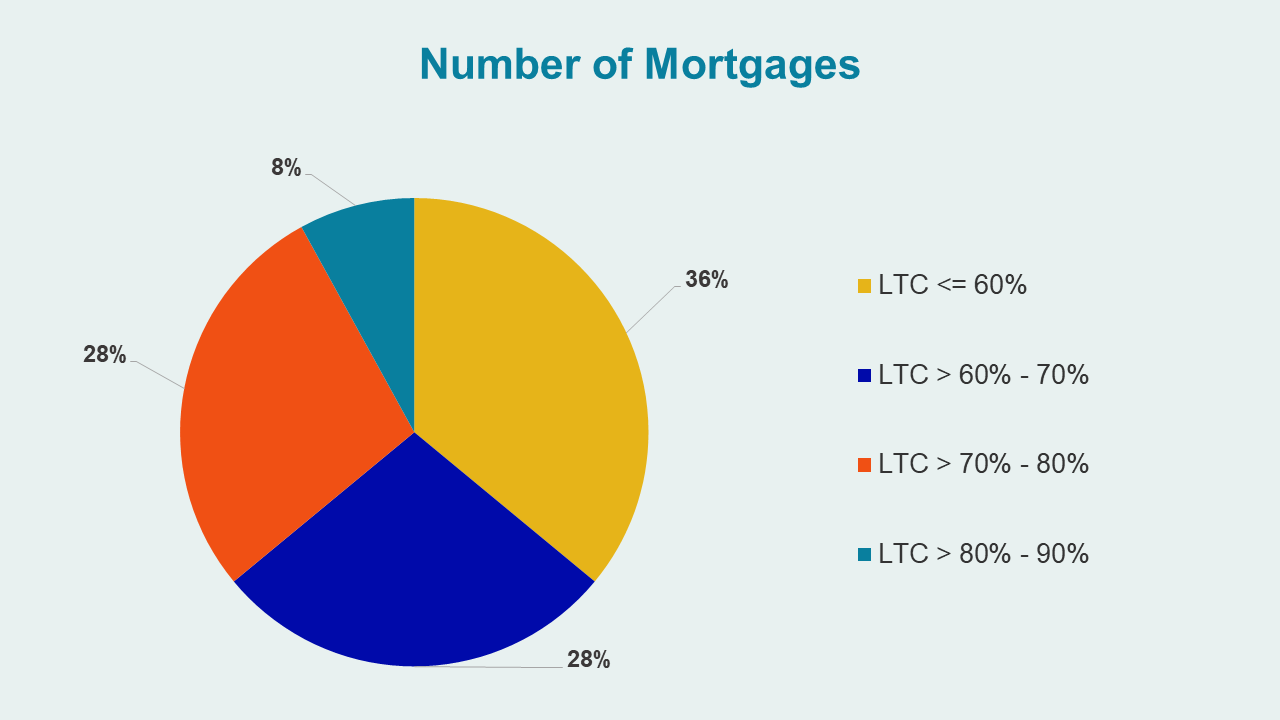

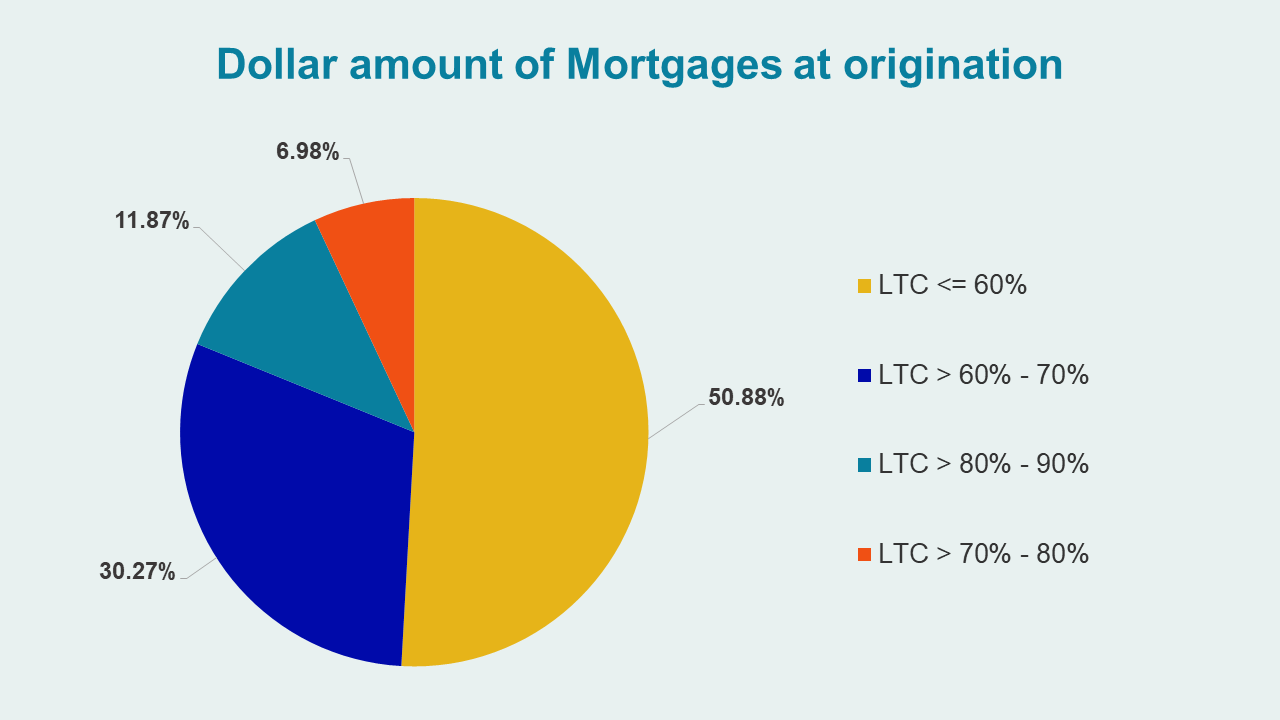

Loan-to-cost for development or construction properties

Policies & procedures manuals (“PPM”) review

FSRA reviewed 42 PPM excerpts related to the updated NQSMI supervision and policies and procedures for the mortgage brokerages that reported dealing and trading in NQSMIs during the first reporting period. Below are the key findings from the review:

- lack of reference to legislative changes to reflect the transfer of oversight framework for NQSMIs in Ontario

- lack of documented processes on the verification of investors/lenders and borrowers’ classes

- lack of reference to the specific MBLAA requirements between individual Permitted Clients and entity Permitted Clients

- reference to Form 3s, which are no longer required after the transfer of oversight framework

Next reports requirement

FSRA reviewed all feedback obtained during the submission of the first report and thanks industry for their comments. Based on the feedback from industry, FSRA has updated the data collection format of the second report. The new format was socialized with a sample of industry participants, and the comments were positive.

FSRA will continue to work with industry participants to come to a balanced approach to data gathering without adding undue burden to licensees.

What this means for you

FSRA would like to remind industry of their duties to ensure that they comply with required regulatory filings. Similarly, the Policies and Procedures Manual should be updated in a way that ensures that the mortgage brokerage can continue to comply with the MBLAA, its regulations, and FSRA Guidance and Rules as the regulatory environment evolves.

1 Reported “Other” type of properties were, for example, residential properties that are owner-occupied, Debtor-In-Possession Loans, Mixed use properties including improved land for development, Industrial (not income producing property), Serviced Lots that are for sale, etc.