Executive summary

The mortgage brokering sector in Ontario is growing, as more consumers rely on mortgage professionals to assist with one of the largest financial purchases of their lifetime: buying a home. In Ontario, the number of licensed agents increased by 17 per cent between June 30, 2020 and 2021, while the number of brokerages and brokers stayed relatively stable from last year. As of March 31, 2021, there were 2,749 mortgage brokers and 13,179 mortgage agents (from 1,251 brokerages) licensed with FSRA.

Forty percent of consumers used a mortgage broker when purchasing a new home in 2020, according to Mortgage Professionals Canada’s Annual State of the Residential Housing Market in Canada for 2020.

Licensed brokers and agents are also handling more mortgages in terms of value. CMHC reported increases in the value of mortgages originated from all types of lenders from 2019 to 2020:

- Chartered banks recorded a rise in 33 per cent of new mortgages

- Credit unions recorded an increase of 44 per cent, and

- Mortgage investment entities (MIEs) also registered an increase of 18 per cent.[1]

More consumers depend on advice from their mortgage professionals on mortgage options, suitability and affordability in a heated housing market. CMHC noted that home sales and price growth are expected to remain elevated from pre-COVID levels. Overall in Canada, CMHC reported that MLS sales increased by 12.6 per cent and the MLS average price increased by 15.6 per cent from 2019 to 2020.[2] As a result, FSRA’s supervision of the mortgage brokering sector becomes increasingly important.

FSRA’s key objects of supervision include promoting high standards of business conduct and protecting the rights and interests of consumers.[3] Fundamentally, consumers, whether they are borrowers or lenders, should expect their brokers or agents to do the following, as required under the Mortgage Brokerages, Lenders and Administrators Act and its regulations (MBLAA):

- Understand their specific needs and circumstances,

- Arrange a mortgage, or mortgage investment, that is suitable based on their needs and circumstances, and

- Provide them with complete, accurate and objective disclosure about a mortgage, or a mortgage investment, so that they can make an informed decision.

In 2020-2021, FSRA focused its supervision activities in the following areas and our key findings are:

- Private lending:

- We noted that “know your lender” information was not updated periodically when a private lender could be used by a brokerage to fund mortgages over a period of time for a number of clients.

- In some cases where a broker or agent was related to a private lender or was the private lender in a mortgage, the brokerage did not have additional procedures to ensure that the broker’s or agent’s role and any conflicts of interest were properly disclosed to the borrower. The brokerage also did not have procedures to ensure that the broker or agent will appropriately consider the borrower’s interest when assessing suitability of the private mortgage.

- Brokers or agents did not often include in their documentation why a private mortgage was suitable for the borrower

- We also noted in a number of occasions where the lender’s identity was not disclosed on a mortgage commitment letter.

- NQSMIs: there continue to be opportunities to improve disclosures to investors in NQSMIs. This is especially true at the point of renewal or extension of the mortgages or during the term of the mortgages.

- Principal Broker supervision: A Principal Broker is responsible for the conduct of the Mortgage Brokerage and its brokers and agents. “Effective supervision” means that the Principal Broker can show that he/she has taken reasonable steps to ensure compliance with every requirement under the MBLAA. We collected information through a questionnaire to 1202 Principal Brokers licensed with FSRA about their roles and responsibilities.

- The responses show that approximately 90 per cent of Principal Brokers are the brokerage owner or main decision-maker of the business. Principal Brokers who have decision-making authority and independence can more effectively carry out their responsibilities of managing compliance, because they don’t need to wait for multiple layers of approval.

- However, 86 per cent of Principal Brokers indicated that the compliance resources at their brokerage consist of either the Principal Broker alone, or with assistance from one or two additional staff. FSRA is concerned that the limited availability of resources could potentially impede compliance effectiveness at the brokerage.

Based on the above supervision findings, and current market environment and trends, FSRA has identified its supervision focus in the mortgage brokering sector for 2021-2022, as follows:

- mortgage brokerage’s practices in private lending

- mortgage administrator’s activities, especially those administering more complex or risky mortgages for non-sophisticated investors

- in addition, we will also carry out the following activities:

- continue to analyse the results of our Principal Broker supervision questionnaire with the goal of publishing best practices guidance,

- monitor the development of the NQSMI market post-transfer of certain oversight responsibilities to the Ontario Securities Commission (OSC), and

- examine any new business models or mortgage products as the market evolves.

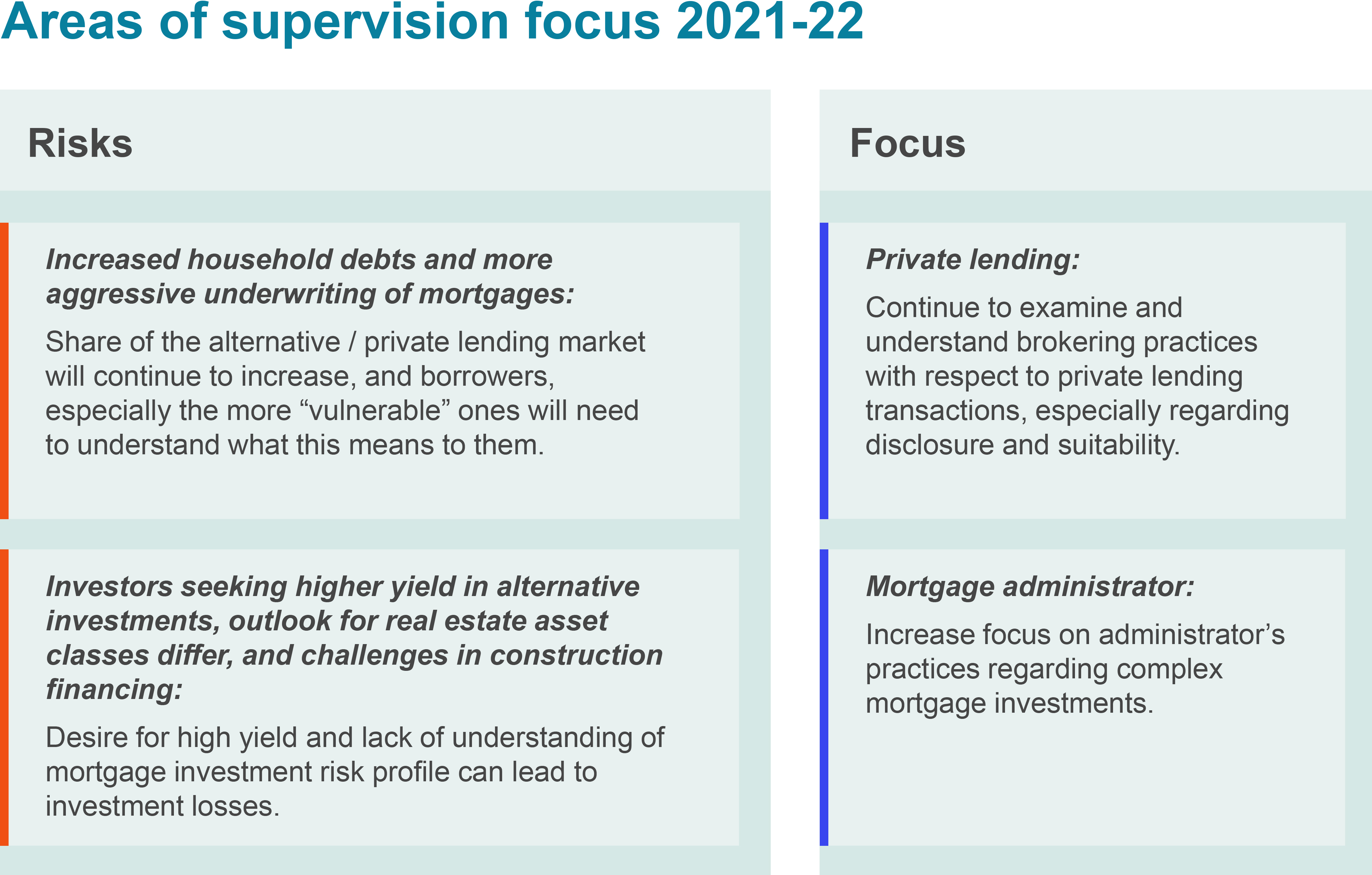

The following are the key market environment and trends that we observed that informed our supervision for 2021-2022:

- Growing alternative or private lending market: The Bank of Canada (Bank) in its latest Financial System Review – 2021 noted increased household debts and greater proportions of new mortgages with higher loan-to-income and loan-to-value ratios. Statistics Canada also reported that uninsured residential mortgages extended by non-bank lenders increased by 49 per cent from Q4-2019 to Q4-2020.[4] These are signals that the alternative or private lending market continues to grow. Mortgage brokerages play an important role in these markets. They help borrowers find suitable mortgage solutions with their interests in mind. At this time, with uncertainty in the mortgage rate environment, it is critical that brokerages explain the financing options, risks and consequences of borrowing more to their clients, especially those who are more vulnerable.

- Increased appetite for higher yield investments: Investors seeking higher yield are increasingly turning to alternative investments, like mortgages. The Bank noted that the total financial assets held by mortgage investment corporations (MICs) has grown rapidly since 2008 and has grown on average eight per cent over 2018 and 2019.[5] Combined with varying outlooks for different real estate investments[6], and challenges in construction financing[7] means that more investors may be getting into more risky types of mortgage investments. Disclosure to investors at the point of sale has received a lot of focus, but disclosure during the term of a mortgage investment and when the mortgage is extended is equally important. This is critical for mortgages that fund construction or raw land development, where a borrower’s ability to make mortgage payments depends on a number of external factors such as zoning approval, market absorption rate for new units, or construction supply chain disruption. This is because it’s important for investors to have the right information to make decisions and adapt their investment strategy if necessary. Mortgage administrators who service mortgages play an important role in ensuring investors receive appropriate and timely information about their investments.

This report provides details about our supervision plan and the consumer protection risks that our plan intends to address. Mortgage brokerages, brokers, agents and administrators are encouraged to review this plan and other FSRA’s publications to ensure, where appropriate, they:

- Have adequate disclosure and suitability practices when working with homebuyers seeking financing from private lenders.

- Disclose information to investors in a timely manner, not just at the point-of-sale but during the mortgage term and at extensions and renewals.

2020-2021 year in review

What did we do?

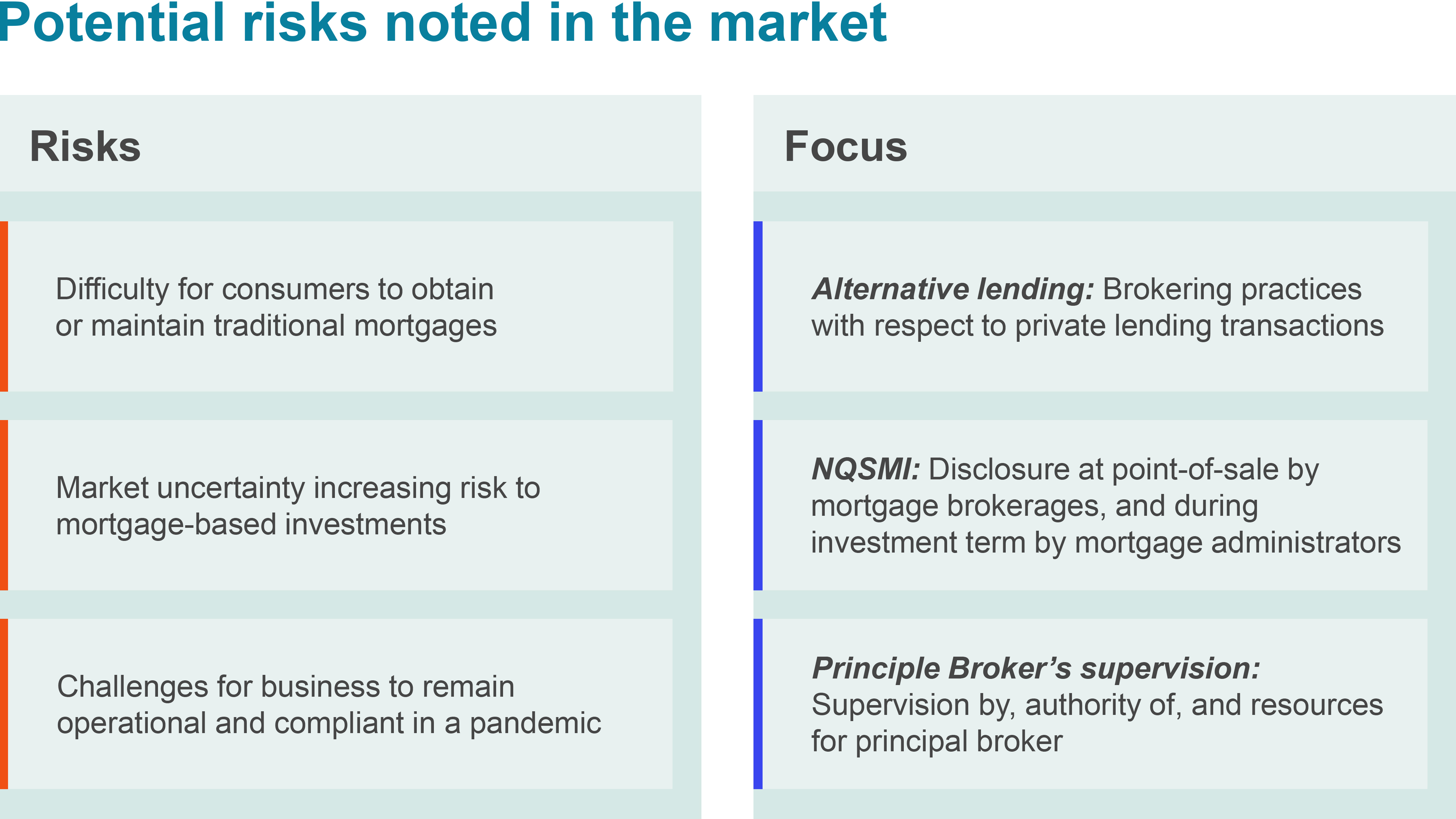

Last year was an unprecedented year. We all had to adapt to a new way of living and working to keep ourselves and our loved ones safe in a pandemic. Many people and businesses also had (and still continue) to struggle with financial uncertainties from loss of jobs or business disruption and closure of operations. Our supervisory focus last year was driven by the following observations about the pandemic environment based on discussions with stakeholders:

- Increased difficulty for consumers to obtain or maintain mortgages with traditional lenders due to economic and market uncertainty and more stringent underwriting criteria: OSFI introduced its Residential Mortgage Underwriting Practices and Procedures Guideline (B-20) in 2012 to set out expectations for strong residential mortgage underwriting for federally regulated lenders. OSFI updated Guideline B-20 in early 2021 to strengthen its expectations to address its concerns with increasing risks in an environment of historically low interest rates, high level of consumer debt and housing imbalances. More stringent underwriting criteria at traditional lenders means that these lenders will be more selective on to whom they would lend, so consumers with a lower credit rating or unsteady income will have to turn to other lenders for mortgage financing;

- Increased risks to investors in mortgage-based investments, such as non-qualified syndicated mortgage investments (NQSMIs), making timely and accurate disclosure of their investment performance more important: as FSRA noted in its Guidance on Mortgage Administrators – Responses to Market Disruptions, the pandemic can have an impact on the viability of a project or property that is subject to a mortgage administered by a mortgage administrator. This can be expected to have a significant effect on the ability of the borrower to continue to make payments, negatively impacting the mortgage performance; and

- Challenges to businesses to remain operational, potentially leading to fewer resources and decreased focus on maintaining adequate compliance.

In the summer of 2020, we communicated that we would focus our supervision for 2020-2021 in the following areas, based on the potential risks noted in the market:

What did we find and what did we learn?

Private lending

We commenced the first round of our review of mortgage brokering practices in arranging private loans, and we will continue our review in 2021-2022. Based on the 2019 AIR, brokerages arranged a total of 141,526 loans from private lenders.[8] We examined 40 private loan transactions in this first round from a sample of brokerages, some of which had a high percentage of private lending business. We focused on the brokerages and their brokers/agents’ know-your-client processes, both for lenders and borrowers, and suitability assessment processes. We found that in private lending, many brokers and agents take on a bigger advisory role, whether it is finding the right financing solution for a borrower or finding the right mortgage investment for a lender. In addition, many industry veterans have informed us that the suitability of a private loan to a borrower is heavily dependent on the existence and feasibility of an “exit” strategy to return the borrower to a more traditional mortgage.

We found that the practices of brokerages, brokers and agents vary. We identified the following practices that are generally not consistent with the consumer protection intent of certain regulatory requirements:

- “Know your lender” information was not updated periodically when a private lender could be used by a brokerage to fund mortgages over a period of time for a number of clients. Without updated lender information, especially lending parameters, a broker or agent involved in arranging a private mortgage will not be able to appropriately assess the suitability of the mortgage for both the borrower and the lender.

- In some cases where a broker or agent was related to a private lender or was the private lender in a mortgage, the brokerage did not have additional procedures to ensure that the broker or agent’s role and any conflicts of interest were properly disclosed to the borrower. The brokerage also did not have procedures to ensure that the broker or agent will appropriately consider the borrower’s interest when assessing suitability of the private mortgage.

- Brokers or agents did not often include in their documentation why a private mortgage was suitable for the borrower or the lender based on their specific needs or circumstances, making it difficult to demonstrate the suitability of the private loan.

We noted a number of occasions where the lender’s identity was not disclosed on a mortgage commitment letter. Borrowers have the right to know who the lender is and understand how the lender may be related to their brokers or agents. In addition, this practice is not consistent with the requirement to disclose details of a mortgage to a borrower. Some brokerages noted that in some cases this practice is to protect the privacy of the lender and the identity would be disclosed after the borrower accepts the mortgage commitment. FSRA will continue to examine this practice to determine whether there are limited circumstances with the proper controls that this practice could be acceptable

We will provide further update on private lending after we conduct further examinations of brokerage’s practices in this area.

NQSMIs

FSRA introduced the real-time supervision program for NQSMIs after its launch in 2019. As part of our supervisory role, we reviewed disclosure (in Form 3.2) that was provided to the first investor or potential investor at the time when an NQSMI was being sold. Our goal was to identify any disclosure issues that would impede an investor from understanding the risk profile of the NQSMI, and not be able to make an informed investment decision. In such cases, we requested that the brokerage correct their disclosures right away. This remained a key component of our supervision in 2020-21.

At the onset of the pandemic in the spring of 2020, when there was significant uncertainty in the market, FSRA published two pieces of guidance for mortgage brokerages and administrators. These guidance documents outlined our expectations of brokerages’ and administrators’ obligations towards lenders/investors during a market disruption, with respect to risk and performance disclosures and suitability assessment as applicable. Reviewing compliance with these guidance became part of our real-time supervision of NQSMIs. We note some instances where brokerages were not disclosing new risks to the NQSMIs that arose from the market disruption.

During 2020-2021, we also examined a number of mortgage brokerages and an administrator to assess their practices of disclosing updated information to NQSMI investors after the initial investment. Given the market disruptions caused by the pandemic, we expected some borrowers would need to renew or extend their mortgages past their initial contractual terms. We also expected that the performance of mortgage investments might fluctuate significantly during their terms, especially for NQSMIs that are considered higher risk. High risk NQSMIs are those that exhibit the following characteristics: funding development or construction, with loan-to-value ratio (calculated using “as is” value) exceeding 100 per cent, repayment can be postponed and where the brokerage or administrator is conflicted due to a relationship with the borrower. As a result, our examination focused on disclosures on these types of NQSMIs that were provided to investors when a renewal or extension was requested and during the term of their investments.

Overall, we found that disclosures can be improved especially on NQSMIs that fund construction or development projects or that are highly leveraged. The key issues we noted are as follows:

- Mortgage brokerages – inaccurate or insufficient disclosures of conflict of interests, material risks and non-compliance with appraisal guidelines in accordance with MBLAA both at the time of extension/renewal and at the initial point of sale.

- Mortgage administrator - incomplete and inadequate information included in the Mortgage Administration Agreement governing the administration of the mortgage and insufficient disclosure was provided to investors on the project status during the term of the mortgage.

For more details, please see Legacy NQSMI review (le français à suivre).

As of July 1, 2021, the regulatory oversight of certain NQSMIs has been transferred from FSRA to the OSC, which has resulted in the following:

- OSC will regulate distribution of NQSMIs to retail investors

- industry participants may be subject to either FRSA’s or the OSC’s regime if they distribute NQSMIs to non-retail investors[9]

- FSRA will continue to regulate administration of NQSMIs

- FSRA will continue to act on behalf of borrowers unless the brokerage qualifies for a FSRA license exemption when dealing with a sophisticated borrower

We will be sharing our findings and experience with the OSC as they develop their supervision programs.

Principal broker supervision

Principal Brokers are responsible and are accountable to FSRA for ensuring regulatory compliance by their brokerages, brokers and agents. FSRA relies on Principal Brokers to influence the compliance culture and set the tone for compliance at their brokerages. However, their effectiveness depends on their authority, independence, the actual compliance programs they put in place, and compliance resources available based on the size and complexity of the brokerage business. Their role becomes more critical when the business of their brokerages is under stress due to, for example, the pandemic, fierce competition or significant growth.

Last year, we requested information from the Principal Brokers of 1202 licensed mortgage brokerages and we received over 1000 responses or a response rate of 81 per cent. The information we collected allow us to better understand the environment under which Principal Brokers operate, such as the size of the brokerage, the organizational structure, their authority, compensation and allocated resources, as well as the compliance activities they carry out.

We found that, although Principal Brokers’ supervision activities vary based on the size of the brokerage, over 90 per cent of them:

- have decision-making authority

- can freely assess the adequacy of compliance at their brokerages

- Have the right to follow-up with management on actions to correct issues.

However, there are other factors that could impact the effectiveness of their role in supervising compliance. These factors include the relatively small amount of additional compliance resources available and Principal Brokers’ other activities (such as servicing clients and managing the brokerage). We are continuing to analyse the responses from the questionnaire and will communicate best practices that improves the effectiveness of a Principal Broker’s supervision.

For more detailed information about our findings, see Principal Broker supervision (le français à suivre).

Current market environment and trends

We have taken stock of the current market environment and trends to determine our supervisory focus for 2021-2022. These include sector outlooks and economic analyses prepared by industry associations and other government agencies, input from industry participants including FSRA’s Technical Advisory Committee, and findings from our examinations. We are highlighting the key trends we observe here.

Increased household debts and more aggressive underwriting of mortgages

The demand for housing in many Canadian markets continues to outpace supply. CMHC forecasts that homes sales and price growth will moderate over the period of 2021-2023, but they will still be elevated from pre-COVID level.[10]

The Bank of Canada (the Bank) notes that it is seeing signs that people may be buying homes because they expect that prices will continue to increase, creating “unsustainable price dynamics.”[11] This can increase people’s tolerance for higher mortgage balance relative to the value of the house or their income. As noted by the Bank, increased house prices relative to income contribute to rising leverage and larger mortgages lead to higher household indebtedness.

The Bank also found that 20 per cent of mortgage borrowers did not have sufficient liquid assets to cover two months of mortgage payments. Although many higher income households are not affected by the pandemic, others are impacted due to higher debts and uncertainty with their employment. In turn, these households will be more susceptible to a housing market correction, loss of income or reduction in disposable income.

The Bank’s research shows that the quality of mortgages issued by Canadian banks based on loan-to-income ratio has declined in 2020, and new mortgage debts issued by Canadian banks from 2019 to 2020[12] was composed of mortgages from borrowers with higher loan-to-income ratio and higher loan-to-value ratios.[13] To address the potential increased financial risk to banks from higher exposure to mortgages in the current Canadian housing market conditions, OSFI announced in April 2021 that it is proposing a new minimum qualifying rate for uninsured mortgages.[14] OSFI noted that the impact of this change, based on their analysis of approved borrowers in Q3-2020 and Q4-2020[15], is that the mortgage loan amount would be reduced between two per cent and four per cent, meaning borrowers would be able to borrow less.

Since Canadian banks are more conservative and the new OSFI proposal would further constrain their residential mortgage lending exposure, alternative lenders who are less risk averse will likely issue more mortgages with potentially higher loan-to-income and loan-to-value ratios, to meet the demand for credit from households entering the housing market. Last year, FSRA anticipated more borrowers would be turning to alternative lenders and we expect this trend to continue. This is supported by Statistics Canada’s report that uninsured residential mortgages extended by non-bank lenders increased by 49 per cent from Q4-2019 to Q4-2020.[16]

Many Mortgage Brokering Technical Advisory Committee members also noted that there are more agents, even inexperienced ones, entering the private lending market. This insight supports our views of the continued growth of the alternative or private lending market. Private capital has also increased with several private equity and fund managers entering the private lending market.

Investors seeking higher yield in alternative investments, varying outlooks for different real estate investments, and challenges in construction financing

Given the low yield bond market, investors are continuing to look for higher yield in alternative investments such as real estate or mortgage investments. The Bank noted that the total financial assets held by mortgage investment corporations (MICs) has grown rapidly since 2008 and has grown on average 8 per cent over 2018 and 2019.[17]The Bank further noted that MIC’s activities are highly concentrated in riskier mortgage products.[18]

The general consensus among industry players is that, although there is uncertainty in the market, COVID impact and varying outlooks for different real estate investments:

- The residential market, except for rental, has not been impacted by COVID. Stay-at-home orders and the ability to telework have incentivized many homebuyers to look for more space and outside of urban centres.[19] The condo market in Toronto, for example, has appeared to have recovered to close to pre-COVID level.[20] The rental market, however, did decline early in the 2020, but has generally shown signs of a recovery in the recent quarter. This trend is expected to continue as the pandemic recedes. CMHC predicted that newly constructed rental units will take longer to lease up.[21]

- In the commercial market, office, retail and hospitality continue to be negatively impacted by COVID. However, industrial (like warehouse) spaces are in high demand in city centre areas with the growth of e-commerce.[22] The hospitality segment will take the longest to recover, and will depend on economic recovery and resumption of group and business travel.[23]

Mortgage investments that fund different real estate asset classes will therefore have very different risk profiles. Sophisticated investors with experience in real estate and mortgages recognize the differences and outlook, and adapt their investment strategies accordingly. Less sophisticated investors who are chasing yields may not fully understand the risks of some of these asset classes.

In addition, recent increases in construction costs due to higher lumber costs and supply chain issues can substantially increase the risk of mortgage investments that fund non-stabilized real estates, such as construction and development. The New Housing Price Index published by Statistics Canada showed increased costs of newly built housing across the country and in many urban areas, for example:

- 9.9 per cent year-over-year increase across Canada in April

- 23.7 per cent increase in Ottawa-Gatineau (Ontario potion)

- 21.9 per cent increase in Kitchener-Cambridge-Waterloo[24]

With traditional bank lenders shifting to higher quality developers, tighter lending criteria and reduced construction financing exposure, an increased number of developers will need to turn to private lending or equity.[25] Investors, especially the less sophisticated ones, may find the yield of construction finance attractive without fully appreciating the corresponding risks.

Unsophisticated investors rely on their financial or mortgage professional to manage his/her mortgage investment. In these cases, especially in uncertain markets, the financial or mortgage professional takes on a greater advisory role. It is important that they monitor and keep the investor informed about market trends as well as investment risk and performance. In addition, once FSRA adopts the MBRCC Code of Conduct, mortgage brokerages, brokers, agents and administrators should follow the Code.

Anecdotally, and perhaps related to the challenge for some developers to secure financing, we have noted developers establishing debt funds directly or indirectly to raise financing, mortgage brokerages arranging equity financing for clients and mortgage administrators providing mortgage brokering services.

Mortgage brokerages acting as advisors and arranging equity financing may require registration with the OSC[26], and mortgage administrators providing mortgage brokering services must obtain a mortgage brokerage license from FSRA.

Areas of supervision focus 2021-22

We determined that our supervisory focus for 2021-2022 will not change substantially from last fiscal year, based on the current market environment and trends and the following findings from last year’s supervision:

- In private lending, brokerages did not have adequate procedures to periodically update “know your lender” information, review mortgage transactions where a broker or agent is conflicted (e.g. related to the lender), and document how a private mortgage is suitable for a borrower; and

- Disclosure about the status of a project funded by NQSMI and impact to mortgage performance was inadequate during the term of the mortgage.

Our primary supervision focus will cover:

Private lending

Homebuyers who have less financial flexibility may increase their leverage in order to enter or remain in the housing market. These homebuyers will need to seek financing from alternative lenders, such as private lenders. As we have noted, private loans are intended to provide bridge liquidity and require the borrowers to be disciplined to improve their current financial situations to transition from the more expensive private financing to more affordable traditional financing. In the private lending market, mortgage brokerages and their brokers/agents play an important role in identifying mortgage options for the borrowers. It is equally important that they explain the terms of potential mortgages, and the consequences if their financial situations deteriorate or they do not follow the identified exit strategy.

Given the expected growth of the private lending market and the borrowers who are generally more vulnerable, we will continue to focus our supervision on private lending that funds residential properties. We will examine more brokerages that have a high proportion of their business in private lending, focusing on their disclosure and suitability practices.

We would like to increase our understanding of those practices that we have identified as inconsistent with our expectations of business practices. Our objective is to determine if they may be appropriate in specific situations or if they pose consumer protection concerns and should be stopped. The practices that are of particular interest are:

- non-disclosure of lender’s identity to borrowers during the initial phases of sourcing potential funding

- suitability assessment of a private loan for borrowers

- extent of “know your lender” processes.

Our plan is to publish best practices guidance for the industry based on our findings.

Mortgage administration

With uncertainty and increasing investor interest in the alternative mortgage investment market, as well as higher risk to certain types of mortgage investments, it is even more critical that investors receive updated information about the risks and performance of their investment during the term of the investment.

Mortgage administrators who administer mortgages for investors have the responsibilities under MBLAA[27] and FSRA Guidance to keep informed of the performance of the mortgages they administer. They must also monitor circumstances that could impact the mortgage performance, such as significant changes in risk to the underlying property and subsequent encumbrances on the property. A mortgage administrator plays a critical role, especially when a mortgage is higher risk (e.g. construction financing) or complex (e.g. NQSMIs[28]) and the investor is unsophisticated. In addition, mortgage administrators are also responsible for ensuring lenders/investors are receiving mortgage payments in accordance to the mortgage terms.

We plan to examine mortgage administrators who administer higher risk or more complex mortgages. The focus of our examinations will be on disclosure, use of discretion and handling of funds with the goal of ensuring compliance with the requirements under MBLAA and FSRA guidance. We will continue to examine disclosures related to mortgage extensions to ensure investors receive adequate information on project performance and changing market conditions impacting risk. The outcome is to enhance administrator’s compliance to increase lender/ investor protection.

We will be sharing the common findings from our examinations with the industry and consumers.

Other areas of focus from NQSMI oversight transfer and supervision findings

Principal Broker’s supervision and compliance structure

We will continue our analysis of the responses from Principal Brokers on our questions about their role and compliance. We will publish guidance and highlight compliance structure or practices that could impact the effectiveness of a Principal Broker’s supervision.

Such guidance is intended to facilitate Principal Brokers in fulfilling their supervision responsibilities and to encourage the industry in enhancing their compliance structure.

NQSMI transfer

With the transfer of certain NQSMI oversight to the OSC, FSRA will continue to be responsible for regulating sales of NQSMIs to sophisticated investors and administration of NQSMIs for all investors. FSRA’s supervision will focus on ensuring sales to unsophisticated investors have moved to the OSC’s jurisdiction and monitoring product development in the NQSMI market.

Unlicensed activities

As the mortgage sector continues to evolve with new ways to finance real estate and incumbents entering into new business, we will continue to monitor new developments to understand new business models and assess impact to consumer protection.

We expect in most cases, industry participants are providing more efficient or new services to the benefit of consumers. In instances where we find that participants are conducting business without the appropriate license, we will follow up and require immediate rectification.

Consumer education

FSRA wants to help consumers understand the financial products and services that we regulate. In 2021-2022, our consumer education priorities in the mortgage brokering sector include high-risk mortgage investments and the Mortgage Brokering Sector Code of Conduct. We will publish content designed to help increase consumers’:

- knowledge – to make informed financial decisions.

- confidence – in the sectors we regulate.

- empowerment – to understand and use the rights they have.

FSRA’s consumer education priorities reflect our commitment to our mandate, including contributing to public confidence and promoting public education and knowledge about the sectors we regulate.

[1]CMHC, Residential Mortgage Industry Dashboard Winter 2021.

[2]CMHC noted that home sales and price growth will remain elevated from pre-COVID level in its Spring 2021 Housing Market Outlook. Overall in Canada, CMHC recorded that MLS sales increased by 12.6 per cent and MLS average price increased by 15.6 per cent from 2019 to 2020.

[3]Section 3 of the Financial Services Regulatory Authority of Ontario Act..

[4]See Table 1 of Survey of Non-Bank Mortgage Lenders: Canadian residential mortgages, fourth quarter 2020.

[5] See Staff Analytical Note 2021-2 Non-bank financial intermediation in Canada: a pulse check.

[6]CMHC, Housing Market Outlook, Spring 2021, and Grant Thornton, COVID-19 Real Estate Trend Accelerator (2021 Real Estate Outlook).

[7]Grant Thornton, COVID-19 Real Estate Trend Accelerator (2021 Real Estate Outlook).

[8] The 2019 AIR noted that in 2019 brokerages arranged 9,390 mortgages funded by MICs, 21,045 mortgages funded by private lenders, and 111,091 mortgages through self-funding (i.e. funded by the brokerages, brokers or agents).

[9]See FSRA Approach Guidance No. MB0041APP Supervision Approach for Non-Qualified Syndicated Mortgage Investments with Permitted Clients and Legacy Non-Qualified Syndicated Mortgage Investments (July 1, 2021).

[10]CMHC, Housing Market Outlook, Spring 2021.

[11] Bank of Canada, Financial System Review – 2021.

[12]Chart 4 of Bank of Canada, Financial System Review – 2021.

[13]Chart 5 of Bank of Canada, Financial System Review – 2021.

[14]OSFI’s news release “OSFI proposes new minimum qualifying rate for uninsured mortgages,” April 8, 2021.

[15]OSFI’s Consultation on the Minimum Qualifying Rate for Uninsured Mortgages – Frequently Asked Questions.

[16]See Table 1 of Survey of Non-Bank Mortgage Lenders: Canadian residential mortgages, fourth quarter 2020.

[17]See Staff Analytical Note 2021-2 Non-bank financial intermediation in Canada: a pulse check.

[18]See Staff Analytical Note 2021-2 Non-bank financial intermediation in Canada: a pulse check.

[19]CMHC, Housing Market Outlook, Spring 2021, and Grant Thornton, COVID-19 Real Estate Trend Accelerator (2021 Real Estate Outlook).

[20]CMHC, Housing Market Outlook, Spring 2021, and Grant Thornton, COVID-19 Real Estate Trend Accelerator (2021 Real Estate Outlook).

[21]CMHC, Housing Market Outlook, Spring 2021.

[22]Grant Thornton, COVID-19 Real Estate Trend Accelerator (2021 Real Estate Outlook).

[23]CBRE, 2021 Canada Real Estate Market Outlook.

[24]ConstructConnect, Volatility the Name of the Game with Latest Economic Data Releases, May 28, 2021.

[25]Grant Thornton, COVID-19 Real Estate Trend Accelerator (2021 Real Estate Outlook).

[26]See OSC website for more information about registration.

[27]Section 18 of O. Reg. 189/08 provides for specific duties for mortgage administrators towards their lenders/investors.

[28]FSRA will continue to regulation the administration of NQSMIs after the transfer of certain NQSMI oversight to the Ontario Securities Commission on July 1, 2021.