Why is FSRA interested?

NQSMIs, by their nature, are more complex types of mortgage investments and may not be suitable for all investors. In the high profile NQSMI cases where investors experienced losses, many investors did not have financial knowledge or financial resilience to understand these investments and the associated financial risks.

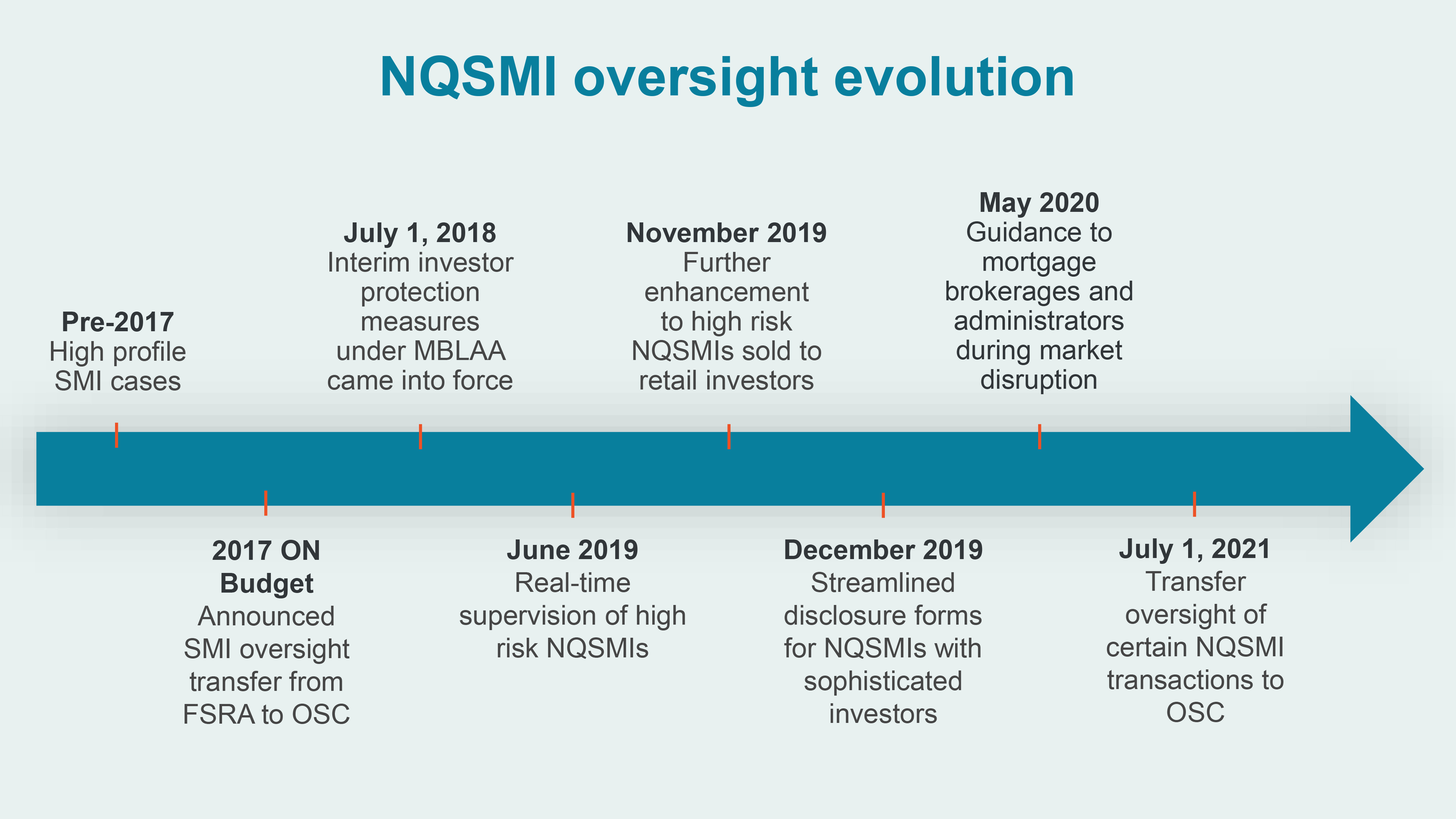

Since the high profile cases came to light, such as Fortress Real Development Inc. and Hi-Rise Capital Ltd., the Mortgage Brokerages, Lenders and Administrators Act, 2006 (MBLAA) was enhanced to increase protection to investors in NQSMIs, during the time when FSCO (predecessor of FSRA), the Ministry of Finance and the Ontario Securities Commission (OSC) worked collaboratively to design a new regulatory regime for NQSMIs. The more notable enhancements include requiring greater and specific disclosures to investors in NQSMIs to allow them to make more informed investment decision and restricting the amount an unsophisticated investor1 can invest in NQSMIs.

What we did and how we did it – supervision pre-transfer

Since its launch in June 2019, FSRA has focused its regulatory effort in supervising NQSMIs that pose the highest risk to investors. FSRA considered NQSMIs that meet the following criteria to be higher risk: (a) loan-to-value ratio, calculated using as-is value, over 100%, (b) the priority of repaying the NQSMI can be postponed, and (c) where the borrower is related to either the mortgage brokerage or mortgage administrator, especially where the investor is non-designated.

FSRA’s risk-based approach in supervising NQSMIs include two components:

- Real-time supervision of NQSMIs at the point of sale through review of disclosure forms provided to investors. The key objective of the real-time supervision is for FSRA to identify sales of NQSMIs to investors who might not have received adequate disclosure about these investments. These scenarios would require immediate rectification. For more details on the oversight activities conducted, see Real-time Supervision of NQSMIs.

- Targeted reviews of mortgage brokerages and administrators who sold and administer NQSMIs. Targeted reviews allow FSRA to assess practices of brokerages and administrators when they request investors to renew or extend their NQSMI investments, specifically in cases where these investments have passed their contractual maturity date. For more details on the results of the supervisory activities conducted, see Legacy NQSMI review.

What we found

FSRA found that, overall, disclosures to investors at the point of sale, renewal or extension can be improved, especially where a NQSMI was determined to be highly leveraged. FSRA also noted the following situations which substantially increase the risk of the NQSMI investments especially when disclosures were incomplete, inaccurate, or non-objective:

- Reliance on “as completed” valuations to support high loan amounts (e.g. reliance on projected sales instead of actual presales) which makes projects more vulnerable in case of market disruptions or unplanned debt increases (i.e. higher costs or cost over runs);

- Conflict of interest, i.e. relationship, between a borrower and the mortgage administrator. This raises concerns about whether the mortgage administrator can objectively act in the investors’ best interests especially when the financial situation of the borrower or the underlying project deteriorates;

- Excessive mortgage extensions past the original term of the mortgage and other contractual rights to extend, if applicable;

- Speculative development not based on actual market demand (i.e. “If you build it, they will come”); and,

- Unplanned attempts to obtain greater development density after the mortgage has been originated (i.e. increasing the number of planned dwelling units to be built on the given area).

Actions we took

During the fiscal year 2020-2021, FSRA took several regulatory actions to address compliance concerns including failure to provide adequate disclosures. The nature of the actions taken was based on the degree of actual or potential consumer harm, systemic nature of the non-compliance, and response and remediation actions taken by the mortgage brokerage or mortgage administrator (and their principals’).

These actions include:

- educating and sharing regulator’s expectations with the licensee to encourage a compliance culture

- letters of warning or caution

- conditions on licenses

- administrative monetary penalties

- license revocation.

In some instances, FSRA placed the licensee under close monitoring or required independent monitoring by a FSRA-approved qualified third-party monitor. Taking these actions were necessary to avoid significant consumer harm.

What we did and how we did it – supervision post-transfer

The graph below provides a summary of the NQSMI Oversight Evolution leading up to the transfer of oversight of certain NQSMIs to the OSC on July 1, 2021.

The new regulatory regime for NQSMIs post-July 1, 2021 intends to preserve investor protections where needed. At the same time, it will reduce regulatory burden for transactions involving financially sophisticated entities (i.e. Permitted Clients2) that do not need the same protections as a retail investor (i.e. non-Permitted Clients). FSRA’s and OSC’s regimes are also aligned where appropriate to ensure a level playing field.

The outcomes are:

- OSC will regulate distribution of NQSMIs to retail investors

- Industry participants will fall either under FSRA’s or the OSC’s regime for distribution of NQSMIs to non-retail investors. The FSRA Final Approach guidance provides more details on the division of regulatory oversight as of July 1, 2021

- FSRA will continue to regulate administration of NQSMIs

- FSRA will continue to act on behalf of borrowers unless the brokerage qualifies for a FSRA licence exemption when dealing with a sophisticated borrower.

What this means for you

More specifically, Table 1 in the FSRA Final Approach guidance summarizes FSRA license or OSC registration requirements for dealing or trading in NQSMIs as of July 1, 2021.

Post-July 1, 2021 transfer, FSRA NQSMI supervision activities will consist of data-driven and targeted compliance reviews based on data collected via the new Quarterly NQSMI reporting for mortgage brokerages.

For mortgage administrators, the focus will be on disclosures, funds handling, and use of discretionary power as per the mortgage administration agreement. Additional information about the scope of the transfer and FSRA oversight activities can be found in the FSRA Final Approach guidance and FSRA Summary of consultation feedback published March 10, 2021.

1 A non-sophisticated investor is an investor who is not a member of the designated class of investors and lenders as defined in subsection 2(1) of Ontario Regulation 188/08.

2 As defined in the OSC National Instrument 31-103.