Contents

Executive summary

Introduction

Supervisory activities

Remediation reviews of Licensed Service Providers

Compliance with guidance, statutory accident benefits claims during the COVID-19 outbreak

Sanctioned practitioner reviews

Annual Information Return (AIR)

Conclusion

Executive summary

The Financial Services Regulatory Authority of Ontario’s (FSRA’s) vision is to promote financial safety, fairness, and choice for Ontario consumers. The HSP Sector came under regulation in Ontario in part as a result of the 2012 Anti-Fraud Task Force Final Report which identified that “fraud played a significant role” in escalating Accident Benefits insurance costs despite a decreased number and severity of injuries. FSRA is responsible for licensing suitable “Service Providers” allowing them to receive direct payment from insurers for benefits claimed under the Statutory Accident Benefits Schedule (SABS). Licensed Service Providers are required to follow prescribed standards related to their business systems and practices, and the management of their operations. Service Providers are typically health and rehabilitation clinics, as well as providers of assessments and examinations. The Health Service Provider (HSP) sector consists of over 5,000 licensed Service Providers. Most Ontarians who have been involved in a motor vehicle accident access the care they need to recover through Service Providers who are licensed with FSRA.

During fiscal year 2020/21 (April 1, 2020 - March 31, 2021), FSRA ran three review programs, the key outcomes of which are summarized below.

1) Remediation Reviews of Licensed Service Providers

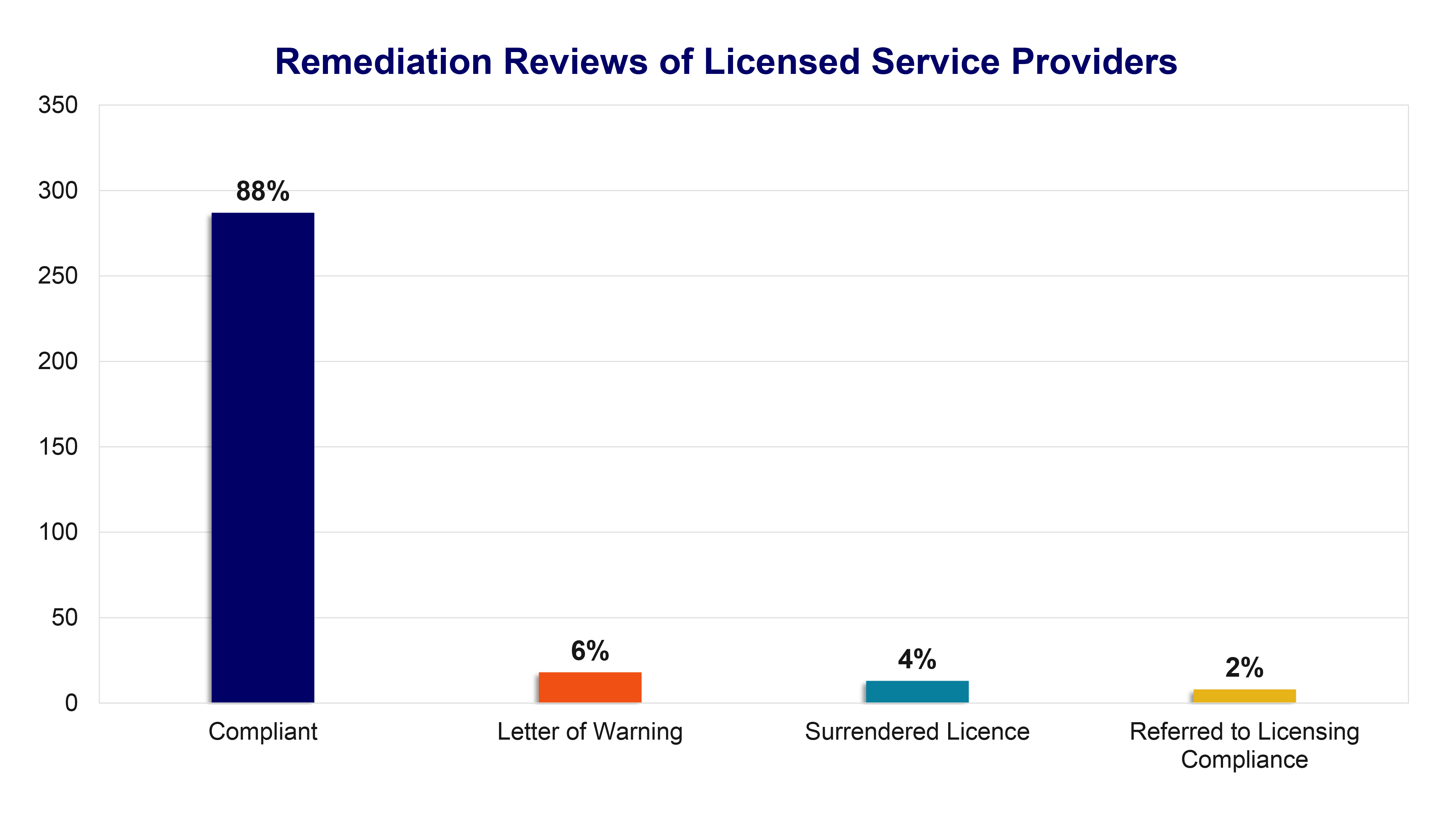

FSRA conducted 326 remediation reviews of licensed Service Providers with previous compliance deficiencies. The program results found that:

- 287 licensed Service Providers were compliant with the reviewed criteria,

- 18 licensed Service Providers were issued a letter of warning,

- 13 licensed Service Providers surrendered their licences, and

- 8 licensed Service Providers were referred to FSRA’s licensing compliance department for enforcement action due to not filing the Annual Information Return (AIR).

2) Compliance with Guidance, Statutory Accident Benefits Claims during the COVID-19 Outbreak

In response to COVID-19, FSRA issued this Guidance to address the impact of the shift to virtual care for SABS claimants. As a follow up to the Guidance, the Market Conduct team developed a virtual care survey to understand the types of reasonable accommodations that are being provided to SABS claimants. In the second half of the year, a sampling of licensed Service Providers who were selected for the remediation review above were also issued the virtual care survey. The program found that 53% of respondents had implemented reasonable accommodations and were compliant with the Guidance, and 47% of respondents did not provide virtual care.

3) Sanctioned Practitioner Reviews

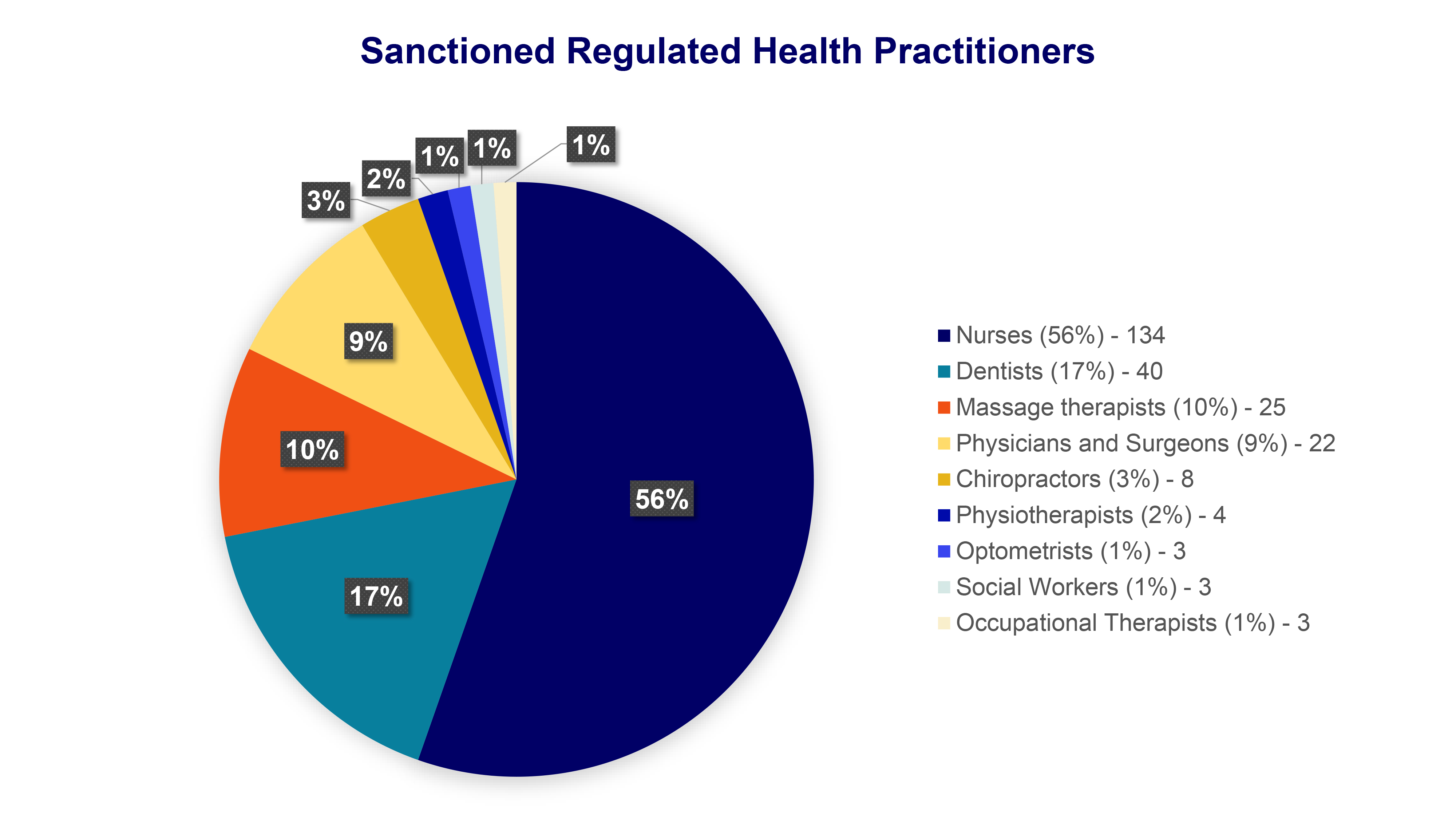

FSRA identified 242 sanctions against Regulated Healthcare Professionals (RHPs). A sanctioned practitioner is a RHP who has had sanctions placed against them by their Regulatory College. Licensed Service Providers who had a sanctioned practitioner listed on their Health Claims for Auto Insurance (HCAI) roster were examined for suitability in the HSP regime and investigated for unauthorized activity in HCAI.

The program found 24 licensed Service Providers with a sanctioned practitioner listed on their HCAI roster. Of these:

- 2 licensed Service Providers appeared to have billed using the credentials of a sanctioned practitioner and were referred for enforcement action:

- 1 Service Provider has entered into a settlement with FSRA, and

- 1 Service Provider remains under investigation.

- The remaining 22 licensed Service Providers removed the sanctioned practitioner from their roster as a result of FSRA’s review.

In addition to the programs above, FSRA administers the mandatory AIR survey for licensed Serviced Providers. In 2020/21, 174 Service Provider licences were revoked for not filing the AIR and paying the annual regulatory fee for at least two years. These businesses are no longer able to receive payment directly from insurers.

Introduction

FSRA is an independent regulatory agency created to improve consumer protection in Ontario. In carrying out it’s mandate in the sector, FSRA licenses Service Providers to use the Health Claims for Auto Insurance (HCAI) billing system to receive payment directly from insurers, collects information about licensed Service Providers’ business systems and practices through an Annual Information Return (AIR), and reviews the business systems and practices of licensed Service Providers. This annual Health Service Provider Market Conduct Compliance Report provides the results of the supervisory work conducted in this sector over the last fiscal year (April 1, 2020 to March 31, 2021).

A licensed Service Provider is defined as a business that provides goods and services to Statutory Accident Benefits Schedule (SABS) claimants, submits invoices on behalf of the claimants through the HCAI system and is paid directly by the insurer. Ontarians who have experienced a motor vehicle accident and receive care from a licensed Service Provider benefit from the convenience of direct billing. It is important to note that all Service Providers must submit requests and billing for goods and services via HCAI, but only FSRA licensed Service Providers can receive direct payments from insurers.

As part of its supervisory activities, FSRA reviews the conduct of licensed Service Providers in relation to SABS claims. Licensed Service Providers are subject to compliance requirements set out in Ontario Regulation 90/14 (Service Providers – Standards for Business Systems and Practices and other Prescribed Conditions). In reviewing evidence of non-compliance under these regulations, FSRA’s HSP regime helps to reduce fraud and to control insurers’ operational costs so that auto insurance rates don’t increase unnecessarily.

Supervisory activities

The emergence of the COVID-19 pandemic had an immediate and broad impact on FSRA’s licensed Service Provider supervisory activities. During the pandemic, FSRA’s on-site examinations were paused and the Market Conduct team shifted to desk reviews and other means to achieve its supervision mandate.

In the HSP sector, the Market Conduct team conducted three supervision initiatives:

- Remediation Reviews of Licensed Service Providers

- Compliance with Guidance, Statutory Accident Benefits Claims during the COVID-19 Outbreak

- Sanctioned Practitioner Reviews

1. Remediation reviews of Licensed Service Providers

Effective June 8, 2019, FSRA assumed regulatory duties for the HSP sector from its predecessor the Financial Services Commission of Ontario (FSCO). The 2020/21 remediation reviews focused on licensed Service Providers who had findings from past desk reviews or on-site examinations. The purpose of the remediation reviews was to verify that previous deficiencies had been resolved.

The remediation reviews focused on the following deficiencies:

- Rostered Health Professionals (RHPs) list in HCAI outdated/inaccurate,

- Policies and procedures not established/appropriate (including verification of identity), and

- Auto Insurance Claims Forms (OCF Forms) not signed by RHP’s and/or patients.

The deficiencies noted above pose potential consumer harm and are among the most common areas of non-compliance identified in past reviews.

FSRA conducted a total of 326 remediation reviews during fiscal year 2020/21. Three questionnaire modules were developed to carry out this work. Licensed Service Providers were sent between 1 and 3 questionnaires depending on their previous compliance deficiencies. A total of 694 questionnaires were sent to licensed Service Providers. The reviews were conducted through email and telephone exchanges. This allowed FSRA to carry out its supervisory duties while complying with government recommendations and directives resulting from COVID-19.

The findings from the 326 remediation reviews are as follows:

- 287 licensed Service Providers were compliant with the reviewed criteria,

- 18 licensed Service Providers were issued a letter of warning for failing to address previously identified deficiencies,

- 13 licensed Service Providers did not complete the desk review and opted to surrender their licence, and

- 8 licensed Service Providers were referred to FSRA’s licensing compliance department for enforcement action due to not filing the AIR.

2. Compliance with Guidance, Statutory Accident Benefits Claims during the COVID-19 outbreak

In June 2020, FSRA released Guidance, Statutory Accident Benefits Claims during the COVID-19 Outbreak, aimed at protecting auto insurance SABS claimants by requiring insurers and licensed Service Providers to provide reasonable accommodations to claimants during COVID-19. As part of FSRA’s response to COVID-19, we expanded our remediation reviews to include a virtual care questionnaire. In total, 19 virtual care questionnaires were sent to licensed Service Providers who were selected for a remediation review to assess their compliance with the Guidance. The results confirmed that 53% of the surveyed licensed Service Providers had implemented reasonable accommodations to SABS claimants and had appropriate safeguards in place to ensure consumers are being treated fairly. The remaining 47% of licensed Service Providers indicated that they do not provide virtual care. FSRA did not identify any instances where reasonable accommodations were not provided.

3. Sanctioned practitioner reviews

The HSP sector is a multifaceted sector where regulatory oversight is divided among numerous entities. One aspect of activity, namely the provision of care by RHPs who are authorized to certify treatment and assessment plans under the SABS, is regulated by multiple Regulatory Colleges (e.g., College of Physicians and Surgeons). The Regulatory Colleges also oversee the quality of care provided by RHPs. Another aspect pertains to the Principle Representative’s responsibilities to ensure that the HSP’s activities are carried out in accordance with the law and with integrity and honesty. Within this multifaceted sector, FSRA’s mandate is to oversee the business systems and practices of licensed Service Providers engaged in providing goods and services to SABS claimants.

Sanctioned Practitioner Reviews involve identifying and reviewing HSPs that are affiliated with RHPs who have had sanctions placed against them by their Regulatory College, resulting in either a suspension or revocation of membership. While their licence is suspended or revoked, a practitioner may not use their credentials to certify, provide or bill for regulated medical services.

In 2020/21, a total of 242 sanctions against RHPs were reviewed by FSRA. Data was collected from information posted on each of the Professional Colleges websites. Licensed Service Providers who were identified as being affiliated with sanctioned practitioners were examined for suitability in the HSP regime and investigated for unauthorized activity in HCAI (e.g., inapproriate billings or invalid authorizations).

If a sanctioned practitioner appeared on a licensed Service Provider’s HCAI roster, FSRA sent a notice to the Principal Representative advising of the disciplinary action taken by the Regulatory College. FSRA further validated that no services were provided by sanctioned practitioners by utilizing Health Claims Database (HCDB) data to confirm compliance. Data transmitted through the HCAI processing system is scrubbed of any identifying personal information or personal health information of claimants and is captured in the HCDB.

Of the 242 sanctions reviewed by FSRA, there were 24 licensed Service Providers who had a sanctioned practitioner listed on their HCAI roster. These 24 licensed Service Providers were reviewed by FSRA and 2 were confirmed to have billed using the credentials of a sanctioned practitioner. The 2 cases were escalated to Licensing and Enforcement. One licensed Service Provider entered into a settlement with FSRA while the other remains under investigation. The remaining 22 licensed Service Providers removed the sanctioned practitioner from their roster as a result of FSRA’s review.

Annual Information Return

Recognizing COVID-19’s impact on the business activities of licensed Service Providers, the deadline to submit the AIR and pay the annual regulatory fee was extended for the 2019 and 2020 AIR. In addition, prioritizing data analytics capabilities has enabled FSRA to capture business data from the HCDB. This has resulted in a shortened AIR questionnaire with a greater focus on compliance and changes affecting licensing suitability, such as licence suspensions and complaints.

Filing the AIR is a legal requirement for all licensed Services Providers under Section 21 of Ontario Regulation 90/14 and Section 288.4 (5) of the Insurance Act. In 2020/21, 174 Service Provider licences were revoked for not filing the AIR and paying the annual regulatory fee for at least two years. These businesses are no longer able to receive payment directly from insurers.

Conclusion

FSRA’s 2020/21 HSP reviews focused on ensuring that licensees are compliant with their regulatory requirements related to SABS claims. This work assisted in fostering compliance and awareness in the HSP sector.