Please note this is a previous version. View latest version.

Approach

No. AU0132APP

Purpose and scope

This Approach Guidance specifies the “Benchmarks” for loss trend rates, reform factors[1] and other key actuarial assumptions that assist the Financial Services Regulatory Authority (“FSRA”) in reviewing Private Passenger Automobile (“PPA”) insurance rate filing applications based on statutory requirements. It supplements the Financial Services Commission of Ontario (“FSCO”) Private Passenger Automobile Filing Guidelines - Major and Technical Notes for Automobile Insurance Rate and Risk Classification Filings, which were transferred from FSCO to FSRA following FSRA’s assumption of regulatory authority effective June 8, 2019.

This Guidance specifies the Benchmarks and describes how FSRA uses the Benchmarks in its review of auto insurance filings. This year’s annual review includes:

- How FSRA uses Benchmarks in its review of auto insurance filings

- FSRA’s perspective on the effect of inflation on future claim costs

- FSRA’s expectations concerning post-pandemic “new normal” frequency level

- FSRA’s expectations concerning investment return on cash flow assumption

- FSRA’s expectations when a pricing actuary relies on the work of others

- FSRA’s expectations concerning rate level adequacy at the coverage level

- FSRA’s review of territory rating in auto insurance

- FSRA’s review of industry advisory rates for auto insurance

- Ontario auto insurance industry Operational Risk Management Journey

Rationale and background

FSRA mandate

In supervising and regulating the insurance sector, FSRA is required to administer and enforce sector statutes and their respective regulations in alignment with FSRA’s statutory objects,[2] in particular:

- regulate and supervise the auto insurance sector

- promote high standards of business conduct in the industry

- monitor and evaluate developments and trends related to auto insurance

- contribute to public confidence in the auto insurance sector

- protect the rights and interests of consumers

- promote transparency and disclosure of information

- foster a strong, sustainable, competitive, and innovative auto insurance sector

FSRA’s Approach as outlined in this Guidance is in line with FSRA’s statutory objects and its duties under the Auto Insurance Rate Stabilization Act, 2003 (“AIRSA”).

Ratemaking legal framework

Section 3 of the AIRSA requires that an application (“rate filing”) for approval of rates and risk classification systems (“RRCS”) be in a form approved by FSRA and be filed together with such information, material, and evidence as FSRA specifies. Details of the applicable forms are outlined in the Private Passenger Automobile Filing Guidelines - Major and its associated Technical Notes for Automobile Insurance Rate and Risk Classification Filings, which this Guidance is intended to supplement.

Section 3 of the AIRSA also requires all insurers writing non-fleet automobile insurance on the Ontario Automobile Policy (“OAP 1”) or Ontario Driver's Policy (“OPF 2”) to have their rates and risk classification system approved or authorized by FSRA.[3]

FSRA is required to refuse the approval of rate filings if, amongst other factors, the proposed risk classification system or the proposed rates are not “just and reasonable.” Benchmarks are used to assist FSRA in making this determination.

Rate regulation principles

FSRA’s statutory obligations and Rate Regulation Principles (“RRP”) are foundational to FSRA’s approach to auto insurance rate regulation. FSRA’s decision to provide an updated Approach on Benchmarks was guided by the principles of Transparency & Disclosure and Simplicity under the RRP.

Benchmarking review process

FSRA's benchmark review process involves the following:

- benchmarks are published twice a year using industry data available from June 30th (“mid-year”) and December 31st (“annual”)

- consultation is held for the annual review only. The mid-year update will be appended to the annual review guidance when the information is available

These practices enable more meaningful feedback, enhance transparency around FSRA’s rate approval considerations, and protect consumers by assisting FSRA in determining whether auto insurance rates are just and reasonable.

Benchmarks

Use of benchmarks

Benchmarks are key actuarial assumptions developed based on the review of industry data, and are used to evaluate the following:

- Fair Rates for Consumers - Benchmarks assist FSRA in reviewing insurers’ auto insurance rate filing applications based on statutory requirements. If an insurer’s ratemaking assumptions are not supported by its own data, to the extent credible, FSRA can use the Benchmarks to guide the rate approval decision process.

- Market Competition - Benchmarks are published twice a year with updated industry loss experience, which provides a means for insurers to compare their loss experience with the industry loss experience in projecting competitive rates.

- Market Health - Benchmarks serve as a regulatory tool for FSRA to monitor the insurance industry loss experience as a whole, and evaluate developments and trends related to auto insurance.

As Benchmarks are developed based on the review of the industry data, they may not represent an individual insurer’s business. FSRA indicated in the 2020-H2 Guidance that insurers are no longer permitted to directly adopt the Benchmarks without justification. FSRA requires that all actuarial assumptions be fully supported with an analysis of the insurers’ own data, to the extent credible, regardless of whether FSRA Benchmarks are assumed. As guided in Section 2620.04 of The Canadian Institute of Actuaries Standards of Practice (“CIA SOP”),[4] actuaries are expected to consider one or more sets of related experience when their data is not fully credible.

Derivation process

FSRA retained Oliver Wyman (the “Consultant”) to independently derive the loss trend rates and reform factors. The Consultant’s report, which outlines the complete derivation of Benchmarks, can be accessed through the links found in Appendix 1.

The Consultant’s analysis reflects feedback that FSRA received through a public consultation process. Further details on this consultation can be found in FSRA’s summary of consultation on Ontario private passenger automobile annual review based on industry data as of December 31, 2022. A summary of the comments received, and the Consultant’s responses may be found in Appendix I of the Consultant’s report.

The analysis of the Benchmarks is based on the Ontario insurance industry PPA loss and loss adjustment expense experience reported to the General Insurance Statistical Agency (“GISA”) as of December 31, 2022. FSRA’s actuaries have conducted a thorough review of GISA data to ensure its validity and worked closely with GISA’s Consulting Actuary to ensure the resulting projections are reasonable (see Appendix 3).

- First, as per CIA SOP regarding the use of another actuary’s work, the Consultant independently reviewed the reported claim count and claim amount experience to estimate the ultimate claim counts and claim amounts.

- Second, the Consultant compared their estimated ultimate claim counts and claim amounts to those based on the GISA Consulting Actuary’s loss development factor selections for reasonableness.

- The Consultant concluded that the GISA Consulting Actuary’s selected factors are reasonable, and there are no material differences in the selected loss trend rates. The Consultant, therefore, accepted and applied the GISA implied development factors to the underlying loss experience data used in the Benchmark analysis.

FSRA Benchmarks for loss trend rates and reform factors

The Benchmarks, as outlined below, apply to rate filings submitted on or after December 12, 2023.

| Coverage | Loss trend rate | |

|---|---|---|

| Past trend | Future trend** | |

| Prior to Oct. 1, 2022 | After Oct. 1, 2022 | |

| Bodily Injury | -3.4% | -3.4% |

| Property Damage | 4.7% | 4.7% |

| Direct Compensation – Property Damage | 8.8% | 8.8% to 15.2% |

| Accident Benefits - Med/Rehab/AC | 0.2% | 0.2% |

| Accident Benefits - Disability Income | -1.3% | -1.3% |

| Accident Benefits - Funeral and Death | -1.7% | -1.7% |

| Accident Benefits - Total | -0.1% | -0.1% |

| Uninsured Automobile | 0.1% | 0.1% |

| Collision | 8.8% | 8.8% to 15.2% |

| Comprehensive | 10.4% | 10.4% to 16.8% |

| Specified Perils | 10.4% | 10.4% to 16.8% |

| All Perils | 10.0% | 10.0% to 16.4% |

| OPCF 44 | 2.2% | 2.2% |

| All Coverages Combined* | 4.7% | 4.7% to 8.3% |

*All Coverages Combined is a weighted sum of the component coverage based on each coverage’s share of losses.

**The future trend rates for Direct Compensation – Property Damage, Collision, Comprehensive, Specified Perils, and All Perils have been adjusted to reflect the higher-than-historical average inflation rate for passenger vehicle parts, maintenance, and repairs.

The benchmark loss trend factors developed based on December 31, 2022 industry data fall within a reasonable range of the benchmark loss trend factors previously developed based on June 30, 2022 industry data. The comparison of benchmark loss trend factors is presented in Appendix 2.

| Coverage | Reform factor |

|---|---|

| Accident Benefits - Med/Rehab/AC | 0.769 |

| Accident Benefits - Disability Income | 0.873 |

| Accident Benefits - Funeral and Death | 1.000 |

| Accident Benefits - Total | 0.793 |

| Other Coverages | 1.000 |

Insurers are expected to consider the inter-dependency between the loss trend rates and the reform factors in their trend analysis.

Commentary

Over the past two years, rising inflation has been brought on by labour and supply trends because of the COVID-19 pandemic and are reflected in the Consumer Price Index (“CPI”). The rise in inflation associated with vehicle parts, replacement vehicles, rental fees, maintenance, and repair costs that began in late 2021 has directly impacted Physical Damage (“PD”) claim costs. While the inflation impact that affects future claim costs is not limited to vehicle parts and repair costs, vehicle parts and repair costs make up a large portion of the PD claim costs.

FSRA has assessed the monthly CPI data for various transportation-related product groups in Ontario in relation to the Ontario PPA PD coverages’ claims severity trends in the past 13 years. Based on the Ontario CPI as of July 31, 2023, the annual inflation rate for passenger vehicle parts, maintenance, and repair costs has reached 8.1%, which is significantly higher than the historical average inflation rate of 1.7% as observed between 2010 and 2021. It is FSRA’s view that past loss trend rates are not an accurate indication of future trend rates given the high inflationary environment. Future trend rates should be adjusted upwards by reflecting the latest CPI index for passenger vehicle parts, maintenance, and repair costs to account for the higher-than-historical average inflation rate. For this reason, FSRA has derived a range of future loss trend rates for PD coverages based on the observed inflation rate.

When determining future trend rates, insurers should evaluate their inflation forecast, particularly in relation to auto insurance. This involves evaluating whether inflation is expected to stabilize, decrease, or increase. Insurers are expected to adjust past trend rates accordingly for the proposed policy period. Other factors, such as injury coverages claims cost, economic index, the value of new and used vehicles and rental costs, and the data points used in the fitted model, should also be considered when selecting future trend rates. FSRA is unlikely to approve rates if the assumed future trend rate, based on the present inflation landscape, is applied uniformly throughout the entire future trend period (spanning 2-3 years).

FSRA will continue to monitor the latest inflation rate affecting the claim costs. Any material changes in future trend rates will be reflected in the mid-year Benchmarks update.

Appendix 2 provides a comparison of the new Benchmarks with those previously released. The all coverages combined future trend rate ranges from 4.7% to 8.3% to reflect the higher-than-historical average inflation rate for vehicle parts, maintenance, and repair costs as of July 31, 2023.

The Benchmarks for loss trend rates and reform factors measure the rate of change in loss cost experience without the influence of COVID-19. Historical loss cost data should be adjusted to remove any impact of COVID-19 prior to the application of the Benchmarks.

Expectations

Post-pandemic “new normal” frequency level

The COVID-19 pandemic fundamentally changed most people’s work mode. With more people adapting to remote and hybrid work models, the post-pandemic claim frequency level is expected to be different than historical claim frequency levels.

The Consultant compared the pre-pandemic claim frequency level with the 2022-2 claim frequency level and observed that the 2022-2 claim frequency levels are generally lower than the pre-pandemic frequency levels for Bodily Injury, DCPD, Accident Benefits, and Collision coverages. In particular, the 2022-2 claim frequency level for DCPD, Accident Benefits, and Collision coverages are between 16% and 31% lower than the pre-pandemic claim frequency levels. As such, the observed reduction in 2022-2 claim frequency may serve as an early indicator of a “new normal” frequency level. While it would not be prudent to fully reflect the lower claim frequency level through a single data point, FSRA expects insurers to regularly review their claim frequency data, and appropriately reflect the post-pandemic “new normal” claim frequency level for the proposed policy period. Appendix H of the Consultant’s report details the “New Normal” Frequency Level analysis.

Investment return on cash flow assumption

As each insurer has their own investment portfolio of assets that reflects their investment strategies, FSRA expects insurers to calculate their own portfolio yield, rather than applying the industry average investment yield, in calculating the present value of cash flows.

FSRA replaced the Benchmark investment return on cash flow of 2.25% with a rate selected by each insurer that reflects their own investment portfolio of assets in the 2020-H2 Guidance. The discontinuation of the Benchmark investment return on cash flow adheres to Section 2620.15-17 of the CIA SOP, which speaks to insurers’ use of their own expected investment return when discounting claims in calculating indicated rates. Specifically, Section 2620.15 states that:

“The investment return rate for calculating the present value of cash flows would reflect the expected investment income to be earned on assets that might be acquired with the net cash flows resulting from the revenue at the indicated rate.”

Furthermore, the CIA SOP states that revenue from all sources of funds, rather than investment income revenue generated from risk-free assets only, should be considered in the determination of the indicated rates. Section 2620.01 of the CIA SOP states that:

“The best estimate present value of cash flows relating to the revenue at the indicated rate should equal the best estimate present value of cash flows relating to the corresponding claim costs and expense costs, plus the present value of a provision for profit, over a specified period of time.”

FSRA’s approach has been, and continues to be, consistent with the CIA SOP in the determination of indicated rates. Accordingly, FSRA expects that the insurers’ selected investment return on cash flow assumption will be reasonably close to the insurers’ investment yields earned in the recent past. Also, the selected investment return on cash flow assumption should reflect the unique investment portfolio of assets and the anticipated future investment returns of insurers.

Pricing actuaries’ best practices

FSRA requires a completed and signed Certificate of the Actuary (“Certificate”) for all rate filing applications by a Pricing Actuary (“PA”), who is a fellow of the CIA, regardless of whether the PA produces their own work or chooses to rely upon that of others.

Accountabilities

In signing the Certificate, the PA assumes full responsibility for the methods and assumptions used to determine the indicated rates.

Specifically, the PA confirms that:

- data is sufficient and reliable

- assumptions and methods used are appropriate

- the actuarially indicated rates have been calculated in accordance with Accepted Actuarial Practices (“AAP”)

- indicated rates, including classification differentials, are just and reasonable

- the risk classification system distinguishes risks fairly between classes

Insurers remain responsible for exercising appropriate due diligence in overseeing the conduct of PAs acting on their behalf.

Processes and practices

FSRA assumes that the PA takes full responsibility when using others’ work and attesting that the indicated rates are just and reasonable. Oliver Wyman suggests the following best practices when the PA uses the work of others in rate applications:

- Discussing the purpose of their work and the associated materiality standard with the other party, including especially whether the other party’s valuation work is suitable for the purpose of determining future rates for a specific coverage in Ontario.

- Ensuring that the granularity of data used in the other party’s valuation work aligns with the experience period data used by the PA to determine indicated rates for a specific coverage in Ontario. Justifying the use of different data (i.e., the aggregation of various lines of business, companies and/or provinces) and explaining any adjustments made to accommodate the difference.

- Ensuring that the valuation date of the data used by the other party in their valuation work aligns with that used by the PA to determine indicated rates for a specific coverage in Ontario. Explaining any adjustments made to accommodate the difference.

- Reviewing the valuation work of the other party to understand the methods, adjustments, assumptions and the rationale(s) underlying the selected best estimate of the ultimate loss amount. Specifically:

- The PA should ensure that the assumptions made by the other party in loss development work (e.g., loss trend rates, premium on-level factors, reform factors, etc.) are consistent with the PA’s own ratemaking assumptions in the rate filing.

- If the PA finds that a portion of the other party’s valuation work is not appropriate for its use, then any modification to the other party’s work should be supported by the PA in the rate filing.

Back testing of rate setting accuracy

FSRA will engage insurers for retrospective evaluation of the insurer’s rate setting accuracy in the following circumstances:

- the expectations outlined above have not been satisfied (this would include the PA being unable to explain discrepancies in assumptions)

- the rate level indication is significantly higher than the insurer’s proposed rate change

- the insurer, based on FSRA’s assessment, seems to be using the Standard Filing Guidance in a manner other than for the purpose of keeping rates aligned with changing claims costs

Rate level adequacy at the coverage level

FSRA expects insurer’s rates to be accurate at the coverage level, with each coverage price being reflective of its cost. This practice is expected to better align the relationship between premiums paid by consumers and the cost of the coverages they have chosen.

FSRA will continue to monitor and evaluate insurers’ rate level adequacy at both the overall and coverage levels. In reviewing insurers’ rate filing applications, FSRA may request that insurers provide additional support to ensure the overall and by-coverage proposed changes are in line with the indications and actual rate needs.

Territory rating in auto insurance

FSRA’s supervision and regulation of auto insurance RRCS includes the review of territory rating in rate filing applications. RRCS, including territory rating, must meet statutory standards prior to FSRA’s approval.

Territory review

FSRA has recently completed its multi-faceted review of the current territory definition guidelines, outlined in the Technical Notes for Automobile Insurance Rate and Risk Classification Filings, which includes two reports prepared for FSRA by a leading actuarial consultancy, consultation feedback from the sector and consumers, and FSRA’s internal expertise.

The expert consultant’s territory rating review is comprised of the following parts:

- Part 1 - Review FSRA’s existing territory requirements relative to FSRA’s RRP, and research territory rating practices in other jurisdictions across North America. Pinnacle Territory Rating Review Report.

- Part 2 - Perform data analysis based on industry data. Define, detect, and measure potential unfair discrimination in territory rating. Provide recommendations to FSRA on building a principles-based and outcome-focused territory rating framework. Pinnacle Territory Guidance – Principles-Based Framework Report

As there is no intentional bias in the Bulletin, and as it does not require practices contrary to the Insurance Act, its regulations or the Unfair or Deceptive Acts and Practices Rule made pursuant to such legislation, FSRA has concluded the current territory definition guidelines are not unfair territorial rules; and therefore, the current territory definition guidelines do not lead to unfair discrimination.

FSRA has also concluded that the current inflexible territory rating requirements limit insurers’ ability to offer lower rates in low-cost geographical areas, potentially leading to less competition and subsidization in rates across territories and within territories. While the pooling of risks for auto insurance will always require consumers with different individual risk profiles to be treated as part of a group, the arbitrary territory requirements may result in some geographic areas of consumers paying premiums that do not accurately reflect their risks – for example, risks arising from collisions or theft - since they are, due to the current territory constraints, grouped in with consumer areas with higher, or lower, risks.

The main conclusions of our review are that the current territory rating requirements are outdated, do not reflect technological advancements in data and analytics, are highly prescriptive in nature, and do not allow some consumers to benefit from lower rates available from innovation in rate setting (recognizing also that such lower rates may result in higher rates for other consumers). The current territory rating requirements are also inconsistent with FSRA’s principles-based, outcomes-focused regulatory framework.

Next step

FSRA intends to announce a territory implementation plan in January 2024. The plan will enable participating auto insurers to propose territory rating changes through FSRA's Test and Learn Environment (TLE) without the need to adhere to territory constraints.

Following the TLE announcement, insurers are encouraged to approach FSRA to discuss territory rating change proposals and explore implementation details.

When reviewing TLE applications, FSRA will continue to assess whether proposed rates are actuarially sound in addition to considering fairness in terms of consumer outcomes when determining the approval of territory rating changes.

FSRA’s review of industry advisory rates for auto insurance

FSRA is embarking on a new initiative involving the review and approval of industry advisory rates for PPA and Commercial Vehicles. This change is intended to facilitate new entrants into the Ontario automobile insurance market. During FSRA's comprehensive review process, the regulatory evaluation will center on an array of factors, including ratemaking data, actuarial methodologies, and the assumptions and judgments that contribute to the formulation of industry advisory rates. FSRA will review these foundational elements that might potentially lead to excessive rates, ultimately ensure the proposed industry advisory rates are both just and reasonable.

Once the industry advisory rates receive FSRA’s approval, insurers, particularly smaller ones without the resources to establish their own rates and rating systems, will be able to expediently adopt these rates without providing supporting actuarial justification. Furthermore, other insurers can also utilize FSRA approved industry advisory rates as a reference for assessing their own loss trends and average premiums within the marketplace.

IAO Actuarial Consulting Services Inc. has expressed its intention to submit its industry advisory rates for FSRA's review and approval. FSRA also extends an invitation to other industry advisory organizations interested in having their advisory rates reviewed and approved.

Ontario auto insurance industry Operational Risk Management (ORM) journey: Where are we today?

FSRA is working to enhance the rating and underwriting process of automobile insurance through our Operational risk management framework in rating and underwriting of automobile insurance guidance. This guidance on the ORM framework for auto insurance companies will promote just, reasonable, and accurate automobile insurance rates and will support the fair treatment for consumers engaged in the underwriting process. The degree of adoption of this Guidance will be a function of a proportionality principle, meaning that it is commensurate with the nature (including business model), size, complexity, and risk profile of the insurer.

The 14 largest auto insurance companies, which represent over 95% of Ontario PPA written premium, were invited to participate in a self-assessment survey issued by FSRA to understand the insurer's current ORM practices. The scope of the survey was to explore the current operational risk management practice, including data risk and model risk, operation, governance, and controls in rating and underwriting of Ontario automobile insurance.

FSRA also conducted interviews with insurers to gain clarity on their survey responses, although no specific measures were used to validate the accuracy of the responses. According to the information provided by each insurer, the survey respondents were categorized into three groups.

| Criteria | % of Insurer Groups Surveyed |

Market Share PPA (written premium) |

|---|---|---|

| Group 1 The insurer had established frameworks for operational, model, and data risk. | 33% | 51% |

| Group 2 The insurer had some frameworks in place and intends to have frameworks for all three risk areas by the end of 2024. | 42% | 31% |

| Group 3 The insurer lacked a defined framework for one or more of the three risk areas and didn’t have a clear plan for creating one. | 25% | 16% |

FSRA noted that not all auto insurers currently possess a robust framework for operational, model, or data risk management. Some insurers are in the process of developing these essential frameworks, policies, and procedures. The implementation of effective frameworks, along with the associated policies and procedures, is essential to ensure comprehensive risk mitigation and achieve desired outcome for consumers. Additionally, there's a deficiency in technical and domain expertise within the second line of defense. The consequence was that “second reviews” were performed by First Line staff who were considered independent from model development which is not the preferred process for effective oversight and review of models.

Each insurer needs to implement operational risk mitigation according to their size, complexity, and structure. Our survey marked the initial step in shaping FSRA's guidance for improving risk management in automobile insurance rating and underwriting.

Operational Risk Management

All insurers indicated they had an ORM framework in place that described definitions, roles and responsibilities, and accountabilities in the management of operational risks. While all insurers were tracking operational risk in some form, we noted some differences between FSRA’s expectations in the guidance and what has been observed in practice.

Most insurers confirmed that they currently consider data and model risk as part of operational risk in their ORM frameworks. However, a few insurers indicated they did not consider data and model risk to be part of operational risk. Based on FSRA’s guidance, insurers are encouraged to consider data and model risk as part of the ORM lifecycle.

While all insurers indicated they had an ORM framework in place, insurers were at different levels of maturity, and one insurer was still in the process of creating an ORM framework.

Overall model governance and data governance

The majority of insurers indicated that they had a model governance framework in place that represent 72% of the written PPA premium in Ontario. Insurers that did not have a model governance framework in place indicated that they were in the process of creating one.

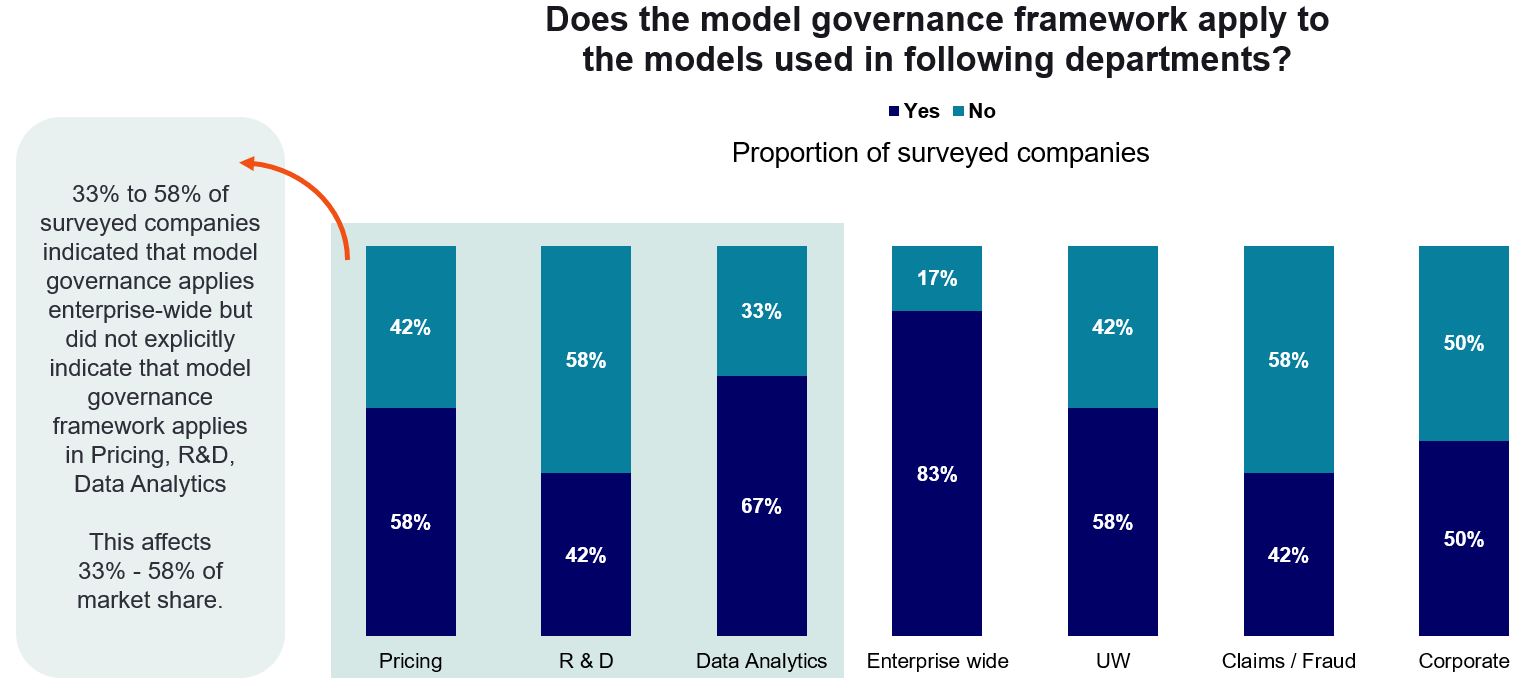

However, there was a discrepancy in the coverage of the model governance framework at some insurers. A few insurers’ model governance frameworks did not cover models created by their Pricing, Research and Development, and/or Data Analytics teams.

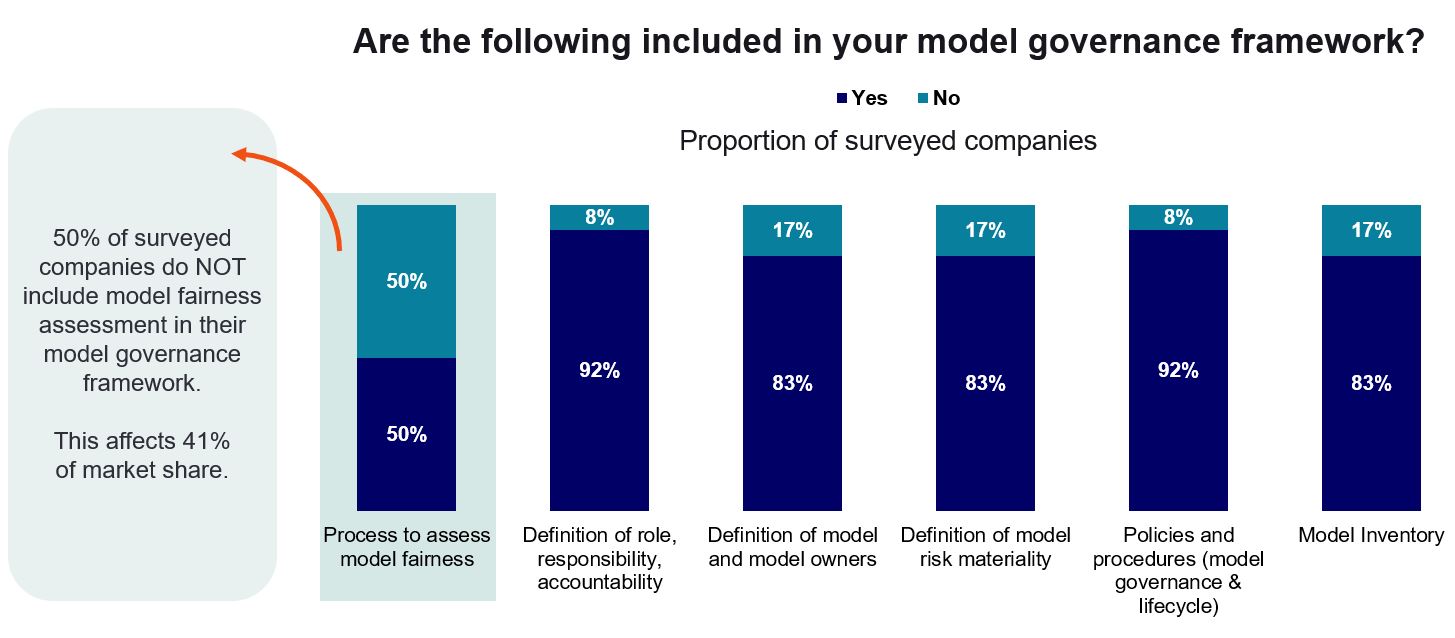

Half of the insurers indicated they included a process to assess model fairness in their model governance framework. Model fairness and social bias assessment and mitigation are areas of focus for FSRA, but insurers viewed it as difficult to include it in their frameworks as they are unable to collect data associated with sensitive attributes. Even if they were able to collect data on protected groups, insurers were concerned about the possible reputational risk if they were to begin asking customers for that data.

For those insurers that have a model governance framework in place, there is a lack of awareness by certain teams of their framework that results in incomplete application of the policies and procedures in the model governance framework. Insurers need to ensure that their model governance framework is being applied in practice and that all necessary areas are aware of the framework. A similar approach should be taken for the data governance framework to ensure that all areas are aware of policies and procedures relating to data risk.

Insurers stated that data governance was frequently embedded in other functions, such as in their model risk management framework. Lacking an enterprise-wide data governance framework can make it difficult to view all data risk and to understand the state of data across an insurer.

Model governance specifics

FSRA asked about documentation created for models, model-related roles and responsibilities, considerations during the model lifecycle, and other related concepts. FSRA’s goal was to get relevant information on how insurers were operationalizing their Model Governance Framework.

All insurers indicated they had an independent review process in place for models, and most insurers indicated they had some form of model documentation and an inventory where that documentation is stored.

However, there was some disparity on which areas conducted those reviews. Some insurers had their first line perform independent reviews as there was a lack of technical skills and/or domain knowledge in the second line. Based on their size and complexity, insurers need to develop the necessary skills in all three lines of defense to effectively challenge models during independent reviews.

Many insurers who were not testing for model fairness as part of model governance stated they were unsure how to test for fairness and mitigate disparate impacts. Appropriate guidance could help insurers understand unfair outcome detection and mitigation throughout the entire model lifecycle and help communicate how disparate impacts could occur, even though data used for model building didn’t contain any prohibited rating variables.

More than half of insurers indicated they used machine learning (ML) models. Half of the insurers used these models for underwriting, with more than half for pricing. The growing complexity of pricing and underwriting models can introduce greater risks of unanticipated adverse effects on consumers, primarily stemming from a lack of model transparency, explainability, and interpretability. To address these risks, insurers should consider the elevated challenges posed by AI/ML into their model governance frameworks. To ensure fair consumer outcomes, insurers should take proactive measures to assess potential adverse impacts that overly intricate and complex AI/ML models may have on particular consumer segments.

Next step

We highly appreciate insurers' participation in FSRA's Survey Questionnaire on ORM Practices. The insights gathered through this survey are instrumental in shaping the FSRA Supervisory Framework development for auto insurance rates and underwriting, which is designed to establish reasonable and consumer-oriented expectations. We invite insurers to get in touch with us to initiate discussions about the aspects where your company is making progress and to identify areas within ORM that may require additional attention.

Effective date and future review

This Approach became effective on December 12, 2023. The next Benchmarks development process began in Fall 2023.

About this Guidance

This Guidance is an Approach. Approach Guidance describes FSRA’s internal principles, processes and practices for supervisory action and application of Chief Executive Officer discretion. Approach Guidance may refer to compliance obligations but does not in and of itself create a compliance obligation. Visit FSRA’s Guidance Framework to learn more.

Appendices and Reference

Appendix 1 – Associated documents

The table below provides a quick reference to all Guidance documents, consultation summaries, and benchmarking reports produced since this Approach Guidance was launched.

Appendix 2 – Comparison to previous Benchmarks

This appendix focuses on the change in future loss trend rates by comparing the previous Benchmark as of June 30, 2022, and the new Benchmark as of December 31, 2022.

On an All Coverages Combined basis, the future loss trend rate for the new Benchmark ranges from 4.7% to 8.3%, compared to the previous Benchmark range from 4.2% to 7.4%. The table below compares the change in future loss trend rates for major coverages the total change.

| Coverage | Future loss trend rate | |

|---|---|---|

| Previous benchmark | New benchmark | |

| Bodily Injury | -4.2% | -3.4% |

| Accident Benefits | -1.0% | -0.1% |

| Direct Compensation - Property Damage | 8.5% to 14.3% | 8.8% to 15.2% |

| Collision | 8.7% to 14.5% | 8.8% to 15.2% |

| Comprehensive | 10.4% to 16.2% | 10.4% to 16.8% |

| All Coverages Combined | 4.2% to 7.4% | 4.7% to 8.3% |

For more detailed information on the change in Benchmarks, please refer to the Commentary section of this Guidance.

Appendix 3 – FSRA’s process for reviewing and approving of GISA automobile statistical plan PPA factor report and ultimate loss projections

This appendix explains how FSRA ensures that the ultimate loss and claim count projections used by the Consultant in its analysis are fit for use.

Beginning in 2022, GISA’s consulting actuary performs their valuation of ultimate losses for Ontario PPA based on full year loss development data. The “Automobile Loss Development Factor Report” has been significantly enhanced to include a comprehensive industry claims valuation.

GISA’s consulting actuary considers the following methodologies in their projections:

- Incurred Loss Development Method

- Paid Loss Development Method

- Claim Frequency and Severity

- Bornhuetter-Ferguson

- Cape Cod Method

- Benktander Method

Results from various projection methodologies are considered in the final ultimate losses’ selections.

In addition to reviewing industry aggregate loss development data for each coverage, FSRA reviews every insurer’s loss development data, twice a year, to identify any data reporting issues, changes in claims handling and case reserving practices. FSRA’s actuaries work with GISA’s consulting actuary, assessing the extent of each insurer’s data issues by adding, removing, and adjusting each insurer’s data one at a time to understand the impact. GISA’s final Loss Development Factors have accounted for adjustments made to those reporting issues, such that the impact of any distortions is immaterial at the industry aggregate level.

Additional details are available in GISA Exhibit - AUTO-0002-ON, 2022-2 Valuation of Ultimates Report, Ontario Private Passenger (excluding farming vehicles).

Appendix 4 – Mid-year update based on industry data as of June 30, 2023

This appendix will be updated based on 2023 H1 industry data as it becomes available.

References

Consistent with its commitment to transparency in rate regulation and guidance development, FSRA conducted a public consultation on the preliminary annual report prior to issuing this Approach Guidance. The Summary of Consultation outlines the feedback gathered and how it was considered in the final annual report. Please find the Consultation Summary here: FSRA’s summary of consultation on Ontario private passenger automobile annual review based on industry data as of December 31, 2022.

Effective Date: December 12, 2023

[1] Loss trends: measure annual rates of change for past and future claim costs (examples of loss trend drivers: advancements in safety technology, changes in medical costs, monetary inflation).

Reform factors: restate historical losses to reflect the current level of claim costs as a result of prior product reforms. Reform factors enable the calculation of loss trends without being impacted by the effect of government reforms.

[2] See Financial Services Regulatory Authority of Ontario Act s. 3

[3] Pursuant to Section 3(2) of the Auto Insurance Rate Stabilization Act, 2003, an application for approval of a risk classification system or rates shall be in a form approved by the Chief Executive Officer and shall be filed together with such information, material and evidence as the Chief Executive Officer may specify. However, for the purposes of this Approach Guidance, the reference will be to FSRA.

[4] Section 2620.04 of the CIA SOP states that “the actuary would consider the blending of information from subject experience with information from one or more sets of related experience to improve the predictive value of estimates.”