Consider the following

John has been a homeowner with a bank mortgage for the last 10 years. His mortgage is coming up for renewal.

He recently lost his job and is now doing gig (freelance or temporary) work. He has fallen behind in paying his bills and his credit score has gone down.

He wants to combine all of his bills into the new mortgage but was not approved by his bank for the amount he needs.

Year 1

John gets a private mortgage

John’s broker reviews his finances and arranges a one-year interest-only mortgage with a private lender.

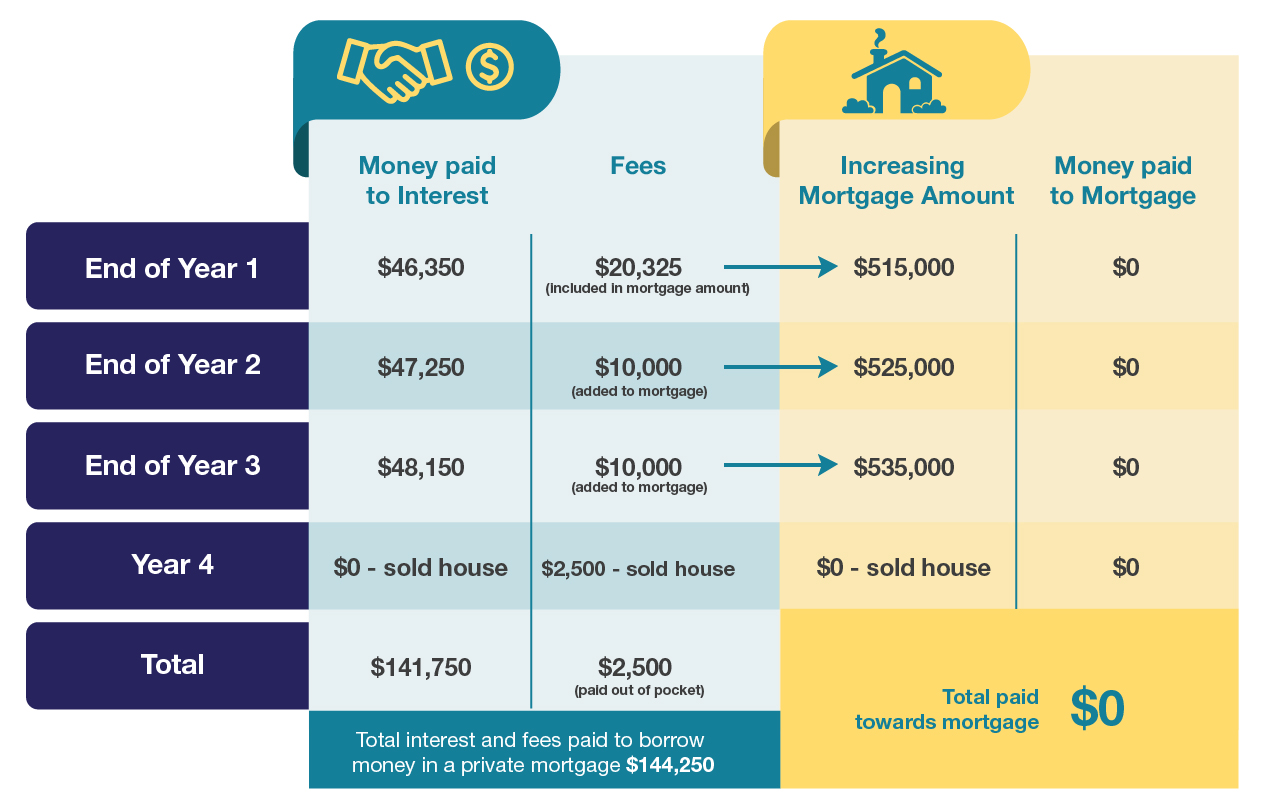

Since John doesn’t have the money to pay fees out-of-pocket, the lender agrees to add them to the mortgage amount. In total, his current mortgage, the bills he is paying off and the added fees and costs equal a mortgage of $515,000. The interest rate is 9%. His mortgage payments go toward interest only.

He and his broker discuss how this private mortgage is a good solution as it gives John the time to stabilize his income and work to improve his credit score. As this is a temporary solution, after a year, John hopes he’ll be approved for a traditional mortgage at the bank

At the end of year 1:

- Total interest payments (on the full mortgage amount, which includes the brokerage fees, lender fees and legal costs that were added): $46,350

- Principal balance repaid: $0

- Mortgage amount still owing: $515,000

Year 2

John does not follow through on his exit strategy and renews his private mortgage

John’s credit has not improved enough to get a traditional mortgage from a bank, and he has only just started a new job.

His broker renews the mortgage with the private lender. Same mortgage amount, interest rate and terms for another year. Again, the fees are added to the mortgage amount, increasing it to $525,000.

John’s broker cautions him that the housing market is shifting downward while his mortgage is going up, so he needs to work hard to improve his credit and secure stable work.

At the end of year 2:

- Total interest payments throughout the year (on the full mortgage amount, which includes the renewal fees and costs): $47,250

- Principal balance repaid: $0

- Mortgage amount still owing: $525,000

- Total mortgage interest payments paid since year 1 (including the added fees and costs): $93,600

Year 3

John does not follow through on his exit strategy and keeps renewing his private mortgage

John’s financial situation has not improved: he is back to unpredictable gig work and has started missing payments again.

His mortgage broker recommends selling his property, as continuing with private mortgage financing is costing him a lot of money. A few houses on the street have recently sold for approximately $575,000, which is nearly 11% less than what it was in year one. If John sold the property now for that much, after paying back the mortgage of $525,000, he would be able to walk away with about $50,000 (not including costs/fees to sell).

Despite this downward trend, John renews with the private lender. Same interest rate and terms for another year. The fees are added to the mortgage amount again, increasing it to $535,000.

At the end of year 3:

- Total interest payments throughout the year (on the full mortgage amount, which includes the renewal fees and costs): $48,150

- Principal balance paid: $0

- Mortgage amount still owing: $535,000

- Total mortgage interest payments paid since year 1 (including the added fees and costs): $141,750

Year 4

John must sell his property because the private lender will not renew his mortgage

John’s financial situation has not improved. He still cannot qualify for a traditional mortgage from a bank or alternative lender and the private lender will not renew his mortgage. John must sell his property.

John sells the property for $575,000. He pays back the mortgage of $535,000 plus $2,500 in legal costs. He has $37,500 left to pay real estate fees, move, and pay the deposit for rent somewhere new.