FSRA releases Progress Report

The Way Forward: Building a Modernized and Adaptive Regulator

Board of Directors Progress Report

April 2018

"With financial services and pensions sectors changing at a rapid pace… Ontario needs a regulatory authority that is flexible, innovative, and in possession of expertise appropriate to match the consistently evolving financial environment. We call not for amendments, revisions or improvements to the existing regulatory framework and apparatus, but for the replacement of the current regulatory structure and approach with a more nimble and accountable one …"[1]

Table of Contents

- Introduction

- Context

- Governance

- Strategic Framework

- Overview of Current and Future Activities

- Key Initiatives and Directions

Introduction

In Canada and across the world, the financial services sector is experiencing significant change and disruption. With the emergence of new technologies, business models, products, and services, regulators recognize they must adapt to become more agile and responsive. As part of this transformation, new approaches, enabled by legislative changes and policy tools such as rulemaking, oversight and enforcement are being implemented. As FinTech and other digital innovations dramatically shift the delivery of services and use of data, the regulator of the future needs mechanisms to support innovation, while at the same time protecting consumers and ensuring market integrity. Regulators must balance consumer protection and fraud prevention with support for a strong and innovative financial services sector.

The Financial Services Regulatory Authority of Ontario (FSRA) is a new, independent regulatory agency established by legislation in June 2017 to improve consumer and pension plan beneficiary protections in Ontario.

When operational, FSRA will be an innovative, self-funded regulator capable of responding to the dynamic pace of change in marketplace, industry and consumer expectations. It will regulate many sectors that are important to Ontario consumers and pension plan beneficiaries, including property and casualty insurance; life and health insurance; credit unions and caisses populaires; loan and trust companies; mortgage brokers; health service providers (related to auto insurance); and pension plan administrators.

Since inception, FSRA has been developing a comprehensive transition plan to assume functions currently delivered by the Financial Services Commission of Ontario (FSCO) and the prudential oversight function from the Deposit Insurance Corporation of Ontario (DICO). The transition plan is based on FSRA becoming fully operational by April 2019, pending requisite approvals and agreements required for implementation.

This report provides an update on FSRA's current status and activities, a high-level overview of FSRA's proposed strategic framework and key areas of focus to enable a successful transfer of operations and staff, ensure business continuity, and lay the foundation for ongoing transformation and modernization.

This work is informed by the Expert Panel Review of the Mandates of the Financial Services Commission of Ontario, Financial Services Tribunal, and the Deposit Insurance Corporation of Ontario (Expert Panel) and other reports, invaluable input from FSCO and DICO management, and a comprehensive analysis of regulatory and financial services best practices from other jurisdictions. As well, the Board has met with over 60 organizations and individuals, representing a wide range of stakeholders in the government, financial services and regulatory sectors, to further understand and explore issues, opportunities and perspectives. Going forward, ongoing dialogue and consultation will be at the core of FSRA's approach to an ambitious transformation and modernization plan.

The Board of Directors extends its deep appreciation to the Ministry of Finance and the Financial Services Regulation Modernization Secretariat for its commitment and support for the modernization and transformation of financial services regulation in Ontario. The Board of Directors also acknowledges and thanks FSCO and DICO for their active participation and input, which were invaluable to informing this plan.

We wish to also acknowledge the important role that all staff at FSCO and DICO play to ensure great service and operational stability as we build to the future together.

We look forward to sharing our ongoing progress and plans over the coming months.

Bryan Davies, Chair

Financial Services Regulatory Authority Board of Directors

Context

The Case for Change

A well-functioning financial services sector is foundational to a successful economy [2]. Toronto's financial services sector directly accounts for 270,000 jobs and 14% per cent of its GDP, with another 115,000 jobs in supporting industries such as consulting, accounting, legal and technology services [3]. To ensure ongoing success, the rapid pace of change in the sector and economy demands regulatory flexibility, evolution and support to protect consumers and pension plan beneficiaries while enabling innovation and growth.

Over the last five years, Ontario's financial services regulatory environment has been assessed in a number of reviews. Reflecting extensive research and consultation, the resulting reports included written submissions by organizations and individuals, sector-specific roundtable discussions, and open dialogue during informal meetings with regulators, financial services stakeholders, and investor advocates.

- International Monetary Fund: In early 2014, the IMF issued a report on the current state of financial services in Canada. It noted that current regulatory systems in Ontario lack the resources and financial capacity to proactively, consistently and effectively administer necessary oversight.

- Auditor General of Ontario: Following an extensive audit of FSCO's activities, the 2014 Annual Report of the Office of the Auditor General of Ontario identified gaps and risks in FSCO's regulatory functioning and suggested that, given the wide scope of responsibility, FSCO consider ways to transfer responsibility to self-governing industry associations and other regulatory bodies.

- Expert Panel: Appointed by the Minister of Finance in 2015, the Expert Panel conducted a mandate review of three agencies important to the financial well-being of Ontarians: FSCO, the Financial Services Tribunal (FST), and DICO. Its work was informed by a government mandate to make recommendations to modernize financial regulation and improve consumer protection, by wide-ranging stakeholder consultations and by best practices in other jurisdictions. Its findings highlighted key shortcomings in the rapidly changing regulatory environment and called for the creation of a new, independent and integrated regulator called the Financial Services Regulatory Authority.

Environmental Scan

A comprehensive environmental scan [4] identified a number of trends that are impacting regulated sectors, each with specific implications for financial services regulators:

- Ongoing consolidation among major market players;

- Non-traditional market entrants will continue to disrupt regulated sectors. The nature of competition will change and the degree of competitiveness will accelerate, compelling regulators to balance a level playing field with fostering continued innovation;

- Innovative new technologies (e.g., artificial intelligence) will emerge and the overall pace of change will increase. The transformation of business models, customer experiences, operations, and regulatory compliance will require regulators to be forward-looking, proactive, and collaborative;

- The traditional lines that distinguish "vertical" sectors will blur as new partnerships will enable organizations to bypass traditional value chains. Regulating and establishing consistent standards for "horizontal" activities and characteristics common across all industry sectors will be critical;

- There will be increased domestic and global regulatory integration. A "regulator of the future" in Ontario must thoughtfully consider its scope, capabilities, and interaction model with other regulatory bodies; it cannot operate in a vacuum; and

- Customers will have rising expectations for products, services, and experiences. As regulated sectors innovate to meet high expectations, a robust and agile regulator is needed to adequately protect customers and investors.

Governance

Mandate

FSRA was established in the Financial Services Regulatory Authority of Ontario Act, 2016 (FSRA Act), which came into force on June 29, 2017.

The Act establishes FSRA's role in regulating the regulated sectors and sets out powers in the administration and enforcement of the Act and Sector Statutes and outlines the basic governance and accountability structure. FSRA will administer the following statutes at launch:

- Insurance Act

- Automobile Insurance Rate Stabilization Act, 2003

- Compulsory Automobile Insurance Act

- Prepaid Hospital and Medical Services Act

- Credit Unions and Caisses Populaires Act

- Loan and Trust Corporations Act

- Mortgage Brokerages, Lenders and Administrators Act, 2006

- Pension Benefits Act

The FSRA Act sets out its intended objects, which are:

- to regulate and generally supervise the regulated sectors;

- to contribute to public confidence in the regulated sectors;

- to monitor and evaluate developments and trends in the regulated sectors;

- to cooperate and collaborate with other regulators where appropriate;

- to promote public education and knowledge about the regulated sectors;

- to promote transparency and disclosure of information by the regulated sectors;

- to deter deceptive or fraudulent conduct, practices and activities by the regulated sectors; and

- to carry out such other objects as may be prescribed.

FSRA's intended objects with respect to the financial services sectors are:

- to promote high standards of business conduct;

- to protect the rights and interests of consumers; and

- to foster strong, sustainable, competitive and innovative financial services sectors.

FSRA's intended objects with respect to pension plans are:

- to promote good administration of pension plans; and

- to protect and safeguard the pension benefits and rights of pension plan beneficiaries.

This legislative framework will enable FSRA to become a modern and adaptive regulator with:

- specific categories of rule-making authority, with flexibility in its approach to regulating insurance, pensions, and mortgage brokers;

- the ability to establish a funding framework, similar to the authority currently given to the Ontario Securities Commission; and

- a process by which FSRA can make rules, in lieu of regulation, which would involve substantial public consultation and notice.

Governance Framework

FSRA is established as a self-funded Crown corporation with a Board of Directors consisting of members who are appointed by the Lieutenant Governor in Council on the recommendation of the Minister of Finance. The Authority is accountable to the Minister and, through the Minister, to the Ontario Legislature.

The Act provides that the Authority is to be composed of at least three and not more than eleven Members. Appointments are made in accordance with the Agencies and Appointments Directive and the procedures of the Public Appointments Secretariat of the Government of Ontario. One Member is designated as Chair by the Lieutenant Governor in Council on the recommendation of the Minister.

Under the Act, the Board appoints a Chief Executive Officer who shall, subject to the supervision and direction of the Board, be responsible for the management and administration of the Authority and exercise the powers and duties conferred or assigned to the CEO under the Act and the Sector Statutes. Mark White was appointed FSRA's inaugural Chief Executive Officer, effective May 7th, 2018.

Board of Directors

| Name | Term |

|---|---|

| Kathryn Bouey | June 29, 2017 to June 28, 2019 |

| Blair Cowper-Smith | February 28, 2018 to February 27, 2020 |

| Bryan Davies (Chair) | June 29, 2017 to June 28, 2019 |

| Brigid Murphy | February 28, 2018 to February 27, 2020 |

| Richard Nesbitt | February 28, 2018 to February 27, 2020 |

| Lawrence E. Ritchie | March 12, 2018 to March 11, 2020 |

| Judith Robertson | June 29, 2017 to June 28, 2019 |

Strategic Framework

FSRA's initial strategic framework outlines key directions focused on delivering on FSRA's mandate; key enablers to ensure effective, adaptive, agile and modernized financial services regulation; and standards of excellence to drive strong, positive organizational culture and performance. Further engagement and evolution of these directions will take place in the coming months.

Strategic Directions

- Protect consumers and pension plan beneficiaries

- Promote innovation and competition

- Enhance market integrity and stability

Key Enablers

- Rule-making capacity

- Collaborative, forward-thinking culture

- Support for collaboration & innovation

- Integrated systems for data & analysis

- Effective & efficient corporate services

- Simple, consistent & fair funding model

Standards to Deliver Excellence

- Good governance practices and expert leadership

- Empowered, high-performing people and technologies

- Continuous consultation with stakeholders

- Coodination with other regulators

- Effective stewardship of resources

- Transparent, principle and evidence-based approach to regulation

- Experimention, proactivity and adaptability

- Operational independence from, and continuous collaboration with, government

- Positioning of Ontario as a good place to do business

Strategic Directions

FSRA will implement new regulatory systems, tools, and processes in order to:

1) Protect consumers and pension plan beneficiaries: Represent the interests of consumer and pension plan beneficiaries to enhance their confidence and understanding as they engage with regulated entities

- Embed the 'voice of the consumer' across the organization

- Conduct outreach and public education to increase knowledge and understanding of the financial services sector

- Apply consumer-based research and policy support to inform strategies and actions

- Improve systems for consumer complaint tracking and resolution

- Provide increased information and resources on products, services and regulated entities

2) Promote innovation and competition: Foster a strong, sustainable and dynamic financial services sector

- Drive innovation enablement at FSRA with new tools and capabilities

- Ensure that regulation and oversight is conducted with a view to encouraging innovation and competition in the interests of consumers

- Work proactively with core regulatory functions to ensure organizational capacity, flexibility, and nimbleness to anticipate and respond to changes in the regulated sectors

- Provide an integrated organizational view across sectors, while maintaining responsiveness to the unique needs of each sector

3) Enhance market integrity and stability: Promote the integrity and stability of Ontario's financial services system

- Implement modern technologies, systems, and processes to improve transparency and disclosure, monitor and identify deceptive or fraudulent conduct, and improve data analytics for policy formulation and risk assessment

- Enhance cooperation and collaboration with other regulators to improve responsiveness, leverage best practices, and reduce costs and barriers to innovation

- Increase transparency and disclosure, enhancing deterrence of deceptive or fraudulent conduct, practices, and activities by regulated entities

Key Enablers

FSRA's key enablers represent the capabilities it requires to be agile, future-focused, responsive, and better positioned for the emergence of new technologies, business models, products and services. FSRA's ambitious vision for modernization and transformation is anchored in these capabilities.

| Key Enabler | Description |

|---|---|

| Legislative framework with enabled rule-making capacity to adapt quickly and effectively | Rulemaking authority (reflecting meaningful collaboration with the Ministry of Finance and other key stakeholders), combined with new and enhanced functions and capabilities will enable FSRA to be responsive, data-driven, and dynamic in its regulatory approach |

| Organizational leadership and committed staff aligned to a collaborative, forward-thinking culture | To drive transformation across the organization, changed ways of working are required to support the regulatory function to become more agile, innovative, and forward-looking and will be reinforced through an aligned organizational culture. Key to this will be building on existing expertise and dedication of staff and securing their commitment to transformation. |

| Mechanisms to support collaboration and implementation of innovations | FSRA will work with market participants on innovative, technology-enabled initiatives and will provide the flexibility to test out new ideas and gather data to better inform ways to meet regulatory requirements (e.g., regulatory innovation "Super Sandbox" in collaboration with the Ontario Securities Commission and the Ministry of Finance) |

| Strong, able, robust, integrated systems for data and analysis | Data and analytics capabilities will provide FSRA with a competitive edge, improve regulatory efficiency, drive positive business outcomes, and enable fact-driven decision making |

| Effective and efficient corporate services systems and processes | To operate independently and support transformation, FSRA will build essential corporate services (e.g., Finance, Human Resources, Information Technology) and operational capabilities |

| Simple, consistent and fair funding model | FSRA seeks to operate a principles-based funding model, in which details are accessible and comprehensible to all stakeholders, and does not create unintended barriers or advantages for any particular participants or sectors |

Standards to Deliver Excellence

FSRA will apply high standards to establish and nurture a strong, positive organizational culture:

- Follow good governance practices with leadership from an expert Board and senior management team

- Achieve operational excellence with an expertly staffed team of empowered, high- performing people equipped with necessary technology

- Continuously consult with consumers and industry to understand needs, context, and trends

- Apply a transparent, principles and evidence-based approach to regulation

- Use authorities appropriately to move quickly, experiment and proactively adapt

- Be cost-effective stewards of resources

- Coordinate seamlessly with provincial, national and international regulators to avoid regulatory overlap and gaps

- Foster a productive and collaborative relationship with the government, while maintaining operational independence

- Ensure a globally-informed regulatory approach positioning Ontario on the international stage as a good place to do business

Overview of Current and Future Activities

Plan for Launch

At Launch, FSRA will be a new Ontario financial services regulator, comprising functions now performed within existing provincial regulators, as well as new functions to carry out the mandate and powers under the Financial Services Regulatory Authority of Ontario Act. FSRA will not simply be the continuation of existing Ontario regulators, but rather a fundamentally transformed organization. The future-state organization will reflect a thorough assessment of current organizational structures and functions, expanded scope and capacity, and best practices from regulators in other jurisdictions.

FSRA is working to become fully operational by April 2019. Legislative amendments would, if passed, enable the transition of most of FSCO's regulatory functions to FSRA. Further assessment and planning is underway related to the transition of DICO's prudential oversight functions. Until FSRA is fully operational and functions are transitioned, FSCO and DICO will continue to exercise their statutory duties.

In preparation for Launch, FSRA's leadership will focus on a number of activities to ensure that the organization is positioned to succeed.

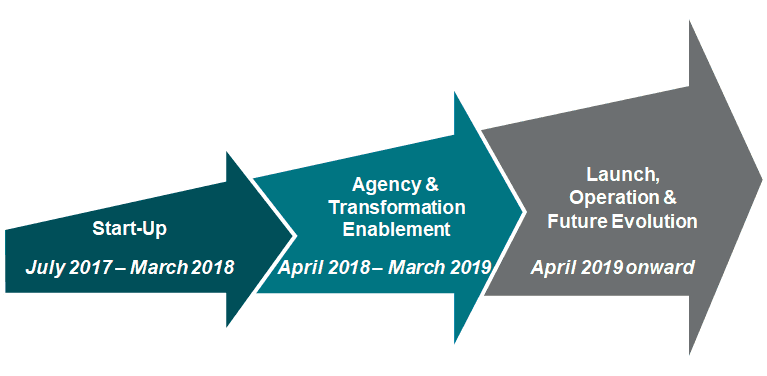

Timeline and key activities

1. Start-up (completed)

Since their appointment, the initial Board of Directors has moved quickly to establish the organization and develop a comprehensive plan to assume regulatory functions currently under the auspices of FSCO and DICO. The Board has focused on the development of a transition plan; consultation with stakeholders and liaison with the Government on legislation to clarify FSRA's mandate, structure, governance and rule-making abilities; and recruitment for FSRA's Chief Executive Officer. Key accomplishments to date include:

- The appointment of Mark White as FSRA's inaugural Chief Executive Officer, effective May 7, 2018;

- Active and ongoing outreach, engagement and information sharing with executives and senior management at FSCO and DICO;

- Continuous liaison and dialogue with the Ministry of Finance, with the support of the Financial Services Regulation Modernization Secretariat;

- Consultation with over 60 organizations and individuals, representing a wide range of stakeholders in the financial services and regulatory sectors;

- The appointment of four additional directors to the Board;

- Initial by-laws and policies to ensure accountability for business affairs;

- On-boarding of an initial transition team to build new capabilities for FSRA in parallel to sustaining operations at FSCO and DICO;

- Support for transition-related communications to FSCO and DICO staff;

- Launch of a corporate website at www.fsrao.ca; and

- Securing office space for FSRA staff and the initial transition team.

2. Agency and Transformation Enablement (April 2018 – March 2019)

Over the next year, FSRA will establish solid organizational foundations to ensure a successful launch, support transition and business continuity, and initiate an ambitious transformation.

- During this interim period, FSCO and DICO will continue to exercise their statutory duties. FSRA will conduct joint planning and coordination with the Ministry of Finance, FSCO and DICO on transition planning and on key initiatives to "hit the ground running" at transfer. FSRA is working closely with FSCO, DICO, government partners and bargaining agents to ensure a smooth and successful transfer of people and functions. A key focus will be on ensuring consistent and timely communications with stakeholders.

- FSRA, with key input and coordination with FSCO and DICO, will build foundational administrative and operational systems (currently provided by the Ontario Public Service) to support a standalone organization and add new and enhanced capabilities to support transformation.

- FSRA will initiate new areas of focus including consumer engagement, innovation enablement and a new fee model

3. Launch, Operation and Future Evolution (April 2019 onward)

Pending required approvals and agreements, staff, functions and regulatory authority will transfer to FSRA as it builds the future-state organization. FSRA will continue the development of new and enhanced systems and business processes, while delivering ongoing change management to support continued transformation. Key elements include:

- Organizational design and development: A robust organizational design, based on the guiding principles outlined in the table below, will enable FSRA to deliver on its ambitious mandate and strategic priorities. The organizational structure will be finalized in consultation with FSRA's founding CEO and shared over the coming months.

- Our people: FSRA is committed to building a consistently positive employee experience and fostering a positive, strong culture. Comprehensive human resources policies, approaches and supports will support a smooth transition and help FSRA attract and retain talented, engaged and energized staff aligned with the organization's vision.

- Continued business transformation: FSRA will build and implement high-impact, effective capabilities, technologies and business processes to streamline electronic filings and information exchange, support advanced data gathering and analytics, deter and detect fraud, and improve monitoring and risk management.

The following organizational design principles reflect the recommendations of the Expert Panel, input from FSCO and DICO management and stakeholders:

| Principle | Description |

|---|---|

| Mandate and consumer focused | Facilitates effective, innovative oversight, regulation and supervision, and ensures robust, proactive protection of consumers and beneficiaries |

| Agility and innovation | Responsive to changing consumer and industry needs |

| Simplicity | Easily understandable and simple to navigate |

| Collaborative and transparent | Fosters collaboration within the organization, with the Ministry of Finance, other regulators and market participants, and greater transparency and accountability |

| Sustainable | Demonstrates financial responsibility with effective, efficient operations |

Communications and Engagement

The establishment of FSRA represents a significant change with impacts for both internal and external stakeholders. To ensure a successful transition and lay the foundation for future transformation, FSRA is committed to providing clear, consistent, and timely information at key milestones and throughout the transition. Ongoing dialogue and consultation will be at the core of FSRA's approach to an ambitious transformation and modernization plan.

Internal stakeholders

For transferring employees, our objective is to build a positive employee experience and foster a strong, positive FSRA culture. Throughout the transition, FSRA is committed to driving transparency and engagement, clearly articulating a case for change, ongoing consistent and timely information sharing and dialogue with employees and supporting ongoing business continuity and service delivery.

External stakeholders

For external stakeholders, FSRA's mandate to drive transformation in the regulation of financial services will result in different impacts at different points in time. From transition-related operational communications to support business continuity, to ongoing and future dialogue on elements such as changing fee structures and rules, FSRA will provide clear and consistent communications. Effective information-sharing and consultation with other regulators is essential to support coordination and build momentum for change across and between jurisdictions and sectors.

Key Initiatives and Directions

FSRA is adopting a transparent and evidence-based approach to regulation, focusing on key initiatives as we set up operations and lay the groundwork for future transformation.

Consumer Office

Building on the foundation of work underway by FSCO, FSRA will reinforce and drive a fundamental consumer-focused culture across the organization. The Consumer Office will increase FSRA's visibility with consumers, conduct outreach and public education, obtain consumer perspectives to inform future policy, and enable a more flexible, innovative and responsive regulatory function to better protect consumers and pension plan beneficiaries.

Rule-making Authority

Rule-making authority (reflecting meaningful collaboration with the Ministry of Finance and other key stakeholders), combined with new and enhanced functions and capabilities will enable FSRA to:

- Become more responsive to current and emerging opportunities, issues and regulatory gaps;

- Bring decision-making closer to regulatory operations and enhance it through more data-driven decision-making; and,

- Develop a more dynamic approach to innovation enablement.

FSRA expects to begin work shortly on an initial fee rule which will form the source of cost recovery going forward. As required in the Act, FSRA will publish proposed rules for public comment for at least 90 days. If FSRA makes a material change to the proposed rule following the public comment period, the rule would be republished for further public comment. Proposed rules must also be submitted to the Minister of Finance for review and approval.

Innovation Enablement

FSRA will work with market participants to identify innovative, technology-enabled initiatives to inform required flexibility in regulatory requirements. One example of this type of initiative is the proposed regulatory innovation "Super Sandbox" in collaboration with the Ontario Securities Commission and the Ministry of Finance. This will support FSRA to become more proactive, responsive, and better integrated within the broader financial services ecosystem.

FSRA welcomes your ideas and perspectives at [email protected]. To receive ongoing updates, please subscribe to FSRA's mailing list.

- ^ Final Report of the Expert Panel Review of the Mandates of the Financial Services Commission of Ontario, Financial Services Tribunal, and the Deposit Insurance Corporation of Ontario, March 2016

- ^ Conference Board of Canada: Partners in Growth: 2017 Report Card on Canada and Toronto's Financial Services Sector

- ^ Conference Board of Canada: Partners in Growth: 2017 Report Card on Canada and Toronto's Financial Services Sector

- ^ The scan involved interviews with current and former employees, as well as online research, of industry associations, regulated entities and other regulators in multiple jurisdictions including the Ontario Securities Commission; Capital Markets Regulatory Authority; Office of the Superintendent of Financial. Institutions; Autorité des marchés financiers, Québec; Australian Securities and Investment Commission; and Financial Conduct Authority, United Kingdom.