When FSRA launched in 2019, the sector recommended that FSRA focus on the Asset Transfer and Wind Up application processes. Both of these transactions had large backlogs of unapproved or stalled applications and were seen as unnecessarily cumbersome.

FSRA quickly initiated work on an updated Asset Transfer Guidance and re-envisioned its approach to reviewing and approving these transactions. The new Supervisory Approach to Defined Benefit Asset Transfers Guidance was released in January 2021. The Guidance also addressed FSRA’s newly legislated ability to approve variances to Asset Transfer Notice content and timing, and it reflected a harmonized consent process (i.e., providing a letter of consent vs. Notice of Intended Decision) for all types of Asset Transfers.

In September 2020, a specialized Asset Transfer Team was established, followed by a specialized Wind Up Team in January 2021. Both teams were tasked with eliminating backlogs of over 200 applications and streamlining approval processes.

Using a collaborative approach, these teams work with pension colleagues across FSRA and the applicant to review the Asset Transfer and/or Wind Up application. The teams use an outcomes-focused approach to their review. This ensures applications are processed in a timely manner while also ensuring pension plan members rights are protected.

FSRA is committed to continuous education to enhance sector compliance. In February 2021, FSRA hosted a widely attended webinar on the purpose of the new Guidance, the application and review process and key insights on decisions. It was an opportunity to re-engage the sector and answer questions, highlighting FSRA’s approach to problem solving and sector engagement to co-develop solutions:

As part of FSRA’s digital transformation, in March 2021 we released a new partially automated Defined Contribution (DC) Wind Up Application on the Pension Services Portal (PSP). We also hosted meetings with DC third-party service providers in June 2021 to share best practices and hear their feedback.

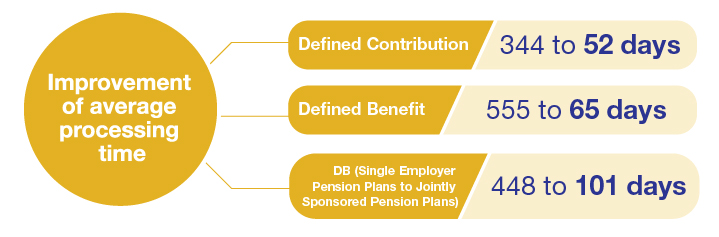

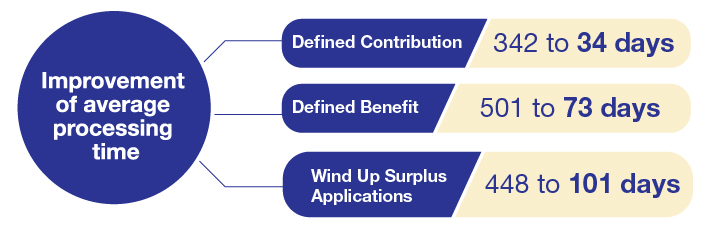

These actions resulted in clearing the backlogs and significantly improving the average processing times. Take a look at our results below (as of July 18, 2022):

Results

Total applications processed since specialized teams established

Asset transfers

Wind ups

Improvement to average processing times

Asset transfers

The average processing times since the creation of specialized teams and release of the Supervisory Approach to Defined Benefit Asset Transfers under the PBA has improved drastically.

Wind ups

The average processing times since the creation of specialized teams and launch of the DC wind up application on the Pension Services Portal has improved drastically.

Note: “Days” refers to business days.

Asset transfer and wind up application tips

We’re continually enhancing our processes based on our experience and by listening to your input. Here are a few tips to keep in mind when filing Asset Transfer and Wind Up applications:

- File each document in a separate electronic file (e.g., the actuarial report, notices, amendments, etc.) and clearly label each file.

- File a complete application. We begin our review once we receive a complete application.

- Respond to our request for information in a timely fashion. This ensures we process your application within our service standards.

- Address pre-existing regulatory issues with involved plan(s). For example, ensure that all historical amendments to the plan were filed with FSRA and identify any outstanding matters/approvals/etc.

- File all application-related plan amendments for each involved plan before their effective date and ensure they are signed by a person or persons with authority to amend the plan.

- Notices should contain all required elements (subject to any variations requested and permitted).

- Notices should be provided to any Unions who represent members in the wound up plan or in the transferring or receiving plans (including those that do not represent transferring members in the case of an Asset Transfer).

- Do not file your application as part of an amendment submission on the PSP.

- Provide membership breakdown by jurisdiction.

- Effective dates on the application and notices should be consistent.

- Address multi-jurisdictional issues. For example:

- there must be a certification of compliance for each applicable jurisdiction

- where there is a partial Asset Transfer involving defined benefit (DB) plans, assets must be allocated by jurisdiction (in accordance with CAPSA’s multi-jurisdictional pension plan agreement)

Update: asset transfers notice variances and waivers (activity for the year ending June 30, 2022)

Under the Pensions Benefits Act (PBA), FSRA has discretionary powers to vary or waive the content and timing of Asset Transfer notices. Section 5 of the Supervisory Approach to Defined Benefit Asset Transfers under the PBA assists Plan Administrators with notice variance requests.

FSRA is committed to assisting Plan Administrators in fulfilling their duties under the PBA. Below, we provide information on the notice variance requests received from September 2020 to July 2022 and outcomes. Over the period, 29 notice variance requests were received. The majority of them (25 out of 29) were approved. The remaining 4 were denied.

Approved requests

Most approved variances were requesting to reference the most recent annual or biennial statement provided to the original plan members to satisfy some of the Asset Transfer notice requirements (required under section 40 of the Ontario Regulation 909).

While these types of notice variances are typically approved, FSRA asks that, for DB plans*, updated benefit amounts be provided to members as of the effective date of the Asset Transfer, if the annual statement date is before the effective date of the Asset Transfer. For example:

- Annual statement date: December 31, 2021

- Asset transfer date: March 31, 2022

- FSRA will require that members be informed of the benefit amount being transferred to the successor plan as of the effective date of the Asset Transfer.

*This does not apply to DC plans if members have access to daily account balances through an on-line platform.

Requests not approved

FSRA, in its role to protect plan beneficiaries is committed to enabling well informed decisions by ensuring that plan sponsors and administrators communicate clearly and transparently to plan beneficiaries in easily understood language. The reasons for refusing to approve the requests included:

- A request to waive the requirement for Unions representing members of either the original and/or successor plan to be provided a copy of the Asset Transfer application. FSRA’s position is that all Unions under the original and successor plans must be provided a copy of the Asset Transfer application (or be advised how they can request a copy), whether their members are a part of the transfer group or not.

- A request to reference the original plan member booklet in the notice was not granted as the plan member booklet did not reflect the latest plan provisions.

How to file a variance request

As described in section 5.2 of the Supervisory Approach to Defined Benefit Asset Transfers under the PBA, applicants should request a waiver or variance before notices are issued. Waiver and/or variance requests can be made by sending an email to FSRA providing:

- The nature of the request

- Background on the Asset Transfer (plans involved, effective date, etc.).

- The elements of the Asset Transfer notice content or timing requirements that are being requested to be varied and/or waived with reference(s) to the applicable section(s) of the PBA and, rationale.

If you have any questions about the variance request process, please contact FSRA.