You missed the deadline to do your private mortgage course. Now what?

The law[1] states that anyone who didn’t pass the private mortgage course before March 31, 2024 will transition to a level 1 agent licence upon renewal.

Level 1 agents may only arrange mortgages with National Housing Act-approved lenders or financial institutions.

It’ll take at least one year to become a level 2 agent again; and at least three years to become a broker again.

| Upgrade to Level 2: | Upgrade to Broker: |

|---|---|

|

|

In addition, all brokers and level 2 agents who held a licence during the year starting April 1, 2023 and who did not complete the private mortgage course by March 31, 2024, are not eligible to apply to upgrade their licence during the licence year that begins April 1, 2024.

What's on this page:

Why did these changes occur?

In April 2022, the government and FSRA implemented a new licence class for mortgage agents. Enhanced educational requirements were also introduced for brokers and agents working with private mortgage lenders and raising capital.

The new requirements better protect consumers and investors by helping ensure they receive appropriate mortgage advice and product recommendations when dealing with private mortgages.

Effective April 1, 2023, there were two licence classes for mortgage agents:

Level 1 agent

Agents authorized to deal and trade in mortgages with lenders that are financial institutions or approved under the National Housing Act, as described in regulation

Level 2 agent

Agents authorized to deal and trade in mortgages with lenders that are financial institutions or approved under the National Housing Act, as described in regulation, and all other mortgage lenders such as mortgage investment companies, syndicates, private individuals, agents, brokers, and brokerages

Full details can be found in FSRA’s guidance.

Engagement with the Mortgage Brokering sector

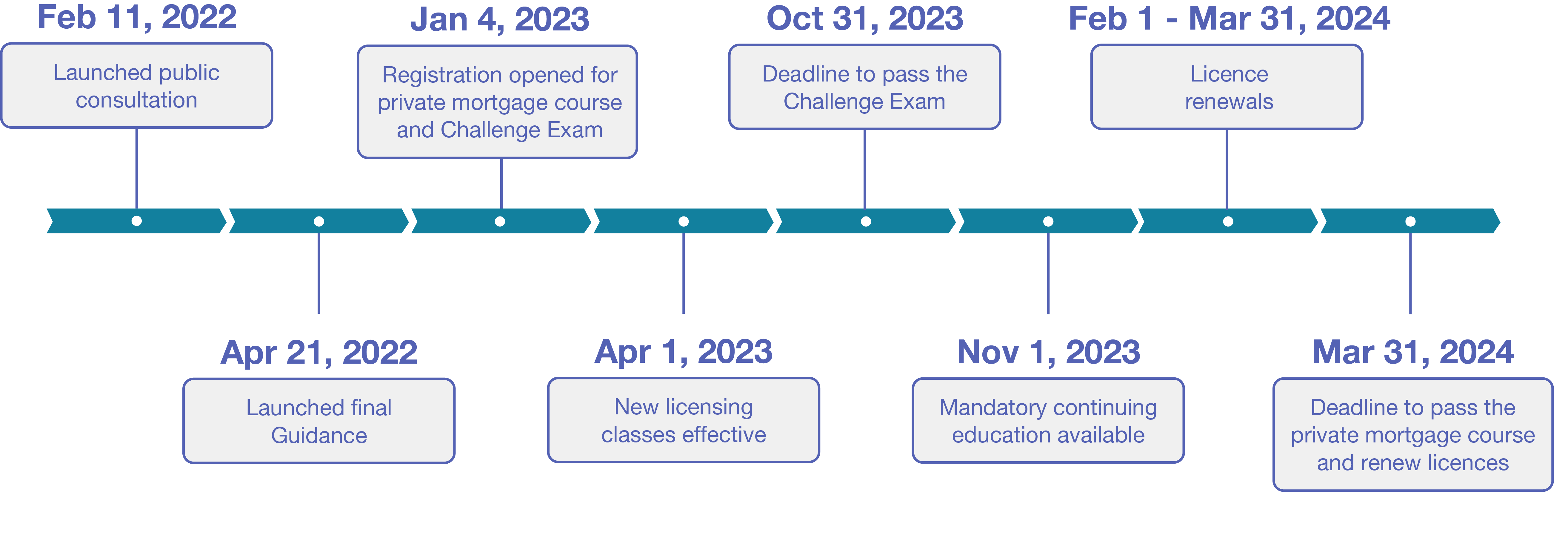

FSRA launched public consultation on New Mortgage Agent and Broker Licensing Requirements in February 2022 and finalized the guidance in April 2022. The guidance was clear that the new licencing class became effective on April 1, 2023.

Since the announcement in April 2022, FSRA has been proactively communicating with principal brokers, brokers and level 2 agents to support the industry and remind them about these new requirements:

- 62 email reminders and newsletter articles sent, including monthly reminders in licensing communications between October 2023 and March 2024

- 40 individual principal brokers contacted at Ontario’s largest mortgage brokerages

- 1,300 principal brokers, brokers and agents participated in two FSRA webinars

- Dedicated page was made available on FSRA’s website with key information about the new requirements

- 10 major industry associations and brokerage networks were used to raise awareness of the new requirements to thousands of principal brokers, brokers and agents

- FSRA presented at 10 major industry events

- Media interviews were conducted with senior FSRA leadership to promote the new licensing requirements:

- Antoinette Leung with Canadian Mortgage Professional Mar 2022

- Huston Loke with Canadian Mortgage Professional Apr 2022

- Huston Loke with Canadian Mortgage Professional Feb 2023

- Jelena Pejic with Canadian Mortgage Professional Mar 2024

- Jelena Pejic with Canadian Mortgage Trends Mar 2024

Timeline

Private mortgage course information

The FSRA-approved Private Mortgage Course is available through:

- Canadian Mortgage Brokers Association (CMBA) – Ontario

- Mortgage Professionals Canada (MPC)

- Real Estate and Mortgage Institute of Canada (REMIC)

Resources

- New mortgage agent and broker licensing requirements final guidance

- FSRA's principal broker webinar on new licensing requirements (November 9, 2022)

- FSRA's new licensing classes webinar for mortgage agents and brokers (November 15, 2022)

Questions? Contact us.

FSRA Contact Centre

[email protected]