Contents

Executive summary

Background

Objective

Review Approach & Scope

Detailed Observations

1. Rapid growth of MGAs with considerable increase in the number of agents and recruits

2. Sale of relatively complex products by many newly licensed agents

3. Concerns with agent training

4. Lack of agent oversight

Conclusions & next steps

Appendix 1

Executive summary

Buying individual insurance is an important long-term financial decision and commitment. Consumers should be able to establish confidence and a trusted relationship with their agents[1]. In turn, their agents should provide advice on what products best meet their insurance needs and financial goals.

The Canadian Council of Insurance Regulators (CCIR) continues to work on behalf of all stakeholders, including consumers, to ensure financial safety, fairness, and choice for everyone. Between December 2021 and June 2022, the Financial Services Regulatory Authority of Ontario (FSRA) led and coordinated the joint CCIR cooperative review of individual Life and Health (L&H) insurance business of three Managing General Agencies (MGAs)[2] that appeared to have a similar business model.

These MGAs use a tiered-recruitment business model (may also be referred to as a multi-level-marketing, network-marketing, recruitment-focused, or tiered-level model). They focus on recruitment and actively encourage their agents to recruit new individuals. The agents are paid not only for their own insurance sales, but also for those made by people that agents recruit, and so on. This results in MGAs paying multiple layers of agents for one insurance sale.

This tiered-recruitment business model does not appear to be standard practice in L&H MGAs. Generally, agents are paid based on their own insurance sales. Under this model, “upline agents”[3] may be paid without having a direct connection to the consumer.

The 2021-2022 MGA-Focused Thematic Review (the review) was to determine whether mechanisms were put in place by these MGAs to ensure consumers are treated fairly.[4] Through the review of these MGAs, involvement of insurers and potential practices of their contracted agents were also considered. The review identified potential market conduct and consumer risks.

In summary, key observations from the review of these three selected MGAs include:

- all three MGAs use a tiered-recruitment business model and are growing rapidly by recruiting individuals who are not yet licensed (recruits)[5]

- agents are paid for insurance sales they make, but also often for sales made by other agents in the same network that are subordinate to the aforementioned agent

- agents are paid compensation based on their tier or level: agents can rise to a new tier when they sell more, recruit more, and/or the people they directly or indirectly recruit do the same

- all MGAs had a high proportion of newly sponsored agents[6] with less than two years of experience as licensed agents

- one MGA had minimal screening for recruits, mainly collecting personal and work eligibility information

- these MGAs with many newly licensed agents are selling relatively complex products

- a large proportion of L&H insurance gross income at most MGAs came from sales of permanent life insurance products, mostly Universal Life (UL) products

- most of the L&H insurance gross income during the review period came from sales with a few particular insurers

- one MGA’s large proportion of sales were made through a strategy called Insured Retirement Plan (IRP)[7]. Through the IRP, consumers are recommended to put more money into a UL policy than the insurance costs to save and/or invest money within the contract

- one MGA’s vast majority of L&H insurance gross income during the review period came from a single insurer

- there are concerns with agent training and monitoring

- several agent-related duties are delegated by insurers to the MGAs, however, there is minimal reporting of completion of those functions by the MGAs to insurers

- the MGAs’ supervision framework further relies on delegation of these duties to their agents

- there are some written policies and procedures, however, their adoption or operational effectiveness in practice was not always confirmed or demonstrated

- some mandatory training materials may not be consistent with regulatory obligations, and/or Fair Treatment of Customers (FTC) principles[8]

- no risk assessment was performed by the MGAs to select agents for proactive reviews

- no formal proactive agent reviews were conducted by the MGAs

FSRA, in collaboration with CCIR, expects these review results will inform the industry in support of achieving FTC principles and protecting consumers.

In 2022-2023, CCIR members will consider a variety of regulatory tools to address these concerns and protect consumers. These include but are not limited to enhancing the regulatory framework and supervisory approach, conducting insurer and agent reviews, and leveraging enforcement options where applicable.

Background

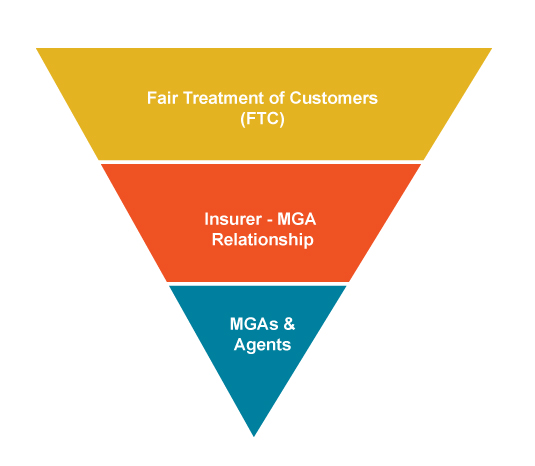

Between 2017 and 2021, CCIR conducted joint reviews of insurers to examine FTC and individual FTC reviews of insurers in the CCIR members’ own jurisdictions based on FTC principles[9]. These reviews highlighted key observations, some of which related to insurers’ oversight of intermediaries (including MGAs) for topics such as training and incentives.

Between 2020 and 2021, FSRA conducted a thematic review to consider insurer oversight of intermediaries, including MGAs.[10]

The Insurer-MGA Relationship Thematic Review (the thematic review) was an extension to the joint cooperative FTC reviews. It focused on the MGA channel which is the most commonly used distribution channel for individual L&H insurance.

Following the thematic review, and using a risk-based approach, FSRA continued to assess evidence gathered from:

- complaints data[11]

- Life Agent Report Forms (LARFs)[12]

- discussions with insurers and industry stakeholders

- results of other FSRA examinations and reviews

- observations that indicated potential risk due to oversight and supervision gaps within a tiered-recruitment business model

Based on the observations, FSRA conceptualized and proposed to CCIR to directly review selected MGAs that appeared to adopt a tiered-recruitment business model. In June 2021, CCIR approved FSRA’s proposal and six jurisdictions agreed to participate in the joint CCIR cooperative review.[13]

Between December 2021 and June 2022, FSRA, Quebec’s Autorité des marchés financiers (AMF) and New Brunswick’s Financial and Consumer Services Commission (FCNB) conducted the joint review in virtual mode[14] and in accordance with CCIR’s Cooperative Supervision Framework[15]. FSRA acted as the lead regulator for coordinating and conducting the overall review of all three MGAs. The AMF and FCNB were active participants.

The participating members carried out the review according to the respective laws of their jurisdiction:

- the Ontario Insurance Act, R.S.O. 1990, c. I.8

- the Act Respecting the Distribution of Financial Products and Services, CQLR, c. D-9.2

- the New Brunswick Insurance Act Section 373(3)

and considered FTC principles and industry best practices.

The review focused on potential market conduct risk associated with MGAs operating in multiple jurisdictions using a tiered-recruitment business model. This business model generally encourages, compensates, and promotes agents based on recruitment of other individuals and the business they bring in. Under this model, the agents can be compensated for their own insurance sales and also other agents in the same network.

The regulatory bodies are aware this tiered-recruitment business model does not appear to be standard practice in L&H MGAs. However, the model raised potential consumer protection concerns that called for further assessment and review.

Objective

The objective of this review was to assess the business practices of selected MGAs and better understand their contractually delegated agent-related activities.

The review will help:

- inform and educate the industry, and set expectations through the release of key observations

- consider opportunities for guidance, rules, and other regulatory tools around oversight of intermediaries, including MGAs

- change industry members’ market conduct, including improved quality of service, through active supervision

The review’s intention is to strengthen the intermediation chain and ensure oversight mechanisms are in place to deter agents from engaging in activities that could reasonably result in consumer harm.

Review approach & scope

For the review, three MGAs which use a tiered-recruitment business model were selected. The selected MGAs differed in size, complexity, resources, and other factors. Not all jurisdictions have a specific licensing category for MGAs. For instance, in Ontario, MGAs are generally required to be licensed as life insurance agents and/or corporate or partnership agencies to distribute insurance products, even if they use their contracted agents to complete sales. The regulators understand that not all MGAs use this type of business model.

The review focused on four key areas:

1. Understanding the MGA: The first section explored the MGA’s overall structure, business lines, operations, and high-level compensation structure. This provided an overview of the MGA's business composition, roles and duties, and overall practices.

In this section, information was gathered and reviewed, including:

- overview of corporate structure

- overview of business model and sales strategy

- number of agents in each jurisdiction

- number of sponsored agents in Ontario

- number of recruits in Canada and Ontario

2. Applicant and Agent Recruiting, Screening, and Onboarding: The second section focused on practices related to recruiting, screening, and onboarding. This provided an overview of the MGA's current processes and factors considered before contracting a recruit.

In this section, information was gathered and reviewed, including:

- list of all insurers the MGAs are contracted with

- list of all L&H insurance products offered

- proportion of total gross income by each line of business

- proportion of L&H insurance gross income by each jurisdiction

- proportion of L&H insurance gross income by each product category

- proportion of L&H insurance gross income by each insurer

3. Candidate and Agent Training: The third section focused on practices related to training of recruits and agents. This provided an overview of the MGA’s current processes and how it supports and delivers training.

In this section, information was gathered and reviewed, including:

- insurer-MGA agreements

- documented policies and procedures related to agent training

- overview of how the MGAs train their agents

- list of individuals and departments formally overseeing the training function

- list of all training offered to agents and relevant materials including

- mandatory training

- optional training

- initial and recurring training

4. Agent Monitoring and Supervision: The last section focused on practices related to agent monitoring and supervision. This provided an overview of the MGA's current processes and how it reviews and monitors its agents.

In this section, information was gathered and reviewed, including:

- insurer-MGA agreements

- documented policies and procedures related to agent monitoring

- overview of how the MGAs monitor and supervise their agents

- list of individuals/departments formally overseeing the entire monitoring function

- number of agent reviews conducted by the MGAs

- number of agent reviews conducted by the contracted insurers

A questionnaire was submitted to the reviewed MGAs to gather information related to the topics above, which can be referenced here: CCIR Cooperative MGA-focused thematic review questionnaire.

Detailed observations[16]

The review revealed four main areas of concern:

- rapid growth of MGAs with considerable increase in the number of agents and recruits

- sale of relatively complex products by many newly licensed agents

- concerns with agent training

- lack of agent oversight

1. Rapid growth of MGAs with considerable increase in the number of agents and recruits

Key observations

- rapid growth in number of agents across Canada and in Ontario

- a high proportion of newly sponsored agents in Ontario who have less than two years of experience as licensed agents

- a large inflow of recruits who are recruited to become licensed agents across Canada and in Ontario

The review gathered information on the number of agents and recruits across Canada. This was used to assess the size and growth rate of each MGA. The reviewed MGAs reflected a range of sizes and different stages of maturity.

Growth of agents in Canada

The review found all three MGAs have seen continued growth in Canada between 2018 and 2021. As of 2021, the three MGAs together had approximately 27,000 agents.

The reviewed MGAs have been expanding their agent numbers Canada-wide over the last few years. Between 2020 and 2021, these MGAs grew their number of agents by approximately 40%. Overall, the MGAs experienced considerable growth in agents, between 67% to 160% in Canada, from 2018 to 2021

The reviewed MGAs had tiered compensation structures. These included components such as recruiting and insurance sales by the agents and their “downline agents"[17]. Each MGA had a compensation schedule, including:

- promotion guidelines, indicating various compensation percentages depending on the level of the agents

- requirements to move up the levels

Under this model, the review found some of the top agents at one MGA (based on L&H gross income generated between 2018 and 2021) have sold zero to relatively few policies.

Growth of agents in Ontario

The review found all three MGAs have seen continued growth in Ontario between 2018 and 2021. As of 2021, the three MGAs together had approximately 11,000 agents.

The reviewed MGAs have been expanding their agent numbers in Ontario over the last few years. Between 2020 and 2021, these MGAs grew their number of agents by approximately 50% to 70%. Overall, the MGAs experienced considerable growth in agents, between 55% to 191% in Ontario, from 2018 to 2021.

Growth of sponsored agents in Ontario

In Ontario, agents must be sponsored by an insurance company for their first two years of licensing. At two of the reviewed MGAs, sponsored agents made up a large portion of all licensed agents (approximately 45% in 2021). Also, the review found all newly licensed agents at these two MGAs were sponsored by a single insurer.

Growth of recruits

Recruits are typically unlicensed individuals who are in the process of becoming licensed agents. Under a tiered-recruitment business model, one of their duties appeared to be bringing prospects to the MGAs. The review found that most MGAs recommended recruits attend sales meetings with other agents.

In addition to the growth of agents at each MGA, the review found there were a significant number of recruits Canada-wide. The three MGAs together had approximately 66,000 recruits across Canada in 2021. The review found the MGAs’ screening processes for recruits were not in-depth. For example, one MGA mainly collected personal information and work eligibility; no formal interviews were conducted.

The review found the number of recruits at the MGAs was much higher than the number of total agents contracted with the MGA in Canada (approximately 1.25x to 2.70x) and in Ontario.

Person-to-person recruiting appeared to be the most used recruiting method amongst all three MGAs. The review found agents were strongly encouraged to recruit clients after a sale at most MGAs. One MGA recommended, “developing a prospect list should be the top priority for a new agent”. It also recommended “the prospect list should have a minimum of 100 names to start and continue to grow.”

The recruits were encouraged to reach out to their family and friends regarding the purchase of life insurance products and attend business meetings to join the MGA. One MGA recommended developing a prospect list, booking training presentations, and making calls with their trainer present. Another MGA recommended connecting with multiple people each day and setting several appointments in a week.

At all reviewed MGAs, individuals were strongly encouraged to recruit, where:

- Agents may receive direct monetary compensation. They may also receive non-monetary rewards such as points for a promotion.

- Recruits may receive non-monetary rewards such as credit towards a future promotion. They may also receive monetary compensation such as bonuses after they become licensed agents.

The Ontario Insurance Act states unlicensed individuals cannot act as licensed agents. Although recruits were encouraged to attend sales meetings with agents and bring prospects to join the MGAs, the MGAs asserted no income is earned for recruitment alone and an individual must be licensed to sell insurance

Requirement for licence

No individual, partnership or corporation shall act as an agent unless the individual, partnership or corporation is licensed under this Regulation.

O. Reg 347/04 s.2(1).

In conclusion, the review found large and rapid agent growth across Canada and in Ontario. It also found a significant number of sponsored agents and recruits at all three MGAs. Agents are heavily incentivized to recruit and expand business while being responsible for supervision of their downline agents. However, the MGAs may not have the necessary resources to supervise their agents in proportion to the rapid growth.

Mechanisms and controls are established to identify and deal with any departure from the organizational strategies, policies and procedures, any conflicts of interest or any other situation likely to interfere with the Fair Treatment of Customers.

Appropriate measures are taken to ensure that employees and representatives meet high standards of ethics and integrity, beginning at recruitment.

FTC Guidance, Section 6.1.

Governance and Business Culture

Without establishing independent and proportionate compliance infrastructure, the rapid increase could present potential challenges and risks in oversight of agents. Some challenges identified include sufficient training and regular monitoring of agents. These aspects are explained further in sections 3 and 4 below.

Establishing screening and suitability assessments of new recruits and developing proportional oversight infrastructure is critical to achieving FTC outcomes.

2. Sale of relatively complex products by many newly licensed agents

Key observations

- two MGAs’ largest proportion of L&H insurance gross income came from sale of permanent life insurance products, predominantly UL products

- one MGA’s vast majority of L&H insurance gross income came from one particular insurer, who is also its only sponsoring insurer

- one MGA’s large proportion of sales are made through a strategy called IRP

L&H insurance gross income

The review found over 90% of all three MGAs’ 2021 Canadian gross income came from L&H insurance business. Other lines of business included mutual funds and various referral services.

L&H gross income by product and insurer in Canada

- gross income by product

- the review obtained proportional breakdowns of L&H insurance gross income by product category that showed what products were distributed by each reviewed MGA

- a large portion of 2021 L&H insurance gross income came from the sale of permanent life insurance products, specifically UL products

- gross income by insurer:

- the review obtained proportional breakdowns of L&H insurance gross income by insurer that showed which insurers each MGA conducted the most business with

- at any given year during the review period, there were mainly four contracted insurers that the reviewed MGAs conducted the most business with

- one MGA’s vast majority of L&H insurance gross income during the review period came from a single insurer

Permanent life insurance products are beneficial to many consumers and can meet their financial needs. Generally, permanent life insurance products are relatively more complex than term life insurance products. They often have a higher cost of premium compared to term life insurance products of the same face value. Some of these complex products and/or strategies are often targeted to meet the specific needs of a demographic that is sophisticated, financially secure, and/or have additional room for investment

CCIR and CISRO expect that distribution strategies are tailored to the product, consider the interests of the target Consumer groups and result in consistent Consumer protections independently of the distribution model chosen.

FTC Guidance, Section 6.5.

Distribution Strategies

One MGA generated the majority of its L&H insurance gross income from the sale of UL products.[18] It stated its main strategy is training its agents to sell overfunded UL policies using an IRP strategy. The MGA further stated its focus is on the “middle market segment” and its main client base consisted of individuals with annual earnings generally around $40,000 to $50,000 and who are mostly immigrants

CCIR and CISRO expect that a customer is given appropriate information to make an informed decision before entering into a contract. The information provided should be sufficient to enable customers to understand the characteristics of the product they are buying and help them to understand whether and how it may meet their needs.

FTC Guidance, Section 6.6.

Disclosure to Customer

In conclusion, agents selling these complex insurance products and retirement strategies should possess knowledge about them. Insurers and MGAs should train agents to ensure such products/strategies are sold based on specific consumer circumstances and needs. Agents must give careful consideration, especially if selling complex insurance products to clients outside the provisions recommended by insurers. Agents should provide consumers with all necessary information throughout the sales process.

Also, monitoring should be in place to verify that FTC is a primary consideration when conducting business. To achieve compliance with FTC principles, the sales process should have controls to ensure appropriate outcomes are reached. For example, needs assessments conducted should be adequately reviewed to ensure consumers’ needs are considered and they are the appropriate target for specific products or strategies.

Combined with rapid agent and recruit growth, and sale of relatively complex products by many newly licensed and relatively inexperienced agents can present an increased risk of consumer harm. Risk is further increased when combined with concerns related to agent training and lack of oversight, noted below

Delegation of agent-related functions

The reviewed MGAs were delegated with certain functions by their contracted insurers through the Insurer-MGA agreements. These included agent screening, training, and monitoring/supervision. MGAs were delegated similar agent-related functions regardless of their size, complexity, and available resources.

All three MGAs completed and submitted the annual Compliance Review Survey (CRS) and/or similar survey to their contracted insurers. The CRS confirmed the existence of policies and procedures. However, it did not seek to verify their adoption or operational effectiveness.

For agent screening, activities performed by the three MGAs varied. However, it appeared more structured compared to other delegated functions, such as use of the Agent Screening Questionnaire (ASQ).

The review noted concerns with agent training and monitoring, where MGAs further delegated elements of these functions to their agents.

Under the Ontario Insurance Act, insurers have an obligation to establish and maintain a system that is reasonably designed to ensure that each agent acting on their behalf complies with the Insurance Act, the regulations and the agent’s licence requirements. Whether or not oversight functions have been delegated by an insurer to third parties, insurers retain this regulatory responsibility for the compliance of agents acting on their behalf. Delegation of these functions does not relieve the insurers of their responsibility to ensure their agents are adequately trained and monitored and consumers are treated fairly.

Observations regarding concerns with training and lack of oversight will be discussed further in sections 3 and 4 below.

3. Concerns with agent training

Key observations

- further delegation of training function to their agents by all MGAs

- none to minimal controls or oversight to obtain reasonable assurance of completion at most MGAs

- some mandatory training materials may not be consistent with regulatory obligations, and/or FTC principles

- no formal reporting of progress or completion of delegated training function by the MGAs to insurers

Training function delegated by the insurers

The reviewed MGAs were delegated agent training by their contracted insurers through the Insurer-MGA agreements. The review found:

- minimal mandatory training required at two MGAs and more extensive mandatory training required at one MGA

- some mandatory training materials may not be consistent with regulatory obligations, and/or FTC principles and may encourage omission of key disclosures

- optional training available with no tracking and oversight conducted by MGAs to ensure agents are completing these training

- no formal reporting of progress or completion of the delegated responsibility from MGAs back to insurers

Training function further delegated by the MGAs

The reviewed MGAs appeared to further delegate certain elements of the training function to their agents. Typically, upline agents are expected to train their downline agents. The review found:

- no detailed guidelines or expectations set by most MGAs on how agents should carry out this function

- none to minimal oversight conducted of upline agents for completion of delegated function at most MGAs

- no controls in place to obtain reasonable assurance that agents are completing training made available at most MGAs

Association with third-party course providers

All agents are required to use an approved course provider for completion of Harmonized Life Licensing Qualification Program (HLLQP). Of the MGAs reviewed, one MGA had no formal agreement with any course provider, while the other two had formal agreements with specific course providers. In these cases, the MGAs recommended recruits use the particular course provider. One MGA also had a referral allowance arrangement with a course provider for materials/products purchased by recruits and licensees. It is unclear whether these recruits and licensees were made aware of this arrangement.

The requirement for all individuals to complete the HLLQP with an approved course provider creates a business opportunity for MGAs to generate income through recruitment. This also may create an associated potential conflict of interest.

In conclusion, the need for proper agent training is crucial due to:

- rapid growth of agents and recruits

- sale of relatively complex products

- use of an IRP strategy

If training is delegated by insurers, all parties should be clear on their roles in order to fulfill the responsibility. If the function is further delegated to other parties by MGAs, they should also clearly set out the expectations. All parties should understand their responsibilities, including monitoring for completion of delegated functions.

To ensure the delivery of quality advice, Insurers and Intermediaries establish ongoing training programs that allow the persons giving advice to maintain an appropriate level of knowledge about

- their industry segment

- the characteristics and risks of the products and services and their related documentations

- the applicable legal and regulatory requirements

FTC Guidance, Section 6.8.

Advice

Insurers and Intermediaries are committed to delivery of relevant advice, communicated in a clear and accurate manner that is comprehensible to the Customer. Minimizing the risk of inappropriate sales is a core priority. Independent of the distribution model or the medium used, it is made clear to the Customer whether advice is being provided or not.

… The basis on which a recommendation is made is explained and documented, particularly in the case of complex products and products with an investment element.

FTC Guidance, Section 6.8.

Advice

In addition, agents trained with materials inconsistent with regulatory obligations and/or FTC principles may conduct business in a manner that does not adequately inform consumers or prioritize their needs. Oversight should be present to ensure training is relevant, accurate, free of potential conflicts of interest, and incorporates FTC principles.

4. Lack of agent oversight

Key observations

- further delegation of monitoring function to their upline agents by all MGAs

- no risk assessment performed by the MGAs to select agents for proactive reviews

- no formal proactive agent reviews conducted by the MGAs

- none to minimal controls or oversight to obtain reasonable assurance of completion

- none to minimal formal reporting of progress or completion of delegated monitoring function by the MGAs to insurers

Monitoring function delegated by the insurers

The reviewed MGAs were delegated agent monitoring and supervision by their contracted insurers through the Insurer-MGA agreements. The review found:

- all MGAs had some documented policies and procedures related to monitoring and supervision

- however, their adoption or operational effectiveness in practice was not always confirmed or demonstrated

- all MGAs had a compliance department for overseeing the function

- however, they had a very limited number of compliance personnel compared to the total agent population and number of newly licensed agents

- no risk assessments performed by the MGAs to determine which agents to proactively review

- no standard approach and no formal cycle established to evaluate agents

- no formal proactive agent reviews conducted by the MGAs

- some MGAs performed reviews of agent-submitted insurance applications

- however, the reviews appeared to be checks for completeness without conducting analysis or in-depth assessment of the information submitted

- two MGAs conducted some reactive and investigative type of reviews based on spikes in commissions, chargebacks, or complaints received, etc.

- however, the volume was limited compared to the total agent population

- one MGA conducted an annual agent compliance attestation

- however, verification and review were performed only on a fraction of the submitted responses

- zero to minimal formal reporting of progress or completion of delegated function from MGAs back to insurers

All three MGAs reported very few agent reviews conducted by their contracted insurers. This was the case even for the sponsoring insurers of newly licensed agents. One MGA was not aware of the total number of reviews conducted by their contracted insurers.

| Number of Agents (approximate) | Reviews Conducted by | % of Agents Reviewed | ||

|---|---|---|---|---|

| MGA | Insurers | |||

| 2019 | 16,000 | 0 | 19 | 0.1% |

| 2020 | 19,000 | 0 | 56 | 0.3% |

| 2021 | 27,000 | 0 | 26 | 0.1% |

Note: One MGA had no data available on the total number of agent reviews conducted by Insurers

Monitoring function further delegated by the MGAs

The reviewed MGAs appeared to further delegate certain elements of the monitoring function to their upline agents. The review found :

- no detailed guidelines or expectations provided by MGAs on how upline agents should carry out this function

- zero to minimal formal reporting in place to obtain reasonable assurance that upline agents are fulfilling this delegated function

- one MGA only required its upline agents to conduct agent monitoring when any issues were noted with their downline agents

- however, the MGA did not require a report back to confirm completion of the task

The review found gaps in MGAs’ monitoring and supervision structure as noted above. This raises concerns about the presence of reasonable systems to ensure agent compliance.

In addition, all reviewed MGAs had zero formal proactive agent reviews and minimal reactive monitoring practices. Lack of oversight of delegated functions may lead to potential consumer harm.

It is important to note agent training and monitoring are critical steps to ensure business is conducted incorporating FTC principles. This is especially true because agents interact directly with consumers. Considering the business model used, rapid growth in the number of recruits and agents, and gaps in agent training and supervision, market conduct risk could reasonably increase.

Therefore, a proactive risk-based approach to supervision will assist MGAs in ensuring agents are compliant with regulatory obligations, industry best practices, and FTC principles. Furthermore, this may also assist MGAs and insurers in assessing whether MGAs are fulfilling their delegated agent-related responsibilities.

Insurers and Intermediaries review the “client files” of those under their responsibility to exercise control after the fact on the quality of the advice given, take any necessary remedial measures with respect to the delivery of advice and, if applicable, are in a position to examine fairly any complaints submitted to them.

FTC Guidance, Section 6.8.

Advice

Conclusion & next steps

The report summarizes the review results of three MGAs using a tiered-recruitment business model. The agent population at these MGAs totaled approximately 27,000 across Canada in 2021. Of these agents, 11,000 were licensed in Ontario, which represented approximately 20% of the provincial total (approximately 56,000).

Although not all MGAs use this type of business model, the following factors indicate and/or could lead to potential consumer harm and market conduct risks:

- 32% of total LARFs received by FSRA since inception related to the reviewed MGAs

- 20% of total Ontario licensed agents contracted with the reviewed MGAs

- rapid expansion of agent population at the reviewed MGAs

- sale of relatively complex permanent life insurance products by newly licensed agents

- lack of demonstrable evidence in implementation and operational effectiveness of delegated agent training and monitoring functions

Through this review, multiple gaps were identified in the reviewed MGAs’ business model and their operations. Certain agent-related functions were delegated to MGAs by insurers, which MGAs then further delegated to their agents. Without proper oversight or requirement to report completion, this could result in potential market conduct risk and consumer harm.

In addition, the review also confirmed the observations noted during FSRA’s 2020-2021 thematic review, including:

- delegation of agent-related functions and lack of detailed expectations set out contractually between the insurers and MGAs

- lack of evidence of insurer oversight related to delegated agent-related functions, including agent training and monitoring

- inadequacy of CRS

- no meaningful volume of agent reviews/audits conducted by the reviewed insurers

This raised concerns about whether insurers have reasonable systems of compliance to ensure agents comply with legislations and regulations.

With the rapid expansion of recruits and newly licensed agents at the reviewed MGAs, there are potential challenges in training and monitoring of agents and establishing proportional oversight infrastructure. It is important to reiterate that insurers and other entities in the distribution chain who delegate their functions are not relieved of their responsibilities. They need to ensure agents are adequately trained and supervised and treat consumers fairly.

The concerns noted with these reviewed MGAs may not be representative of all MGAs in the industry and their contracted insurers. However, results of the current and previous reviews indicate that market conduct risks associated with specific distribution channels and business models may increase, if not appropriately regulated and supervised.

The following may assist in agent compliance with regulatory obligations, industry best practices, and FTC Guidance:

- correcting course on the development of appropriate training materials

- establishing an in-depth risk assessment mechanism to select agents for proactive reviews

- an independent and proactive risk-based approach to agent supervision

- periodic reporting of progress and completion to the insurer

Based on the review results, CCIR members are committed to:

- describing and giving effect to the regulatory framework and supervisory approach/guidance for intermediaries, including MGAs

- working with governments on policy reforms, as necessary

- communicating with industry stakeholders, for example, FSRA Technical Advisory Committee (TAC) members, to ensure observations are relayed to the appropriate stakeholders and influence the development of MGA framework

- conducting reviews on selected insurers contracted with the reviewed MGAs

- conducting thematic review of life agents contracted with the reviewed MGAs

- continuing to conduct reviews as per the CCIR Cooperative Supervisory Plan

- leveraging enforcement options under each jurisdiction

FSRA, in collaboration with CCIR, expects these review results will inform and educate the industry and the public. The results should also serve as a tool for all insurers and intermediaries, including MGAs, to assess and update their practices in support of achieving FTC and consumer protection. Doing so will enhance market conduct compliance, support fair outcomes for consumers, and strengthen consumer protection across Canada.

Appendix 1

FSRA Market Conduct became aware of reports and complaints specifically related to agents contracted under MGAs which utilize a tiered-recruitment business model.

Agent review trends and consumer harm

FSRA Market Conduct became aware of agent activities such as:

- targeting vulnerable population(s)

- tampering with official documents

- potential cheating on licensing examinations

Approximately 32% of LARFs received by FSRA since inception relate to the three reviewed MGAs.

In addition, FSRA recently published results of 70 reviewed agents which reflected 105 violations of the Insurance Act and 334 Best Practice contraventions.

Related public announcement links:

- FSRA Warns The Public About Employment Offers Linked To Buying Life Insurance

- FSRA Requires Insurers to Monitor Agent Conduct

- FSRA requires honesty and integrity from life agent candidates and course providers

Related publication links:

[1] For the purpose of this review, “agent” refers to an individual licensed by a Canadian province or territory to sell L&H insurance (this individual may be contracted and/or employed directly with the MGA and/or under an Associate General Agency). Agent is also referred to as representative in Quebec.

[2] Although the definition of an MGA may vary by jurisdiction, for the purpose of this review, “MGA” generally refers to a distribution entity that holds at least one agreement with a life insurance company registered to do business in Canada and insurer has delegated or given control with respect to certain tasks.

[3] For the purpose of this review, “upline agent” refers to an agent who brought in the new recruit(s) into the MGA and/or an agent who receives compensation from the sale of “downline agent(s)” and members of the same network. This individual may be responsible for training and/or monitoring downline agents. Please see endnote 17 for a definition of “downline agent”.

[4] The review covered a period from 2018 to 2021.

[5] For the purpose of this review, “recruit” refers to an unlicensed individual who applies to contract with/be employed by the MGA and is in the process of becoming a licensed agent. Recruit is also referred to as candidate, student, trainee, applicant, or associate.

[6] In Ontario, new life agents must be sponsored by a licensed insurer (“sponsoring insurer”) for their first 2 years of licensing.

[7] Also referred to as Insured Retirement Strategy (IRS).

[8] CCIR/CISRO Guidance Conduct of Insurance Business and Fair Treatment of Customers

[9] CCIR Cooperative Fair Treatment of Customers (FTC) Review – Consolidated Observations Report, issued October 2021, provides details and conclusions of the cooperative FTC reviews.

[10] FSRA’s Insurer-MGA Relationship Review Report, issued July 2021, describes observations from a review of insurers whose combined business comprised 50 per cent of the L&H insurance market.

[11] Refer to Appendix 1 for related links to public announcements.

[12] Life Agent Reporting Form is proposed by Canadian Life and Health Insurance Association Inc. (CLHIA) for use by insurers reporting unsuitable agents to regulators.

[13] The active participating authorities were FSRA, Quebec’s Autorité des marchés financiers (AMF) and New Brunswick’s Financial and Consumer Services Commission (FCNB). Passive participating authorities were British Columbia’s Financial Services Authority, Nova Scotia’s Department of Finance, and Prince Edward Island’s Department of Justice and Public Safety.

[14] The review was conducted by analyzing Questionnaires, obtaining and reviewing documentation, and conducting virtual interviews and walk-throughs.

[15] Following CCIR adoption of Memorandum of Understanding on Cooperation and Information Exchange in 2015, CCIR implemented a Framework for Cooperative Market Conduct Supervision in Canada which established CCIR members’ commitment to collaborate and share information towards improving market conduct oversight of the insurance industry.

[16] Figures provided are as of September 30th of the relevant year between 2018 and 2021, unless specified. Also, information obtained from the reviewed MGAs were mainly related to the top three L&H insurers (determined by L&H insurance gross income).

[17] For the purpose of this review, “downline agent” refers to an agent who was brought into the MGA by another agent and/or shares compensation from the sale with “upline agent(s)” and members of the same network. Please see endnote 3 for a definition of “upline agent”.

[18] This MGA stated it had a layered approach in insurance products sales where policies included UL standalone and UL base with riders such as term and/or critical illness.