Executive summary

Life insurers are increasingly reliant on Managing General Agencies (MGAs) for product distribution. In their agreements with MGAs, insurers can delegate a variety of oversight functions to MGAs. These can include the screening, training, and monitoring of agents.

The MGA channel can benefit both insurers and consumers, as long as insurers effectively oversee MGAs to ensure they and their agents sell products that consumers need and can afford. Insurers must screen and monitor their agents to ensure they are suitable to sell insurance and comply with Ontario insurance law. Therefore, it is essential for insurers to ensure MGAs fulfil the duties they accept with respect to agent screening, training, and monitoring. When systems reasonably designed to achieve these goals are in place, consumers can be more confident that they have the right coverage to protect them in the face of unforeseen, lifechanging events.

This report is specific to observations in the Life & Health (L&H) insurance sector in Ontario, where a regulatory framework specific to MGAs does not exist. This may create perceived regulatory gaps and result in supervisory challenges. Therefore, the Financial Services Regulatory Authority of Ontario (FSRA) embarked on a thematic review[1] to understand the Insurer-MGA relationship. FSRA assessed insurers’ compliance frameworks and oversight mechanisms in place to monitor MGAs and the agents who work for them and gain a deeper understanding of the individual life insurance distribution channel landscape.

This evidence-based review identified gaps and a lack of clarity relating to the roles and responsibilities shared among insurers, MGAs, and independent agents. Key observations include:

- Independent agents placing business through MGAs is the most prevalent distribution channel adopted by the reviewed insurers

- Insurer-MGA agreements lack detailed expectations and requirements related to delegated screening, training, and monitoring functions

- Insurers’ oversight programs do not appear to provide reasonable assurance that MGAs understand and fulfill their delegated agent-related responsibilities, especially when functions are entirely delegated to the MGAs

- Insurers lack in-depth MGA risk assessment processes

- Insurers check for the existence of MGAs’ policies and procedures, rather than evaluating their implementation and operational effectiveness

- Insurers do not proactively risk assess their agents contracted through MGAs, nor do they conduct a meaningful volume of agent reviews

When multiple parties and complex chains of product and service distribution are involved, consumers’ interests may not be given sufficient attention and consumer harm can be exacerbated, especially where there is no clear delineation of roles and responsibilities among the parties. As a result, there is an area of potential risk for consumers due to oversight and supervision gaps within MGAs, where the contracted agents directly interacting with end-consumers may not be sufficiently trained or knowledgeable.

Other pitfalls consumers could be exposed to when agents are not supervised properly include issues with product suitability, churning, misrepresentation, tied selling, undue influence, and/or conflicts of interest.

Insurers and their agents are required to treat consumers fairly in accordance with insurance law, including unfair and deceptive acts and practices regulations and established Fair Treatment of Consumers (FTC) principles. To meet their obligations, insurers are required to establish and maintain a system that is reasonably designed to ensure their agents comply with the Insurance Act (the Act) and its regulations. Therefore, insurers and their intermediaries, including insurer contracted MGAs, who have been delegated oversight responsibilities are expected to ensure that their agents meet high standards of ethics and integrity, and that the public interest is well-served.

FSRA does not have a specific licensing regime for MGAs. However, MGAs may be licensed as life insurance agents/corporate agencies in order to distribute insurance products and must comply with the obligations that apply to agents. FSRA intends to use its authority over insurers and agents (including MGAs licensed as corporate agencies) to supervise the distribution of insurance and to protect consumers.

The review results will help FSRA develop an informed and evidence-based approach to address regulatory risks and challenges posed by the MGA distribution channel in Ontario, with an ultimate goal of enhanced consumer protection and FTC. Such an approach aligns with the national Canadian Council of Insurance Regulators (CCIR) / Canadian Insurance Services Regulatory Organizations (CISRO) Guidance on Conduct of Insurance Business and Fair Treatment of Customers (FTC Guidance). The FTC Guidance clarifies the insurer’s ultimate responsibility does not absolve intermediaries, including MGAs, of their own responsibilities for which they are accountable Treating customers fairly is a shared responsibility when insurers and intermediaries, including MGAs, are both involved. In Ontario, this implies fulfillment of responsibilities as set out within the Insurer-MGA agreements. This helps strengthen public trust and consumer protection and supports FSRA’s priority to enhance market conduct oversight to protect consumers.

Introduction

FSRA is an independent regulatory agency created to improve consumer protection in Ontario. FSRA promotes high standards of business conduct by regulating financial services sectors, including L&H insurance.

FSRA licenses and oversees approximately 60,000 agents and 6,300 corporate insurance agencies who work on behalf of approximately 70 life insurers that are licensed in Ontario. Over the years, many insurers and agents have shifted away from exclusive distribution arrangements.[2] Today, the independent agent channel[3] is the most prevalent distribution model, with many agents placing business through MGAs.[4] Unlike agents and insurers, MGA[5] is not a specific licensing category in Ontario; however, MGAs may be licensed as life agents or corporate agencies in order to distribute insurance products.

FSRA’s legislative mandate includes:

- Regulate and generally supervise regulated sectors

- Contribute to public confidence

- Monitor and evaluate developments and trends

- Promote public education and knowledge

- Promote transparency and disclosure of information

- Deter deceptive or fraudulent conduct practices and activities

Regardless of the distribution channel used, appropriate oversight is needed to ensure fair outcomes for consumers. In particular:

- Ontario Regulation (O. Reg.) 347/04: Agents, under the Act,[6] requires insurers to establish and maintain a system reasonably designed to ensure each agent complies with the Act, its regulations, and the requirements of the agent’s licence. The ultimate responsibility to oversee and monitor agents lies with the insurer.

- On January 1, 2021, FSRA announced that it would use CCIR/CISRO’s FTC Guidance to supervise the conduct of insurers and other entities FSRA regulates under the Act, with respect to the fair treatment of customers. The FTC Guidance applies to all intermediaries, including MGAs.

As insurers have shifted to the MGA distribution model, many have also delegated a variety of agent-related functions to MGAs, such as agent screening, training, supervision and monitoring, among others. However, the delegation of agent-related functions to MGAs does not discharge insurers of their oversight responsibilities.

FSRA expects insurers to develop and implement strong compliance frameworks for the supervision and oversight of the MGAs and agents that distribute their products. However, market indicators, including complaints, previous agent review data, and CCIR co-operative FTC insurer review observations, have revealed some potential gaps in insurers’ oversight of contracted MGAs and agents, prompting this thematic review.[7]

Detailed observations

FSRA selected a combination of Tier-1 and Tier-2 insurers to review,[8] which together constituted approximately 50% of the Ontario market share.[9] FSRA’s review focused on the following four key areas:

- Understanding Distribution Channels

- Screening and Onboarding of MGAs

- Insurer-MGA Contractual Agreements

- Supervision and Monitoring of Delegated Functions

By taking a “deep dive” into each of these areas, FSRA achieved an understanding of how L&H insurers distribute their products in the marketplace. FSRA also learned about the relationship between insurers and their contracted MGAs, including delegated functions. The information gathered, and observations made throughout the review, validated the perceived gaps of insurers’ oversight of their contracted MGAs and agents. These observations will drive the development of FSRA’s future regulatory framework and initiatives, including potential guidance development.

1. Understanding distribution channels

The purpose of this area of review was to gain an understanding of the different types of distribution channels used by insurers and their business composition.

FSRA gathered information including:

- Types of distribution channels and overall distribution strategy

- Number of contracted MGAs and independent agents

Types of distribution channels and overall distribution strategy

The information received with respect to this area of review validates FSRA’s understanding that many distribution channels exist in the marketplace, and insurance products are most commonly distributed through independent agents, who places business through MGAs. Of the aforementioned sampled insurers reviewed, their business is placed as follows (based on direct written premiums):

- All independent agents, whether contracted through MGAs or placing business directly with the insurer: approximately 79%

- MGA-contracted independent agents: approximately 68%

These results demonstrate that independent agents placing business through MGAs is the most prevalent channel within the reviewed insurers. However, not all of the reviewed insurers have a formal written distribution channel strategy. Some insurers indicated that their distribution strategy is a response to changes in the marketplace, while others noted that they distribute primarily through only one channel, and therefore do not see the need for a channel strategy. However, as distribution channels continue to evolve, a formal distribution strategy may assist in aligning insurers’ business objectives with their target markets in order to achieve fair consumer outcomes.

Number of contracted MGAs and independent agents

The review found that the number of MGAs contracted with each reviewed insurer ranges from 30 to 53, while the number of independent agents contracted with each insurer ranges from approximately 11,000 to 36,000. However, there appears to be no correlation between the number of MGAs, the number of independent agents contracted, and the market share of the reviewed insurers. This variation in the number of MGAs and independent agents contracted may present potential challenges in oversight and monitoring, as insurers with a large number of MGAs and agents may not have the resources and compliance infrastructure needed to effectively oversee and supervise their MGAs and agents.

Key Observations:

- Independent agents placing business through MGAs is the most prevalent distribution channel adopted by the reviewed insurers

- Most insurers lack a formal written strategy for the selection of their distribution channels

- There is no correlation between the reviewed insurers’ market share and the number of MGAs and agents with whom they contract

2. Screening and Onboarding of MGAs

The purpose of this area of review was to gain an understanding of insurers’ practices when screening and onboarding MGAs, including what insurers take into consideration before entering into Insurer-MGA agreements.

FSRA gathered information including:

- Overall strategy for selecting MGAs

- Process for screening and onboarding MGAs, including senior management of MGAs

Overall strategy for selecting MGAs

FSRA observed that only one insurer of the aforementioned reviewed insurers comprising 50% of the Ontario market share, has a formal written strategy in place for selecting MGAs, which includes factors such as: alignment to a specific target market, strategic direction, shared values and vision, alignment of advisors, and operational efficiency and technology, etc. The other reviewed insurers have no formal written strategy for selecting MGAs.

FSRA understands the industry’s progression and evolution to the MGA distribution model, and that onboarding new MGAs does not happen frequently for some insurers. However, as distribution continues to evolve, a formal MGA distribution strategy may assist in aligning insurers’ business and distribution strategies with their choice of distribution partners.

Process for Screening and Onboarding MGAs, including Senior Management of MGAs

The review indicated that all reviewed insurers have written screening and onboarding processes in place for contracting with MGAs. However, it was noted that these processes include minimal screening of MGAs’ senior management. Specifically, no measures appear to be in place beyond the standard Agent Screening Questionnaire (ASQ), which is conducted only for the MGAs’ senior management who are also licensed agents.

FSRA observed that most reviewed insurers follow CLHIA Guideline G18: Insurer-MGA Relationships and conduct due diligence prior to onboarding an MGA. However, the individual factors considered by each insurer vary in structure and complexity.

In addition, FSRA found minimal formal review of MGA screening and onboarding policies and procedures by the reviewed insurers. Formalized screening and onboarding processes for MGAs and ongoing due diligence practices may assist in establishing an appropriate “tone from the top” at the insurer and alignment of compliance culture, two important factors in ensuring fair outcomes for customers.

Key Observations:

- Insurers lack formal written strategies for selecting MGAs

- Insurers have formalized MGA onboarding processes, but with minimal senior management screening of MGAs

- There are minimal formal reviews of the MGA screening and onboarding policies

3. Insurer-MGA agreements & 4. Supervision monitoring of delegated functions

The purpose of next two areas of review was to gain an understanding of the various types of contractual agreements that exist between an insurer and an MGA, as well as to assess oversight and supervision of functions delegated to MGAs — particularly agent screening, training, and monitoring.

FSRA gathered information including:

- Overall design of Insurer-MGA agreements

- Contractual terms regarding the delegated screening, training, and monitoring functions

- Operational effectiveness of the delegated functions

- Insurer monitoring, with a focus on the insurers’:

- Risk assessment of MGAs

- Supervision of MGAs and delegated functions

- Direct supervision and oversight of independent agents contracted through MGAs

Overall Design of Insurer-MGA Agreements

The review found that each reviewed insurer has a standardized agreement across most of its MGAs, as well as a range of supplementary documents covering different areas (e.g., commission schedules, codes of conduct, etc.). All reviewed insurers delegate some agent-related functions to MGAs through their contractual agreements, though the expectations and activities required to fulfill the delegated functions vary by insurer.

Further, there is no formal rationale for the selection of specific functions that are delegated to MGAs. FSRA observed that most of the reviewed insurers delegate similar agent-related functions to all their contracted MGAs, regardless of the MGAs’ varying size, complexity, and resources. This reflects a lack of strategy, not only during the MGA screening and onboarding noted earlier, but also when delegating certain functions to MGAs.

A formalized delegation process and well-established expectations considering the compliance infrastructure of each MGA may assist in establishing an appropriate “tone from the top” and alignment with expected FTC outcomes.

Contractual Agreements Key Observations:

- Similar agent-related functions are delegated regardless of the MGAs’ varying size, complexity, and resources

- Insurers lack policies and procedures related to the handling of agreements (e.g., periodic review and renewal process)

Finally, the review found that policies and procedures relating to the handling of agreements are minimal. Most of the reviewed insurers do not have a periodic review process for their MGA agreements, nor is there a contract renewal process in place.

Contractual terms and operational effectiveness of the delegated functions

FSRA took a two-pronged approach to assessing how insurers fulfill the requirement to have a system for ensuring that agents authorized to act on their behalf comply with the Act, regulations, and agent licence requirements.[10] FSRA looked at both the contractual design and, in practice, how the reviewed insurers confirmed these delegated agent screening, training, and monitoring functions are fulfilled by the MGAs (“operational effectiveness” of the delegated functions).

4.1 Screening

Purpose

Every insurer who authorizes agents to act on its behalf must establish and maintain a system reasonably designed to ensure its agents comply with Ontario insurance law.[11] This system must screen each agent to confirm the person is suitable to carry on business as an agent.[12]

Insurers may delegate duties that relate to screening of agents, but they retain the ultimate responsibility for ensuring only suitable agents are authorized to act as the insurers’ agents.

Contractual design

The review indicated that all reviewed insurers delegate varying degrees of the agent screening function to their contracted MGAs, as per their Insurer-MGA agreements. Some agreements include high-level screening requirements to be performed by the MGAs, while others delegate the function entirely to the MGAs.

Moreover, FSRA observed some disparity in the responses among the reviewed insurers regarding their screening expectations. While one insurer provides a documented advisor screening guideline for its MGAs, another insurer outlines very minimal screening expectations or requirements. The documents do not provide enough consistent detail to ensure MGAs understand which screening duties the insurers expect them to perform, or how to perform them.

FSRA also noted an insurer’s audit recommendation requesting its MGA use the ASQ to form a more robust agent screening process. This suggests that screening expectations may not have been clearly outlined or communicated at the onset of the agreement. In practice, FSRA understands that some MGAs may use the ASQ or a similar process to screen agents. However, most insurers’ expectations are not clearly articulated within the agreements or supplementary documents.

Operational effectiveness

In addition to reviewing how Insurer-MGA agreements describe the screening duties delegated to MGAs, FSRA reviewed the steps insurers took outside the contracts to clarify their expectations and to ensure MGAs screen agents as the reviewed insurers expect.

Most of the reviewed insurers conduct second-level screening of agents, independent of their contracted MGAs. However, in cases where screening and selection of agents is entirely delegated to MGAs, with no second-level screening by the insurer, there does not appear to be sufficient oversight of MGAs’ screening practices to obtain reasonable assurance that the delegated function is being performed appropriately.

Screening Key Observations:

- Insurer-MGA agreements lack detailed expectations and requirements related to delegated agent screening functions

- Insurers lack oversight when the screening function is entirely delegated to MGAs

As MGAs vary in scale, maturity, compliance structure, and resources, FSRA understands that not all MGAs may be screening agents consistently and in accordance with industry standards and expectations. This risk is increased when requirements are not clearly outlined within Insurer-MGA agreements. The alignment of policies, procedures, and practices between an insurer and an MGA is essential to ensure adequate and consistent due diligence throughout the agent screening and onboarding process.

As noted in section 4.3, below, FSRA understands insurers rely on the Compliance Review Survey (CRS) to ensure MGAs have policies and procedures to address screening. However, FSRA’s review does not provide evidence that insurers confirm these policies and procedures are followed.

4.2 Training

Purpose

As noted above, an insurer must establish and maintain a system reasonably designed to ensure its agents comply with Ontario insurance law.[13] In connection with training, this means insurers must have a system reasonably designed to ensure, for example, their agents receive enough training to understand their obligations under the Act and regulations,[14] to comply with their continuing education obligations,[15] and to understand the insurers’ products well enough to explain them accurately and avoid misrepresentations that are prohibited under the Act and regulations.[16]

Insurers may delegate duties that relate to training agents, but they retain the ultimate responsibility for ensuring their compliance program is sufficient to reasonably ensure agents can and will comply with the Act, regulations, and their licence requirements.

Contractual design

The review found that all reviewed insurers delegate varying degrees of the training function to MGAs, as per their agreements. The high-level training content outlined within the agreements varies widely among insurers; some include sales and product topics only, while others contain compliance and FTC elements. In the end, FSRA observed that most insurers do not clearly outline detailed training expectations and requirements within the agreements or supplementary documents. Further, none of the reviewed insurers have contractual provisions regarding training for key non-licensed MGA personnel, such as senior management or compliance staff who are responsible for ensuring the MGA complies with the Act and regulations.

FSRA recognizes that training is undertaken as a shared responsibility and provided by both insurers and MGAs. However, most insurers’ expectations about what duties MGAs will perform, and how, are not clearly articulated within their agreements or supplementary documents. Once again, the insurer is ultimately responsible and best positioned to develop appropriate training content and to outline explicit requirements in relation to fulfillment of delegated training functions.

Operational effectiveness

In practice, all reviewed insurers provide access to various tools and training materials, with content delivered through online agent portals, as well as in-person. However, not all insurers review or provide guidance to MGAs on training. In addition, there are minimal mechanisms in place to ensure that MGAs fulfill their delegated responsibilities and that agents complete the training offered.

Training Key Observations:

- Insurer-MGA agreements lack detailed expectations and requirements related to delegated training functions

- Insurers lack mechanisms to ensure that independent agents complete the training offered

FSRA acknowledges that most insurers do not assume sole accountability for providing training to independent agents. Therefore, it is important that insurers obtain reasonable assurance that MGAs understand and fulfill their delegated training-related responsibilities.

As noted in section 4.3, below, FSRA understands insurers rely on the CRS to ensure MGAs have policies and procedures with respect to training. However, FSRA’s review does not provide evidence that insurers confirm these policies and procedures are followed.

4.3 Monitoring

Purpose

Each insurer’s compliance system must be reasonably designed to ensure that, on an ongoing basis, its agents comply with the Act, its regulations and the conditions of their licences.[17] An insurer can delegate duties with respect to ongoing monitoring of its agents but it retains the ultimate responsibility to ensure its compliance program is reasonable and that any delegation is reasonably designed to achieve the monitoring the insurer would otherwise perform itself.

Contractual design

The review found that all reviewed insurers delegate varying degrees of the monitoring function to MGAs, as per their agreements. Like training, monitoring is viewed by insurers and MGAs as a shared responsibility between them. It was noted that Insurer-MGA agreements may require MGAs to maintain a system designed to ensure agents continue to meet basic licensing requirements, such as maintaining a valid licence, errors and omissions insurance, and completing required continuing education credits.

However, most insurers’ expectations are not clearly articulated within their agreements or supplementary documents. Once again, it is important that insurers obtain reasonable assurance that MGAs understand and fulfill their delegated responsibilities, including their specific role in monitoring agents.

Operational effectiveness

In practice, FSRA understands that most insurers require their contracted MGAs to complete the CRS to evaluate the existence of policies and procedures at the MGA level. While this requirement of the CRS is not articulated within most agreements or supplementary documents, all reviewed insurers rely on the CRS to assess and evaluate how MGAs address the delegated agent screening, training, and monitoring functions.

To understand this further, FSRA took a focused look at risk assessment, supervision of delegated functions, and direct supervision of agents to evaluate the monitoring activities performed by the insurers.

a) Risk Assessment of MGAs

The review found that all reviewed insurers use the CRS, or the CRS results in conjunction with sales volume, to assess the overall risk and rank their MGAs, and to determine how frequently MGAs should be reviewed. Although not all insurers require their MGAs to complete a full CRS on an annual basis, a similar or shortened survey is required instead.

However, it should be noted that the CRS focuses on the existence of policies and procedures at the MGA level, but does not seek to verify that they are in effect and functioning. Therefore, performing risk assessments using only the CRS results may not be comprehensive enough to determine which MGAs may present higher risks to the insurer, or how often certain MGAs should be reviewed.

b) Insurer Supervision of MGAs and Delegated Functions

The review indicated that the reviewed insurers have varying policies and procedures in place to conduct cyclical reviews or audits of their contracted MGAs. These differ in breadth, depth, and complexity.

It was noted that all reviewed insurers use the CRS as the basis for their MGA review/audit program. The responses from CRS are reviewed and validated; however, it does not appear that the reviewed insurers conduct a separate evaluation of the actual implementation of these policies and procedures, or the compliance programs executed at the MGA level.

It was also observed that not all reviewed insurers have formal periodic engagement with their MGAs to discuss compliance matters and to generate reports to present to senior management. FSRA noted that, although insurers have delegated various functions to their MGAs, no insurers require MGAs to report back on a periodic or formal basis outside of the CRS.

As noted above, the CRS mainly assesses the existence of policies and procedures, which may not significantly change year-over-year at the MGA level. Where an insurer does not have a comprehensive program to monitor how MGAs implement delegated functions and to receive periodic reports on these functions, the insurer may not have a holistic supervisory picture and be able to confirm whether the delegated functions are implemented and performed as the insurer’s expectations.

c) Insurer Direct Supervision and Oversight of Independent Agents contracted through MGAs

FSRA understands that agent oversight is viewed and performed as a shared responsibility. However, it is important to note that delegating certain responsibilities to an MGA does not exempt the insurer from the responsibility to monitor the MGA’s fulfillment of those responsibilities, nor does it discharge the insurer from its agent supervision responsibilities.

The review found that all reviewed insurers directly review agent conduct, but that practices vary among the insurers with regard to: (i) the level of proactive risk assessment performed, and (ii) the number of agent reviews conducted.

i) Proactive Risk Assessment

The review indicated that not all insurers perform proactive in-depth risk assessments or consider different risk factors when identifying agents for review. FSRA observed a wide range of agent selection approaches, from weighted risk-scoring to a random selection. It also appears that not all relevant data is used in the review selection process. For example, one insurer stated that it conducted several investigations on agents prompted by complaints and concerns but did not factor these investigations into their selection criteria for agent review.

ii) Number of Agent Reviews

The number of agent reviews conducted annually by the reviewed insurers ranges from 40 to 180 agents per insurer, and there does not appear to be a correlation between the number of agents reviewed and the number of agents contracted, or the number of MGAs contracted. Considering the number of agents contracted ranges from 11,000 to 36,000 per insurer, it is not clear that the current number of reviews being conducted provides the insurers with meaningful information regarding the effectiveness of their agent oversight programs.

In summary, establishing an in-depth risk assessment of agents, and a proactive risk-based approach to agent supervision, may assist insurers in verifying whether their agents are compliant with regulatory obligations, industry best practices, and FTC Guidance. Furthermore, this may also assist insurers in assessing whether MGAs are fulfilling their agent-related responsibilities. Finally, this would assist insurers in ensuring they meet their obligations, as insurers are required to establish and maintain a system that is reasonably designed to ensure their agents comply with the Act and its regulations.

Monitoring Key Observations:

- Insurer-MGA agreements lack detailed expectations and requirements related to delegated agent monitoring functions

- Insurers lack in-depth MGA risk assessment processes

- Insurers check for the existence of MGAs’ policies and procedures, rather than evaluating their implementation and operational effectiveness

- Insurers do not proactively risk assess their agents contracted through MGAs, nor do they conduct a meaningful volume of agent reviews

Conclusion and next steps

As previously mentioned, FSRA expects insurers to treat consumers fairly in accordance with established FTC principles. To meet their obligations, insurers are required to maintain compliance systems reasonably designed to ensure their agents comply with Ontario insurance law, even where parts of those duties are delegated to MGAs. It is important that agents (including MGAs licensed as corporate agencies) meet high standards of conduct, ethics, and integrity and they put consumers’ interests first so that public interest is well-served and consumers are protected.

FSRA identified two key areas of market conduct assessment[18] in the L&H Insurance sector for 2020/21:

- Implementation of FTC principles across distribution channels, in collaboration with the CCIR and its member regulators

- Review of the relationship between insurers and MGAs

Through this thematic review, FSRA confirmed that the MGA channel is the predominant distribution channel for individual L&H insurance in Ontario. FSRA also assessed the due diligence conducted by insurers in the key areas of agent screening, training, and monitoring delegated to MGAs, and identified gaps and a lack of clarity relating to the specific roles and responsibilities shared among insurers, MGAs, and independent agents.

These observations were shared with FSRA’s L&H Insurance Technical Advisory Committee on Insurer Oversight of Managing General Agencies and Consumer Advisory Panel in order to validate the accuracy of the observations and to discuss any relevant issues.

Based on the review results, FSRA is committed to:

- Develop a proposed regulatory framework and supervisory approach for distribution channels that rely on MGAs and evaluate options to assist insurers in monitoring and supervising their distribution channels; and

- Build supervisory capacity to oversee agents – either directly or by working with insurers and/or MGAs - and continue its risk-based supervision of the end-to-end distribution, including assessment of particular MGA business models that could potentially result in negative consumer outcomes due to the activities of persons regulated by FSRA.

FSRA is looking to strengthen the intermediation chain and ensure adequate oversight mechanisms are in place to deter independent agents from engaging in activities that do not serve consumer interest and result in consumer harm.

In the interim, FSRA would like to reiterate that subsection 12(1) of O. Reg 347/04 requires every insurer that authorizes one or more agents to act on behalf of the insurer to establish and maintain a system that is reasonably designed to ensure that each agent complies with the Act, the regulations and the agent’s licence. In doing so, FSRA notes that there are regulations and industry guidelines[19] that set out the policies, procedures and practices that insurers should implement to effectively manage and oversee their relationships with MGAs and to assist insurers in meeting their obligations.

As set out in the FTC Guidance, though the insurer is the ultimate risk carrier, intermediaries, including MGAs, play a significant role in insurance distribution. With the emergence of the MGA channel, FSRA expects that when MGAs are involved in the design, marketing, distribution and servicing of insurance products, good conduct in performing these services is a shared responsibility of the parties involved. Insurers and their agents – whether directly or through intermediaries, including MGAs – are required to assess and adequately fulfill the delegated functions for agent screening, training, and monitoring, since these are critical in ensuring fair consumer outcomes.

FSRA is committed to moving forward in a transparent manner with the development of a Market Conduct Compliance Framework and assessing how insurers, agents, and other regulated entities are affected by distribution channels and MGA business models. This will strengthen accountability and oversight of the distribution chain and support FSRA’s vision for consumer safety, fairness, and choice.

Appendix

Appendix 1

Complaints and Agent Review Data

Complaints Data

The complaints data collected[20] from insurers on the 2017 and 2018 Annual Statement of Market Conduct (ASMC) indicated that the majority of complaints were in relation to administration, product, and marketing and sales. Most of the causes for complaints appeared to be related to independent agent selling and general misalignment with consumer expectations.

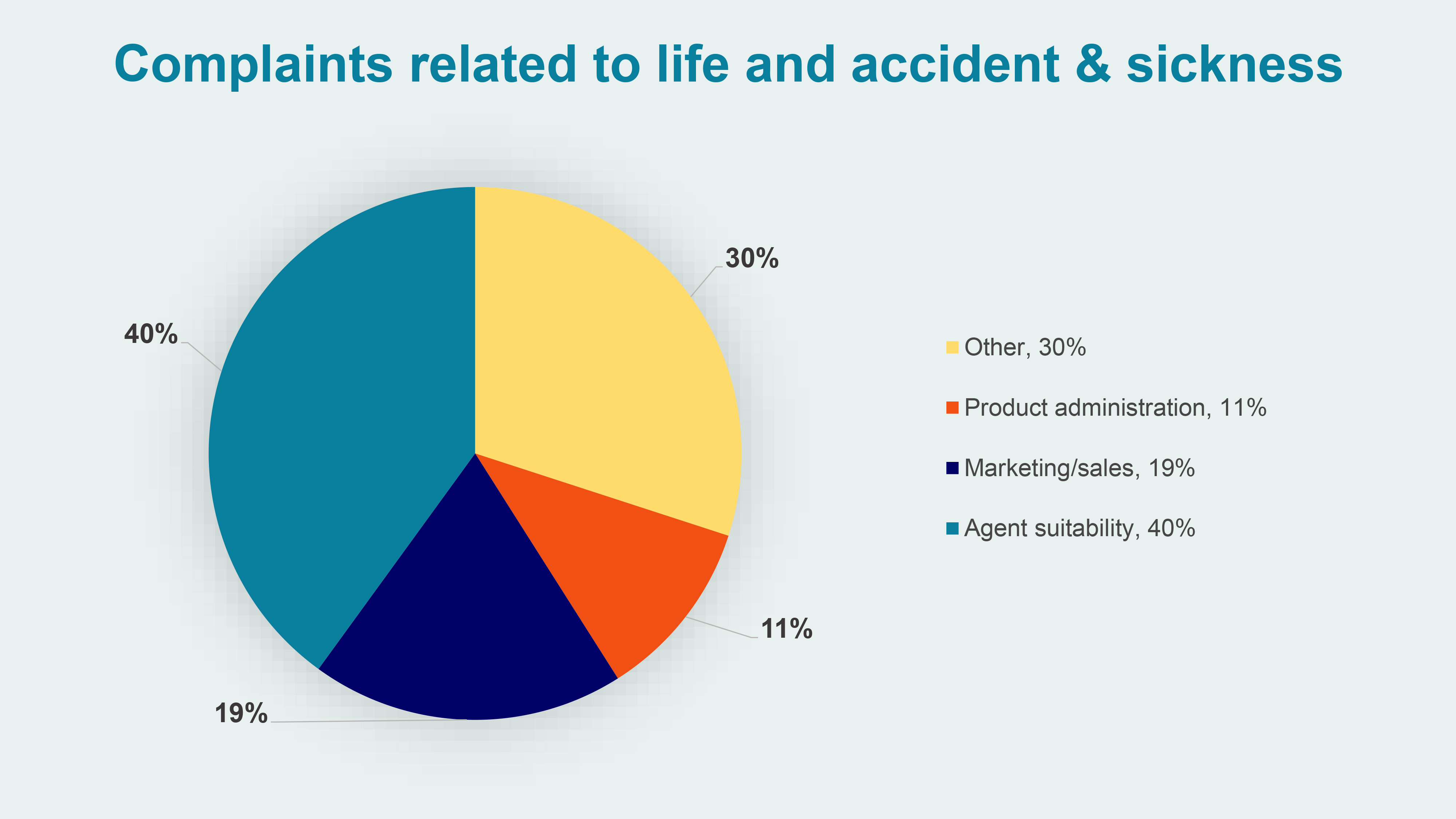

In addition, the complaints data relating to L&H insurance[21] indicated that a large number of complaints related to the suitability of the agent, as well as the broad categories of marketing and sales, and administration.

A breakdown of the different types of complaints received by FSRA in 2017-2018 is as follows:

Historical Agent Review Data

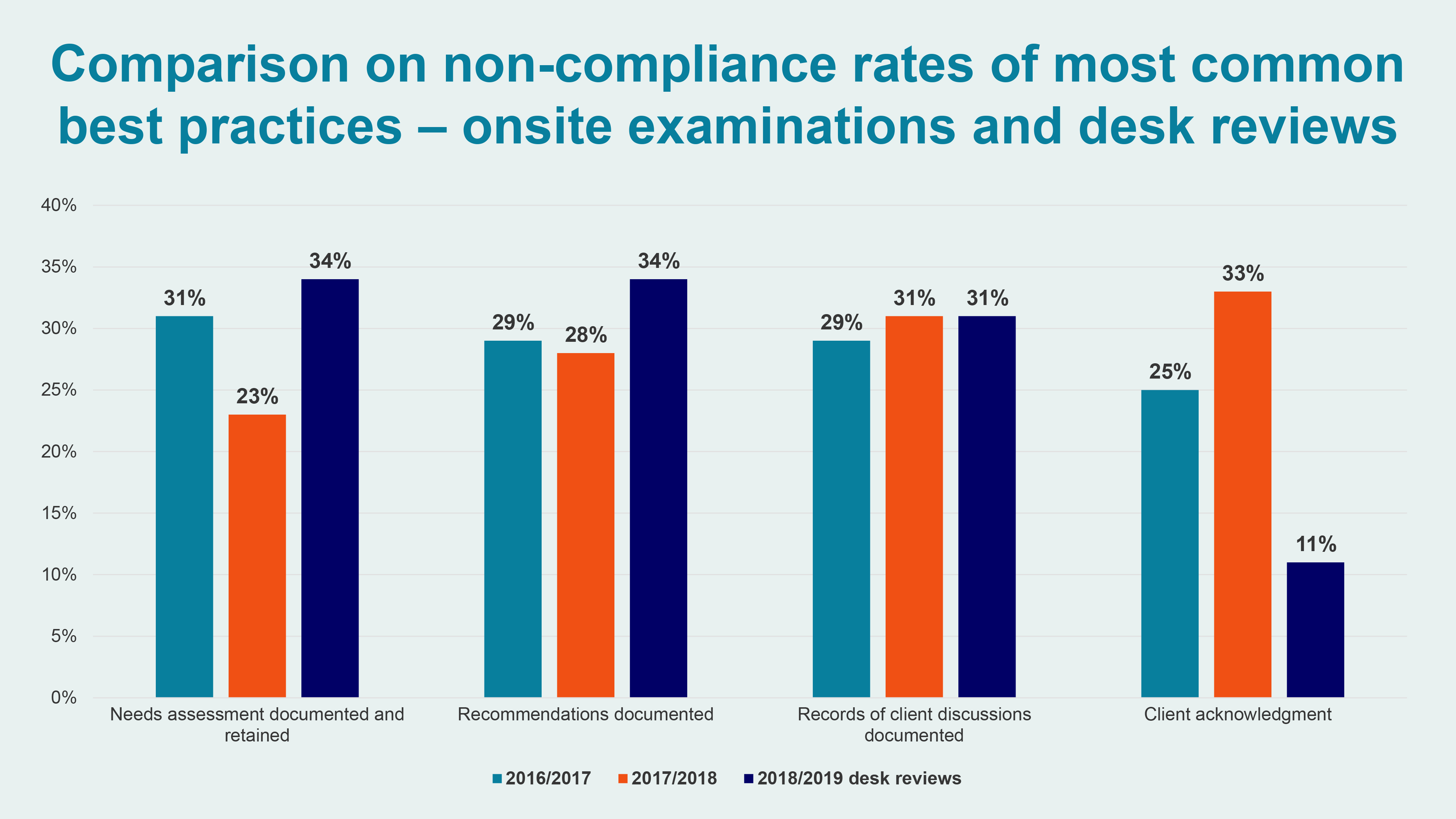

Data from past on-site and desk reviews conducted by the Financial Services Commission of Ontario, FSRA’s predecessor, indicated that agents were not adhering to industry best practices.[22]

The most common issues from 2016-2019 and their non-compliance rates are illustrated in the following chart.

As a result of these agent-related complaints and review data, FSRA observed several trends including:

- An overall lack of training or product knowledge leading to unsuitable sales

- Minimal agent oversight and supervision

- A misalignment of consumer expectations with the products they were being sold by agents

Canadian Council of Insurance Regulators (CCIR) Co-operative Insurer FTC Review Observations

In recent years, FSRA collaborated with CCIR members to conduct FTC reviews covering the end-to-end product life cycle right from design to complaints and claims-related obligations. These examinations also touched on insurer contractual agreements and elements of delegated functions at a high level.

Through these reviews, FSRA observed several trends including:

- A lack of clear and specific expectations with respect to roles and responsibilities

- Weak demonstrable compliance training of independent agents

- Minimal oversight and ongoing monitoring of MGAs and independent agents

Appendix 2

- O. Reg 347/04: Agents

- O. Reg 7/00: Unfair or Deceptive Acts or Practices

- CCIR/CISRO Guidance Conduct of Insurance Business and Fair Treatment of Customers

- ICP-19: Conduct of Business

- CLHIA Guideline G8 Advisor Suitability: Screening, Monitoring and Reporting

- CLHIA Guideline G18 Insurer-MGA Relationships

- CCIR Issues Paper: Managing General Agencies Life Insurance Distribution Model (Agencies Regulation Committee, February 2011)

- CCIR Position Paper: Strengthening the Life MGA Distribution Channel (Adopted September 2012)

- CLHIA – Materials for Advisors and MGAs

- ADVOCIS: Re: Managing General Agencies (MGAs) Distribution Channel in the Life Insurance Industry

[1] As per the CCIR Cooperative Supervisory Plan, the areas of review can be entity-specific, systemic, and thematic. In particular, the thematic review is conducted to address emerging market conduct risks.

[2] Exclusive agents primarily sell products of one insurer and also known as captive or career agents.

[3] Independent agents are able to sell products of multiple insurers.

[4] According to the Canadian Life and Health Insurance Association (CLHIA)’s “Overview of the life and health insurance industry” presentation, MGAs account for more than half of the new sales in Life and Living Benefits. Also, as per the Guideline 18: Insurer–MGA Relationships, MGAs account for a large proportion of new life insurance premiums in Canada.

[5] For the purpose of this review, "MGA" referred to a distribution entity that i) the insurer has delegated or given control with respect to certain tasks, or ii) has some control over tasks that affect the insurer’s ability to comply with its duties under the insurance law or the CCIR/CISRO’s FTC Guidance with respect to the distribution of insurance; and there is no agreement between the insurer and the entity that prohibits the entity from acting for other insurers.

[6] Please see Insurance Act, RSO 1990, c I.8.

[7] See Appendix 1 for details on the market indicators considered by FSRA in this review.

[8] Insurers that were i) affiliated with or owned by banks, ii) Quebec incorporated, and iii) predominantly using direct/exclusive agent distribution channels, were excluded from the selection.

[9] FSRA used “MSA Researcher online” statistics, which provided the Ontario life insurer market share based on individual life by Direct Written Premium.

[10] O. Reg 347/04, Agents, subsection 12 (1)

[11] O. Reg 347/04, Agents, subsection 12 (1)

[12] O. Reg 347/04, Agents, subsection 12 (2)

[13] O. Reg 347/04, Agents, subsection 12 (1)

[14] O. Reg 347/04, Agents, subsection 12 (1)

[15] O. Reg 347/04, Agents, section 14

[16] Insurance Act s. 438, O. Reg 7/00, Unfair or Deceptive Acts or Practices.

[17] O. Reg 347/04, Agents, subsection 12 (1)

[18] Referenced in article “FSRA announces Life & Health sector key areas of assessment” (published September 15, 2020)

[19] See Appendix 2 for a partial list of regulations and industry Guidelines.