Contents

Executive summary

Background

Educational initiatives

Health Service Provider Quick Guide to Compliance

Health Service Provider webinar

Supervisory activities

Insurer-Initiated Examination reviews

Focused compliance reviews

Sanctioned practitioner reviews

Annual Information Return (AIR)

Conclusion

Executive summary

The Financial Services Regulatory Authority of Ontario (FSRA) is an independent regulatory agency that places a strong emphasis on improving consumer protection in Ontario. This includes promoting high standards of business conduct and protecting consumers’ rights and interests. Individuals who suffer an injury as a result of a motor vehicle accident may need to make an insurance claim to cover their health and rehabilitative expenses. FSRA licenses Health Service Providers (HSPs), allowing them to receive direct payment from automobile insurers for benefits claimed under the Statutory Accident Benefits Schedule (SABS).

Licensed HSPs submit invoices on behalf of claimants through the Health Claims for Auto Insurance (HCAI) system and are paid directly by insurers. As of January 2024, there were 4,982 HSPs licensed in Ontario.

During fiscal years 2022/23 and 2023/24 (April 1, 2022 - March 31, 2024) over $1.39 billion in adjudicated invoices were processed through HCAI. Approximately 99% of all invoices processed through HCAI were from HSPs licensed with FSRA. During this time, over 314,000 claimants accessed treatment following a motor vehicle accident. If a consumer is injured in a motor vehicle accident and seeks treatment from an HSP, it is essential that the consumer’s benefit dollars are appropriately used towards their care and recovery. Effective supervision of this sector is crucial to ensure fair outcomes for consumers.

During fiscal years 2022/23 and 2023/24, FSRA conducted three supervision initiatives to ensure compliance with regulatory requirements. The top findings are summarized below:

|

Supervision initiatives |

Key findings |

|---|---|

|

Insurer-Initiated Examination Reviews |

Desk Reviews

On-Site Reviews

|

|

Focused Compliance Reviews |

|

|

Sanctioned Practitioner Reviews |

|

Under the 2022-2024 Health Service Provider Supervision Plan, FSRA also developed and delivered educational tools to support HSP sector compliance. The Health Service Provider Quick Guide to Compliance (Quick Guide) was published in November 2022. The Quick Guide highlights compliance obligations and summarizes key legal requirements related to the most common areas of non-compliance. On March 1, 2023, FSRA hosted a Health Service Provider Webinar (Webinar) on compliance requirements. The Webinar helped new and existing licensees understand their duties, responsibilities, and regulatory requirements. FSRA expects sector participants to be aware of and comply with their regulatory obligations.

The outcomes of FSRA’s proactive supervision initiatives show unacceptable levels of non-compliance. Moving forward, FSRA will consider further initiatives that will lead to a more informed and compliant sector. This may include formal legal action to impose regulatory sanctions for non-compliance with statutory requirements and regulatory misconduct. A more compliant sector will help to ensure fair treatment for claimants who access SABS benefits following a motor vehicle accident.

In addition to the initiatives above, FSRA administers the mandatory Annual Information Return (AIR) filing for licensed HSPs. In 2023, FSRA suspended or revoked the licences of 170 HSPs who did not comply with their annual business reporting obligations.

Background

This report details FSRA’s supervisory activities during fiscal years 2022/23 and 2023/24, which were carried out under the 2022-2024 Health Service Provider Supervision Plan. FSRA’s proactive supervision initiatives have focused on fostering compliance and awareness in the sector to help reduce opportunities for fraud.

FSRA licenses HSPs, allowing them to receive direct payment from automobile insurers for benefits claimed under the SABS. Licensed HSPs submit invoices on behalf of claimants through the HCAI system and are paid directly by insurers. HSPs who are not licensed with FSRA are still required to submit approved forms via HCAI, however they do not qualify for direct payment reimbursement.

The following forms are required to be submitted via HCAI:

- OCF-21 – Auto Insurance Standard Invoice

- OCF-23 – Treatment Confirmation Form

- OCF-18 – Treatment and Assessment Plan

- Form 1 – Assessment of Attendant Care Needs

As part of its supervisory activities, FSRA oversees the billing and business systems and practices of licensed HSPs. The Unfair or Deceptive Acts or Practices Rule took effect on April 1, 2022. The rule strengthens the supervision of the industry and enhances consumer protection by clearly defining outcomes that are unfair or harmful to consumers. HSPs engaging in unfair or deceptive acts or practices may be subject to investigation and enforcement action by FSRA.

The following are FSRA’s goals in the HSP sector:

- regulate and supervise licensed HSPs to ensure financial safety and fairness for Ontarians

- monitor and evaluate trends, while engaging in dynamic principles-based and outcomes-focused regulation

- promote honesty and credibility by identifying and deterring deceptive or fraudulent conduct and practices

Educational initiatives

FSRA recognizes that there is a need for increased sector awareness and education to ensure that licensed HSPs understand and comply with all regulatory requirements. FSRA continues to work with stakeholders to explore educational opportunities to assist with increasing compliance across the sector.

Health Service Provider Quick Guide to Compliance

FSRA published the Quick Guide in November 2022. The Quick Guide highlights key obligations under the Insurance Act, its regulations and applicable FSRA Rules. In addition, the Quick Guide summarizes key legal requirements related to the most common areas of non-compliance found in past supervisory reviews.

Health Service Provider webinar

On March 1, 2023, FSRA hosted a webinar on compliance requirements. The Webinar helped new and existing licensees understand their duties, responsibilities and regulatory requirements with FSRA.

Key areas covered included HSP obligations under the Insurance Act, its regulations, applicable FSRA Rules and key legal requirements. Over 300 attendees participated in the Webinar and had the opportunity to ask questions directly to FSRA. The Webinar is available on FSRA’s website for licensees and industry participants to view.

Supervisory activities

As part of its supervisory activities, FSRA reviews the conduct of licensed HSPs related to SABS claims. FSRA’s supervisory activities in 2022/23 and 2023/24 focused on fostering compliance and awareness in the sector to help reduce opportunities for fraud.

FSRA conducted three supervision initiatives to address key issues in the HSP sector:

- Insurer-Initiated Examination Reviews

- Focused Compliance Reviews

- Sanctioned Practitioner Reviews

These priority areas for supervision were highlighted to the sector in FSRA’s 2022-2024 Health Service Provider Supervision Plan. All reviews examined whether licensed HSPs were compliant with their regulatory requirements.

Insurer-Initiated Examination reviews

Insurer-Initiated Examinations (IEs) are required by the insurer for the purpose of determining whether a claimant is entitled to a benefit under the SABS. FSRA conducted reviews focused on licensed HSPs who conduct IEs under section 44 of the SABS. These HSPs provide medical recommendations that insurers rely on to determine claimants’ benefit entitlements. Given the impact on consumers, FSRA conducted a review focused on these HSPs to ensure they were compliant with their regulatory requirements.

IE desk reviews

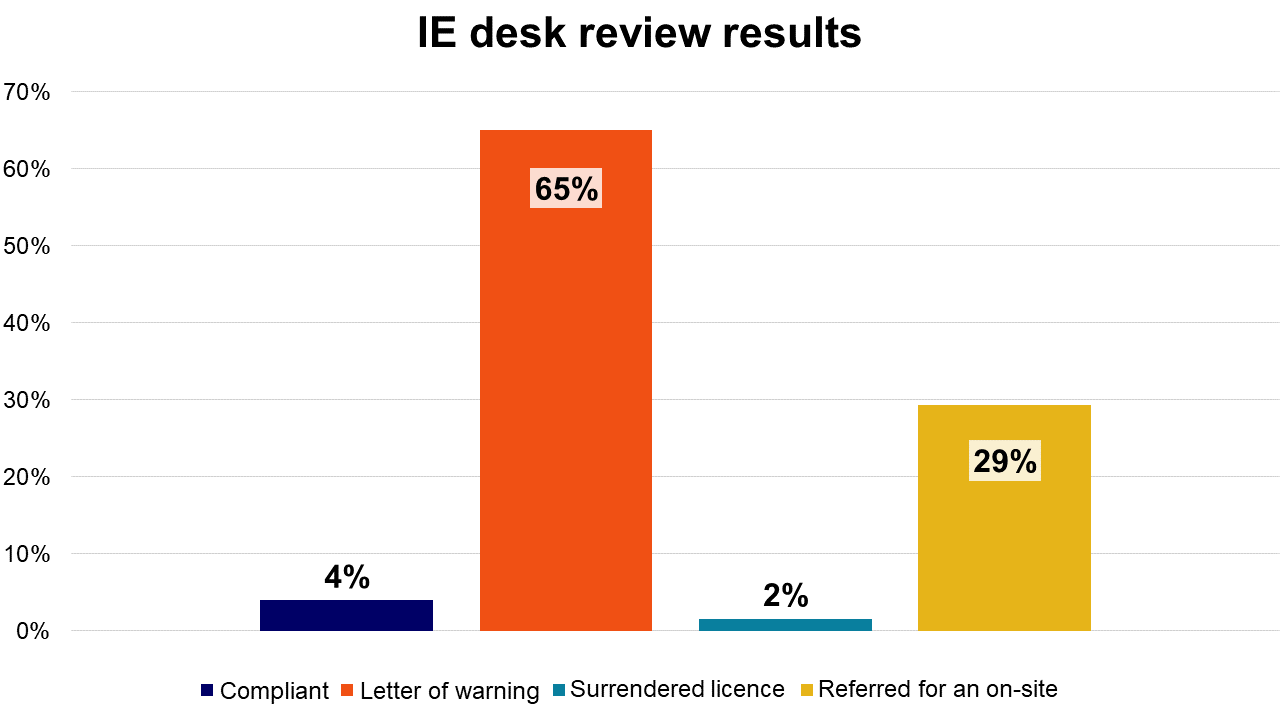

FSRA conducted a total of 126 desk reviews of licensed HSPs who met one of the following criteria:

- indicated in their 2021 AIR that they provide IEs, or generated SABS revenue from IEs

- indicated in their 2021 AIR that they were not a participant of IEs, but billed more than $10,000 for IEs through HCAI

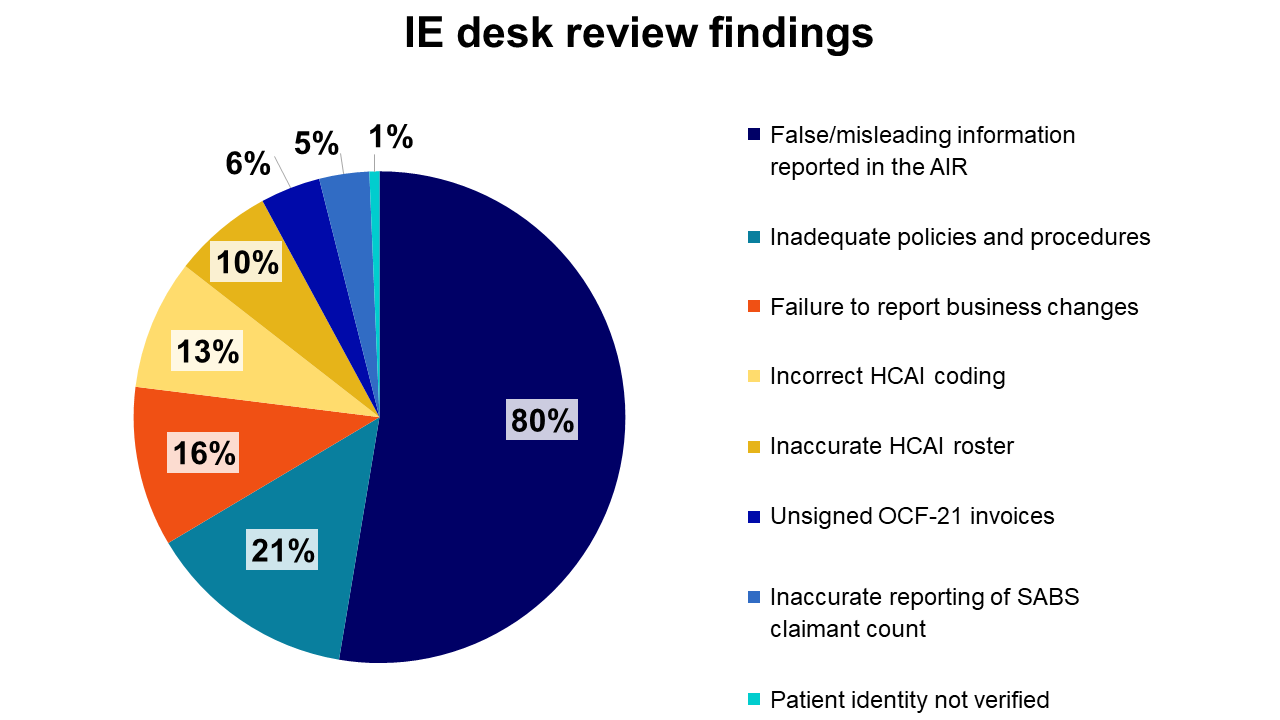

The desk review results found that:

- 5 HSPs were compliant with the reviewed criteria

- 82 HSPs were issued a warning letter for failing to comply with regulatory requirements (may include multiple non-compliant findings)

- 2 HSPs surrendered their licence

- 37 HSPs were confirmed to provide IEs and were referred for an on-site review

The majority of warning letters issued as a result of these desk reviews were related to HSPs providing false and misleading information in their AIR. These HSPs indicated they conducted IEs under section 44 of the SABS, however the desk review determined this to be inaccurate. It is imperative for HSPs to provide accurate information in their AIR. FSRA utilizes AIR data to understand the sectors business activities, compliance culture and market trends to inform its consumer protection measures.

The non-compliant findings identified during the desk reviews are outlined below:

|

IE desk review findings |

References |

Expectations |

|---|---|---|

|

False/misleading information reported in the AIR |

Insurance Act, Section 447(2)(a) |

HSPs must ensure that all information reported to FSRA is accurate and is a true representation of their business operations. |

|

Inadequate policies and procedures |

Insurance Act, O. Reg. 90/14, Section 17 |

HSPs shall establish and implement policies and procedures which address all aspects of the regulation. |

|

Failure to report business changes |

Insurance Act, O. Reg. 90/14, Section 19 & 20 |

HSPs must ensure that FSRA is provided with updated contact information within five business days after the day the relevant change occurs. |

|

Incorrect HCAI coding |

Superintendent’s Guideline No. 02/18, SABS, Section 49 & 67 |

HSPs are required to complete and submit forms and invoices utilizing the correct codes as specified. |

|

Inaccurate HCAI roster |

Superintendent’s Guideline No. 02/18 |

HSPs must keep their HCAI roster current. A Regulated Healthcare Professional (RHP) that is no longer working for the clinic must be removed and de-activated on HCAI within 10 days. |

|

Unsigned OCF-21 invoices |

Superintendent’s Guideline No. 02/18 |

HSPs must always keep on file an original paper version, or an electronic true copy, of the OCF-21 that includes the authorized signature of the RHP and/or the ‘Authorized Signatory’. |

|

Inaccurate reporting of SABS claimant count |

Financial Services Regulatory Authority of Ontario Rule 2022 - 001 Assessments and Fees (Fee Rule) |

The number of SABS claimants shall be the total number of persons for which payment has been received for one or more listed expenses (calculated per accident) during the prior calendar year. |

|

Patient identity not verified |

O. Reg. 90/14, Section 5 |

HSPs shall take all reasonable steps to verify the identity of each individual. |

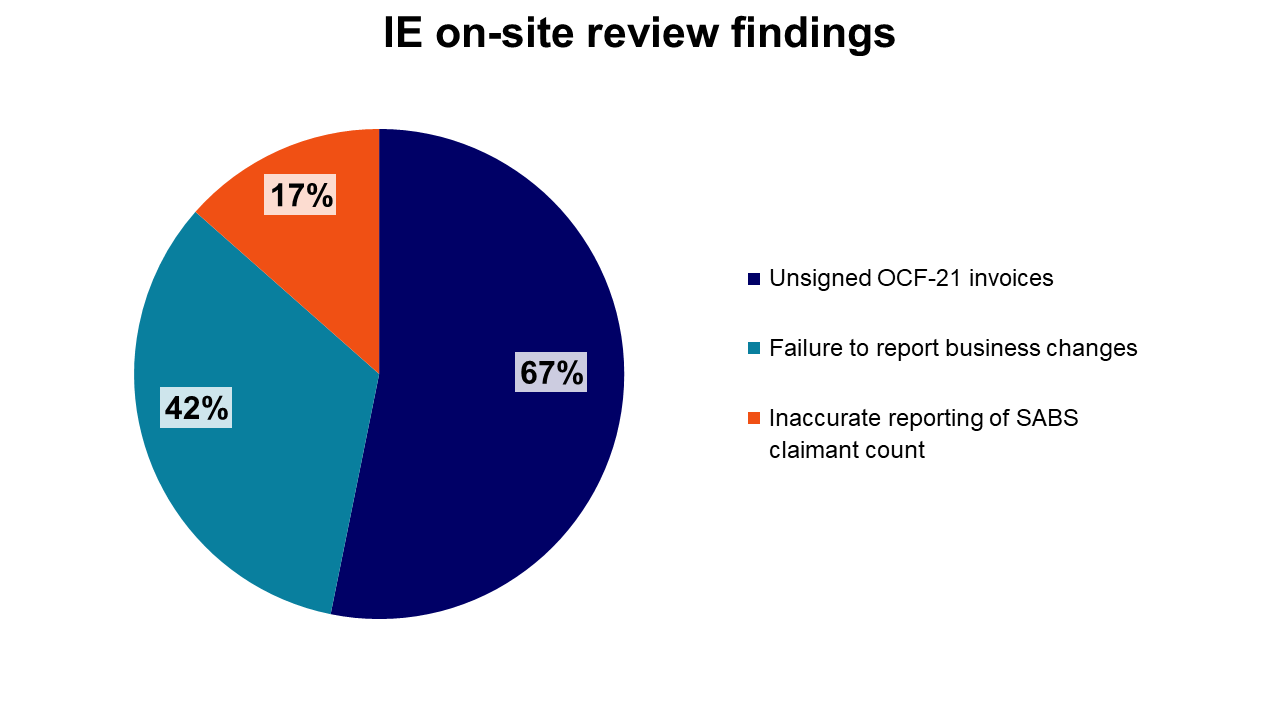

IE on-site reviews

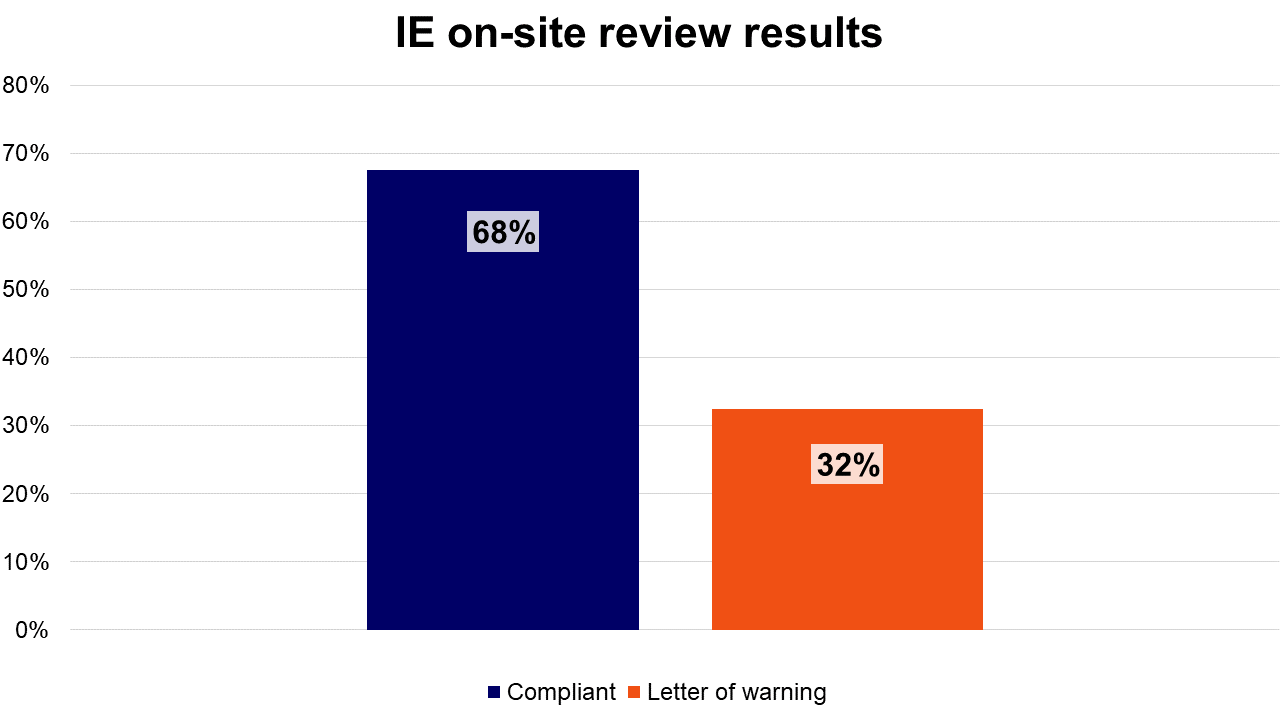

The desk reviews completed by FSRA determined that only 37 of the 126 HSPs reviewed in fact conducted examinations under section 44 of the SABS. A tailored on-site review program was developed to address specific areas where the desk review module had limitations. FSRA conducted an on-site review of these 37 HSPs.

The on-site review results found that:

- 25 HSPs were compliant with the reviewed criteria

- 12 HSPs were issued a warning letter for failing to comply with regulatory requirements (may include multiple non-compliant findings)

The warning letters issued as a result of the on-site reviews related to HSPs having unsigned OCF-21 invoices, failing to report business changes within five business days and not adhering to the calculation method prescribed in the Fee Rule when reporting the total number of SABS claimants.

The non-compliant findings identified during the on-site reviews are outlined below:

|

IE on-site review findings |

References |

Expectations |

|---|---|---|

|

Unsigned OCF-21 invoices |

Superintendent’s Guideline No. 02/18 |

HSPs must always keep on file an original paper version, or an electronic true copy, of the OCF-21 that includes the authorized signature of the RHP and/or the ‘Authorized Signatory’. |

|

Failure to report business changes |

Insurance Act, O. Reg. 90/14, Section 19 & 20 |

HSPs must ensure that FSRA is provided with updated contact information within five business days after the day the relevant change occurs. |

|

Inaccurate reporting of SABS claimant count |

Financial Services Regulatory Authority of Ontario Rule 2022 - 001 Assessments and Fees (Fee Rule) |

The number of SABS claimants shall be the total number of persons for which payment has been received for one or more listed expenses (calculated per accident) during the prior calendar year. |

The outcomes of both the IE desk reviews and IE on-site reviews confirmed a lack of understanding of regulatory requirements and indicate a need for better sector awareness and education. Given that the non-complaint findings identified during these reviews were due to poor understanding of compliance obligations, and were otherwise not egregious in nature, FSRA elected to issue warning letters rather than escalate for enforcement action.

Findings of non-compliance may result in warning letters, undertakings (Minutes of Settlement), or Administrative Monetary Penalties, depending on the severity of the non-compliance. Additionally, licensed HSPs may be required to surrender their license, or FSRA may suspend, revoke or place conditions on a license.

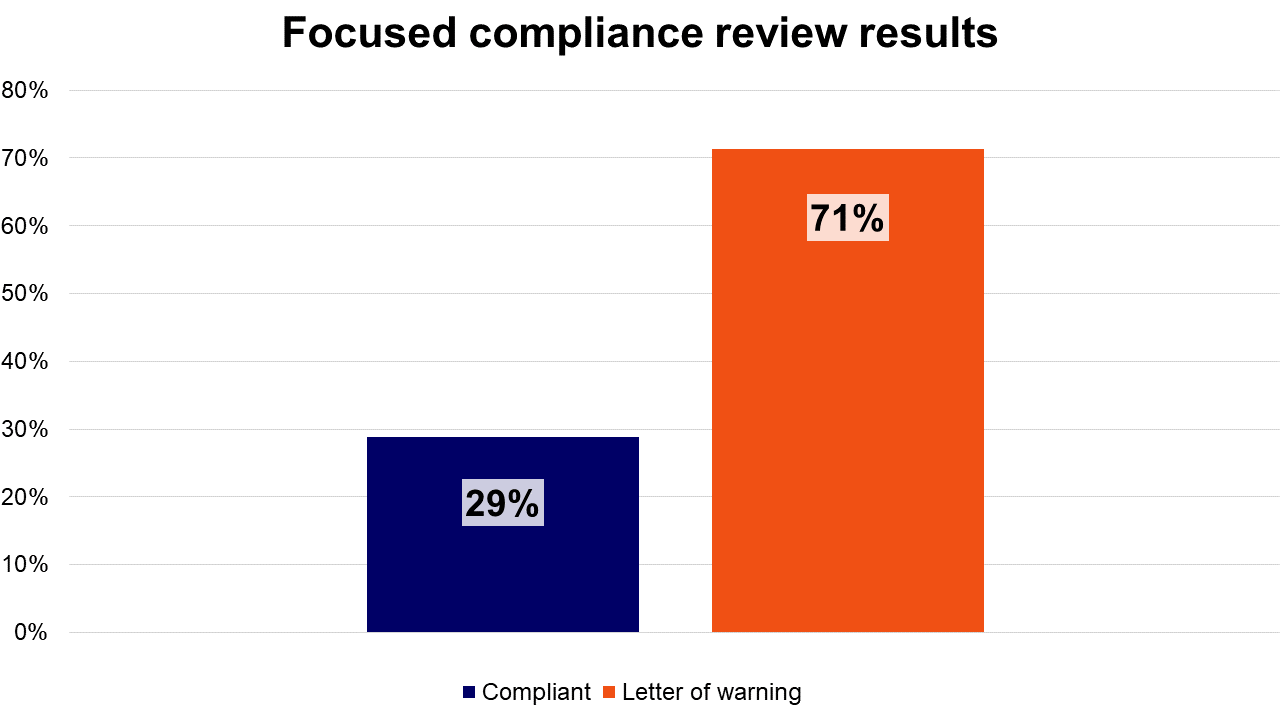

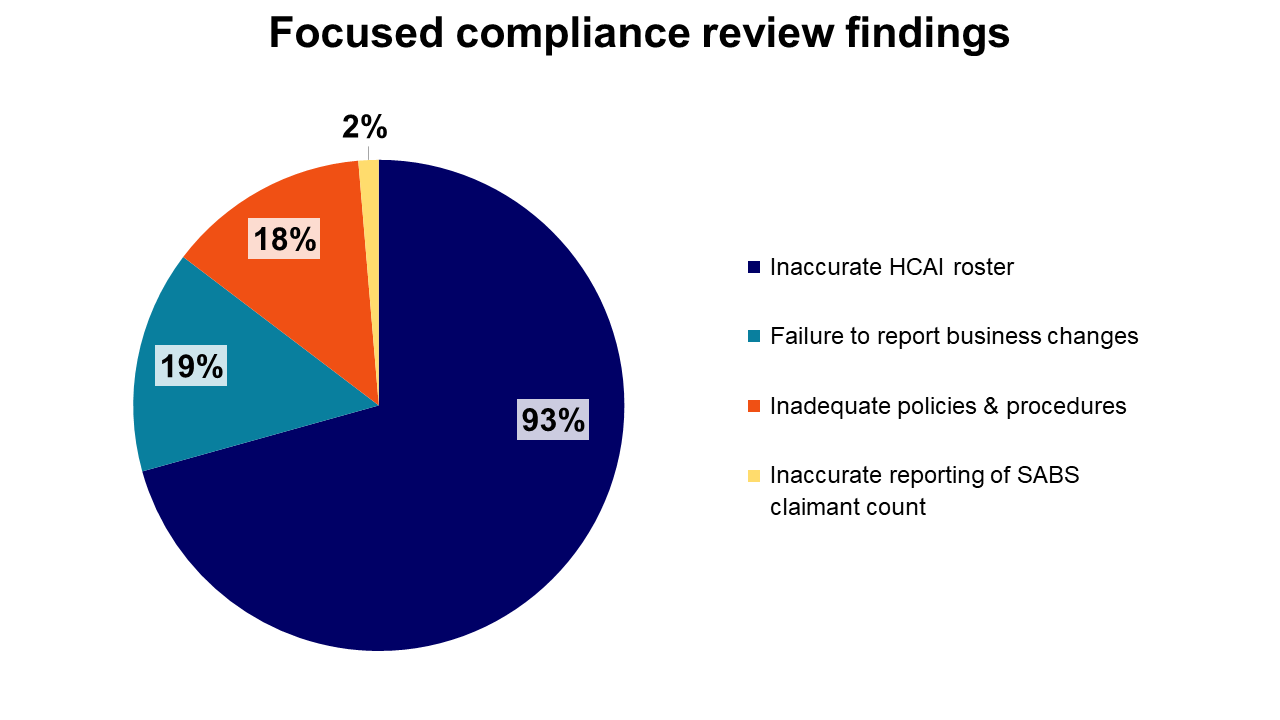

Focused compliance reviews

The outcomes of FSRA’s 2021-2022 supervisory reviews and input from stakeholders pointed to a need for better understanding of regulatory requirements. Based on this feedback, FSRA conducted focused compliance reviews targeting the common areas of non-compliance that have been identified since the HSP sector came under regulation in Ontario.

To expand FSRA’s reach across the sector and increase awareness of compliance obligations, 80 focused compliance reviews were conducted. These reviews focused on licensed HSPs who had never been subject to an examination or review by FSRA and were top billers in HCAI. These HSPs billed between $30,000 and $3,000,000 through HCAI in 2022.

The focused compliance review results found that:

- 23 HSPs were compliant with the reviewed criteria

- 57 HSPs were issued a warning letter for failing to comply with regulatory requirements (may include multiple non-compliant findings)

The warning letters issued following these reviews related to HSPs having an inaccurate HCAI roster, failing to report business changes within five business days, inadequate policies and procedures and not adhering to the calculation method prescribed in the Fee Rule when reporting the total number of SABS claimants.

The non-compliant findings identified during the focused compliance reviews are outlined below:

|

Focused compliance review findings |

Reference |

Expectations |

|---|---|---|

|

Inaccurate HCAI roster |

Superintendent’s Guideline No. 02/18 |

HSPs must keep their HCAI roster current. A RHP that is no longer working for the clinic must be removed and de-activated on HCAI within 10 days. |

|

Failure to report business changes |

Insurance Act, O. Reg. 90/14, Section 19 & 20 |

HSPs must ensure that FSRA is provided with updated contact information within five business days after the day the relevant change occurs. |

|

Inadequate policies and procedures |

Insurance Act, O. Reg. 90/14, Section 17 |

HSPs shall establish and implement policies and procedures which address all aspects of the regulation. |

|

Inaccurate reporting of SABS claimant count |

Financial Services Regulatory Authority of Ontario Rule 2022 - 001 Assessments and Fees (Fee Rule) |

The number of SABS claimants shall be the total number of persons for which payment has been received for one or more listed expenses (calculated per accident) during the prior calendar year. |

The outcome of these reviews resulted in a low compliance rate of only 29%. FSRA considers this compliance rate to be unacceptable and will continue to educate and monitor adherence to applicable requirements of the Insurance Act, its regulations, and FSRA Rules. FSRA will consider escalations for enforcement action if repeated instances of non-compliance are identified.

Sanctioned practitioner reviews

FSRA monitors health regulatory college websites to identify sanctions placed against Regulated Healthcare Professionals (RHPs). These sanctions may result in a restriction, suspension or revocation of a certificate of registration. If a certificate of registration is suspended or revoked, it is prohibited for a practitioner to use their credentials to certify, provide or bill for specific listed expenses.

In Ontario, health regulatory colleges are responsible for ensuring that RHPs provide health services in a safe, professional and ethical manner. This includes setting standards of practice for the profession, investigating complaints about members and disciplining them, where appropriate.

FSRA’s oversight in this multifaced sector pertains to the business and billing practices of licensed HSPs. Identified sanctions are cross referenced with the Health Claims Database to determine whether a sanctioned practitioner’s credentials were used when not authorized.

During fiscal years 2022/23 and 2023/24, FSRA identified 251 individual sanctions placed against RHPs by their health regulatory colleges. Out of the identified sanctioned practitioners, 41 appeared on the HCAI roster of 93 licensed HSPs. FSRA conducted a review to identify unauthorized activity in HCAI, such as inappropriate billings or invalid authorizations. Licensed HSPs were notified if a sanctioned practitioner appeared on their current HCAI roster. Principal Representatives (PRs) were reminded that it is prohibited to submit documents using the credentials of a RHP while their licence is suspended or revoked.

FSRA identified one HSP who billed using the credentials of a sanctioned practitioner. After further review, it was determined that the treatment was provided by another RHP. The total billing amount was nominal, and the non-compliant activity was administrative in nature. FSRA considers the amount and frequency of billings when determining appropriate enforcement action. Given the circumstance of this occurrence, a warning letter was issued.

FSRA is working to enhance efficiency and regulatory effectiveness through collaboration with the regulatory colleges of health professionals. FSRA will continue to explore opportunities to work with regulatory colleges to build stronger partnerships in the oversight of the sector. Sanctioned practitioner data will continue to be utilized as a risk indicator for supervisory reviews.

Annual Information Return

The AIR is an annual questionnaire designed to collect specific information from HSPs licensed by FSRA. It must be filed electronically and may only be completed by the PR. Filing the AIR is a legal requirement for all licensed HSPs under section 21 of O. Reg. 90/14 and section 288.4(5) of the Insurance Act. Licensed HSPs are required to submit an AIR and pay a regulatory fee to remain in good standing with FSRA to maintain their right to directly bill automobile insurers.

In 2023, FSRA took action against HSPs who did not file their AIR and pay their licensing fee. These HSPs failed to comply after FSRA conducted multiple follow ups and informed them about potential enforcement action. As a result, a total of 118 licences were revoked and a total of 52 licenses were suspended. HSPs with suspended or revoked licenses may still provide care to motor vehicle accident victims but cannot receive direct payment from automobile insurers.

Information collected in the AIR helps FSRA conduct market analysis, risk assessment and oversight of the sector. FSRA uses this information to inform our supervision priorities and identify trends that could lead to consumer risks and areas of concern. It is essential for HSPs to report accurate information in their AIR. This data empowers FSRA to exercise vigilant oversight of the sector using a risk-based approach.

Conclusion

FSRA helps to protect the rights of consumers by promoting high standards of business conduct within the HSP sector. Licensed HSPs must comply with all applicable requirements of the Insurance Act, its regulations and FSRA Rules. During 2022/23 and 2023/24, FSRA focused on fostering compliance and awareness in the sector to help reduce opportunities for fraud and ensure financial safety and fairness for Ontarians.

Based on the outcomes contained within this report, there continues to be a lack of compliance with regulatory requirements across the sector. FSRA remains committed to increasing awareness of compliance obligations through educational initiatives. To assist licensed HSPs with understanding their compliance obligations, FSRA developed the Quick Guide and conducted a Webinar on compliance requirements. In addition, all approval notifications for new HSP licences issued after February 2, 2024, now include a link to the Quick Guide. FSRA expects all sector participants to review these tools to ensure they are aware of and comply with regulatory requirements.

FSRA is continuing to explore opportunities to strengthen the risk assessment of HSPs and will continue to collaborate with sector participants to assist in the development of our supervision priorities and key areas of risk assessment. FSRA will also consider whether further action, including escalation to enforcement, is necessary to ensure sector compliance with regulatory requirements. A more compliant sector will help to ensure fair treatment for claimants who access SABS benefits following a motor vehicle accident.