Guidance

☒ Interpretation ☒ Approach ☐ Information ☐ Decision

No. CU0082INT

Purpose

This guidance1 provides the Financial Services Regulatory Authority of Ontario’s (FSRA):

- interpretation of the provisions of the Credit Union and Caisses Populaires Act, 2020 (The Act)2 as requiring large Credit Unions and Caisses Populaires (CUs) to develop and maintain resolution plans

- approach for assessing CU adherence to the principles set out in the Interpretation section of this guidance

The Approach section of this guidance does not prescribe compliance requirements for Ontario CUs. Rather, it is intended to define the processes and practices that FSRA will follow when exercising its discretion under the Act3. The Interpretation section of this guidance sets out FSRA’s view and interpretation of requirements under the Act where non-compliance may lead to supervisory action and enforcement sanctions.

Scope

This Interpretation and Approach guidance affects CUs incorporated under the Act which are considered large. For the purposes of this guidance, large CUs are those with more than $1 billion in total assets.

This guidance complements the information provided in, and should be read in conjunction with, other FSRA guidance and supporting publications available on FSRA’s website (www.fsrao.ca).

Rationale and Background

FSRA acts as both the supervisory authority and resolution authority for the Ontario CU sector and has distinct roles as it relates to the recovery and resolution of CUs.

- A supervisory authority is the organization responsible for the prudential regulation and supervision of financial entities. Recovery planning is generally a requirement of the supervisory authority.

- A resolution authority is the organization responsible for managing the process once a financial entity is deemed non-viable. Resolution planning is generally a requirement of the resolution authority.

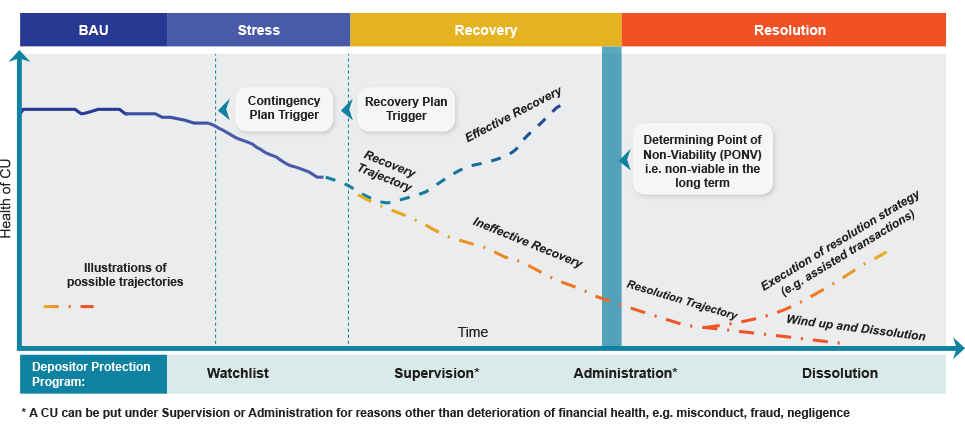

Recovery describes the state when a CU is under severe stress but remains viable. FSRA acting as the supervisory authority applies high supervisory intensity on the CU4 while the CU is trying to return to Business as Usual (BAU).5

Resolution describes the point after FSRA, acting in its capacity as resolution authority, determines the non-viability of a CU. The resolution authority, whose mandate is to maintain the financial stability of the system, minimize disruption, and protect the deposit insurance fund, will either restructure the institution through drastic measures (e.g., forced asset sale or merger) or wind-up the failing CU.

FSRA determining that a CU has reached the Point of Non-Viability (PONV) distinguishes a CU in recovery from a CU in resolution. This determination also distinguishes FSRA acting primarily in its capacity as the resolution authority for the failed CU.

Determining that a CU has reached the PONV will be made by FSRA in its discretion based on the relevant information and data available. A CU reaching the PONV may be shared with the CU Board, management, members/depositors and other stakeholders on a need to know basis, taking into consideration FSRA’s relevant statutory objects.

The list of factors below is non-exhaustive and FSRA, at its discretion, may rely on any single criterion, combination of criteria, or other measures in forming an opinion on whether a CU has reached the PONV. In determining the outlook for non-viability, FSRA will also consider the persistence (duration) as an added dimension. The PONV is determined by FSRA on a case-by-case basis with regards to its statutory objects. Factors may include:

- regulatory capital falls below specified minimum levels

- required liquidity falls below specified minimum levels

- the CU is expected in the near future to be unable to pay liabilities as they fall due

- the CU’s earnings capacity has been seriously impaired

- the CU is unable to raise investment shares to offset capital shortfalls

- there is a serious impairment of the CU’s access to funding sources

- the CU depends on official sector financial assistance to sustain operations or would be dependent in the absence of resolution

- there is a significant deterioration in the value of the CU’s assets

- the CU’s business plan is non-viable

- the CU is expected, in the near future, to be balance-sheet insolvent

FSRA can use its powers6 under the Act which relate to Financial Assistance, Administration, Supervision, Dissolution and Winding Up to resolve a CU. These legislative powers provide FSRA with the authority to undertake recovery and resolution activities.

The diagram below illustrates how these powers may be used in the recovery and resolution process.

Recovery and Resolution Continuum

Due to long-standing pressures towards consolidation, Ontario’s CU system is becoming more concentrated with fewer, larger, and more complex CUs. Historically, non-viable CUs have merged with other CUs or have been liquidated. Over the last decade, there have been fewer liquidations7 and dissolutions8 but merger activity continues. The option to merge has become more complicated for large CUs, who are less likely to find a partner capable or willing to merge with in the event of non-viability.

FSRA’s interpretation of existing legislative requirements under the Act9 is that CUs are required to develop resolution plans. Resolution plans provide FSRA with an understanding of the structure of large CUs, enhance data readiness for valuation and depositor payout, enable operational continuity of functions servicing client needs, and plan for the most effective resolution strategy.

To manage the resolution of a large CU, FSRA will need a detailed understanding of the CU’s systems, processes and resources to ensure that insured deposits are fully paid-out, which would be provided through resolution planning. FSRA will also require this information to assume the operations of the non-viable CU to either sell assets, merge and/or wind-up the CU.

Smaller CUs are not required to develop a resolution plan as their failure could be managed with the information gained through the regular supervisory process and options to merge are more readily available.

Resolution planning supports FSRA’s goal of developing a sound resolution regime for the Ontario CU sector to promote and maintain stability of the CU sector in the event of a crisis. These outcomes are consistent with several FSRA statutory objects, as set out in s. 3(1) and s. 3(4) of the Financial Services Regulatory Authority of Ontario Act, 2016 (the FSRA Act):

- to contribute to public confidence in regulated sectors

- to provide insurance against the loss of part or all of deposits with CUs

- to promote and otherwise contribute to the stability of the CU sector in Ontario with due regard to the need to allow CUs to compete effectively while taking reasonable risks

- to pursue the objects for the benefit of persons having deposits with CUs and in such manner as will minimize the exposure of the Deposit Insurance Reserve Fund (the DIRF) to loss

Interpretation

FSRA has identified the following specific desired regulatory outcomes for resolution planning:

- Impediments to resolution are materially removed through robust planning to ensure that resolution activities can be carried out in a timely and orderly fashion.

- Continuity of business operations is maintained to serve CU members and customers through orderly resolutions of failed CUs. This is enabled by ensuring that large CUs have credible and feasible resolution plans in place that can be operationally implemented and facilitate effective use of FSRA’s resolution powers.

- Loss to the DIRF and harm to depositors (including insured and uninsured depositors), members, consumers, and other creditors are minimized through improving transparency and mitigation of the risks posed by potential failures of large CUs.

- Public confidence and sector stability are promoted through effective resolution planning and timely implementation.

To satisfy the requirements under the Act, CUs must adhere to the principles set out in this section in a manner that demonstrates the degree of care, diligence and skill that a prudent person would exercise in comparable circumstances. Effective adherence to the principles would:

- demonstrate how powers and duties must be exercised and discharged by each director, officer or committee member of a CU under s. 109(1) of the Act

- reflect adherence to the standard of care that each director, officer, or committee member of a CU must exercise pursuant to s. 109(2) of the Act

This Interpretation sets out FSRA’s view of the following requirements under the Act:

- S. 198(1) and s. 199(1) of the Act respectively provides FSRA with such powers to request information relating to the CU’s business as is required for the purpose of carrying out powers and duties. FSRA is interpreting these subsections of the Act as creating an obligation by a CU to provide a resolution plan to FSRA on a regular basis

- S. 109(2) of the Act which requires that each “director, officer or committee member to exercise the degree of care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances”, to include an obligation for directors and officers, as part of their duty of care, to ensure that a resolution plan for the CU is implemented and kept current

Therefore, to the extent that large CUs do not implement and maintain a resolution plan consistent with FSRA’s Interpretation of the requirements under the Act, it may lead to supervisory action or enforcement sanction by FSRA against the CU, its Board or senior management. This may include requiring remediation and reporting, and/or issuing orders and in extreme cases, placing the CU under supervision or administration.

FSRA will monitor adherence to these principles and requirements as part of its supervisory approach, as outlined in the Approach section of this guidance below.

Principles

Consistent with a principles-based and outcomes-focused framework for resolution planning, FSRA has identified the following principles for effective resolution planning to satisfy its Interpretation of the Act. FSRA will apply these principles to assess the CU’s resolution planning to determine whether the requirements of the Act are satisfied.

Principles of Resolution Planning

- Effective Resolution Plan Development: Large CUs have an obligation to contribute to maintaining the stability of the CU system in the event of its failure, continue to provide delivery of critical function, minimize disruption to the depositors, members, and other stakeholders in the system.

Through its Board and senior management, the CU has an obligation to create a resolution plan that provides sufficient information to satisfy these objectives.

A CU’s resolution plan submission must include a comprehensive profile of the CU that is consistent with the scope of its activities and footprint. This includes the development of a preferred resolution strategy and an operational plan, which will inform FSRA’s resolvability assessments and identify actions for the CU to take to remove any identified impediments to resolvability.

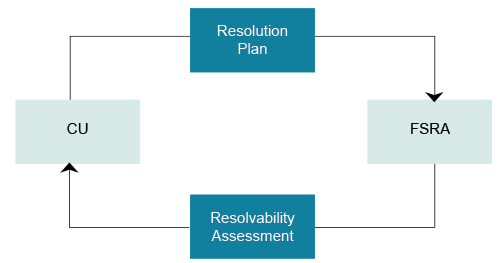

Resolution Plan Cycle

- Accountable Governance: The CU, through its Board and senior management, must be accountable for resolution planning.

Resolution planning activities must be undertaken by different levels of the CU, including the Board and senior management, and the CU’s business records, including the Board minutes, must evidence this process. The resolution plan must be strategically focused and reflect conclusions and observations about implementation given the CU’s unique legal, financial, and operational structure. - Timely Coordination and Engagement with FSRA: CUs must keep FSRA informed on the execution of their recovery actions upon activation of their recovery plans. Should recovery be unsuccessful, the CU must engage with FSRA to prepare for resolution.

CUs must self-identify issues and create a timeline to implement recovery actions according to their recovery plans. If financial health cannot be restored, CUs must work with FSRA and prepare for resolution to ensure resolution activities can be carried out in a timely and orderly fashion. - Depositor, Member and Consumer Protection: Resolution planning must be robust and accurate to minimize harm to depositors, members and consumers.

A disorderly failure of a CU can negatively impact depositors, members and consumers. Resolution planning activities must promote the timely and orderly resolution of the CU to minimize harm to depositors, members and consumers. Resolution planning must also be robust and accurate to protect the sector, as well as the members and depositors in other CUs, both from loss via the DIRF, contagion and reputation risk. - Periodic Testing and Reassessment: The resolution plan must be periodically tested to validate its effectiveness and ensure the resolution plan is up to date with current information.

A CUs resolution plan must be tested to validate its effectiveness during a crisis. For example, a resolution plan’s effectiveness can be validated through table-top exercises, simulation scenarios or other methods identified by the CU.

A regular cadence must also be established for re-assessing and refreshing resolution plans. For example, addressing lessons learned after a resolution exercise, when adding or exiting a business line, or responding to an external development. The resolution planning process is an iterative process that aims to continuously improve the quality and feasibility of the plans to ensure they are current. - Proportionality: Resolution plans, targeted for large CUs, must be developed based on the structure, size, complexity, and risk profile of a CU.

A CU resolution plan must be tailored to the structure, size, complexity, and risk profile of the institution.

Approach - Processes and Practices

FSRA takes a proactive approach through resolution planning to manage potential contagion and disruptions caused by CU failures. Identifying, evaluating, and addressing challenges through resolution planning helps facilitate FSRA’s effective application of resolution tools to ensure orderly resolutions, thereby minimizing the impact to the Ontario CU system. The breadth and depth of information required to facilitate resolution planning is driven by the CU’s size, complexity, and risk profile.

A large CU failure could cause significant contagion in the system. Market reaction to a failed CU and the impact on financial stability may not be completely mitigated by the availability of the DIRF. Difficulties in paying out deposits, due to the magnitude of uninsured deposits or presence of operational issues at the failed CU, can send negative market signals and promote the likelihood of a run on a CU.10 The impact will not only be on the failed CU, but the entire sector. The CU’s resolution plan should describe the breadth and depth of potential impact on members, customers, other financial institutions, and other stakeholders upon the CU’s failure.

A CU’s resolution plan should include a resolution profile, as well as a self-assessment on several areas to inform the CU’s resolvability. Although it is not possible to prescribe in advance the precise course of action to be pursued in executing the resolution strategy, some consideration can be given ahead of time to enhance crisis preparedness through resolution planning.

CUs are welcome to submit supporting documents such as internal management or board reports as appendices to their resolution plans that would address FSRA requirements identified in the Interpretation section of this guidance. The format of the information is at the CU’s discretion.

In assessing whether a CU’s resolution plan meets the objectives stated in the Interpretation section of this guidance, a CU’s resolution plan should contain the following core elements.

A. Resolution profile

The purpose of the resolution profile is to provide a comprehensive view of the CU, identifying those material elements that in resolution must be focused on to maintain stability in the system. The profile should highlight the critical functions that the CU performs as well as the shared services that support those functions. Planning for the continuity of these functions and services upon entry to resolution will form the basis for determination of the resolution strategy.

Legal entities

The resolution plan should identify the CU’s legal entities, including the CU’s parent entity and sister entities (that may not be CUs), any subsidiaries (whether active or inactive), minority investments, joint ventures, partnerships, and special purpose vehicles.

Sufficient detail should be provided for each legal entity, such as:

- incorporation and operating jurisdiction (provincial/ federal)

- ownership percentage, and other parties who hold the remaining ownership stake

- basic financial information (assets/liabilities; income/expenses)

- general information on the Board of Directors

- intra-group guarantees or other support mechanisms

- applicable protection schemes (in addition to the DIRF), supervisory/resolution authorities; relevant regulations and regulatory/capital requirements

- share structure (number and types of shares e.g., member shares, investment shares, profit shares)

- mapping of legal entity to business lines/critical functions (see below)

- mapping of legal entity to critical shared services (see below), including any activities outsourced to third parties

- number of staff employed with employment contracts at the legal entity

- tangible and intangible assets including all registered and unregistered patents, trade names, trademarks, copyrights, and any other intellectual property rights to which the legal entity holds title

Critical functions

CUs should also identify a list of critical functions applicable in their business profile. Critical functions are defined as activities, services or operations that would need to be continued because the discontinuance of which will cause significant disruption to the financial stability of the Ontario CU system due to the size and/or complexity of the CU. Examples include deposit and lending activities in the retail or commercial sector.

Critical shared services

CUs should also identify a list of critical shared services that support its critical functions. Critical shared services are activities performed within the CU or outsourced to third parties. Failure would lead to the inability to perform critical functions, and therefore disrupt operations and services. Examples include:

- information technology supporting core banking processes (data storage and processes; IT infrastructure, software licenses, access to external providers, application maintenance, report generation, user support)

- human resources (payroll, staff administration/contracts, communications)

- transaction processing

- real estate provision and management (leases, facilities management, access control, security)

- corporate legal services and support

- payment, clearing and settlement systems

B. Resolution strategy

While FSRA has several options to resolve a failed CU, FSRA may put it into “Open CU Resolution”. FSRA will utilize information provided in a CUs resolution plan and decide as to whether “Open CU Resolution” is the optimal strategy. Open CU Resolution will enable a large CU to remain open but under the control of FSRA. Depositors will have full or partial access to their accounts while resolution activities are performed. FSRA will maintain CU operations, potentially restructure the CU through drastic measures (e.g., forced asset sale, purchase and assumption, merger if possible), and use the CU’s own systems to process any depositors’ withdrawals and support members.

There will be immediate, short-term, and long-term objectives during resolution. For example, for deposit taking, immediate objectives could include maintaining full customer access (branch, online, mobile, ATM network) and maintaining sufficient liquidity to meet expected deposit outflow. Short-term objectives should include preservation of value through customer retention and pricing strategy. Long-term objectives could include a forced asset sale, purchase and assumption, and/or restructuring and mergers facilitated by FSRA. Achieving these objectives could depend on factors like operational continuity of branches and technology infrastructure, retention of key staff, and uninterrupted access to banking systems.

Given the above context, CU’s resolution plan should contain a description of:

- Immediate, short-term, and long-term objectives in resolution for each business line/asset/critical function/legal entity.

C. External and internal dependencies for operational continuity

One of the desired outcomes in resolution is the continuity of business operations to serve CU members and customers during the orderly resolution of a failed CU. Operational continuity can only be enabled if key internal and external dependencies have been identified and favourable terms are present in the corresponding governing contractual agreements. These may include but not limited to leases, IT services, loan origination and servicing, risk assessment/underwriting platforms, clearing and settlement services, back-office operations, and use of intellectual property.

A CU’s resolution plan should consider, for external operational dependencies, key contracts with third parties, including a description of termination clauses upon insolvency or a restructuring event. Relevant terms and provisions on termination should be assessed by the CU in ongoing or upcoming contract negotiations to promote operational continuity of services in resolution. In an Open CU Resolution, it is important for all contracts supporting critical functions to continue despite the CU being put under administration by FSRA. Any unreasonably withheld consent or extortionate power exercised by third party suppliers (e.g., landlords, software vendors) could create barriers for transfer of business to a purchaser during an Open CU Resolution. Such potential impediments should be identified in the resolution plan and brought to the CU Board’s attention so that they can be addressed accordingly to improve resolvability.

For internal dependencies, a CU’s resolution plan should consider identifying key employees and strategies for retention upon resolution, details of their current compensation levels, employment contract details, and the roles these employees play including providing internal and external communications during resolution.

D. Divestitures

Another desired outcome in resolution is the timely and orderly operationalization of resolution activities. Depositors and customers of the failing CU may choose to source alternative providers through natural attrition. Alternatively, FSRA may restructure the failed CU in resolution through drastic measures (e.g., forced asset sale, purchase and assumption, merger if possible) where the failing CU’s depositors and customers will be transferred to the new financial service provider. Information collected through CU’s resolution plan should facilitate effective performance of such transitional activities, resulting in the least disruption to the system.

Marketability, transferability, and valuation

A CU’s resolution plan should include a marketability, transferability, and valuation assessment of its assets. This could include a description of the CU’s membership profile (e.g., age, demographics, loans and deposits compositions) highlighting any potential areas of concerns in the context of resolution. A CU should include segmenting its assets or business lines from the most marketable to the least marketable, and from the most transferrable to the least transferrable in a purchase and assumption transaction. CUs may consider additional granularity to describe composition of assets to reflect varying degrees of underlying credit quality, product features and complexity that could affect marketability and transferability.

Understanding the relative value of assets (given their type, complexity, market, physical location) and any vulnerabilities to market illiquidity and/or impairment concerns can increase resolution preparedness. A CU’s resolution plan should describe the valuation principles currently applied on various types of assets, the information and system capabilities that will be required for that valuation, the point in time at which the valuation is to take place, and any current engagement with business valuators.

Separability

A CU’s resolution plan should identify any impediments to separation/divestiture of assets. Separability issues could arise from legal change of control provisions, position of assets/liabilities in the legal structure, terms and conditions in operating and joint venture legal agreements involving third parties. Other separability issues could arise when different businesses in a CU or its subsidiaries are reliant on common infrastructure, resources, or people, preventing these businesses from being operated or sold separately (e.g., shared computer systems, facilities, banking platforms, branches).

Approvals

A CU’s resolution plan should identify any regulatory and/or judicial approvals required to implement a divestiture, transfer of assets and liabilities of business activities that are not regulated by FSRA. This could include any key information requirements, conditions and timelines that must be met to allow for the approval. FSRA will work with other regulators, including setting up Memoranda of Understanding (MOU), to coordinate and streamline the activities in planning, coordinating, and implementing resolution.

A CU’s resolution plan should also identify any third-party approvals from service providers or joint venturers if they could be a barrier to resolution if they are not obtained.

E. Funding sources and financial exposures

Minimizing the loss to the DIRF is another desired outcome in a CU resolution. The CU’s sources of funds and exposures to contingent liabilities are important considerations and should be understood as they would influence the ultimate impact on the DIRF. For example, a CU’s resolution plan should include a description of:

- any intra-group exposures among legal entities, including with its parent if any, in the form of capital, funding, or liquidity arrangements

- any cross-guarantees, cross-collateral arrangements, cross-default provisions, and intra-group and cross-product netting arrangements

- any risk transfers and booking arrangements

- any off-balance sheet commitments

- any profit and loss sharing in joint ventures, strategic alliances, or partnerships agreements of which the CU is a party should also be included

- any mortgages sold for the purpose of securitization where the CU may be required to repurchase assets or assets that include set-off provisions should be outlined

- any asset pledging requirements including amounts and types of securities pledged for any drawn or undrawn secured liabilities

- any material assets that are carried at a significant premium (or discount) to market value should be highlighted in the resolution plan

F. Data capabilities

Depositor payout

To ensure preparedness of an orderly payout of depositors in resolution, a timely, accurate, and complete deposit dataset containing all necessary data attributes (required to accurately determine insured deposit coverage under the DIRF) should be available. The dataset should be based on, among other details, clear identification of account types (e.g., single account, joint account, trust account with beneficiaries information, registered vs. non-registered). A CU’s resolution plan should include an example of such dataset. In addition, a description of the CU’s banking system’s capabilities, a self-assessment of data quality and completeness, any manual adjustment required in the determination of insured deposits, and system status and readiness for significant deposit payout activities should also be discussed.

Members communications

CUs should have reliable and accurate information on their members and related capital investments (membership shares, investment shares) to ensure communications, voting/meetings and capital issues can be communicated accurately and in a timely manner. A resolution plan should demonstrate the CU’s capabilities in providing such information, including an example dataset.

Due diligence process

Given the time-critical nature in executing a resolution strategy which may involve a potential sale, purchase and assumption, merger transaction, it is necessary to ensure timely, accurate data that could be used in a due diligence process are available to potential buyers. A CU’s resolution plan should include a description of such data and internal reports or management information that could be readily generated and provided. The CU’s capabilities in producing key status and risk data on an off-cycle basis should also be discussed.

G. Plans to address impediments

Resolution planning and assessment processes are iterative in nature and will likely require further refinement and adjustment over time as more experience is gained, and more issues are identified for deeper considerations. CUs are encouraged to self-identify gaps and detail short- and long-term plans to address gaps and improve resolvability.

Submission frequency and assessment considerations

Large CUs must review and update their resolution plan annually, which should be approved by the CUs Board. The resolution plan should be made available to FSRA upon request.

FSRA will evaluate resolution plans and related processes and may ask questions and identify potential shortcomings or concerns. Based on information provided in the resolution plan, FSRA will provide a resolvability assessment.

The development of an effective resolution plan is an iterative process that requires significant interactions between the CU senior management and its Board. Senior management has the responsibility to improve the plan, address self-identified gaps and issues, and address concerns raised by FSRA. CU Board should review and approve any updates on the resolution plan. The plan should be periodically reviewed and refined by the CU to ensure that it remains relevant given changing conditions within the CU and in the broader financial environment.

FSRA’s resolvability assessment will determine whether the CU is required to address deficiencies in the subsequent draft to be submitted within a specified timeframe or if further enhancements and refinements can be addressed as part of the next scheduled review.

If FSRA requires re-submission before the next scheduled filing, the plan should be amended and include explanations to address FSRA’s concerns when resubmitted.

Effective date and future review

This guidance will be effective as of [March XX, 2022]. However, CUs to which this guidance applies will have a transition period during which they will be required to develop credible resolution plans to be submitted to FSRA by [January 31, 2024]. In order to provide CUs with an opportunity to receive feedback as they develop their resolution plans during the transition period, FSRA will require that CUs provide an interim submission detailing the key components of their resolution plans by [April 30, 2023]. FSRA will also consider proportionality in the application of the requirements.

This Guidance will be reviewed on or before [March XX, 2027].

About this guidance

This document is consistent with FSRA’s Guidance Framework. As Interpretation guidance, it sets out FSRA’s view of requirements under its legislative mandate (i.e., legislation, regulations and rules) so that non-compliance can lead to enforcement or supervisory action pursuant to that legislative mandate. While as Approach guidance, it describes FSRA’s internal principles, processes and practices for supervisory action and application of CEO discretion where applicable.

Appendix – statutory authority

The following sections of the Act provide the statutory basis for this Guidance:

Standard of care – section 109

- The director, officer or committee member shall exercise the degree of care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances.

Information required by Chief Executive Officer – section 198

- The Chief Executive Officer may require a credit union, a subsidiary of a credit union or any other person to provide the Chief Executive Officer with such information as the Chief Executive Officer may require for the purpose of carrying out the Chief Executive Officer’s powers and duties under this Act.

Information required by authority – section 199

- The Authority may require a credit union, a subsidiary of a credit union or any other person to provide the Authority with such information as the Authority may require for the purpose of carrying out its powers and duties under this Act

Powers of authority (financial assistance) – section 228

- The Authority may, in furtherance of its objects in respect of credit unions, as set out in section 3 of the Financial Services Regulatory Authority of Ontario Act, 2016

- provide, in its discretion, financial assistance for the purpose of

- assisting a credit union under administration in its continued operation

- assisting in the orderly winding up of the operations of a credit union

- provide, in its discretion, financial assistance for the purpose of

- The Authority may attach conditions to financial assistance provided under clause (1) (a) and, without limiting the form in which such financial assistance may be provided, the Authority may provide such financial assistance by

- purchasing securities of a credit union

- making or guaranteeing loans, with or without security, or advances to or deposits with a credit union

- taking security for loans or advances to a credit union

- guaranteeing the payment of the fees of, and the costs incurred by, a liquidator of a credit union

Supervision (supervision by the Chief Executive Officer) – section 230

- The Chief Executive Officer may order that a credit union is subject to the supervision of the Chief Executive Officer in any of the following circumstances

- The credit union requests, in writing, that it be subject to supervision

- The credit union is in contravention of section 77

- The Chief Executive Officer, on reasonable grounds, believes that the credit union is conducting its affairs in a way that might be expected to harm the interests of members or depositors or that tends to increase the risk of claims by depositors against the Authority

- The credit union or an officer or director of it does not file, submit or deliver a report or document required to be filed, submitted or delivered under this Act within the time limited under this Act

- The credit union has failed to comply with an order of the Chief Executive Officer

Supervision (interpretation) – section 230

- For the purposes of paragraph 2 of subsection (1), a variation under section 80 does not bring a credit union into compliance with section 77

Administration (administration by Chief Executive Officer) – section 233

- The Chief Executive Officer may order that a credit union is subject to administration by the Chief Executive Officer in any of the following circumstances

- The Chief Executive Officer, on reasonable grounds, believes that the credit union is conducting its affairs in a way that might be expected to harm the interests of members, depositors or shareholders or that tends to increase the risk of claims by depositors against the Chief Executive Officer, but that supervision would, in the circumstances, not be appropriate

- The credit union has failed to comply with an order of the Chief Executive Officer made while the credit union was subject to the supervision of the Chief Executive Officer

- The Chief Executive Officer is of the opinion that the assets of the credit union are not sufficient to give adequate protection to its depositors

- The credit union has failed to pay any liability that is due or, in the opinion of the Chief Executive Officer, will not be able to pay its liabilities as they become due

- After a general meeting and any adjournment of no more than two weeks, the members of the credit union have failed to elect the minimum number of directors required under section 86

- The Chief Executive Officer has made an order under section 207

Administration (administrator’s powers) – section 234

- As an administrator, the Chief Executive Officer may exercise the following powers:

- carry on, manage and conduct the operations of a credit union

- preserve, maintain, realize, dispose of and add to the property of a credit union

- receive the income and revenues of the credit union

- exercise the powers of the credit union and of the directors, officers and committees

- exclude the directors of the credit union and its officers, committee members, employees and agents from the property and business of the credit union

- require the credit union to

- amalgamate, by requiring the credit union to enter into an amalgamation agreement under section 251

- dispose of its assets and liabilities

- be wound up

Dissolution – section 237

- A credit union that has no assets and no liabilities may, if authorized by a special resolution of the members, apply to the Chief Executive Officer for an order dissolving the credit union

- The Chief Executive Officer may, if the Chief Executive Officer receives an application under subsection (1) and is satisfied that a dissolution of the credit union is appropriate, issue an order dissolving the credit union

- A credit union in respect of which an order is issued under subsection (2) ceases to exist on the day stated in the order

Voluntary winding up – section 238

- The members of a credit union may, by special resolution passed at a general meeting called for that purpose, require the credit union to be wound up voluntarily

Winding up by court order – section 240

- A credit union may be wound up by order of the court if

- the members, by a special resolution passed at a general meeting called for that purpose, authorize an application to be made to the court to wind up the credit union

- proceedings have been started to wind up the credit union voluntarily and it appears to the court that it is in the interest of contributories and creditors that the proceedings should be continued under the supervision of the court

- it is proved to the satisfaction of the court that the credit union, though it may be solvent, cannot by reason of its liabilities continue its business and that it is advisable to wind it up

- in the opinion of the court it is just and equitable for some reason other than the bankruptcy or insolvency of the credit union that it should be wound up

Effective Date: TBD

1 This guidance is being published as combined Interpretation and Approach Guidance under FSRA’s Guidance Framework. Each component is labelled for clarity.

2 The following sections of the Act provide the statutory basis for this Guidance: s. 109 (2) s. 198(1), s. 199(1) s. 228(1)(a)(i)-(ii) and s. 228(2)(a)-(d), s. 230 and s. 231, s. 223 and s. 224, s. 237, s. 238 and s. 240. See appendix for additional details on the relevant statutory authority for this Guidance.

3 Both the CEO of FSRA and FSRA may exercise regulatory discretion under the Act. However, for the purposes of this Guidance, reference will only be made to FSRA as the CEO may delegate authority to FSRA staff, as permitted by s. 10(2.3) of the Financial Services Regulatory Authority of Ontario Act.

4There is a continuum of supervisory work that ranges from lesser to greater supervisory intensity: document review, meeting with senior management and Board, off-site monitoring, off-site desk review or examination, targeted (limited scope) on-site examination, comprehensive on-site examination.

5 Additional information on requirements related to recovery planning is detailed in the Recovery Planning Interpretation and Approach Guidance (CU0069INT).

6 The powers granted to FSRA are prescribed in following sections of the Act: s. 228(1)(a)(i)-(ii) and s. 228(2)(a)-(d), s. 230 and s. 231, s. 223 and s. 224, s. 237, s. 238 and s. 240. See appendix for additional details on the relevant statutory authority for this Guidance.

7 Liquidation refers to the process of closing a CU so that its assets can be sold to pay its obligations. Liquidation is detailed in s. 241(5) and 241(6) of the Act.

8 Dissolution refers to the act of formally closing a CU. Dissolution can only occur once the CU has no assets or liabilities (after the liquidation or sale of all assets).

9 The following sections of the Act provide the statutory basis for this Guidance: s. 109(2), s. 198(1), s. 199(1), s. 228(1)(a)(i)-(ii) and s. 228(2)(a)-(d), s. 230 and s. 231, s. 223 and s. 224, s. 237, s. 238 and s. 240. See appendix for additional details on the relevant statutory authority for this Guidance.

10 A “run on a CU” is an event in which many depositors at a CU withdraw all their funds within a short time period as they believe the institution is non-viable.