If you belong to a defined benefit pension plan in Ontario, some of your benefits may be protected if your employer goes bankrupt and they don’t have enough in the pension plan to pay your benefits.

What is the Pension Benefits Guarantee Fund (PBGF)?

The PBGF is a fund that provides protection to Ontario beneficiaries of single employer defined benefit (DB) pension plans in the event of employer bankruptcy where plan assets are not sufficient to make pension payments. Ontario is the only jurisdiction in Canada with a fund of this type.

Who is covered by the PBGF?

PBGF protects beneficiaries of single employer defined benefit (DB) pension plans. In the event of an employer's bankruptcy, the PBGF guarantees benefits payable from these plans, subject to specific maximums and exclusions.

The PBGF does not cover the following:

- Multi-employer pension plans

- Jointly sponsored pension plans

- Individual pension plans

- Defined contribution pension plans

- Pension plans that have existed for less than five years

- Benefits earned in Ontario that are not subject to the Ontario Pension Benefits Act (e.g., pension benefits earned by federally regulated employees of airlines and banks)

How does the PBGF work?

The PBGF was established in 1980 under the Pension Benefits Act (PBA) and Regulations.

In a PBGF-eligible pension plan, you and/or your employer make contributions and the plan administrator invests the assets to pay the benefits when you retire. (NOTE: For most pension plans, your employer is your plan administrator.)

If your employer goes bankrupt, FSRA appoints a new administrator. The plan will need to be terminated and everyone’s benefits must be settled. If there aren’t enough assets to make the payments, the new plan administrator can apply to have the PBGF cover some of the benefits. If approved, the PBGF will transfer money into the pension plan.

How much of my benefits are covered by the PBGF?

Generally speaking, the PBGF works with the assets in the pension plan to guarantee the first $1,500 of your monthly benefits.

Example #1

Your monthly benefit is $1,500 or less.

Your monthly benefit is $1,400. The pension plan has enough assets to pay 70% of those benefits.

Your entire monthly benefit is guaranteed because it’s less than $1,500:

- $980 would come from the assets in the pension plan (70% x $1,400)

- $420 would come from the PBGF (30% of $1,400)

Total monthly benefit: $1,400

Example #2

Your monthly benefit is more than $1,500.

Your monthly benefit is $2,800. The pension plan has enough assets to pay 70% of those benefits.

a) The first $1,500 of your monthly benefit is guaranteed:

- $1,050 would come from the assets in the pension plan (70% x $1,500)

- $450 would come from the PBGF ($1,500 less $1,050)

b) For the remaining portion of your monthly benefit (i.e., $1,300 or ($2,800-$1,500)), you would receive $910 per month:

- $910 from the assets in the pension plan (70% x $1,300)

- The PBGF does not apply as it only guarantees the first $1,500 payment

Total monthly benefit: $2,410

Some benefits are not covered by the PBGF, such as:

- benefit improvements made less than five years before the plan is terminated

- cost-of-living adjustments to protect against future inflation

Governance

Under the PBA, the CEO of FSRA is responsible for the administration of the PBGF. The PBA requires the CEO to declare that the PBGF applies if specified conditions are met. For example, a plan sponsor cannot pay contributions to the plan, and/or the plan sponsor is bankrupt. The CEO of FSRA is also responsible for how assets of the PBGF are invested.

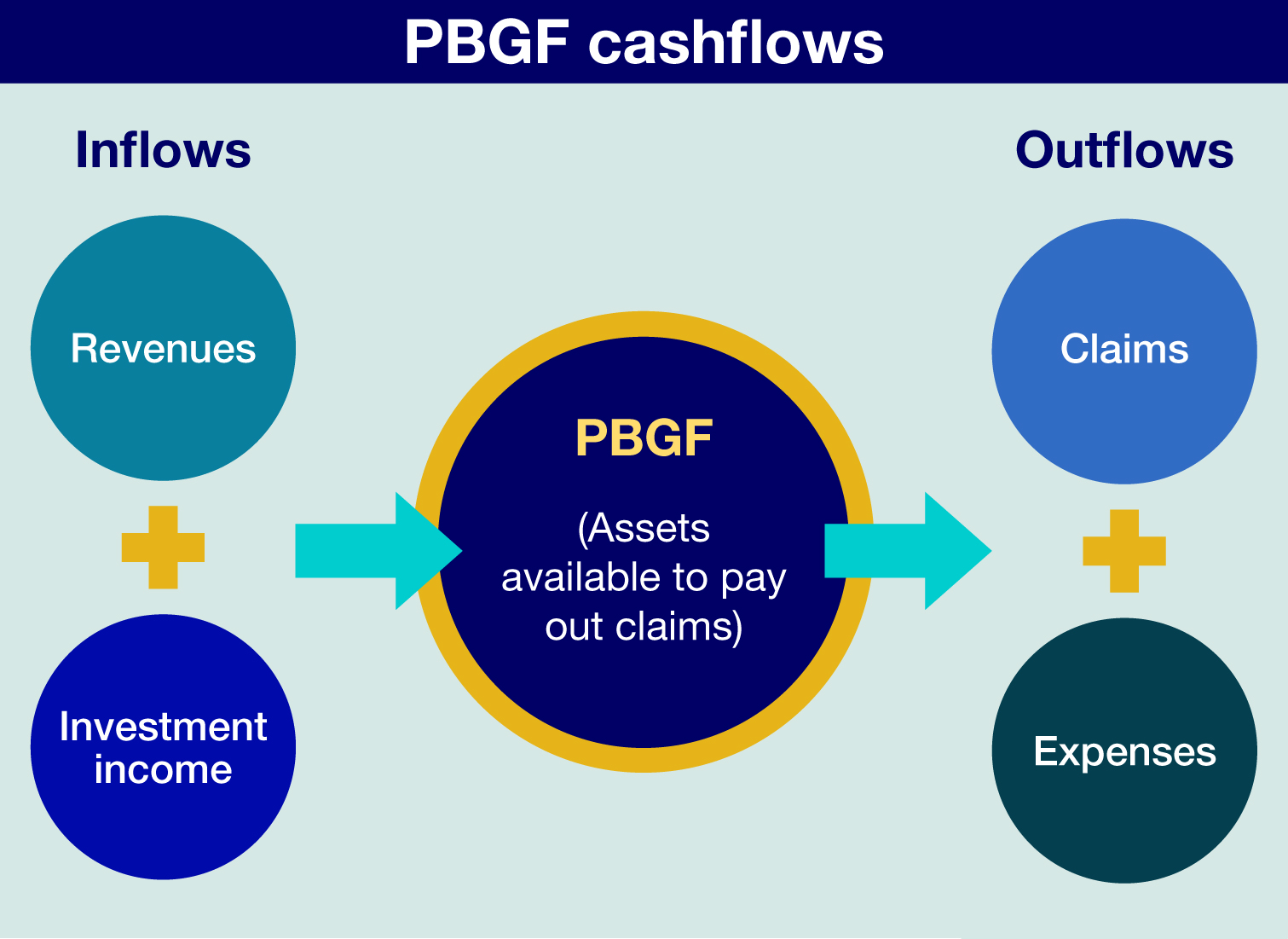

PBGF cash flows

This illustration summarizes the PBGF’s cash flows:

Inflows: Revenues

The main revenue source of the PBGF are assessments paid annually by plan sponsors of PBGF-eligible plans. The assessment rates are set by the Ontario government.

Assessments are payable in arrears, nine months after the fiscal year end of the pension plan. To pay the assessment, plan administrators complete an annual PBGF Assessment Certificate as prescribed under the regulation of the PBA.

A plan’s PBGF assessment is calculated based on the funded level (i.e., solvency) of the pension plan and the number of Ontario members covered under the plan. The larger the plan’s solvency shortfall, the larger its PBGF assessment.

Assessments reflect the extent to which plan assets can meet plan obligations. The assessment calculation does not account for the financial health of the plan sponsor.

Inflows: Investment income

The second source of inflows to the PBGF is investment income. FSRA’s CEO is responsible for administering the PBGF, including investment of the PBGF’s assets. FSRA has selected the Investment Management Corporation of Ontario (IMCO) to invest the assets of the PBGF as of summer 2024.

The PBGF is invested in a strategy that is expected to generate a reasonable return with a low to moderate risk exposure.

Outflows: Claims

The major source of outflows to the PBGF are claims. FSRA’s CEO may pay out claims over a 10-year period. This improves the sustainability of the PBGF when large claims occur.

Outflows: Expenses

The PBGF incurs expenses for its administration, such as the investment of the assets, oversight of the appointed administrators, and monitoring the sustainability of the Fund.

FSRA monitors the sustainability of the PBGF

An important part of FSRA’s role in supporting the CEO, as the administrator of the PBGF, is to conduct analysis of PBGF-eligible plan data each quarter. This includes monitoring the PBGF-eligible pension plans for factors such as their projected funded status and the potential impact of various plausible economic environments might have on them. This in turn informs the sustainability of the PBGF.

Helpful resources:

- Glossary of pension terms for definitions of the terms used on this page.

- Member Guide: My employer is bankrupt. What does that mean for my workplace pension?

- Guide to Understanding Your Pension Plan includes helpful links to:

- How FSRA regulates pension plans

- An overview of the retirement income system

- How registered pension plans work

- How life events can impact your pension benefits

- Pension Benefits Guarantee Fund (PBGF) Report - Year end March 31, 2023

- FAQs - Pension Benefits Guarantee Fund (PBGF)

- To see FSRA's PBGF financial statements, read the PBGF section of our past annual reports