FSRA has released its 2022 report on the Funding of Defined Benefit Pension Plans in Ontario (available in English only).

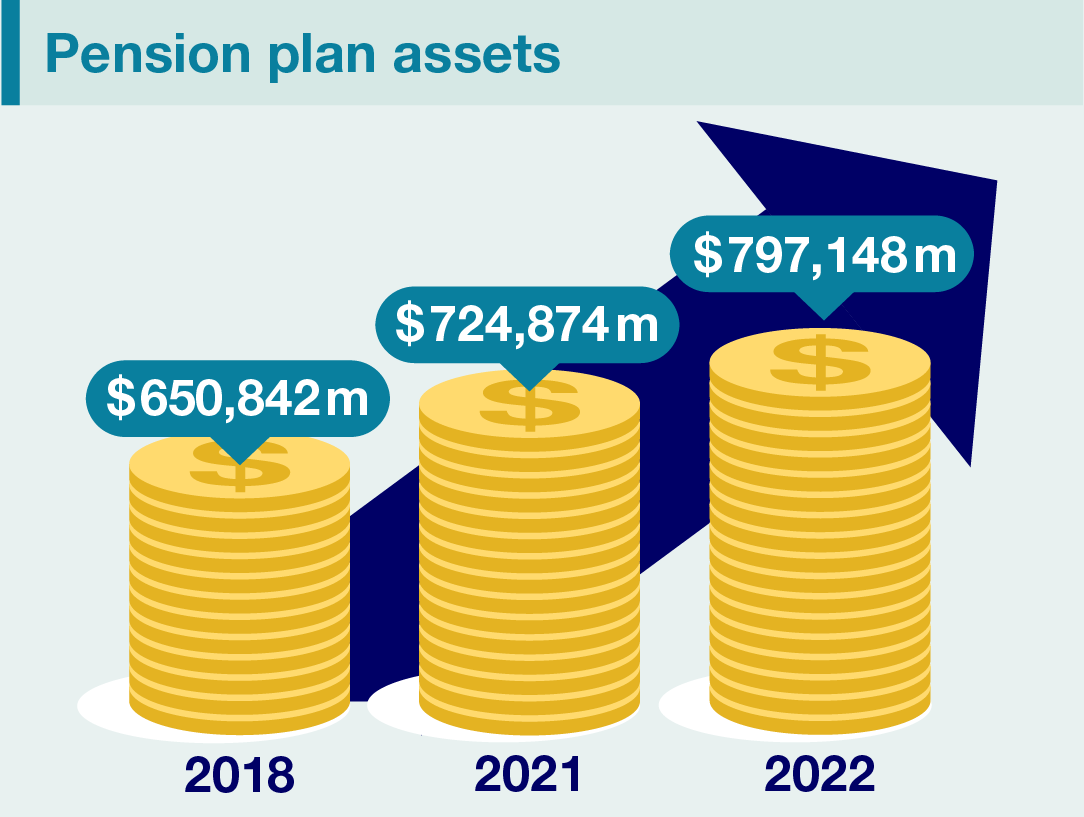

FSRA regulates all pension plans registered in Ontario and as Canada’s largest pension regulator, is a trusted source for the pension industry. As part of FSRA’s efforts to deliver on our mandate to promote good administration of pension plans, and to protect and safeguard the pension benefits and rights of pension plan beneficiaries, this report provides pension stakeholders with funding, investment and actuarial information on the registered defined benefit (DB) pension plans we regulate.

Highlights of the report include:

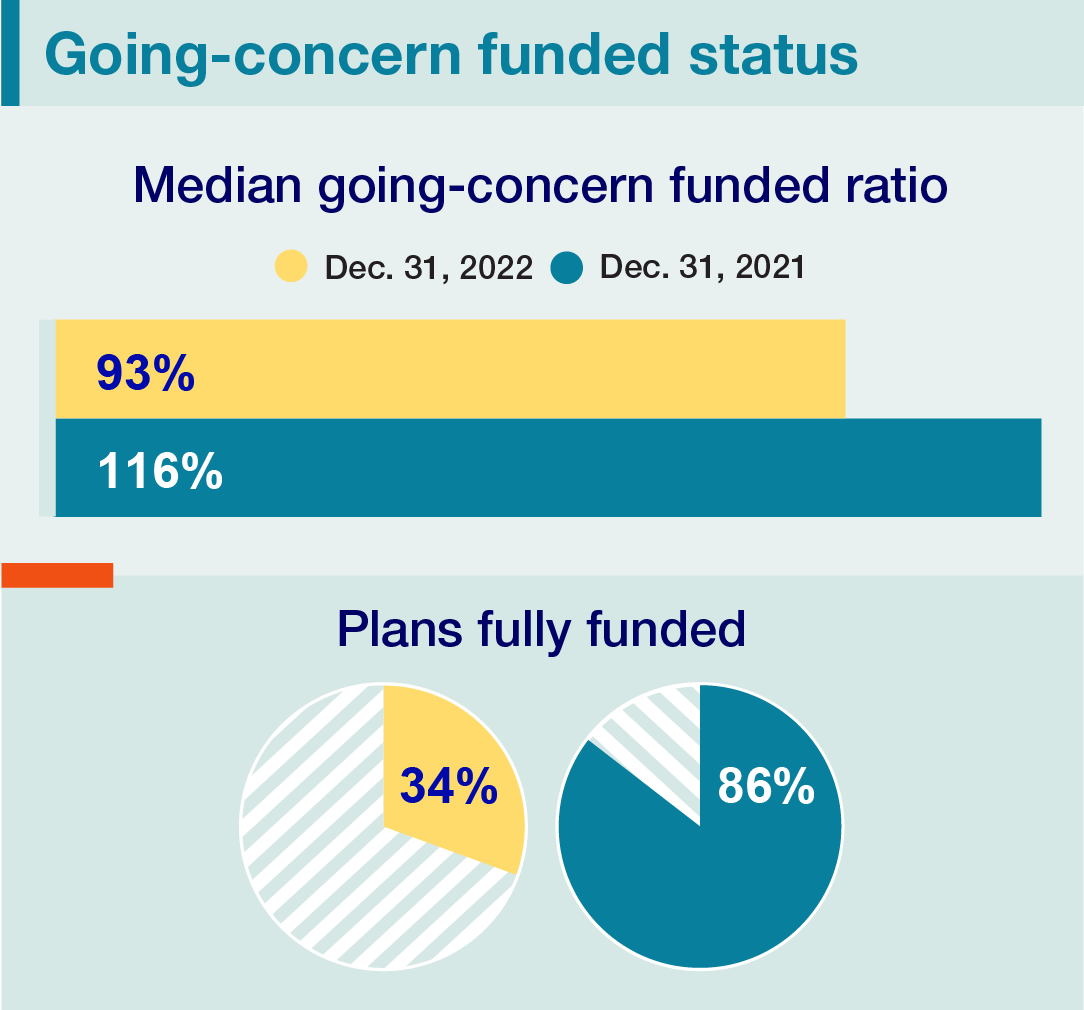

- the estimated median going-concern funded ratio has declined to 93% as at December 31, 2022 compared to 116% as at December 31, 2021

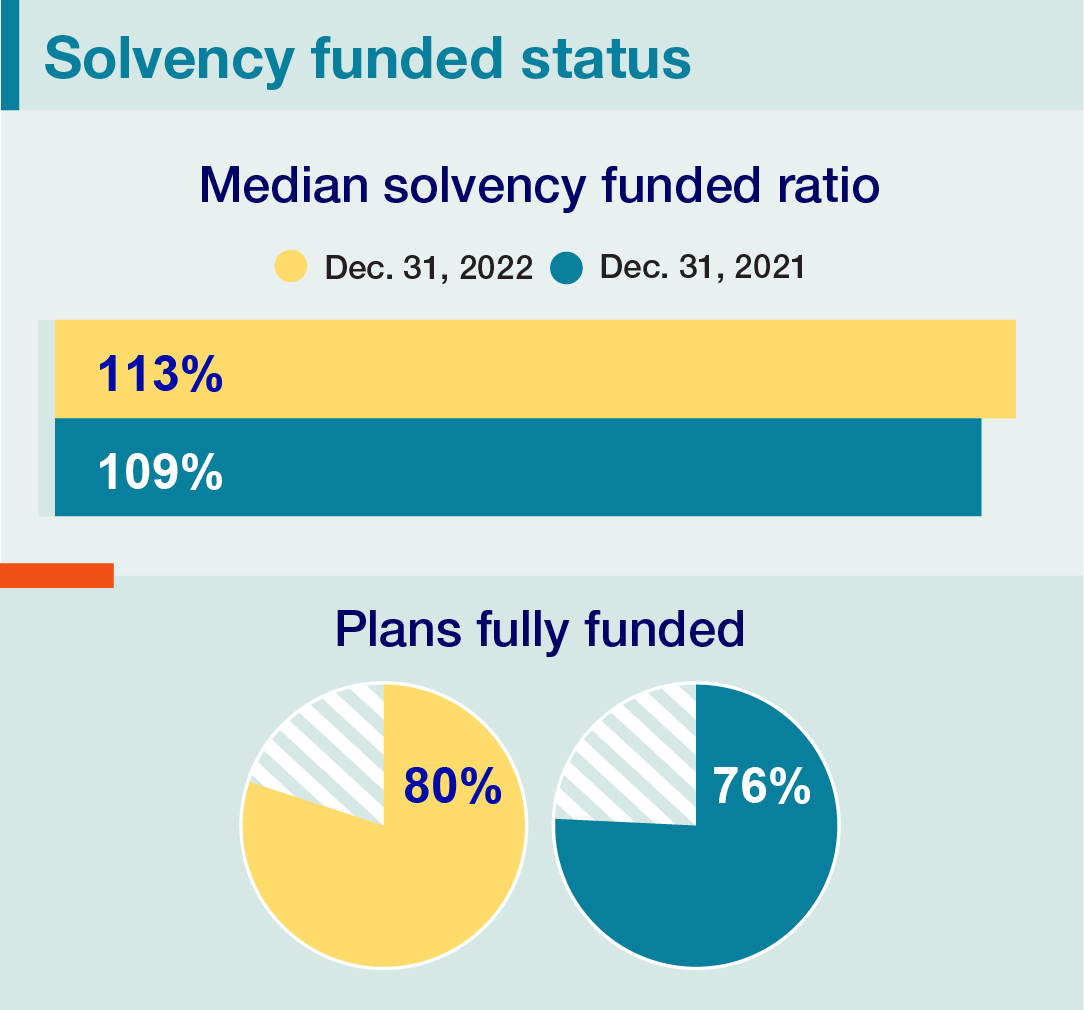

- the estimated median solvency ratio increased to 113% as at December 31, 2022 versus 109% as at December 31, 2021

- the going-concern and solvency funded ratios changed in opposite direction:

- double-digit negative investment returns in 2022 moved both ratios lower due to its effect on plan assets

- estimated solvency liabilities decreased more than the assets due to a significant increase in solvency discount rates in 2022, thereby increasing

- estimated going-concern liabilities did not decrease as they are based on assumptions about the long-term investment returns of the pension fund which were assumed to remain unchanged (i.e. more stable and much less sensitive to short-term market fluctuations)

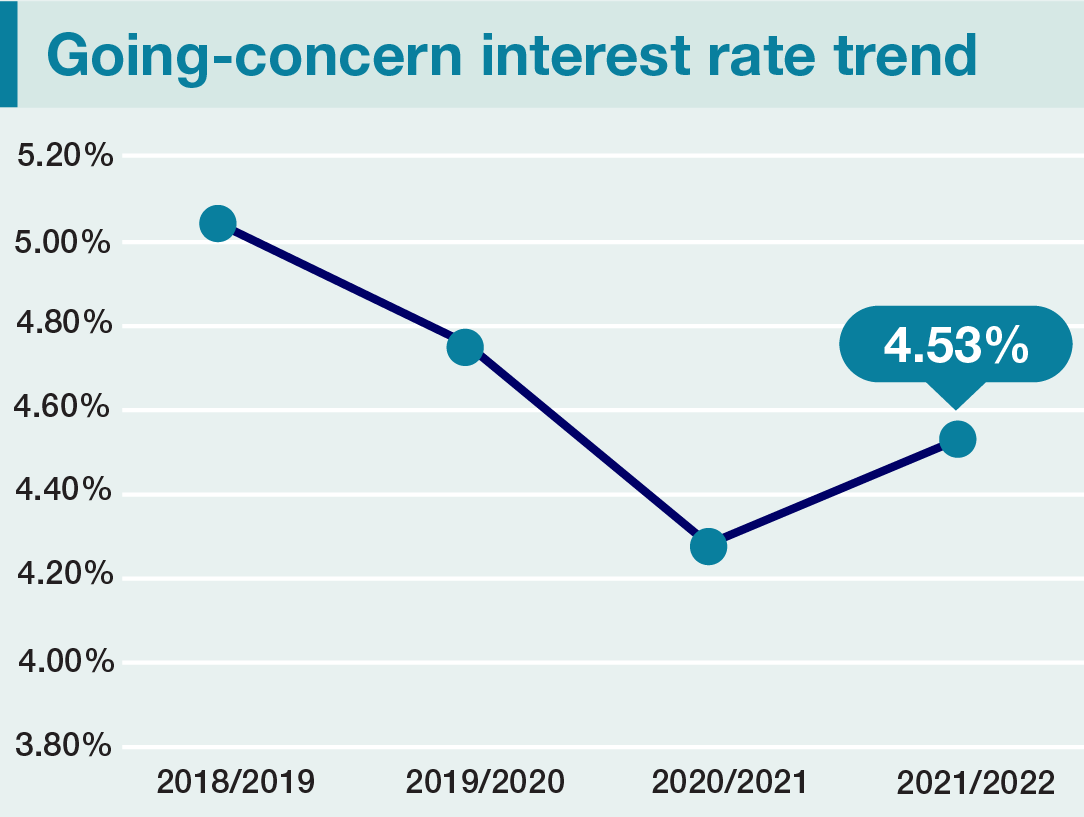

- the average assumed going-concern discount rate decreased from 5.05% (for valuations between July 1, 2018 to June 30, 2019) to 4.53% (for valuations between July 1, 2021 to June 30, 2022

- This is the second report in which all of the plans analyzed have filed an actuarial valuation report subject to the current funding regime introduced in 2018. There are 942 plans which are required by the regulations to have a Provision for Adverse Deviations (PfAD). The data shows that:

- the number of plans identifying themselves as closed and open for purposes of determining the PfAD are 731 and 211 respectively. The median PfAD for all these plans is 9.1%

- Plans with the prescribed PfAD have largely eliminated the use of an explicit margin that they previously had. It should be noted, however, that they are not mutually exclusive. The prescribed PfAD is a component of the minimum funding target. An explicit margin, however, can be used for other purposes as part of the funding and investment policies – for example, it may be used to establish a reserve to moderate the effect of gains and losses on funding levels and contribution requirements

- The asset allocation of single employer pension plans (SEPPs) remained relatively stable, with no significant changes observed in the allocation between fixed income and non-fixed income. In contrast, multiemployer pension plans (MEPPs) experienced a 2.7% decrease in their fixed income allocation, accompanied by a 3.1% increase in their allocation to real estate. Jointly sponsored pension plans in subsection 1.3.1(3) of Regulation 909 (Listed JSPPs) displayed more pronounced shifts in their asset allocation, with a notable 7.9% reduction in fixed income allocation and a corresponding increase of 6.8% in alternative investments. Listed JSPPs have substantially higher allocations to alternative investments (average of 38% vs. 10% for SEPP and 8% for MEPPs)

- SEPPs significantly underperformed their MEPP and Listed JSPP counterparts in the most recent period covered by the Investment Information Summary filed in 2022 (for over 90% of plans this was calendar 2021). This is attributable to the significantly different asset mix employed by these plans – most notably SEPPs have a much higher allocation to bonds and fixed income investments compared to MEPPs and Listed JSPPs – fixed income investments underperformed equities and real estate investments by a wide margin in 2021

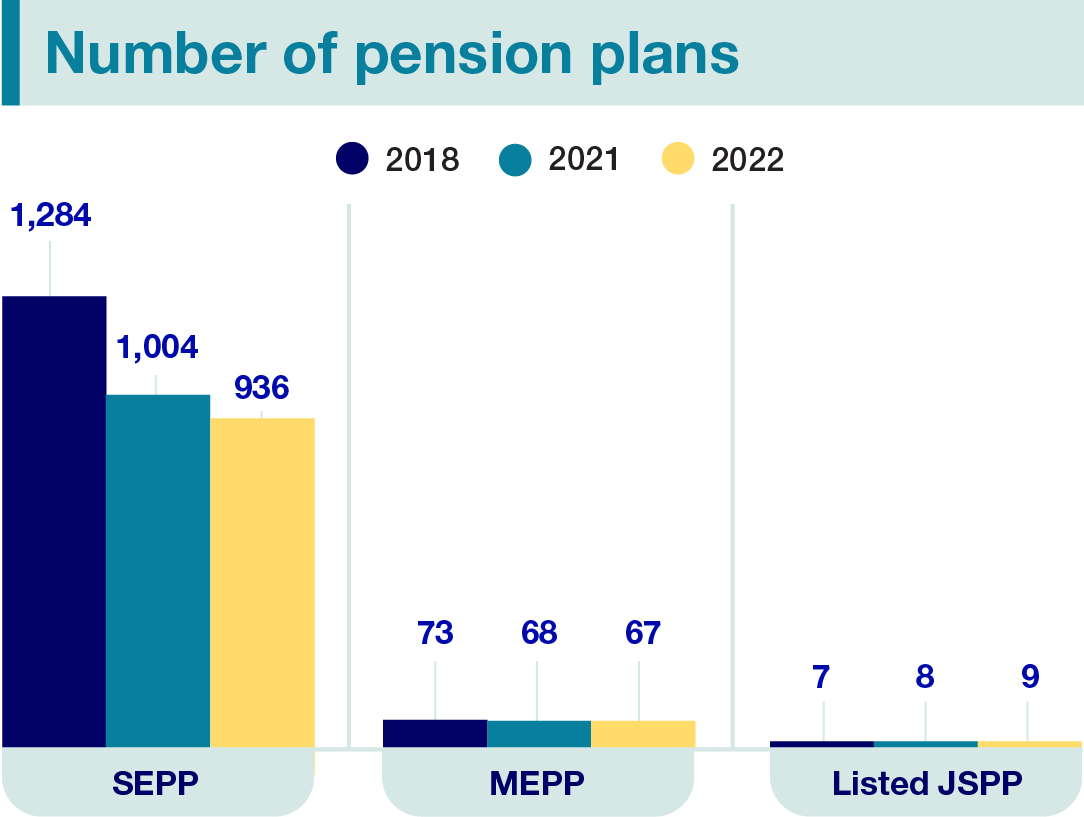

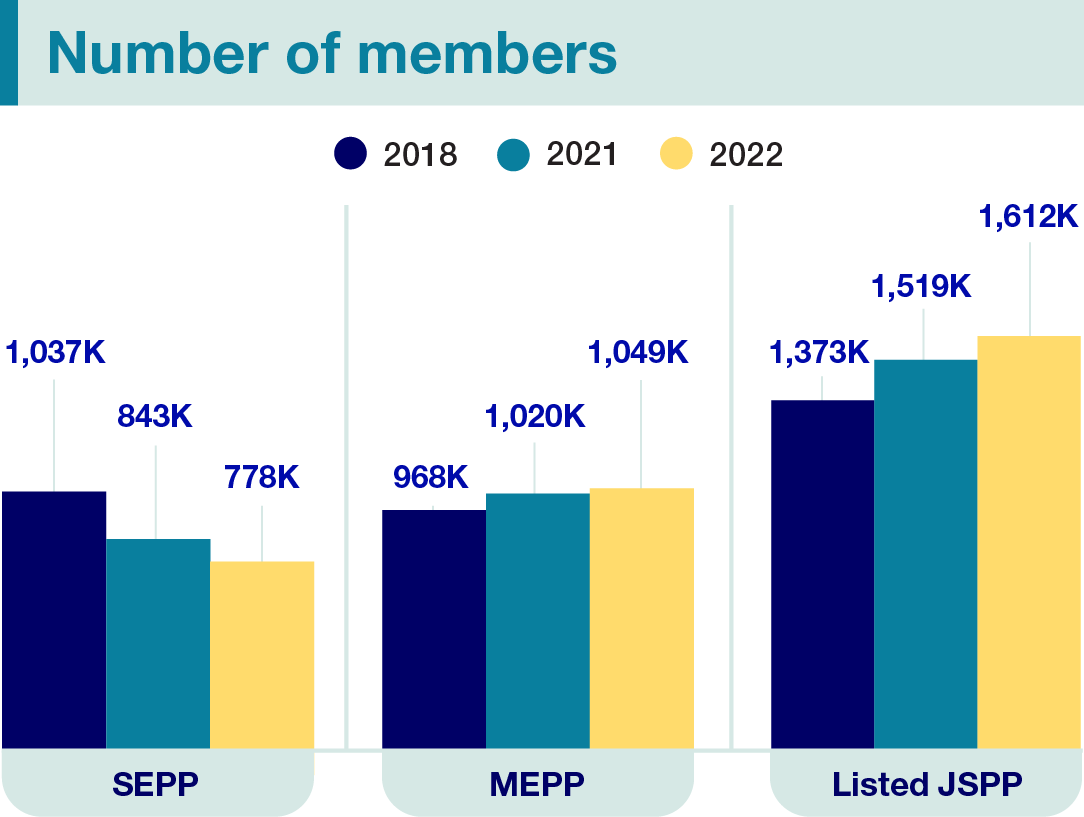

- The total number of SEPPs and MEPPs has decreased by 69 compared to the 2021 Report, mainly due to plan windups and asset transfers, such as plan mergers. On the other hand, the number of listed JSPPs has seen an increase with the establishment of University Pension Plan (UPP). This reflects a continued trend of declining membership in SEPPs and increasing membership in Listed JSPPs and MEPPs.

Subsequent events

Note that a primary purpose of these reports is to provide information that is factual and objective. Consequently, the impact of more recent events is generally not reflected in the analysis shown in this report. However, FSRA does monitor the estimated solvency funded position of pension plans on a quarterly basis which reflects plans’ up-to-date experience – these can be viewed at Estimated Quarterly Solvency Funded Status.

At FSRA, we remain vigilant in monitoring the health of our registered pension plans. It is crucial for pension plan administrators to comprehensively assess the risks faced by their plans and to make necessary adjustments to effectively manage those risks. FSRA is committed to continue engaging with plan sponsors and fiduciaries to collaboratively enhance plan administration and ensure the security of benefit for beneficiaries.