Ontario's Pension Benefits Guarantee Fund (PBGF) protects members and beneficiaries of certain single employer defined benefit pension plans. In the event of an employer's bankruptcy, the PBGF guarantees benefits payable from these plans, subject to specific maximums and specific inclusions.

The fund is governed by the Pension Benefits Act (PBA) and Regulations, and is administered by the CEO of FSRA.

Detailed information about the PBGF can be found below:

- PBGF coverage

- Regulation changes to the PBGF – January, 2019

- PBGF forms 2.1 and 2.2

- Related pension policies

Pension Benefits Guarantee Fund (PBGF) report

Year end March 31, 2023

About the PBGF

The PBGF is a fund that provides protection to Ontario beneficiaries of single employer defined benefit (DB) pension plans in the event of employer bankruptcy where plan assets are not sufficient to make pension payments.

Generally speaking, the PBGF works with the assets in the pension plan to guarantee the first $1,500 of monthly benefits. Ontario is the only jurisdiction in Canada with a fund of this type.

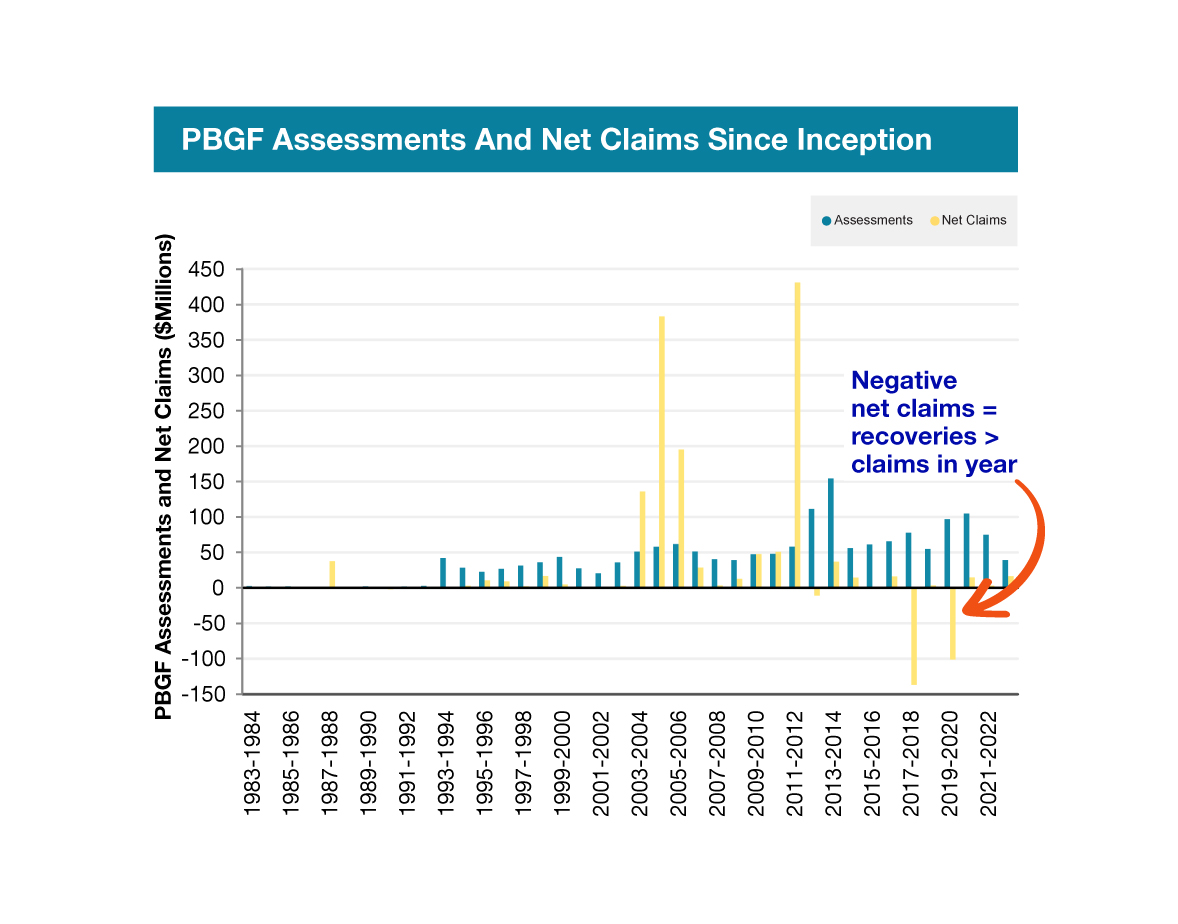

The main source of inflows to the PBGF are assessments paid annually by sponsors of PBGF-eligible plans at a rate set by the Ontario government.[1] Assessments are determined based on the PBGF assessment base (which corresponds to the plan deficits attributable to Ontario members) as well as plan membership.

Those interested to learn more about the PBGF, please visit FSRA’s website.

Market value of PBGF*As at March 31, 2023

| Money Market | $360MM | 30% |

| Government Bonds | $851MM | 70% |

| Total | $1,211MM | 100% |

|---|

Projected plan deficits*As at March 31, 2023

| Solvency Position of Plans | Solvency Surplus | Solvency Deficits | Total PBGF Eligible Plans |

|---|---|---|---|

| No. of plans | 785 [86%] | 129 [14%] | 914 |

| No. of members | 556,567 | 97,546 | 654,113 |

| Assessment Base | - | - | $785MM |

Projected solvency position*As at March 31, 2023

| Median projected solvency ratio | 115% (Median solvency ratio is at an all time high.) |

|---|---|

| Percentage of plans with a solvency ratio: | |

| Greater than 100% | 86% |

| Between 85% and 100% | 12% |

| Below 85% | 2% |

What should I do as a member of a PBGF-Eligible plan?

- Review at your annual pension statement, it shows the funded status of your plan.

- If you are concerned about the solvency of your employer: review FSRA’s bankruptcy guide to understand what happens to your plan when your employer is bankrupt or insolvent.

- If you believe your employer is facing material business or financial challenges, the plan administrator is not acting in the best interest of pension plan beneficiaries, or any other concerns about your pension rights and entitlements, you may contact FSRA at any point.

PBGF analysis trends

A large portion of the PBGF assessment base is concentrated in three sectors – industrials, materials, consumer discretionary. The number of pension plans in these sectors make up about 55% of the total number of PBGF-eligible plans.

FSRA actively monitors employer sponsor health across all sectors and intervenes where there is a heightened concern as to benefit security.

In an average year, the PBGF receives 5 claims and pays out $31 million in claims. Most claims are small relative to the total assets of the PBGF, but there have also been high profile insolvencies in the past that required much greater support from the PBGF. FSRA monitors for potential large claims that may be spread between a small number of plans, especially where multiple plans in one sector could be affected at the same time.

Plans in solvency deficit

| Top 3 Sectors | No. of Plans Solvency [% of all plans in deficit] |

Assessment Base | No. of Members |

|---|---|---|---|

| Materials | 22 [13%] | $341MM | 22,986 |

| Industrials | 44 [20%] | $67MM | 30,607 |

| Consumer Discretionary | 14 [11%] | $30MM | 4,477 |

Stress test

A recent PBGF Stress Test conducted by FSRA indicates the PBGF has sufficient assets to pay potential future claims in the following twelve months even under the most severe historical scenario (the Global Financial Crisis).

FSRA continues to work to better understand the sufficiency of PBGF assets in the longer term.

How is FSRA addressing PBGF risks?

With the support of FSRA, the CEO has taken steps to support the PBGF’s long term sustainability and adequacy that include:

- Implemented a new approach to supervision for PBGF-eligible plans where there may be a heightened concern with respect to benefit security.

- Strengthening PBGF predictive analysis by adopting tools such as deterministic stress testing.

- Developing a stochastic model, which will allow the CEO to look at the impact of a wider range of scenarios on the PBGF.

- Monitoring capital markets, the broader economy, and trends in merger / acquisition activity.

- Reviewing the impact of the Federal Pension Protection Act (Bill C-228) which elevates the priority of claims relating to plan deficits on insolvency. FSRA expects that this may have a material positive impact on PBGF sustainability.

PBGF financial statements

To see FSRA's PBGF financial statements, read the PBGF section of our past annual reports.

Eblasts

- Reminder: Paying Your Pension Benefits Guarantee Fund (PBGF) Assessment Electronically (August 2022)

- Reminder: Pension Benefits Guarantee Fund Assessment Remittance (April 2022)

- Reminder: Pension Benefits Guarantee Fund Exposure Data Collection (April 2022)

- Consultation: Interpretation Guidance on Pension Benefits Guarantee Fund (PBGF) Assessment Deadlines and Calculations (February 2021)

- Reminder: PBGF assessment remittances (February 2021)

- Data collection for Pension Benefits Guarantee Fund (PBGF) exposure (July 2021)

- Pension Benefits Guarantee Fund – e-payment (July 2021)

- Pension Benefits Guarantee Fund e-payment option (April 2021)

[1] See Ontario Regulation 909