Purpose

This Guide provides members and their spouses an overview of valuing and dividing a member’s pension upon marriage breakdown. It is also a helpful resource for plan administrators and other professionals. Sections of this Guide may also apply to common law spouses (see: Common Law Spouses).

For questions not covered in this guide, members and spouses should contact the plan administrator. They may also obtain professional advice. FSRA encourages plan administrators and other professionals with technical questions to review FSRA’s Guidance on Administration of Pension Benefits upon Marriage Breakdown.

Contents

How do I deal with my pension after separation?

What are the steps in the process?

What rules apply to me?

Where do I start?

Step one: apply for a statement of Family Law Value

Step two: plan administrator prepares the statement of Family Law Value

Step three: deciding on dividing the pension

Step four: prepare the settlement instrument and apply for payment of the pension assets

Part A: drafting the settlement instrument

Part B: applying to divide the pension

Step five: plan administrator pays the spouse

Step six: plan administrator adjusts the plan member's remaining share

What if the money is held in a locked-in account?

Roles and responsibilities: who does what?

Can pensions be garnished for support?

Additional resources

Appendix A: summary checklist for plan members

How do I deal with my pension after separation?

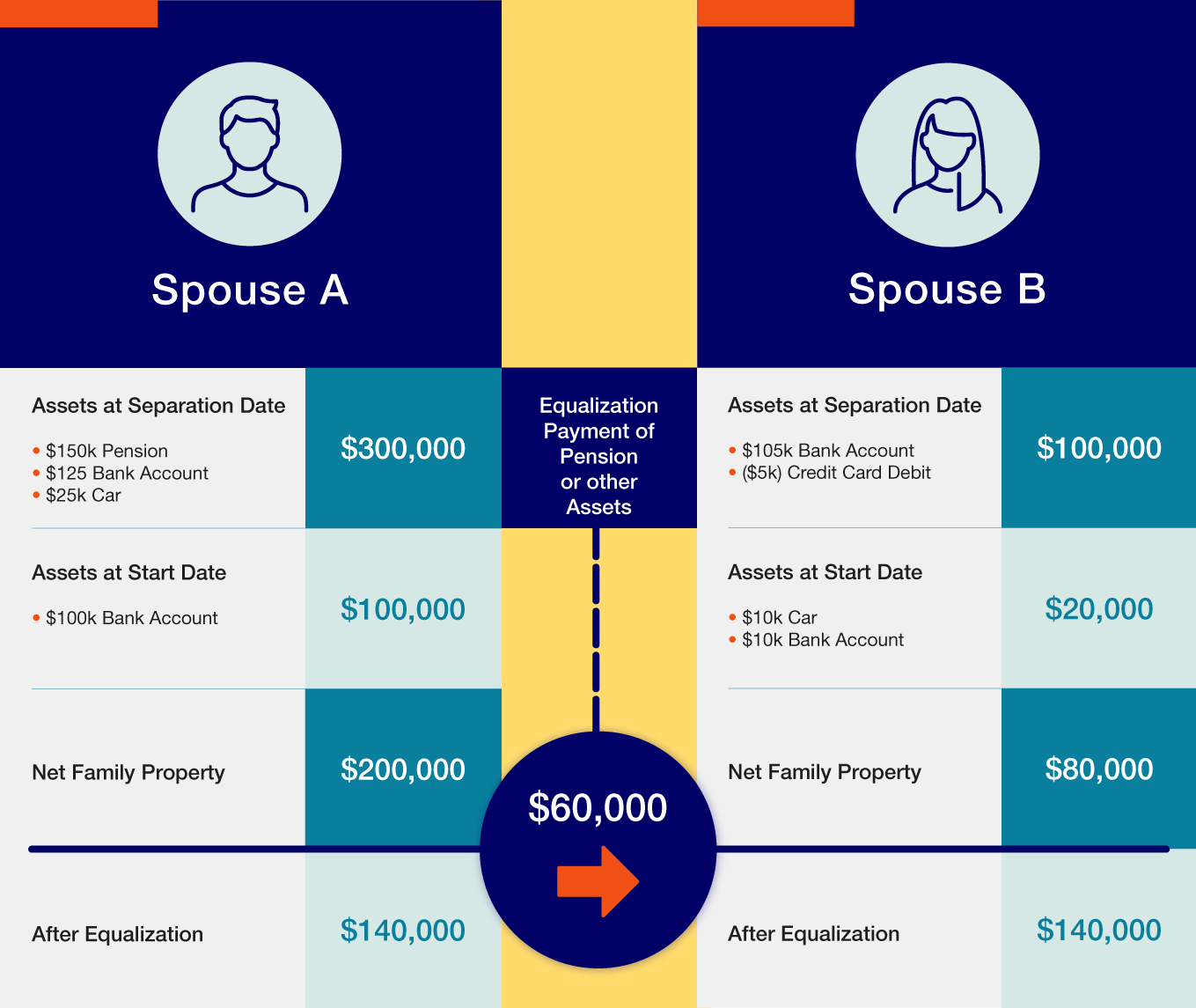

When married couples separate, spouses usually keep the property they own. But they share in any increase in the value of their property during the marriage. This increase is net of debts and is referred to as “Net Family Property”.

The value of a pension is an asset included in the calculation of Net Family Property. Each spouse has their own Net Family Property amount. The law entitles the spouse with the smaller Net Family Property to one half of the difference between their two numbers. The payment from one spouse to the other is an “equalization payment”. Spouses may, but do not have to, use pension assets to make this payment.

Text description of image titled "How do I deal with my pension after separation?"

Explanation: Spouse A has a larger Net Family Property than Spouse B. To equalize, calculate the difference between the Net Family Property of Spouse A ($200,000) and Spouse B ($80,000). This equals $120,000. Spouse A must then make an equalization payment of one half of that difference ($60,000) to satisfy their obligation. Spouse A can settle the equalization payment using the pension, other assets, or a combination thereof. The above tables are illustrative only, and do not take into account tax considerations.

What if I am in a common-law relationship?

The Ontario Family Law Act does not require common-law spouses to equalize their Net Family Property. They may choose to do so under a domestic contract or a family arbitration award. Common-law spouses who are considering dividing their pension assets should seek legal advice.

Common-law status makes a difference as to whether you must equalize Net Family Property. It does not make a difference for many other issues including spousal and child support and pension survivor benefits.

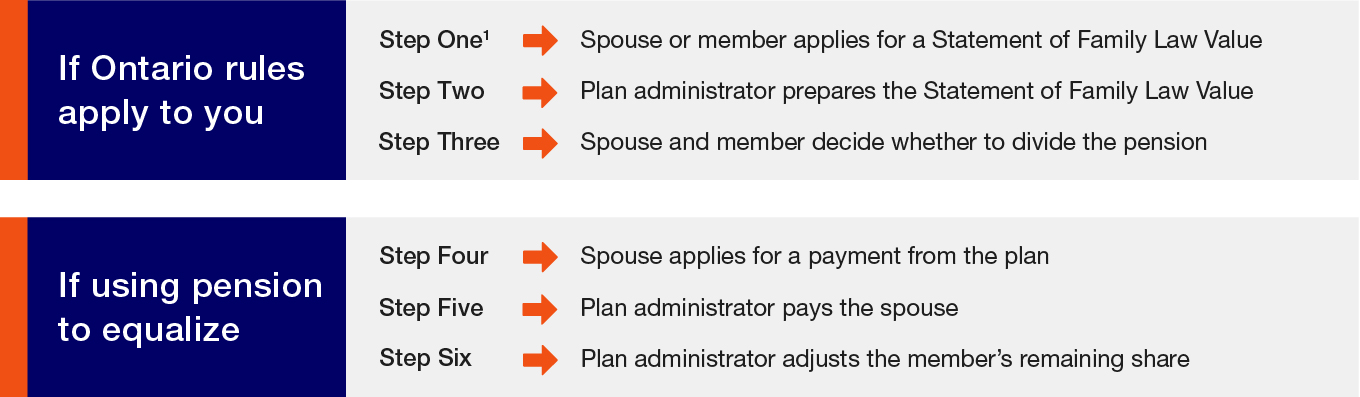

What are the steps in the process?

Pension legislation governs how a pension is valued for inclusion in the Net Family Property calculation. It also governs how to divide any part of a pension used as an equalization payment. The Guide explains this process below.

Steps 1[1] to 3 show how to get the value of a pension. Complete steps 4 to 6 if you and your spouse decide to use the pension to equalize your Net Family Property.

Text description of image titled "What are the steps in the process?"

Family Law Value: The total value of the pension accrued during the relationship. Spouses can, but do not have to, use up to 50% of this value to equalize Net Family Property.

What rules apply to me?

The Ontario family property rules explained in this Guide apply to married spouses. See How do I deal with my pension after separation? This Guide also applies to common-law spouses if they choose to divide pension assets.

The process for valuation and division in this Guide applies if:

- The Ontario Family Law Act applies to your marriage breakdown;

- The last place you and your spouse resided together before separation was in Ontario; and

- The Ontario Pension Benefits Act applies to the pension benefit.

If you are unsure if this Guide applies to you, check with your plan administrator or a lawyer. This Guide does NOT apply if you are an Ontario resident participating in the following plans:

- Federally regulated pension plans (e.g. plans in federally regulated sectors such as aviation, banking, telecommunications or interprovincial transportation when performing work under federal regulation). Contact your plan administrator for assistance. You may also refer to the Office of the Superintendent of Financial Institutions' newsletters. Look under Marriage or Common-Law Partnership Breakdown.

- Federal government pension plans (e.g. Canadian Forces pension). Contact the Government of Canada Pension Centre for assistance.

- Government sponsored retirement benefits (e.g. Canada Pension Plan (CPP)). Contact Service Canada for information about credit-splitting for CPP.

- Any other pension or retirement savings plans not governed by the Ontario Pension Benefits Act (e.g. Supplemental Employee Retirement Plans (SERPs), Retirement Compensation Arrangements (RCAs), Registered Retirement Savings Plans (RRSPs), etc.). Contact the provider of these plans for assistance.

What if I have an agreement signed before January 1, 2012?

On January 1, 2012, the rules dealing with pensions on marriage breakdown changed. This Guide does not apply where:

- the Settlement Instrument was dated before January 1, 2012;

- it required one spouse to make an equalization payment under section 5 of the Ontario Family Law Act.

Instead, the pre-2012 pension valuation and division rules apply. Settlement Instruments include the following:

- court order;

- family arbitration award; and

- domestic contract (e.g. separation agreement).

If the pre-2012 rules apply, the plan administrator cannot make a payment until the earliest of the date when the member:

- terminates employment (or plan membership in the case of multi-employer pension plans);

- reaches the normal retirement date under the pension plan;

- retires; or

- dies.

To request payment from the plan, provide the plan administrator with a certified copy of a Settlement Instrument. Contact the plan administrator or consult a lawyer with any questions about the pre-2012 rules.

Certified Copy: A certified copy has an endorsement that it is a true and complete copy of the original. The person who signs the endorsement must compare the original document with the copy and confirm that they are the same. Contact the plan administrator to find out whose certification they can accept.

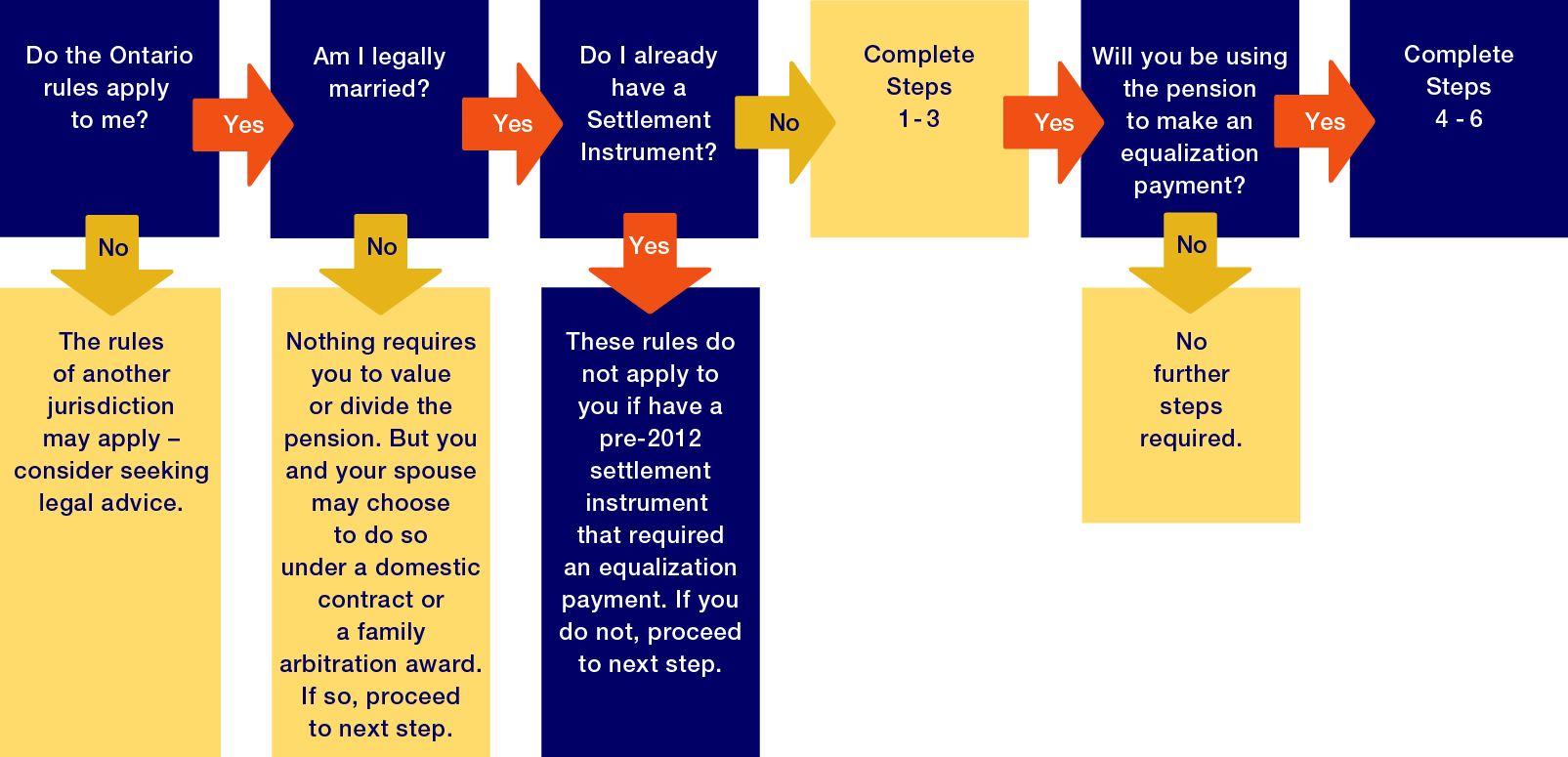

Where do I start?

Text description of image titled "where do I start?"

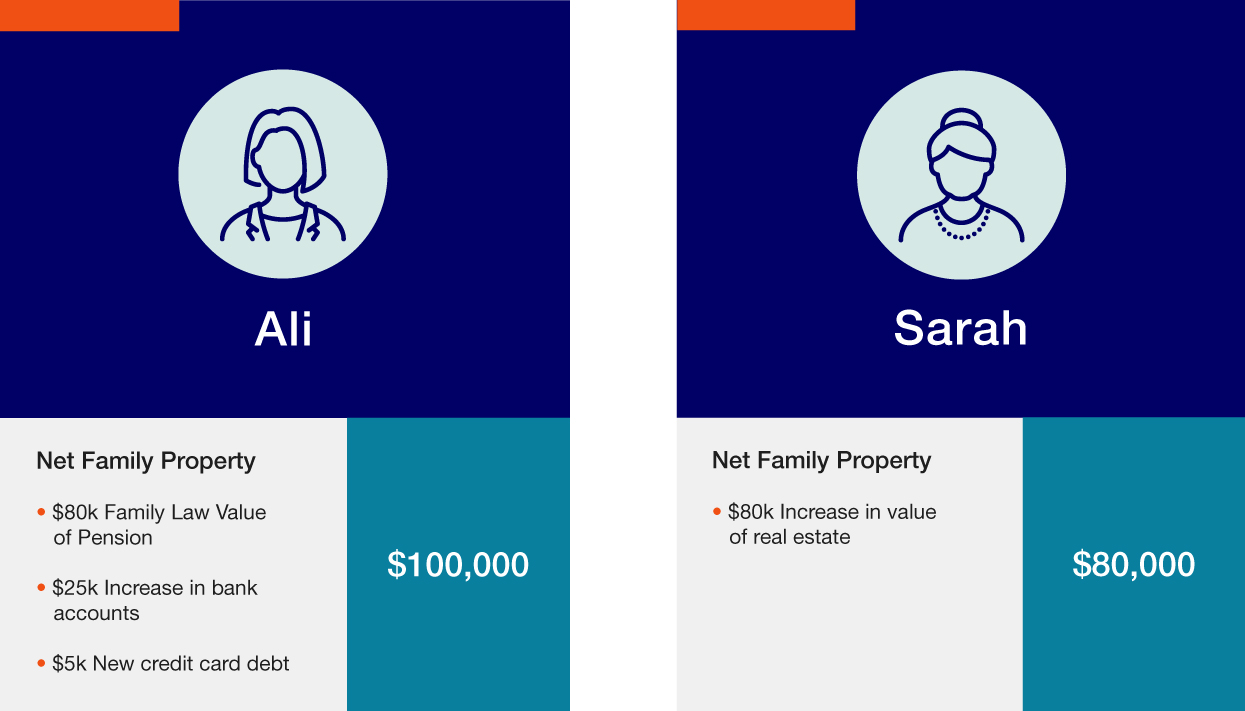

Example One: Ali and Sarah are divorcing. Under the Family Law Act they are both required to disclose their Net Family Property. This requires that they both determine the increase to the value of their property during their relationship.

Ali has a defined benefit pension that he accrued during the spousal relationship. Ali therefore must determine the value of his pension that he should include in his Net Family Property. Ali first determines whether the rules in this Guide apply to him (see: What Rules Apply to Me?). Ali meets the three criteria set out in this Guide, so the rules do apply to him. Ali and Sarah must complete steps 1-3 to value Ali’s pension (even if they do not intend to divide it).

Either Ali or Sarah completes Step One by sending an Application for Family Law Value to the plan administrator. The administrator sends Ali and Sarah a copy of a Statement of Family Law Value (Step Two). The statement shows that Ali’s Family Law Value is $80,000 (reflecting the increase to his pension during the relationship). It also shows the maximum amount he can use to satisfy an equalization payment, which is $40,000 (half). Ali then includes this Family Law Value in his Net Family Property.

Text description for image titled "Ali and Sarah"

Explanation: Ali must make an equalization payment of one half of the difference between their Net Family Property. The difference between their Net Family Property is $20,000 ($100,000 - $80,000 = $20,000), therefore Ali owes Sarah $10,000. Since this $10,000 obligation is below $40,000, which is the maximum amount available for equalization, Ali could satisfy the full $10,000 obligation using his pension. Note that this example is for illustrative purposes and does not account for any necessary tax adjustment.

After adding up assets and debts, Ali has a higher Net Family Property than Sarah, by $20,000 (see above). Ali owes Sarah one half of the difference between their Net Family Properties. This is in the form of a $10,000 dollar equalization payment. However, instead of dividing the pension, Ali and Sarah agree that Ali will make the payment from a bank account. The pension is not divided so Ali and Sarah do not need to complete any further steps.

Example Two: Using the same figures as above. Ali and Sarah may want to use the pension to satisfy the $10,000 equalization payment. If so, they will specify in their Settlement Instrument that the pension is to be divided. They will then move on to complete Steps 4-6.

In this example, Ali has not yet begun to receive his pension on the valuation date. This means Sarah must receive the amount as a lump sum transfer. Sarah must submit a completed Spouse’s Application for Transfer of a Lump Sum to the plan administrator (Step Four). The plan administrator has 60 days after receiving a correctly completed application to transfer the amount (Step Five).

After the plan administrator makes the payment, it will adjust Ali’s pension benefit (Step Six). Ali is an active plan member with a defined benefit in a single employer plan. Therefore, the administrator will delay calculating the reduction until Ali retires or terminates employment. Ali should keep in mind the amount reported on his annual pension statement may not reflect any future adjustment.

What if the money is held in a locked-in account?

This Guide does not apply if the member transfers the pension assets to a locked-in account before separation.

In these cases, the financial institution will be responsible for dealing with any division of the assets. It cannot pay more than 50% of pension assets in the locked-in account as of the Family Law Valuation Date.

FSRA does not provide any forms for division of money held in locked-in accounts. Check with the financial institution administering the locked-in account. They may have their own forms for this purpose.

Locked-in Account: Locked-in accounts are accounts designed to hold “locked-in” pension assets. These include locked-in retirement accounts (LIRAs) or life income funds (LIFs). The “locked-in” element refers to restrictions on withdrawals. These restrictions help ensure the account holder uses the assets in retirement (and not before).

What options are available to the spouse if the pension assets are in a LIF or a LIRA?

The member can use part of the LIF or LIRA for the equalization payment. The spouse may transfer this amount to their own LIRA or a LIF. The spouse may also purchase a life annuity from an insurance company. In certain cases, a spouse may transfer their share to another pension plan. The spouse may transfer their share to another plan if it is registered under the pension legislation of a Canadian jurisdiction. They may also transfer it to a plan provided by a government in Canada. In either case, the administrator of the other plan must agree to accept the transfer.

When can a spouse start receiving payments of the transferred pension assets?

The spouse can start receiving payment at age 55. The spouse will need to purchase a LIF or a life annuity to start receiving payments. The spouse cannot receive money directly from a LIRA.

What if the pension assets were still in the pension plan on the family law valuation date?

A plan member might transfer their entitlement out of the pension plan to a locked-in account. Sometimes this occurs after the Family Law Valuation Date but before requesting a valuation. In these cases, the assets were held by the pension plan on the Family Law Valuation Date.

Where this happens, the valuation rules in this Guide apply. You must get a valuation of the pension. The plan terms in effect on the Family Law Valuation Date apply.

The plan member (locked-in account owner) may ask their former pension plan administrator if they can provide the valuation. If their former administrator does not provide this service, other professionals may have to perform the valuation. For instance, an independent actuary could perform the valuation for defined benefit pension assets.

Roles and responsibilities: who does what?

Plan administrator

The plan administrator is generally responsible for the following:

- Valuing the pension benefit;

- Making pension payments or transferring lump sum amounts; and

- Adjusting the remaining benefits when the process is complete.

The administrator, however, is not responsible for providing legal advice concerning negotiation matters.

How can I contact the plan administrator?

You can find the plan administrator’s contact information at FSRA Pension Plan Information Access. To use this site, you need to know one of the following:

- the name of the employer, union or professional association sponsoring the pension plan;

- the plan registration number; or

- the plan name.

The name or registration number is usually in pension plan brochures / booklets or on the plan’s website. A member’s pension statements would also have this information.

Members and spouses

Under the Family Law Act, members are responsible for valuing their property. However, both the member and the spouse can apply for a valuation of the member’s pension. The member’s spouse is responsible for completing any application to divide the pension.

FSRA’s forms are available on the FSRA Website. You may want to ask the plan administrator if it has pre-populated FSRA’s family law forms with plan information.

FSRA encourages members and spouses to review this Guide in its entirety. This will help them understand the basic process of valuation and division. They are responsible for ensuring that the information provided to the plan administrator is accurate and complete. They are also responsible for responding to any valid requests for documentation or other information requested by their administrator. Responding promptly helps to ensure a smooth and orderly process.

The rules surrounding valuation and division of pensions are complex. Members and their spouses may need the assistance of lawyer of other professionals. This Guide provides a basic overview of the most common valuation and division scenarios. However, in many cases the member and spouse’s situation may be more complicated. In these types of cases, particularly, they may want to seek legal advice from a family law lawyer.

Financial Services Regulatory Authority of Ontario (FSRA)

FSRA is responsible for the administration and enforcement of the Pension Benefits Act (PBA) and its regulations. FSRA does not administer the Family Law Act or provide legal advice.

1. Can FSRA review my complaint relating to family law matters?

The nature of an inquiry or complaint determines whether to contact the plan administrator or FSRA for assistance. The plan administrator maintains all data on a plan member’s entitlements under the pension plan. FSRA does not have personal data about individual members. Plan administrators should answer any questions or concerns about entitlements, or provisions of the plan.

You may contact FSRA for assistance if:

- You are unable to resolve an issue with the plan administrator, or

- You have concerns about contacting the administrator directly.

What if I disagree with FSRA’s conclusion of my complaint?

You may request an Order which you can then appeal. The Financial Services Tribunal (FST) would hear this appeal. You may appeal the FST’s decision to the Ontario Divisional Court.

2. May I go directly to the Court for my family law issue instead of going through FSRA?

It depends on the issue. Matters concerning pension legislation interpretation should go through FSRA. If you are unsure, contact your lawyer or FSRA for assistance.

FSRA requests to be informed of any matter before a court involving an interpretation of the Pension Benefits Act or its regulations. This allows FSRA to decide whether to involve itself in the proceeding.

How can I reach FSRA?

You may contact FSRA by phone or e-mail.

By phone: (416) 250-7250 (toll-free: 1-800-668-0128, ext. 7250)

By email: [email protected]

Can pensions be garnished for support?

Pension payments can be garnished or seized for child support or spousal support if:

- the plan administrator is currently paying a pension to the member;

- the amount of support does not exceed 50% of each pension instalment; and

- the order is enforceable in Ontario.

These types of orders are different from equalization payments. Therefore, it may be possible that more than 50% of a member’s accrued pension can be paid out of the plan.

You may want to contact your lawyer and the Family Responsibility Office (FRO) for matters concerning support payments.

Additional resources

FSRA’s Website:

- FSRA’s Family Law Forms

Other Websites:

- The Pension Benefits Act, Ontario Regulation 287/11 (Family Law Matters) and Ontario Family Law Act are available on e-Laws.

- The Ministry of the Attorney General provides information on family court, division of property and other legal issues.

- Community Legal Education Ontario (CLEO) is Ontario's Centre for Public Legal Education, which publishes information about family law matters.

- The Law Society of Ontario provides services to help you choose the right legal professional.

- Legal Aid Ontario provides a Free Family Law Information Program for anyone about to enter the family justice system. You can find eligibility for legal aid services here.

- For questions related to support payments, contact the Family Responsibility Office (FRO).

- For tax related questions, contact the Canada Revenue Agency (CRA).

- To find an actuary, contact the Canadian Institute of Actuaries (CIA). On the “Hire an Actuary Page”, choose “Marriage Breakdown” for “Specialties” and “Ontario” for “Location of Practice”.

Appendix A: summary checklist for plan members

This Appendix is not legal advice.

1. Valuing a pension

- You need to value your pension because it is property. There are different rules for married and common law spouses.

- There is one standard form to request the value of any type of pension registered in Ontario. That form is Application for Family Law Value.

- Either you or your married spouse can ask the administrator of the pension plan to value the pension. Your common-law spouse cannot ask the administrator for this information.

Application Checklist:

- Do you have your spouse’s contact information? The administrator must provide a copy of the valuation to you and your spouse at the same time.

- Do you have a document that verifies when your relationship began?

- For example, a marriage certificate or court order?

- If not, you and your spouse can sign a Joint Declaration of Period of Spousal Relationship. See Appendix A of the Application for Family Law Value.

- Do you have a document that states your separation date?

- Separation agreement, family arbitration award or court order?

- If not, you and your spouse can sign the Joint Declaration of Period of Spousal Relationship. See Appendix A of the Application for Family Law Value.

- If you and your spouse cannot agree on the separation date, you can request two family law values by signing Request for Two Family Law Values. See Appendix B of the Application for Family Law Value.

- Proof of your and your spouse’s date of birth.

- Did you include the fee? Ask the plan administrator if they charge a fee.

- Send the completed Application for Family Law Value to the administrator of the pension plan, not to FSRA.

- If you have more than one pension, complete a separate form for each pension plan.

Financial Statement:

- Include the value (before tax) of the pension on your Financial Statement. This should be in Part 7(c): Bank Accounts, Savings, Securities and Pensions.

- List your future tax liability for the pension as a debt in Part 8 of your Financial Statement. You may need an actuary to calculate your future tax rate.

2. Dividing a pension

- If you owe your spouse an equalization payment, you can agree to divide your pension to satisfy that debt. This could be all or a part of that debt.

- You will need to have your pension valued before you can divide it.

- There are two steps for pension division:

- A separation agreement, family arbitration award or court order authorizes the pension payment; and

- Your spouse must complete an application form to divide the pension.

- There are different payment options and different forms to complete. Payment options and forms depend on whether or not you were receiving pension payments when you separated.

- If you separated before retirement, the plan administrator can pay a lump sum to your spouse’s locked-in account.

- If you separated after retirement, the plan administrator can pay some of your monthly pension payments directly to your spouse, after deducting tax.

a. Separation Before Retirement

What to consider when drafting the Settlement Instrument:

- Include the separation date. Make sure that it is the same date you used on the Application for Family Law Value.

- Name the pension plan. Specify that the payment is to be direct from this plan to the spouse.

- State the amount the plan will pay to the spouse. Express this as a lump sum dollar amount or as a percentage of the value. It cannot be both.

- Maximum: Make sure that this amount is not more than 50% of the Family Law Value. The pension valuation form states this limit.

- Interest. Consider whether you will be paying interest on the lump sum. The administrator calculates interest on the lump sum from your separation date to the payment date. Be careful to consider the rules on when interest applies. Different rules apply when the payment is as a dollar amount or percentage.

- Tax: Note that the lump sum payment will be a gross, before tax, amount.

- Note: If you retire before the plan transfers the lump sum to your spouse, contact your administrator. Your retirement may decrease the amount available to pay to your spouse.

Lump Sum Transfer Application Checklist:

- Your spouse must complete the Spouse’s Application for Transfer of a Lump Sum.

- The application should include a copy of the document authorizing the payment. This could be a:

- separation agreement;

- family arbitration award; or

- court order.

- Locking In: Keep in mind that the lump sum will not be cash. The pension valuation form lists options available to the spouse.

- If the plan will transfer the payment to a financial institution, your spouse must set up a receiving account. These accounts include a locked-in retirement account (LIRA) or a life income fund (LIF).

- Send the completed application to the plan administrator.

b. Separation After Retirement

What to Consider When Drafting the Settlement Instrument:

- Include your separation date. Make sure that it is the same date you used on the Application for Family Law Value.

- Include the name of the pension plan.

- State the amount of each pension payment you will pay to your spouse. You may state the amount as either as a specified dollar or as a percentage of each pension payment. For example, $500 per month or 25% of each pension instalment. Make sure that this amount is not more than 50% of each pension instalment. Your pension valuation form includes this limit.

- If the payment is a dollar amount, consider whether to adjust for indexation, if applicable.

- You may need an actuary to calculate the percentage. For example, assume your equalization debt is $75,000 and your monthly pension payment is $2,500. An actuary would be able to calculate the percentage of each pension payment that should add up to $75,000.

- Payment Start and End Dates. The plan administrator will calculate payments as though you started dividing your pension the month after separation. If time has passed between your separation date and the first pension division payment, there may be arrears. Payments will cease when the plan member dies, regardless of whether you have fully paid the equalization debt.

- Death of Spouse. Clearly state what happens if the spouse dies before the retired member. Will the pension payments continue to the spouse’s estate or revert to the retired member?

- Tax: Note the plan will deduct tax from the spouse’s portion of the pension payments.

Pension Division Application Checklist:

- Your spouse must complete either:

- Spouse’s Application to Divide a Retired Member’s Pension; or

- Spouse’s Application to Divide a Retired Member’s Pension – Special (Combined Option).

The Statement of Family Law Value will indicate which form your spouse can complete.

- The pension division application should include a copy of the document that authorized the payment. This could be a:

- separation agreement;

- family arbitration award; or

- court order.

- Send this form to the plan administrator.

Contact the administrator for any other practical information on how to effect the division (e.g. use of direct deposit).

Image descriptions

[1] In a common-law relationship, only the member may apply for a Statement of Family Law Value.