Pension update - February 29, 2024

In this Pension eBlast

Welcome message & 2024 outlook

New processes, updates and reminders

- Check it out – It’s a first!! Ontario pension sector overview and activities report

- Want to learn about FSRA’s new examination process? Stay tuned

- Changing fees to better reflect regulatory activities

- Know how to deal with your pension following marriage breakdown

- PBGF Assessment Guidance not in effect

- A huge thank you for participating in Pension Awareness Day

- Looking forward to seeing you at FSRA Exchange

- Feature: Meet FSRA’s pension trailblazers

- What you need to know if considering a contribution holiday

- Looking for people to help make a difference

Welcome message & 2024 outlook

Our journey in 2023 has been marked by resilience and adaptability. There’s no crystal ball for what we can expect in 2024. What we do know, is that defined benefit pension plans have been in their best financial positions in decades. With the possibility of interest rates dropping in 2024, the financial health of each pension plan could be impacted differently. It is important for plan sponsors to proactively use the tools available to them to measure and stress test the impacts that changing interest rates and other financial and non-financial factors could have on their plans. As the dynamics of the pension landscape continue to evolve, our commitment to promote good administration of pension plans, and to protect and safeguard the pension benefits and rights of pension plan beneficiaries remains paramount.

We look forward to the opportunity to continue our dialogues and consultations with the sector, as these ongoing conversations are incredibly valuable to us as they allow us to gain deeper insights, collaborate on innovative solutions and address emerging challenges together. We truly value the input and expertise of our stakeholders, and we are committed to fostering strong relationships that drive positive change within the sector. Let us embrace this year’s opportunities and challenges with renewed optimism and enthusiasm. Wishing you a fulfilling 2024!

- Andrew Fung, Acting Executive Vice President, Pensions

FSRA reports

Q4 2023 Solvency Report

Defined pension plans remain strong despite global uncertainty

FSRA released its Q4 2023 Solvency Report revealing record-breaking median solvency ratios reaching an all-time high of 119%, with the average net investment returns soaring to an impressive 9.9%. It's reassuring to observe the resilience of defined benefit pension plans amid global economic uncertainty. FSRA advises plan sponsors and administrators to stay vigilant and prioritize robust strategic planning.

New processes, updates and reminders

Check it out – It’s a first!! Ontario pension sector overview and activities report

In response to pensions stakeholder feedback, FSRA is pleased to present the first annual Ontario Pension Sector Overview and Activities Report for pension plans regulated by FSRA. The report includes:

- Annual Information Return (AIR) data reported to FSRA as of December 31, 2023

- Pension Operational Activities

- Summary Administrative Monetary Penalties

- Missing Members information

Want to learn about FSRA’s new examination process? Stay tuned

As an introduction to the revamped examination program, FSRA’s Pensions Team will be conducting a webinar to provide pension stakeholders with an overview of the new process. The webinar will highlight the steps within the examination program, as well as a high-level look at the primary areas of focus. It will provide plan administrators with a sense of what to expect when participating in an examination, and how to prepare for this engagement with FSRA. The webinar is scheduled for April, with date and time to be shared at a later date.

Changing fees to better reflect regulatory activities

This is a reminder that FSRA’s new Assessments and Fees Rule is now effective, and some fees are increasing. For instance, for the fiscal year 2024-25, the minimum fee for smaller plans will increase to $1,000 from $750.

The minimum fee has been increased to adequately reflect regulatory activities for smaller plans (under 92 members, which is an increase from 79 members in the previous Fee Rule).

FSRA’s invoices will be released by April 2024. For more information, please review Rule 2022 – 001 Assessments and Fees (Fee Rule).

Know how to deal with your pension following marriage breakdown

It has been over a decade since the Pension Benefits Act was amended to provide for the immediate valuation and division of pension benefits on marriage breakdown, and the introduction of family law forms. Although the Application for Family Law Value indicates that the completed forms should be sent to the plan administrator, FSRA still receives several family law value applications from members and/or their spouses. FSRA also receives questions related to the application, such as:

- Where should the completed family law forms be sent?

- Is there a fee for the valuation, and if so, how much?

- Who can certify the required proof documents?

- Are electronic copies of the forms acceptable?

As the answers to such questions vary from plan to plan, in many instances, FSRA cannot assist individuals and must refer them to the plan administrator. To avoid unnecessary delays during this already difficult time for separating spouses, administrators are encouraged to clearly communicate where answers to such forms-related questions can be found.

To assist all parties involved in the marriage breakdown process, FSRA’s Pensions and marriage breakdown webpage includes resources concerning family law matters.

PBGF Assessment Guidance not in effect

FSRA would like to clarify that the Proposed Pension Benefits Guarantee Fund (PBGF) Assessment Calculations and Deadlines Guidance that was posted for public consultation on February 14th, 2022, is not in effect. Stakeholders should not rely on the Interpretations set out therein. FSRA had communicated this position previously, and we would like to reiterate this given recent enquiries from stakeholders. FSRA will further review in the future to reconsider the need, if any, for any Guidance as it relates to PBGF assessment rules.

A huge thank you for participating in Pension Awareness Day

Pension Awareness Day 2024 was a roaring success and much of that had to do with your participation. Your dedication, enthusiasm, and engagement helped make the event truly unforgettable.

From spreading awareness about the importance of retirement planning, to sharing valuable insights and resources, your efforts made a profound impact on individuals' understanding of pension plans and saving for the future. Whether you shared information on social media or simply took the time to educate yourself and others about the significance of pension awareness, your contributions did not go unnoticed.

Thanks to your support, our publications and social posts engagement surpassed our target benchmark by approximately 130%. Our EVP was able to conduct a total of 17 interviews, amplifying our message and reaching millions of individuals. This has played a significant role in inspiring Ontarians to take proactive steps toward securing their financial futures. Your commitment to this cause is truly commendable, and we are immensely grateful for your ongoing support.

As we reflect on the success of Pension Awareness Day 2024, we extend our appreciation to all the plans and providers who partnered with us for your dedication and enthusiasm. Together, we are making a real difference in promoting financial literacy and ensuring a brighter tomorrow for all.

We look forward to continuing this journey together and making even greater strides in the future!

Looking forward to seeing you at FSRA Exchange

We are thrilled to announce that FSRA Exchange has reached full capacity and is officially sold out!

This speaks volumes about the excitement and anticipation surrounding this event. We look forward to what promises to be an unforgettable gathering of industry leaders, innovators, and experts.

The day will be filled with engaging discussions starting with a fireside chat with CEO Mark White, with insights into the transformational impacts of climate change on financial services and regulation, and an expert AI Panel on AI in financial services.

In the afternoon, participants will learn about risk management and principles-based regulation (PBR), in the Pensions sector, featuring success stories and insights from FSRA’s supervisory approach for defined benefit single employer pension plans, benchmarking of multi-employer pension plans, the revamped examinations process of single and multi-employer defined benefit and defined contribution pension plans and engagement with large public sector pension plans.

Don't miss this opportunity to explore ways to drive positive change in the future of financial services regulation in Ontario.

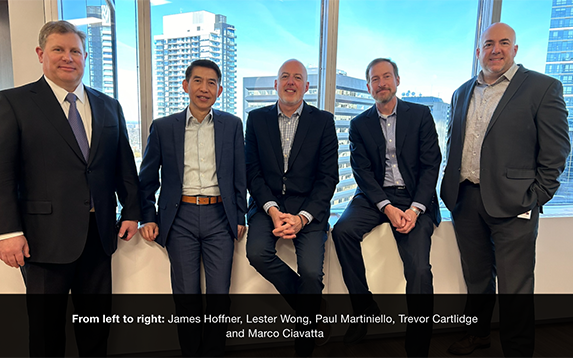

Feature: Meet FSRA’s pension trailblazers

This quarter, we are pleased to spotlight key individuals within the Pensions team, each playing a crucial role in ensuring the efficacy and integrity of our operations.

Paul Martiniello, our Director of Prudential Supervision, single-employer pension plans (SEPPs) and multi-employer pension plans (MEPPs), along with Marco Ciavatta, Sr. Manager of Relationship Management, take the lead in engaging directly with plan administrators. Their accountability extends to providing exemplary leadership in the delivery of relationship management and initiatives that align with our overarching prudential

supervision strategies for single and multi-employer pensions regulated by FSRA. Some of the key initiatives executed by this team include the implementation of the Supervisory Approach for actively monitored SEPPs, a multi-year benchmarking leading practices of all MEPPs in Ontario, and the transition of the Pensions examination process to a risk and principles-based approach.

James Hoffner, as our Chief Prudential Supervision Officer, LPSPPs, spearheads a dynamic team charged with FSRA’s supervision of the large public sector pension plans (LPSPPs) in Ontario. His team’s responsibilities include engaging, developing and implementing FSRA’s supervisory practices for these plans, with particular emphasis on their governance and risk management practices, including with respect to their management of liquidity and other investment risks as well as operational risks. The LPSPPs manage over 60% of the pension assets in Ontario and represent close to 40% of pension members in Ontario. They include some of the largest pension plans in Canada and are considered leaders internationally in their investment and governance activities.

Lester Wong, our Chief Actuary, along with Trevor Cartlidge, Deputy Chief Actuary, lead the Actuarial Team. This dedicated group produces quarterly and annual pension reports and conducts in-depth analyses of plan funding risks. Their oversight helps to ensure all plans submit actuarial documents that align with the Pension Benefits Act’s (PBA) requirements and FSRA's objectives. Beyond their crucial roles, the Actuarial Team, under Lester’s guidance, actively manages, negotiates, and resolves significant, complex, and sensitive technical and compliance matters with stakeholders. Their focus on actuarial aspects encourages pension plan stakeholders to adopt best practices, fostering a culture of excellence and alignment with FSRA's vision.

What you need to know if considering a contribution holiday

Plan administrators are required to advise the pension fund trustees of the expected contributions to the pension plan at the beginning of each plan fiscal year using Form 7. For plans that are considering a contribution holiday, here is a quick reminder of the regulatory requirements:

- A prescribed cost certificate must be filed within the first 90 days of the fiscal year to support a contribution holiday.

- The cost certificate should be prepared in accordance with section 7.1 of Regulation 909 (Regulation) to demonstrate that the plan has sufficient available actuarial surplus (AAS), as prescribed, to meet the funding requirements of the current fiscal year.

- The AAS must be reassessed as of the first day of the current fiscal year, but cannot be greater than the AAS disclosed in the last filed actuarial valuation report, adjusted to reflect any amounts funded from AAS since the date of the last valuation.

Please note the following:

- A plan with an “excess surplus” as described in paragraph 147.2(2)(d) of the Income Tax Act (Canada) is not exempted from filing the above cost certificate within the prescribed timeline. Furthermore, a contribution holiday cannot be taken based solely on the existence of an excess surplus if the other requirements under the Regulation have not been met.

- Section 8 of the Regulation requires that notice of a reduction of contributions be given to all plan beneficiaries and other prescribed parties within the first six months of the plan fiscal year.

If you have further questions, please contact us at [email protected].

Looking for people to help make a difference

We are seeking new members for our four Standing Technical Advisory Committees. These committees advise FSRA on proposed pension regulatory guidance, FSRA initiatives, and identify issues arising out of existing pension legislation. Committee members will be selected based on their pension knowledge, areas of expertise and level of experience, ensuring that each committee has diverse perspectives and representation from unions, employers, plan administrators, plan members and retirees. If you are interested in joining a committee, please send your biography or CV to Jennifer Mullen. Please indicate which committee you would like to join. Terms for new members may begin throughout the year – selected individuals will be notified of their appointment term.

Quick links