Information

No. PE0641INF Active

Contents

Purpose of this guide

Leading practices

Start with a strategy

Identify your audience (member segmentation)

Use plain and consistent language

Structuring (tiering) information

Just-in-time information & life events

Use multiple ways of communicating

Traditional tactics

Digital communications

Resources for members on Financial Planning / Retirement Planning

Workplace champions and other audiences

Evaluate your communications

Conclusions

Effective date and future review

About this Guidance

Purpose of this guide

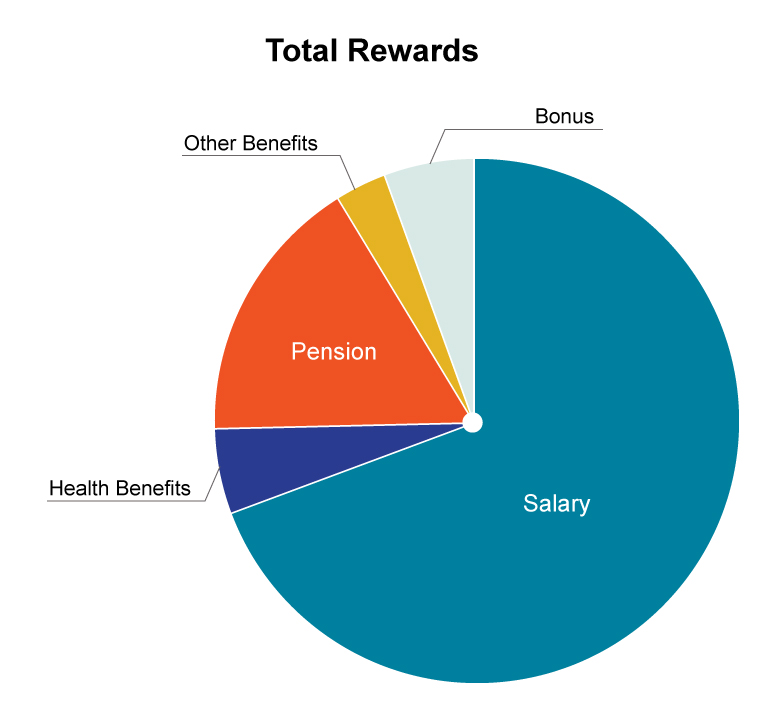

A pension plan is an important part of an employee’s total compensation or total rewards package at their workplace. In some total rewards plans, a pension can be worth tens of thousands of dollars per year!

It is well-documented that many employees:

- Do not join their pension plan at work as soon as they’re eligible. Would an employee choose not to enrol in a health insurance program at work? No. Employees know their health insurance plan is valuable and will act in a way to protect themselves and their families. Why are retirement savings and pension plans different?

- Do not take advantage of employer matching contributions in a defined contribution plan. If I give you $1 for every $1 that you contribute, why would you pass on this opportunity? I am doubling your money and helping you save for tomorrow. How can we do better as a sector? How can more employees maximize the value of the pension plan?

- Delay starting to build their retirement savings to later. That very decision made early in life can have an enormous impact on their financial future. Starting early is a decision that your employees’ future selves will thank you for.

You are an employer offering, or a union that has negotiated, this valuable total rewards package as part of your employment value proposition. Let’s make sure you and your employees get the most out of your plan! Don’t you want your employees, members and prospective employees to know how much you care about them today and in the future? Let’s make sure your plan is well understood and appreciated so your plan results in a multiplier effect in terms employee engagement, talent attraction and retention.

This Information Guide presents ways pension plan sponsors and administrators, including third-party administrators, have found to be successful in engaging with their pension plan members, so they can get the most value out of their plan. The practices and tactics presented in this Guide draw from real programs and initiatives implemented in Ontario.We have also looked to international best practices.

FSRA recognizes the tactics in this Guide go above minimum requirements of the Pension Benefits Act and describes FSRA’s views without creating new compliance obligations. We encourage sponsors and administrators to reflect on the practices and tactics and adopt them if they make sense in the context of your membership and workplace.

FSRA also appreciates that while this Guide is primarily focused on defined benefit pension plans many of the tactics may also work for target benefit and defined contribution pension plans.

Leading practices

Effective communication can increase engagement in pension plans. Many studies have shown that most pension plan members lack either the interest, knowledge, or skills to make choices about their plan. That’s why retirement literacy and financial literacy should also be considered when communicating with your plan members.

For example, a recent research study[1] found that many Ontarians struggle with literacy and numeracy. FSRA’s view is that effective communication is important and the practices in this Guide are effective. Administrators and sponsors should incorporate them as appropriate for their plans and membership.

Start with a strategy

An engagement strategy clarifies the objectives and can be created by answering the following questions:

- What is your value proposition? How does your pension plan fit in your employment value proposition? (e.g., what do you want your plan to represent to your members? how do want your plan to be perceived? what tone, voice and sentiment do you want to convey to your members?)

- Who is the target audience? What is the desired outcome with them?

- What are you engaging on? What are your key messages?

- Is there a call to action?

- How will you engage (on what channels / platforms)?

- When will you engage? (e.g., when changes to the plan text / amendments are made; when tax deadlines are approaching; when cost of living adjustments (COLA) are made)

- Why are you engaging?

- Who will speak on behalf of the plan? On what subject(s)?

- How will you evaluate the success of your strategy? (e.g., fewer calls to your call centre for clarification; social media metrics; attendance at in-person sessions; increased active participation in optional plans; fewer default elections with respect to beneficiaries, contributions and investments)

Identify your audience (member segmentation)

A first step in creating effective plan member engagement is to identify your audience. A single message may not be relevant to all plan members. If you segment your audience, you can tailor messages, language and channel of communication to specific groups, making them more relevant.

Some member segments to consider are:

- active versus retired plan members

- new members versus long-term plan members

- members approaching retirement

- different age groups (e.g., members under 35; 36-49; and over 50 have different needs, habits)

- members with default beneficiaries, contribution levels and/or investment options

- new employees who haven’t joined the plan

- type of employee (management / non-management, or salary / hourly)

- group characteristics (e.g., culture, language, religion)

- level of financial literacy

How you can put this into practice

- Take a personalized communications approach, such as using someone’s name on generic communications, or prepopulating personal financial information. This has significant ‘nudging’ effects.

- Send a personalized email that includes orientation materials such as videos or a plain language member handbook. New plan members might be more engaged by receiving personalized information early in their plan member journey. Their older selves will thank you. This can become a key component of your employee engagement strategy now and in the future.

- Example: OMERS interviews members to create inspiring videos that are screened at annual member meetings and internal all-staff meetings.

- Online calculators and decision-making tools that use information in the member record to produce personalized estimates or information based on the member’s circumstances

- Example: After signing into the portal, Healthcare of Ontario Pension Plan members can see a dollar amount with a single click. This personalized estimate is also mailed to all eligible members.

- Example: Healthcare of Ontario Pension Plan launched a campaign targeting younger members of the Plan using language, tone, design and channels that were targeted to this segment.

Use plain and consistent language

Many pension plans and financial institutions use plain language messaging in their member or consumer-facing content. Plain language is not about excluding important information, or complex content. Rather, the focus is on making information easy to read and understand.

Two easy ways to ‘plain language’ your content are:

- avoiding technical terms, acronyms, and jargon

- breaking down complex pension terms into simple and commonly used words

Member statements and public-facing websites are the most natural places to adopt plain language because they contain information members are looking for and should understand. Depending on your membership, plans may consider offering basic information in other languages.

Best practices in plain language communication, include:

- short sentences

- definite, concrete, everyday words

- active voice to engage the reader

- complex information set out in tables or bullets, with headers and sub-headers

- no legal jargon or technical terms

- clear key messages or a call to action that is prominently displayed

- use simple examples to illustrate complex topics

How you can put this into practice

- Use relatable examples. When explaining how member benefits are calculated, use personas (fictional profiles) that represent a group with similar characteristics. This way people will be able to see how this relates to themselves, their co-workers and their families.

- Example: University Pension Plan uses personas in their member handbook to show how member benefits are calculated in a simplified way.

- Example: Healthcare of Ontario Pension Plan presents members with information about their plan using relatable examples and persons:

- Example: Healthcare of Ontario Pension Plan’s 2023 benefit improvement campaign uses plain language to communicate complex information to plan members.

- Example: OPB provides information to members planning for retirement in late career using plain language, clear headings, bulleted lists and links to more detailed information.

Structuring (tiering) information

How complex is the information you are trying to engage on? How much do your members already know about the topic? Structuring information takes these factors into account.

For example, you may provide basic information at the start of the member journey, moving to more detailed information closer to retirement. This approach provides the necessary level of detail when the member needs it and focuses on what members “need to know” at each stage to make well-informed decisions about their future. Members are more engaged with information they feel is relevant and meets them where they are.

Life events. A great way to put this into practice is to provide relevant information to plan members when major life events occur. Many pension administration platforms can flag upcoming key moments and decision points in advance, giving members sufficient time to plan and make decisions.

Benefit statements. Given that many members don’t read their annual statements and other communications thoroughly, plan sponsors and administrators may want to prioritize information provided to their plan members. You can do this by making the most relevant or important information the easiest to locate. This could mean prioritizing the first page of member communications on your website or mailed correspondence. Don’t forget to provide all mandatory disclosure requirements in your communications to ensure you remain compliant with the legislation. These requirements serve to protect plan members.

How you can put this into practice

- Hold an information session for new hires to explain how the plan works, their responsibilities / actions required, and who to contact with questions.

- Consider holding annual sessions as a refresher.

- For employers that have shift workers, schedule a session for each shift to make it convenient for employees to attend.

- Many employers see higher participation if food and refreshments are available at the sessions. And some employers extend these sessions to the members’ spouse for a more fulsome financial planning event.

- Consider offering one-on-one meetings for members who don’t feel comfortable asking questions in a group setting.

Just-in-time information & life events

Member engagement is more effective when done regularly. Consider distributing meaningful and relatable communications regularly.

A good time to start communicating with plan members is when they are just starting their careers and become new plan members.

Plan members’ information needs will differ based on where they are in their member journey. Significant life events or milestones provide opportunities to engage with a plan member. These are times when plan members can be more receptive to receiving information about their pension benefits and responsibilities.

People are more open to receiving communications about savings when:

- starting a job

- leaving a job

- when their benefits change

Did you know? For greater impact, contextualize your plan member communications. Communications are less impactful when focused on retirement and how much members need to save for retirement.

How you can put this into practice

- A member lifecycle infographic can help plan members easily visualize the different life events with direct links to information about that life event and how it affects their plan.

- Example: University Pension Plan’s member handbook uses a roadmap to illustrate a member’s journey. The roadmap hyperlinks to each relevant section of the handbook.

- Example: The Savings Highway is a concept created by Normandin Beaudry, as a way to flexibly manage a personal savings plan.

- Leverage member data. Data analytics can be used to tailor communications based on user transactions, age or life stage demographics. Data can be gathered from member surveys. These surveys tend to be more effective when conducted electronically because they capture true levels of employee engagement, and it can be more cost effective and efficient.

- Using personas may help members ‘see’ themselves and contextualize the events and decisions in a way that resonates with their own experiences.

Use multiple ways of communicating

Using multiple ways of communication can increase the effectiveness of your communication strategy. For example, using both traditional methods and digital or online methods. Administrators or plan sponsors should consider their membership and the context of other communication with employees and leverage existing tools.

When considering which tactics your plan might use, consider your audience and ask:

- Which channels are they more likely to access?

- What information is relevant to them?

Traditional tactics

Traditional communications tactics include:

- printed materials like booklets, brochures, newsletters, bulletin board notices

- in-person meetings or events like town halls, lunch and learns, one-on-one information sessions

- direct mail

Some of these approaches might resonate with certain member segments more than others.

Digital communications

Pension plans have been transitioning from paper-based communications to digital channels, such as websites, email, and social media platforms. Plan sponsors and administrators can use internal communications channels at the workplace and public facing social media platforms to encourage users to share ideas and thoughts in the form of text / blogs, videos / GIF, and images / infographics in an interactive way.

Internal workplace communications could be shared via a channel(s) on Teams or Slack. Public facing social media platforms include Facebook, Twitter, LinkedIn, YouTube, Instagram, or TikTok.

Digital channels can be cost-effective communication tools. They have the potential to reach large audiences since the majority of people now have electronic hand-held devices like smartphones or tablets. For example, providing pension and retirement savings information by email or text can reach larger audiences and allow messages to be customized, short and crisp.

If the pension plan is either union sponsored, or jointly sponsored with a union, use the union’s communicational channels, including social media channels to reach their membership.

Including a link to FSRA’s member-focused pages and resources can also help members receive neutral communications and promote confidence in the pension sector.

FSRA's policy (PE0123ORG - Electronic Communications Between Plan Administrators and Plan Beneficiaries) explains the PBA requirements relating to electronic communications between pension plan administrators and pension plan beneficiaries. Members should be given advance notice of electronic communications and the option to opt out if they prefer a paper format.

The Accessibility for Ontarians with Disabilities Act, 2005 (AODA) also sets out requirements for making public websites, web content, and web-based applications accessible for individuals with disabilities.

How you can put this into practice

Examples of tactics across a variety of channels:

- Live tutorials or information sessions on Zoom or Teams.

- Website updates, mailings, information pamphlets, annual Pension Statements and annual plan members’ meetings.

- Visual communications, including motion graphic animated videos and infographics.

- Social media could be an effective channel to disseminate information on retirement literacy and retirement planning

- Digital portals with easy-to-find segmented information.

- Add surveys to webpages to get real-time feedback on the usefulness of the content and guide future refinement.

- Digital tutorials and interactive education or decision-making tools where members can self-serve and receive valuable information at their own pace.

Resources for members on Financial Planning / Retirement Planning

Many plans have considered member-facing resources to help members make financial decisions or plan for their retirement. These resources can be passive – like brochures that members seek out on their own or certified financial planners on staff. Or they can be active – like webinars or outreach to members as they terminate from the plan or approach certain retirement milestones.

Some plans provide 1-on-1 financial planning for their members. Providing members with financial planning can help support members’ retirement planning goals. It can also help them better appreciate the value of their pension plan and how it fits as part of their overall financial wellness.

How you can put this into practice

- Example: As a supplement to the guidance Healthcare of Ontario Pension Plan provides to members at various life stages, their Expert Corner provides a space where industry experts share insights and tips online to help members learn about topics such as financial planning, retirement planning, taxes, budgeting, and more.

- Example: The Pension Collective is a group of individuals who communicate regularly through newsletters and events to educate on the foundations of retirement security and good pension plans, the current retirement landscape, research and more. This group is open to all individuals.

- Example: People for Pensions is an information program from OPTrust. It is designed to share information about the value that defined benefit pensions provide to retirees, workers, employers, Ontario's communities and the economy.

- Example: During the pandemic, OMERS began to provide virtual one-on-one member meetings so that individual members can sign up to speak to an expert about their plan. These sessions have become very popular and OMERS intends to continue them indefinitely.

Workplace champions and other audiences

An employer’s human resources (HR) team or dedicated contact can be the go-to person in the workplace for plan information. Empower them to speak confidently about the plan, and ensure they know where to refer staff, especially new hires, for more information.

A common source of information for plan members are other plan members. This is especially true among workplace peers who often share information informally. It is quite common for a member’s colleague or immediate supervisor to speak about their own or someone else’s experience with their pension plan anecdotally, which could lead to misinformation. It is important to strike the balance between relying on workplace champions and providing information through a well-informed source, such as the plan sponsor’s HR or a third-party provider.

Other audiences can also be used as an extension of the pension plan’s voice. Pension plans can engage with their employers, unions or settlors through one-on-one meetings, webcasts, newsletters and emails. Communications can be tailored for their employees and shared through intranets, other internal channels and social media.

When engaging with employers and stakeholders, plans can include research and statistics that show the direct benefit of offering a workplace pension plan to employees and their bottom lines, including attracting talent, employee retention and greater employee productivity.[2],[3]

How you can put this into practice

- To effectively communicate member-to-member plan sponsors may want to consider establishing an ambassador or champion program. These programs designate and train employees to promote the plan and its benefits to their colleagues.

- For unionized workers, pension plan administrators may encourage plan members to seek pension information from their collective bargaining units. This channel of communication is crucial considering that more than 70 per cent of unionized workers in Canada are enrolled in some type of pension plan.

- Pension advisory committees are another example of peer-to-peer information sharing. Generally, these structures are formed by active plan members and / or retirees and their main objectives are to promote engagement and improve overall retirement literacy.

- Some defined benefit plans have implemented programs designed to share information about the value that defined benefit pensions provide to retirees, workers, employers, and society at large.

- Pension plan administrators and sponsors may want to partner with Financial Planners or Advisors. These financial services professionals can speak directly with your members and help to spread and reinforce your message about the value of a pension.

- Example: OMERS plans a roadshow to take senior executives to various locations across Ontario to visit member workplaces to provide updates and answer questions about the plan. This gives members an opportunity to ask pointed questions of executives and executives get the opportunity to interact directly with members. These visits are organized through employers.

Evaluate your communications

To help ensure that your communications strategy is working, you will need to measure your progress. This will allow you to evaluate the success of your communications. Evaluating your communications strategy can also provide insights into how your message is received and identifying areas that may need to be adjusted.

You could also include member communication goals in your annual corporate goals or business plan as part of your social responsibility or ESG goals. This will help ensure your communications are evaluated at least once a year.

How you can put this into practice

Examples of metrics to monitor member engagement:

- email open rates and click rates

- web analytics, such as time spent on a web page

- number of views of your video

- number of plan members registered to your newsletter

- number of booklets or brochures distributed

- number of people attending townhalls or lunch and learns

- number of calls into your pension hotline and types of questions asked

- behaviour over time (e.g., members joining the plan, number contributing to the plan, level of contributions to the plan, actions at key life events etc.)

- periodic analytics reports or on-demand dashboards that can help track user behaviour and inform communication efforts

- Engaging directly with members through surveys and focus groups to better understand members’ needs and gauge the effectiveness of communication campaigns. Survey can range from a simple 1-2 questions sent by email after events or on a regular basis (e.g., annually, or quarterly).

Conclusions

Effective member communications are critical to educating plan members and enabling them to make well-informed decisions. To be successful, it is imperative to develop a strategic communications plan which will help you to:

- identify the various audiences

- develop key messages in plain language that are easy to understand

- establish a series of tactics tailored to the pension plan and its size, budget and available resources

- measure, evaluate and adjust as you go along

FSRA believes it is important for plan members to understand the value of their pension so they can make well-informed decisions today for tomorrow. It is important to influence people early in their careers. This gives them an opportunity to set themselves and their families up for success years down the road. Their future selves will thank you.

Effective engagement is not an easy task for plan administrators and sponsors. This is especially true for those with some of the smaller pension plans. FSRA hopes this Guide will provide some ideas and best practices that can be easily adopted and work well now and into the future.

Effective date and future review

This Guide became effective on February 13, 2023. It will be updated with additional examples over time.

About this Guidance

This document is consistent with FSRA’s Guidance Framework. As Information guidance, it describes FSRA’s views on certain topics without creating new compliance obligations for regulated persons.

Effective date: February 13, 2023

Last updated: December 20, 2023

[1] Skills in Canada: First Results from the Programme for the International Assessment of Adult Competencies (PIAAC)

[2] 2022 Canadian Employer Pension Survey

[3] The Value of a Good Pension - The Business Case For Good Workplace Retirement Plans