Contents

Executive summary

Introduction

Supervisory activities

Phase 1 desk reviews

Phase 2 desk reviews

Sanctioned practitioner reviews

Education for the sector on common supervisory findings

Annual Information Return (AIR)

Conclusion

Executive summary

The Financial Services Regulatory Authority of Ontario (FSRA) has key supervision objectives. These include promoting high standards of business conduct and protecting consumers’ rights and interests. FSRA regulates the billing practices of licensed Service Providers to help maintain fair and reasonable auto insurance rates for consumers. Service Providers are clinics providing medical, health and rehabilitation services, as well as providers of assessments and examinations.

Service Providers bill for their services through the Health Claims for Auto Insurance (HCAI) billing system and receive direct payment from insurers. All Service Providers must submit requests and billing for goods and services via HCAI, but only Service Providers licensed with FSRA can receive direct payments from insurers. FSRA’s oversight pertains to the business and billing practices of licensed Service Providers as they relate to auto insurance injury claims under the Statutory Accident Benefits Schedule (SABS).

It is important to note that in Ontario, regulated health professions are governed under the Regulated Health Professions Act and health profession Acts (e.g., Medicine Act, 1991). This legislative framework establishes health regulatory colleges, which regulate the professions in the public interest. Overseeing the standards of practice and quality of care provided by Regulated Healthcare Professionals (RHPs) falls under the supervision of the health regulatory colleges. Service Providers will have RHPs, overseen by health regulatory colleges for quality of care, and may also be a FSRA licensed Service Provider for its HCAI billing and business practices.

Having a licence with FSRA means that Service Providers may be subject to a compliance examination. FSRA’s process for selecting which licensees to examine emphasizes a risk-based approach. This risk-based approach may utilize indicators such as complaint data, licensing information, Annual Information Return (AIR) data, Health Claims Database (HCDB) data and sanctioned practitioner information.

During fiscal year 2021/2022 (April 1, 2021 - March 31, 2022) FSRA ran three review programs. The key outcomes are summarized below:

1. Phase 1 desk reviews

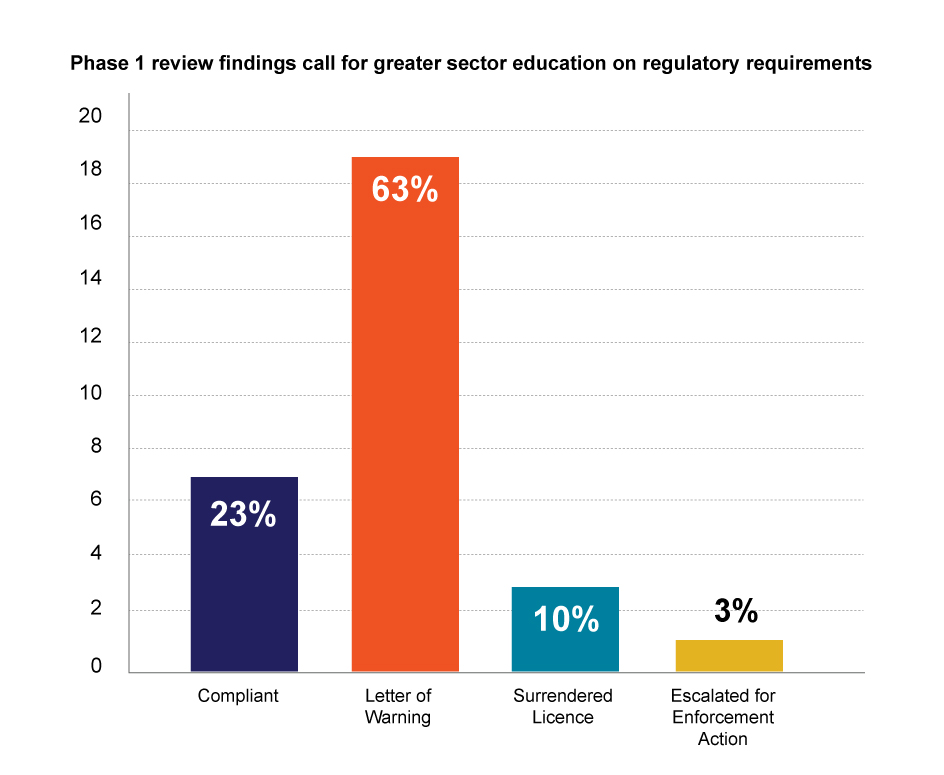

FSRA conducted 30 Phase 1 desk reviews. The program results found that:

- 7 licensed Service Providers were compliant with the reviewed criteria

- 19 licensed Service Providers were issued a letter of warning for failing to comply with regulatory requirements

- 3 licensed Service Providers did not complete the desk review and opted to surrender their licence

- 1 licensed Service Provider was escalated for enforcement action

2. Phase 2 desk reviews

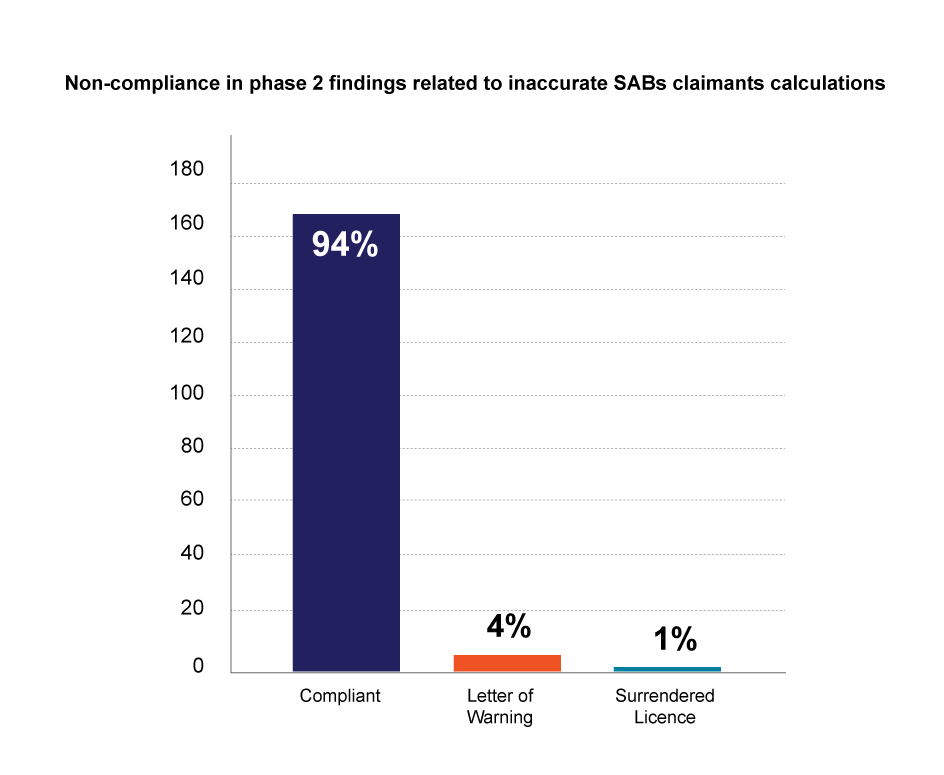

FSRA conducted 180 Phase 2 desk reviews. The program results found that:

- 170 licensed Service Providers were compliant with the reviewed criteria

- 8 licensed Service Providers were issued a letter of warning for failing to comply with regulatory requirements

- 2 licensed Service Providers did not complete the desk review and opted to surrender their licence

3. Sanctioned practitioner reviews

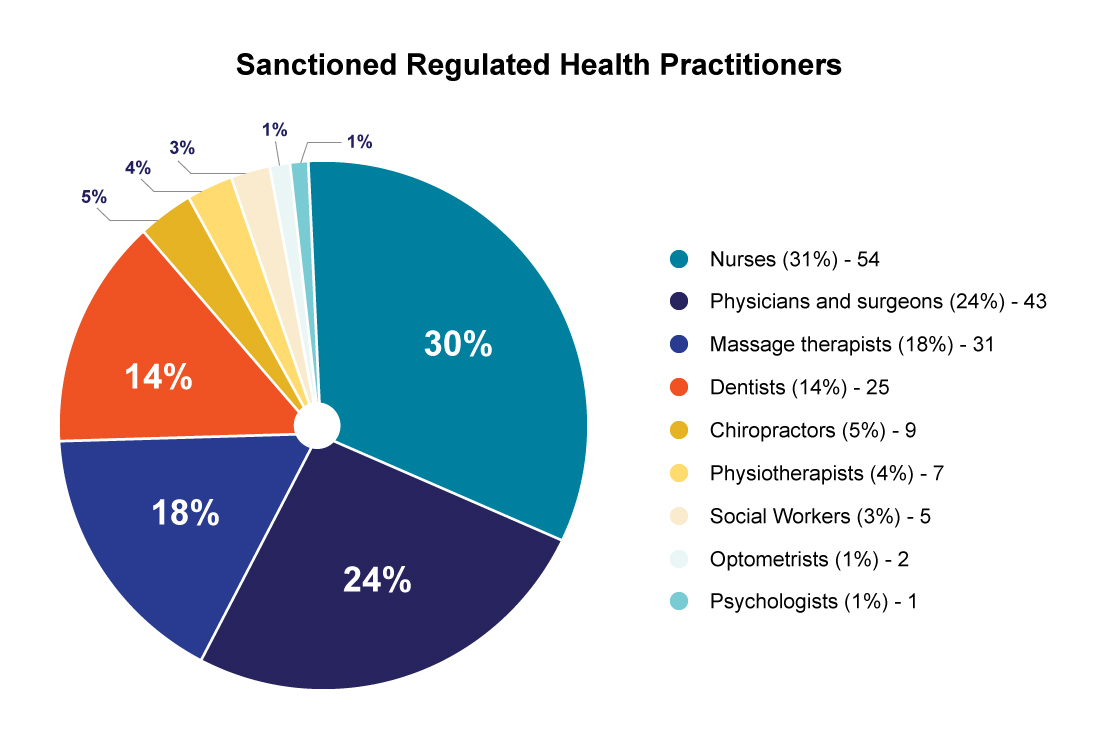

A sanctioned practitioner is a RHP who has been sanctioned by their health regulatory college. FSRA identified 177 individual sanctions that were placed against RHPs by their health regulatory colleges. Out of the identified sanctioned practitioners, 27 appeared on the HCAI roster of 90 licensed Service Providers.

FSRA identified Service Providers who were affiliated with a sanctioned practitioner. These Service Providers were examined for suitability in the HSP regime and investigated for unauthorized activity in HCAI. Our review found that there were no licensed Service Providers who billed using the credentials of a sanctioned practitioner.

AIR

In addition to the programs above, FSRA administers the mandatory Annual Information Return (AIR) survey for licensed Serviced Providers. In 2021/2022, FSRA revoked 169 Service Provider licences and suspended 59 licences for not filing the AIR and paying the annual regulatory fee for one or more years. These businesses are no longer able to receive payment directly from insurers.

FSRA’s supervisory activities in 2021/2022 fostered compliance and awareness in the sector to help reduce opportunities for fraud. FSRA recognizes that there is a need for increased sector awareness and education to ensure that Service Providers understand and comply with all regulatory requirements.

Introduction

FSRA is an independent regulatory agency that places a strong emphasis on improving consumer protection in Ontario.

Individuals who suffer an injury as a result of a motor vehicle accident may need to make an insurance claim to cover their health and rehabilitative expenses. FSRA licenses Service Providers, allowing them to receive direct payment from auto insurers for benefits claimed under the Statutory Accident Benefits Schedule (SABS). A licensed Service Provider is a business that provides goods and services to SABS claimants. Licensed Service Providers submit invoices on behalf of claimants through the Health Claims for Auto Insurance (HCAI) system and are paid directly by insurers. Service Providers are clinics providing medical and rehabilitation services, as well as providers of assessments and examinations. The Health Service Provider (HSP) sector consists of approximately 5,000 licensed Service Providers.

FSRA regulates the billing practices of Service Providers licensed by FSRA to help maintain fair and reasonable auto insurance rates for consumers. HCAI provides a mandatory and common platform for health care facilities to submit Treatment and Assessment plans (OCF-18), Treatment Confirmation Forms (OCF-23), and their associated invoices (OCF-21), as well as Assessment of Attendant Care Needs forms (Form 1) to auto insurers for review and adjudication. Service Providers who wish to be paid directly by auto insurers for specified listed expenses need to be licensed by FSRA. A Service Provider licence will authorize the business to receive direct payments from auto insurers for specific listed expenses. Unlicensed Service Providers must still submit all Ontario Claims Forms (OCF) through the HCAI system however, they are not able to receive direct payment from auto insurers. Individuals who receive care from a Service Provider licensed with FSRA benefit from the convenience of direct billing.

FSRA’s goals in the HSP sector:

- regulate and supervise Service Providers to ensure financial safety and fairness for Ontarians

- engage in dynamic principles-based and outcomes-focused regulation by monitoring and evaluating developments and trends

- promote honesty and credibility in the industry by deterring deceptive or fraudulent conduct, practices, and activities

The Unfair or Deceptive Acts or Practices (UDAP) Rule came into force on April 1, 2022. It replaces the previous UDAP Regulation and will facilitate improved outcomes by better protecting consumers from harm due to improper practices such as fraudulent or abusive conduct related to goods and services provided to a claimant. Service Providers that engage in a UDAP may be subject to investigation and sanctions from FSRA.

Licensed Service Providers are required to follow prescribed standards related to their business systems and practices. As part of its supervisory activities, FSRA oversees the billing practices and business systems and practices of licensed Service Providers.

This annual Health Service Provider Market Conduct Compliance Report provides the results of the supervisory work conducted in this sector over the last fiscal year (April 1, 2021 - March 31, 2022).

Supervisory activities

As part of its supervisory activities, FSRA reviews the conduct of licensed Service Providers related to SABS claims. FSRA’s supervision activities in 2021-2022 focused on fostering compliance and awareness in the HSP sector to help reduce fraud.

In 2021-22, FSRA utilized data available through the HCDB. Data transmitted through the HCAI processing system is scrubbed of any identifying personal information of claimants and is captured in the HCDB. FSRA leveraged this data to validate information reported in the Annual Information Return (AIR). FSRA also verified that licensed Service Providers did not use the credentials of a sanctioned practitioner while they were unauthorized to do so. Information reported in the AIR, and data captured in the HCDB, helped FSRA identify which Service Providers it considers to be higher risk.

During fiscal year 2021/2022, the HSP Market Conduct team conducted three supervision initiatives to address key issues in the HSP sector:

- phase 1 desk reviews

- phase 2 desk reviews

- sanctioned practitioner reviews

All reviews were conducted to enhance oversight and examine whether Service Providers were compliant with their regulatory requirements. Reviews were conducted through email and telephone exchanges. This allowed FSRA to carry out its supervisory duties while complying with government recommendations and directives resulting from COVID-19.

1. Phase 1 desk reviews

Phase 1 desk reviews were in-depth desk reviews of higher risk Service Providers. These reviews focused on obtaining information related to Service Providers’ policies and procedures. The reviews also focused on the submission of OCF forms, HCAI rosters and the roles and responsibilities of individuals affiliated with the clinic. FSRA conducted a total of 30 Phase 1 desk reviews during fiscal year 2021/2022.

Our risk assessment focused on licensed Service Providers who met one or more of the following criteria:

- the Service Provider’s HCAI roster included a sanctioned practitioner

- we received a referral from a FSRA Compliance Officer or Regulatory Discipline Officer

- the Service Provider was a top biller in 2020 and did not file their AIR (as of August 2021)

The findings from the 30 Phase 1 desk reviews are as follows:

- 7 licensed Service Providers were compliant with the reviewed criteria

- 19 licensed Service Providers were issued a letter of warning for failing to comply with regulatory requirements

- 3 licensed Service Providers did not complete the desk review and opted to surrender their licence

- 1 licensed Service Provider was escalated for enforcement action.

Common findings in this phase related to unsigned OCF-21 invoices, policies and procedures not established or sufficient and HCAI rosters being outdated or inaccurate. The predominance of warning letters in this phase indicates a need for better sector awareness and education. It is imperative that Service Providers understand all regulatory requirements related to their billing practices and business systems and practices.

2. Phase 2 desk reviews

FSRA conducted Phase 2 desk reviews to ensure that individuals who have suffered an injury as a result of a motor vehicle accident and make an insurance claim are treated fairly. This phase reviewed a higher number of Service Providers but was streamlined to reduce regulatory burden on licensees. FSRA focused on ensuring that Service Providers are billing auto insurers properly for benefits claimed under the SABS.

FSRA utilized data in the HCDB and AIR to focus on clinics who were providing virtual care during the pandemic.

Phase 2 desk reviews examined whether Service Providers who conducted virtual care appointments provided reasonable accommodations to SABS claimants and treated consumers fairly. In addition, we examined whether Service Providers were taking reasonable steps to ensure both paper and electronic records are secure and cannot be falsified. Lastly, we reviewed whether the total number of SABS claimants submitted in the Service Providers 2020 AIR adhered to the calculation method prescribed in the fee rule. Providing false, misleading or incomplete information to FSRA in the AIR is an offence under the Insurance Act.

Our risk assessment focused on licensed Service Providers who met one of the following criteria:

- the Service Provider attested in their AIR to conducting virtual care appointments during 2020

- the Service Provider billed at least $30,000 through HCAI in 2020

- the Service Provider’s overall billing increased during the pandemic (from 2019 to 2020)

The findings from the 180 Phase 2 Desk Reviews are as follows:

- 170 licensed Service Providers were compliant with the reviewed criteria

- 8 licensed Service Providers were issued a letter of warning for failing to comply with regulatory requirements

- 2 licensed Service Providers did not complete the desk review and opted to surrender their licence

All non-compliant findings in this phase related to Service Providers not adhering to the calculation method prescribed in the Fee Rule. FSRA found that the calculation of SABS claimants is an area that requires a stronger understanding to ensure compliance with regulatory requirements.

3. Sanctioned practitioner reviews

The HSP sector is a multifaceted sector where regulatory oversight is divided among numerous entities.

In Ontario, regulated health professions are governed under the Regulated Health Professions Act, 1991 (RHPA) and health profession Acts (i.e., Medicine Act, 1991). This legislative framework establishes health regulatory colleges, which regulate the professions in the public interest. Health regulatory colleges are responsible for ensuring that regulated health professionals (RHPs) provide health services in a safe, professional, and ethical manner. This includes setting and overseeing standards of practice and quality of care for the profession, investigating complaints about members of the profession and, where appropriate, disciplining them. Within this multifaceted sector, FSRA’s oversight pertains to the business and billing practices of licensed Service Providers related to auto insurance claims under the SABS.

Sanctioned Practitioner Reviews identify and review licensed Service Providers who are affiliated with RHPs who have been sanctioned by their health regulatory colleges. Sanctions placed against RHPs can result in either a suspension, revocation or restriction of their membership. While their licence is suspended or revoked a practitioner may not use their credentials to certify, provide or bill for specific listed expenses.

In 2021/2022, FSRA identified 177 individual sanctions against RHPs by their health regulatory colleges. Data was collected from information posted on each of the professional colleges’ websites. If a sanctioned practitioner appeared on a licensed Service Provider’s current HCAI roster, FSRA notified the Principal Representative of the disciplinary action taken by the health regulatory college. It is prohibited to submit documents, including any treatment plans and invoicing, to insurers via HCAI using the credentials of a healthcare provider whose license is revoked or suspended. Principal Representatives were reminded that they are obligated to ensure that their operations and systems of supervision comply with the law.

Our review found there were 90 licensed Service Providers who had a sanctioned practitioner listed on their current HCAI roster. All licensed Service Providers who were affiliated with a sanctioned practitioner were examined for suitability in the HSP regime. Service Providers were investigated for unauthorized activity in HCAI (e.g., inappropriate billings or invalid authorizations). We determined there were 27 individual RHPs listed on multiple HCAI rosters. FSRA determined there were no licensed Service Providers who billed using the credentials of a sanctioned practitioner.

As a result of FSRA’s review, all licensed Service Providers removed the sanctioned practitioner from their roster, if the sanction was still in effect. In instances where the sanctioned period had ended, an explanation was provided.

Our review confirmed that HSPs are complying with FSRA’s notification program and consumer’s benefits are not being used to pay for services provided by practitioners with a suspended or revoked license.

Education for the sector on common supervisory findings

To increase compliance and awareness in the HSP sector, FSRA is reminding sector participants of the following compliance requirements. Theses are the most common areas of non-compliance identified by FSRA in its 2021-22 reviews:

- OCF-21 invoices not signed

- policies and procedures not established or sufficient

- HCAI roster outdated/inaccurate

- incorrect calculation of SABS claimants

1. OCF-21 invoices not signed

Service Providers must always keep on file an original paper version, or an electronic true copy, of the OCF-21 that includes the authorized signature of the RHP and/or the ‘Authorized Signatory’. RHPs can designate an ‘Authorized Signatory’ to sign OCF-21s on their behalf provided their consent is given.

Service Providers should review Superintendent's Guideline No. 02/18 for further information related to recordkeeping.

2. Policies and procedures not established or sufficient

Service Providers are required to establish and implement policies and procedures that are appropriate to the nature and volume of their business related to statutory accident benefits. Policies and procedures must be designed to avoid the submission of false or misleading information to an insurer and to prevent the business from facilitating such activities by others. Policies and procedures set out the Service Providers business practice standards, promoting consistency and compliant practices. Communication of policies and procedures to all staff and providers involved in SABS billings also helps the business avoid facilitating or carrying out non-compliant practices.

Service Providers should review section 17 of O. Reg. 90/14 and create specific policies and procedures to address each aspect of the regulation.

3. HCAI roster outdated/inaccurate

Service Providers must keep their HCAI roster current. RHPs that are no longer working for the clinic must be removed and de-activated on the HCAI system within 10 days. Having an inaccurate HCAI roster creates an opportunity to misuse the credentials of a RHP and facilitate fraud.

Service Providers should review Superintendent's Guideline No. 02/18 for further details related to the requirement to maintain an accurate HCAI roster.

4. Incorrect calculation of SABS claimants

Service providers must ensure that all information reported in their AIR is correct, including the total number of SABS claimants. The total number of claimants submitted in the AIR must adhere to the calculation method prescribed in the Fee Rule.

Service Providers should review section 4.3 of the Fee Rule for further information related to how fees are calculated.

Annual Information Return

Filing the AIR is a legal requirement for all licensed Services Providers under Section 21 of Ontario Regulation 90/14 and Section 288.4 (5) of the Insurance Act. In 2021/2022, the AIR filing compliance rate improved to 87.5% compared to 71.5% the previous year. A total of 169 Service Provider licences were revoked, and a total of 59 licences were suspended for not filing the AIR and paying the annual regulatory fee for one or more years. These businesses are no longer able to receive payment directly from insurers for SABS claims.

Conclusion

The objective of FSRA’s supervisory activities in 2021/2022 was to foster compliance and awareness in the sector to help reduce opportunities for fraud. Consistent with this purpose, FSRA examined the billing practices and business systems and practices of licensed Service Providers and took action where necessary.

FSRA leveraged HCDB data to validate information reported in the AIR. FSRA also validated that licensed Service Providers are not billing using the credentials of sanctioned RHPs.

Licensed Service Providers are expected to understand and comply with the standards of practice prescribed in O. Reg. 90/14 under the Insurance Act. Service Providers are encouraged to familiarize themselves with the common supervisory findings from the 2021-22 reviews and ensure their business operations meet all legislative requirements. FSRA will continue to work with stakeholders to explore educational opportunities for the HSP sector to assist participants in ensuring they are compliant with all regulatory requirements.