Contents

About the annual information return

About the 2020 mortgage brokerages and administrators annual information return report

Key observations and FSRA supervisory priorities

Mortgage brokerages overview (infographics)

Volume of mortgages and lending sources

Non-bank lenders / alternative lending

Self-funding (brokerage’s, broker’s, or agent’s own funds)

Mortgage investment corporations

Non-qualified syndicated mortgages

Mortgage brokerages compliance with the MBLAA

Errors and omissions insurance

Mortgage administrators overview (infographics)

Administrators portfolio details

Mortgage administrators compliance with the MBLAA

About FSRA

The Financial Services Regulatory Authority of Ontario (FSRA) is an independent regulatory agency created to improve consumer and pension plan beneficiary protections in Ontario.

FSRA is self-funded and capable of responding to the dynamic pace of change in the marketplace, industry, and consumer expectations.

This report summarizes the information provided in the 2020 Annual Information Return (AIR) by licensed mortgage brokerages and administrators about their activities during the 2020 calendar year.

About the annual information return

The AIR collects information about mortgage brokering business volumes, practices, and internal controls for the previous calendar year.

Under the MBLAA, all licensed mortgage brokerages and administrators are required to file the AIR by March 31 of each year, for the previous calendar year, even if they did not do any business during that year. Mortgage brokerages and administrators that failed to file the AIR by the March 31, 2021 deadline may be subject to summary administrative penalties, or other regulatory enforcement action.1

The AIR filings help FSRA to obtain a better understanding of the mortgage brokering sector as a whole and to help assess mortgage brokerages’ and administrators’ overall compliance with the Mortgage Brokerages, Lenders and Administrators Act, 2006 (MBLAA), FSRA’s Guidance and Rules.

FSRA uses data from the AIR to inform consumer protection measures and pursues regulatory action where there is evidence of non-compliance.

FSRA may flag an entity for examination based on a risk assessment of data elements reported in the AIR. Where examination findings indicate instances of non-compliance, FSRA may take enforcement action as appropriate. Enforcement actions may include Letters of Caution, licence conditions, suspension, or revocation of a license and/or administrative monetary penalties. Repeated instances of non-compliance would result in progressive enforcement action.

All licensed mortgage brokerages and administrators must meet their legal requirements under the MBLAA. FSRA encourages licensed brokerages and administrators to visit the Mortgage Brokering section on FSRA’s website to learn more about their legal obligations.

About the 2020 mortgage brokerages and administrators annual information return report

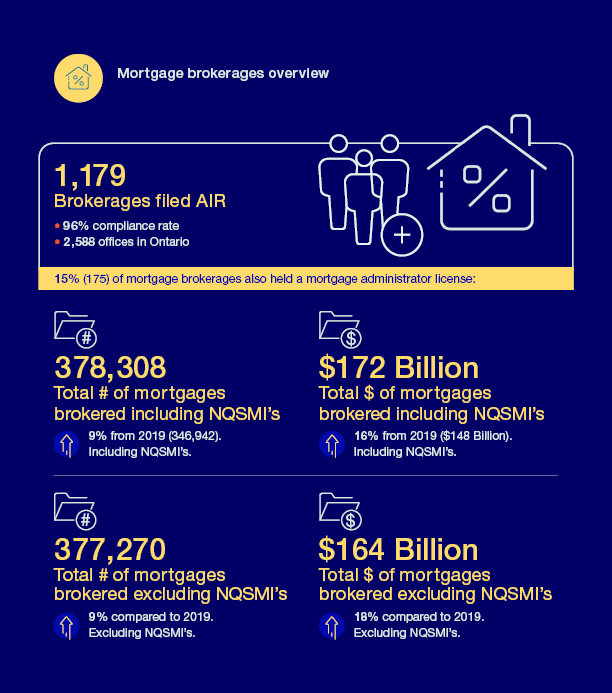

The 2020 AIR Report (“report”) includes data collected by FSRA on the business activities in the mortgage brokering sector during the 2020 calendar year. The report reflects responses from 1,179 mortgage brokerages and 205 mortgage administrators that filed their 2020 AIR. The compliance rate for filing was 96 per cent for mortgage brokerages and 91 per cent for mortgage administrators

This report provides an overview of the mortgage brokering market in Ontario in 2020, by providing data insights, highlights of market segments that FSRA is monitoring, and reported compliance with the MBLAA by mortgage brokerages and administrators.

The report can be used by licensees in the mortgage brokering sector to obtain data insights, identify the key highlights of FSRA-monitored market segments and information on compliance with the MBLAA by mortgage brokerages and administrators.

Key observations and FSRA supervisory priorities

Mortgage brokerages

Sources of lending

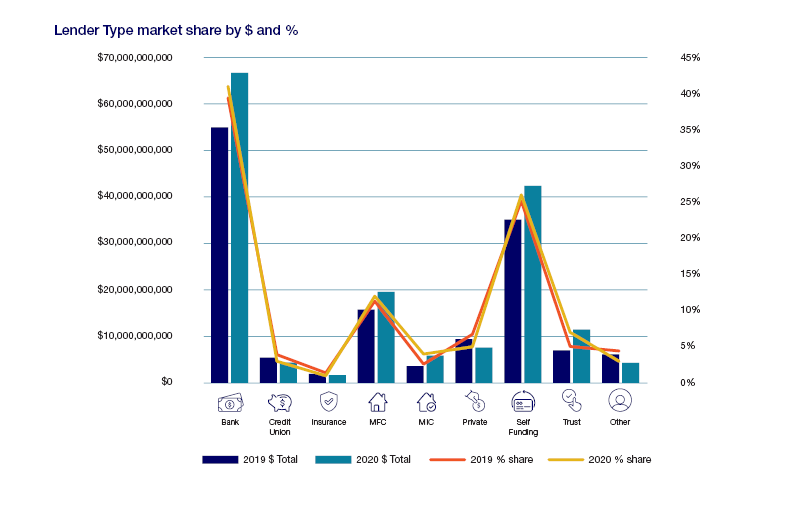

Multiple AIR data points show a growth in Ontario’s mortgage broker sector in 2020 compared to 2019. Bank lending increased by 14 per cent and maintained the position of the top single source of funding at 41 per cent.

Non-Bank / alternative lenders as a whole maintained 46 per cent of the total market share, virtually unchanged from their share in 2019.

From 2019, the value of mortgages funded by Mortgage Finance Companies (MFCs) and self-funded by brokerages both increased by more than 20 per cent; most of these mortgages were funded by large non-bank lenders that are licensed as mortgage brokerages. The value of funding by Mortgage Investment Corporations (MICs) increased by more than 60 per cent, and the value of mortgages funded by private lenders decreased by 19 per cent. 30 per cent of brokerages reported using MICs as a lender, virtually unchanged from the number in 2019. The number of brokerages who reported working with private mortgage lenders decreased from 52 per cent in 2019 to 44 per cent in 2020.

Although mortgages funded by MICs and private lenders are not a large proportion (8.2 per cent) of the total mortgage market, given their unregulated underwriting practices, FSRA’s supervision priorities for 2020-21 included a review of brokerages working with these alternative lenders. Relative to traditional bank lenders, these lenders are often more aggressive in their underwriting practices – e.g., issuing mortgages with higher loan-to-value or loan-to-income ratios – and they are more willing to lend to borrowers who are less financially resilient.2 FSRA will continue to monitor this segment as part of its 2021-2022 supervisory plans while ensuring that licensees are properly assessing the suitability of these alternative mortgages when recommending them to consumers.

Reverse mortgages

AIR data indicates a decrease from 2019 in the number, from 882 to 510, and total dollar value, from $243 million to $158 million, of reverse mortgages transacted via mortgage brokerages in 2020.

However, FSRA’s supervisory findings indicate that new industry entrants are offering mortgage products which meet the definition of a reverse mortgage under the MBLAA3. FSRA is continuing to monitor this segment and has worked with these entities to clarify regulatory requirements when dealing in Ontario.

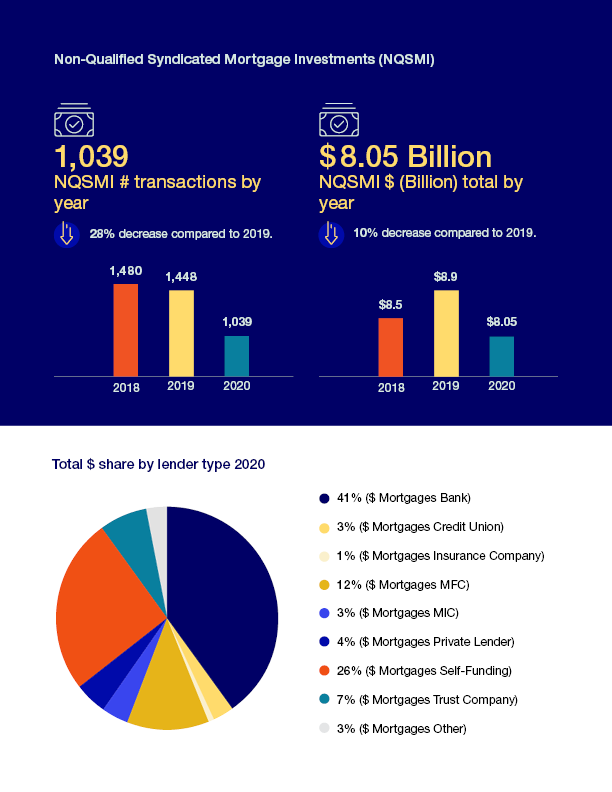

Non-qualified syndicated mortgage investments

Both the number and total dollar value of non-qualified syndicated mortgage investments (NQSMIs) decreased from 2019 by 28 per cent and 10 per cent, respectively, according to the 2020 AIR data, while the average individual NQSMI transaction value has increased by 26 per cent from 2019.

Effective July 1, 2021, the oversight of certain NQSMIs was transferred to the Ontario Securities Commission (OSC). Any new NQSMI transactions originated from July 1, 2021 onwards with Permitted Client investors/lenders fall under FSRA’s oversight, except where specific exemptions apply. Any NQSMI transactions with Non-Permitted Client investors/lenders fall under the OSC’s oversight.

Mortgage broker regulator’s council of Canada code of conduct

FSRA is pleased to see that greater than 80% of brokerages were aware of the Mortgage Broker Regulator’s Council of Canada (MBRCC) Code of Conduct (The Code) at the time of filing. The Code is now incorporated into FSRA’s Supervisory Framework.4

The Code promotes high standards of business conduct to protect consumers of mortgage brokering services. The principles of the Code largely correspond to existing conduct requirements in the Mortgage Brokerages, Lenders and Administrators Act, 2006 (MBLAA) and its regulations. The Code includes conduct standards required under the MBLAA and complementary practices for consumer protection.

Mortgage administrators

In 2020, the AIR data reported a 10 per cent increase in the number of mortgage administrators, an 8 per cent increase in the number of mortgages under administration (814,470), and a 6 per cent increase in the dollar value of mortgages under administration to $307.3 billion compared to 2019.

Mortgage administrators have responsibilities under MBLAA to keep investors informed of the performance of their mortgages. They must monitor circumstances that could impact mortgage performance, such as significant changes in risk to the underlying property and subsequent encumbrances on the property5. FSRA will continue its monitoring of mortgage administrators to ensure they are complying with their regulatory duties.

A mortgage administrator plays a critical role, especially when a mortgage is higher risk (e.g., construction financing) or complex (e.g., NQSMIs) and the investor is unsophisticated.

On May 10, 2020, FSRA released Interpretation Guidance which provides FSRA’s interpretation of mortgage administrators’ obligations under the MBLAA, to ensure the protection of investors and lenders.

Mortgage brokerages overview

Non-Qualified Syndicated Mortgage Investments (NQSMI)

Volume of mortgages and lending sources

The 2020 AIR data revealed the following about volume of mortgages and sources of funding in Ontario: Except where indicated, all numbers and figures exclude Non-Qualified Syndicated Mortgages

- the total number of mortgages arranged increased by 9 per cent to 377,270 from 345,514 in 2019

- the number of residential mortgages arranged increased by 10 per cent to 372,164 from 339,659 in 2019

- the number of commercial mortgages arranged increased by 3 per cent to 4,833 from 4,682 in 2019

- the number of other mortgages arranged decreased by 77 per cent to 273 from 1173 in 2019

- the number of reverse mortgages decreased by 42 per cent to 510 from 882 in 2019

- the total dollar value of mortgages arranged increased 18 per cent to $164 billion from $139.5 billion in 2019

- the dollar value of residential mortgages arranged increased by 21 per cent to $132.4 billion from $109 billion in 2019

- the dollar value of commercial mortgages arranged increased by 4 per cent to $29.8 billion from $28.6 billion in 2019

- the dollar value of other mortgages arranged decreased by 1 per cent to $1.781 billion from $1.798 billion in 2019

- the dollar value of reverse mortgages decreased by 35 per cent to $158 million from $243 million in 2019

| Mortgage type | Percentage of total number of mortgages | Percentage of total dollar value of mortgages |

|---|---|---|

| Bank | 40.4% | 40.6% |

| Credit union | 2.2% | 2.7% |

| Insurance Company | 0.1% | 1.0% |

| Mortgage Finance Company | 12.9% | 11.9% |

| MIC | 3.2% | 3.6% |

| Private lender | 4.3% | 4.6% |

| Self-funding | 31.1% | 25.9% |

| Trust company | 4.9% | 7.0% |

| Other | 0.9% | 2.6% |

Lender Type market share by dollar value and percentage

- Banks funded the largest share of brokered mortgages, representing 40.6 per cent ($66.6 billion) of the total dollar value of mortgages and 40.4 per cent (152,524) of the total number of mortgages.

- The second-largest lender category was Self-Funding6, representing 25.9 per cent ($42.39 billion) of the total dollar value of mortgages and 31.1 per cent (117,257) of the total number of mortgages. These lenders are licensed mortgage brokerages that engage in mortgage lending using their own funds. The top three large non-bank lenders made $37.25 billion or 88 per cent per cent of mortgages by dollar value in this category.

- The third-largest lender type was Mortgage Finance Companies (MFCs)7, which funded 11.9 per cent ($19.57 billion) of the total dollar value of mortgages and 12.9 per cent (48,853) of the total number of mortgages.

Non-bank lenders / alternative lending

Non-bank lenders8 are an alternative lending source providing mortgages to consumers through the mortgage brokering sector.

FSRA collects information about alternative lending through the AIR. Brokerages report their use of non-bank lenders, which are categorized in the AIR as follows: Mortgage Finance Companies, Self-funding (licensed mortgage brokerages funding their own mortgages), Mortgage Investment Corporations, and Private Lenders.

Mortgage finance companies

Mortgage Finance Companies (MFCs) were introduced as a category of non-bank lenders in the 2019 AIR. Prior to 2019, FSRA observed that mortgage brokerages reported funding through MFCs across various lender categories (i.e., not reported consistently in one category of lender). The addition of MFCs as a distinct lender category will support a better understanding of MFC lending in the market.

In 2020, MFCs funded $19.57 billion in mortgages, an increase of 24 per cent from $15.78 billion funded in 2019. The number of mortgages funded by an MFC increased by 15 per cent, from 42,333 in 2019 to 48,853 in 2020.

MFC funded mortgages represented 12.9 per cent of the total volume of mortgages transacted and 11.9 per cent of the total dollar value of all mortgages in 2020.

Self-funding (brokerage’s, broker’s, or agent’s own funds)

Mortgages that were self-funded by a licensed brokerage, broker, or agent within the brokerage itself represented approximately 25.9 per cent ($42.39 billion) of the total dollar value of mortgage transactions reported by mortgage brokerages.

The number of mortgage brokerages that reported they self-funded a mortgage decreased by 2 per cent to 135 in 2020 from 138 in 2019.

During the same period, the number of self-funded mortgages increased by 6 per cent to 117,257 while the total dollar value increased by 21 per cent to $42.39 billion from $35.09 billion in 2019.

Mortgage Brokerages provided the names of the top three Self-Funding lenders they used to fund mortgages. Analysis of the names reported by mortgage brokerages indicate that 88 per cent of the dollar value of mortgages in the Self-Funding category were by large non-bank lenders that are licensed brokerages themselves

Individual licensed mortgage brokers and agents funded 823 mortgages totaling $143 million to make up the remaining 0.34 per cent of mortgages in the self-funding category.

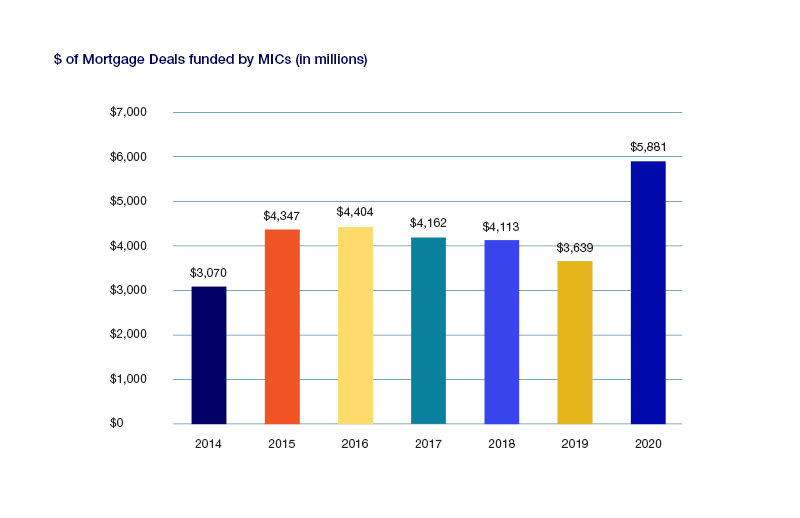

Mortgage investment corporations

Mortgage investment corporations (MICs) funded 11,971 mortgages valued at approximately $5.9 billion or 3.6 per cent of the total dollar value of mortgage transactions reported by mortgage brokerages.

The number of mortgage brokerages that reported using a MIC as a lender increased by 1.7 per cent to 358 from 352 in 2019.

During the same period, the number of mortgages funded by MICs increased by 27 per cent to 11,971, while the total dollar value increased by 62 per cent to $5.89 billion from $3.6 billion in 2019.

$ of Mortgage Deals funded by MICs (In Billions)

Though MICs have a relatively small share of the mortgage market, year over year activity increased sharply in both number of mortgages funded and total dollar value further outlining the continued interest in alternative source of funding offered by MICs.

Mortgage Brokerages provided the names of the top three MICs that they used to fund mortgages. Analysis of the names indicate that there were more than 220 different MICs that funded mortgages in 2020.

Mortgage brokerages reported there was a relationship between the MIC and the mortgage brokerage, broker, or agent on 62 per cent of MIC transactions by the top three lenders.

| Relationship of MIC to brokerage | Percentage | # of MIC Mortgages (top three lenders reported by mortgage brokerages) |

|---|---|---|

| Arm’s Length | 38% | 3,827 |

| Related Entity | 62% | 6,158 |

Brokerages that had relationships with and/or were managing a MIC:

- 7 per cent of mortgage brokerages (85) reported that their principal broker, director or officer had equity interest in a MIC

- 6 per cent of mortgage brokerages (71) reported that their principal broker, director or officer held a management role within a MIC and 36 of these brokerages reported that the MIC was fully managed by the principal broker

Private lenders

Private lenders9 funded 16,123 mortgages valued at approximately 4.6 per cent of the total dollar value ($7.59 billion) of all mortgage transactions reported by mortgage brokerages.

The number of mortgage brokerages that reported using a private lender decreased by 12.6 per cent to 521 from 596 in 2019.

During the same period, the number of mortgages funded by a private lender decreased by 23 per cent from 21,045 in 2019 to 16,123 in 2020 while the total dollar value decreased by 19 per cent to $7.59 billion from $9.40 billion in 2019.

Mortgage brokerages provided the names of the top three Private Lenders that they used to fund mortgages. Analysis of the names indicate there were more than 900 private lenders that lent money on mortgages through a mortgage brokerage in 2020. These private lenders can be categorized into individual persons, and non-individuals.

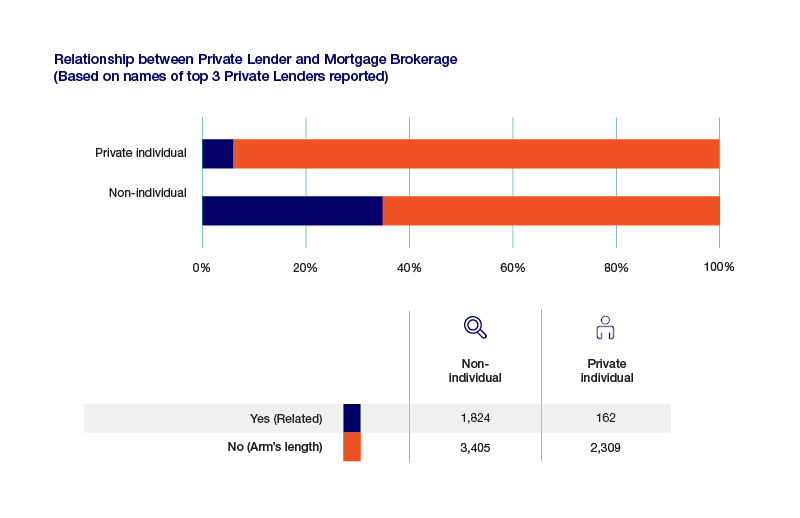

Relationship between Private Lender and Mortgage Brokerage (Based on names of top 3 Private Lenders reported)

Disclosure of relationships and potential conflicts of interest

The 2020 data indicates that a portion of mortgage brokerages reported a relationship / interest with the MICs and private lenders they work with, which could result in a conflict of interest. FSRA reminds brokerages, brokers, and agents of the requirements of the MBLAA to disclose any actual or potential conflicts of interest in connection with a mortgage, or trade in a mortgage, that a brokerage presents for consideration to a borrower, lender, or investor. Where conflicts of interest exist, FSRA expects, as a best practice, that brokerages, brokers, and agents manage them properly to put consumers’ interests ahead of their own and to ensure compliance with their duties under the Concurrent Business provision in section 56 of Ontario Regulation 188/08.

Non-qualified syndicated mortgages

4.8 per cent of mortgage brokerages (57) reported transacting in 1,039 non-qualified syndicated mortgages, representing approximately 5 per cent ($8.05 billion) of the total dollar value of all mortgage transactions reported for the year.

The top 15 brokerages transacting in non-qualified syndicated mortgages arranged 87 per cent ($6.96 Billion) of all non-qualified syndicated mortgages by dollar amount.

Of the brokerages transacting in non-qualified syndicated mortgages, 63 per cent of brokerages (36) reported transacting exclusively in non-qualified syndicated mortgages and arranged approximately 69 per cent ($5.5 billion) of all non-qualified syndicated mortgages.

- the total number of non-qualified syndicated mortgages arranged decreased by 28 per cent to 1,039 from 1,448 in 2019

- the total dollar value of non-qualified syndicated mortgages arranged decreased by 10 per cent to $8.05 billion from $8.9 billion in 2019

- the average individual transaction value of an NQSMI increased 25.9 per cent to $7.746 million in 2020 from $6.154 million in 2019

Note: Effective July 1, 2021, the oversight of certain Non-qualified Syndicated Mortgage Investments (NQSMI) was transferred to the OSC. Any new NQSMI transactions (based on the new definition in O. Reg. 188/08) originated from July 1, 2021 onwards, with Permitted Client investors/lenders falling under FSRA’s oversight except where specific exemptions apply. Any NQSMI transactions with Non-Permitted Client investors/lenders fall under the OSC’s oversight. This new framework applies to any renewals of NQSMIs originated before July 1, 2021 (Legacy NQSMIs), which will be considered new NQSMI transactions once the NQSMI is renewed.

Subsection 6.3 of the FSRA Fee Rule, which required Form 3.2 to be filed and a $200 fee paid, is no longer in effect as at July 1, 2021.

Please refer to FSRA Guidance on the Supervision Approach for Non-Qualified Syndicated Mortgage Investments with Permitted Clients and Legacy Non-Qualified Syndicated Mortgage Investments (MB0041APP) effective July 1, 2021 and the FAQ available on the SMI Resource Syndicated Mortgages Investments resources webpage for more information.

Mortgage brokerages compliance with the MBLAA

Errors and omissions insurance

Under the MBLAA, each mortgage brokerage must have Errors and Omissions (E&O) insurance to protect the brokerage, brokers and agents from acts arising from the business of dealing, trading or lending in mortgages (such as negligence, misrepresentation, or fraud). The coverage must be a minimum of $500,000 per occurrence and $1 million for all occurrences in a year and must be provided by a FSRA-approved insurer.

- 26 per cent of mortgage brokerages (308) had E&O insurance coverage greater than $2 million for all occurrences

- 1.3 per cent of mortgage brokerages (15) reported a total of 22 E&O claims made against the brokerage itself or the brokerages’ brokers and agents – a decrease from the 2.8 per cent of mortgage brokerages (32) that reported a total of 55 E&O claims made against the mortgage brokerage itself or the brokerages’ brokers and agents in 2019

Supervision of operations

Mortgage brokerages reported a variety of methods used to supervise their brokers and agents:

- onsite supervisor / manager (89%)

- remote supervision (41%)

- policies and procedures / best practices (96%)

- file review / audits (94%)

- regular meetings (86%)

- training/support (by phone/email/fax/online) (74%)

- in-person training / support (78%)

- individual performance reviews of agents/brokers (77%)

- other (12%)

For brokerages that have only the principal broker licensed under the brokerage, some of the supervision methods above may not apply. Not applying one of the above methods in isolation does not indicate inadequate supervision.

Mortgage brokerages are required to organize their operations in a way that facilitates adequate supervision of their mortgage brokers and agents to ensure they are compliant with all regulatory requirements in the MBLAA.

Principal brokers are required to carry out their responsibility to ensure the brokerage, and each broker and agent within the mortgage brokerage, is authorized to deal or trade in mortgages on the mortgage brokerage’s behalf, complies with the MBLAA and its regulations, and receives adequate supervision.

The principal broker is also responsible for regularly reviewing the mortgage brokerage’s policies and procedures and updating them to include changes in legislation or new market conditions, or to address deficiencies identified through internal compliance reviews and complaint handling. Greater than 99 per cent of brokerages reviewed and updated their policies and procedures as necessary in 2020.

Disruptions caused by the COVID-19 pandemic and the subsequent requirements to work remotely heightened the responsibilities of principal brokers to adequately supervise and support agents and staff. Many of the methods listed above were facilitated through tools and policies that allowed for remote supervision and training, including scheduled online meetings, electronic file reviews, and online and telephone coaching.

Licensing suitability

The AIR questionnaire requests information from mortgage brokerages which assists FSRA in determining suitability for licensing. From this data FSRA is reporting that:

- seven mortgage brokerages reported that a complaint was made against the brokerage to a regulatory body for allegations of fraud, theft, deceit, misrepresentation, or forgery

- two mortgage brokerages reported that the brokerage was fined or had a monetary penalty imposed on it by a Canadian financial services regulator other than FSRA

- two mortgage brokerages reported that the brokerage was subjected to a charge laid under the law in a Canadian province or territory

- five mortgage brokerages reported a licence they held from another regulatory body/professional organization was revoked or suspended

- 42 mortgage brokerages reported the brokerage was named in a lawsuit (Statement of Claim, Counterclaim, or Third-party Claim)

Referrals

In the 2020 AIR, mortgage brokerages reported the following referral activities to other brokerages, and payment for referrals received from other brokerages:

Referrals made

- 8.6 per cent of mortgage brokerages (102) reported making a total of 1,318 referrals to other brokerages

Referrals received

- 9.3 per cent of mortgage brokerages (110) reporting they received a total of 3,574 referrals from other brokerages

Simple referrals received

- 4 per cent of mortgage brokerages (46) reported receiving a total of 7,121 simple referrals from unlicensed entities

- the average compensation paid for each simple referral was $462

A simple referral is the provision of only the name and contact information to a prospective lender or borrower. The person or entity that provides the contact information (referral) does not need to be licensed under the MBLAA.

While payment to individuals and/or entities that provide a simple referral is permitted under the MBLAA, FSRA reminds brokerages, brokers and agents that, if they are paying or receiving referral fees in the course of their business, they must comply fully with subsections 44(1) and 44(2) of Ontario Regulation 188/08 and sections 1 and 2 of Ontario Regulation 407/07.

Administrators portfolio details

The 2020 AIR data revealed the following about sources of funding and volume of mortgages in Ontario (all numbers and figures include Non-Qualified Syndicated Mortgages):

- 27 per cent of mortgage administrators (55) reported that they administered non-qualified syndicated mortgages.

- 28 per cent of mortgage administrators (57) reported that they operated a Mortgage Investment Corporation (MIC) during the reporting period. This percentage represents a marginal increase from the 27 per cent reported in the 2019 AIR.

- 28 per cent of mortgage administrators (55) reported that they conducted other types of business from their premises. Examples of other types of businesses included mortgage brokerage, real estate brokerage, law practice, accounting office, and MIC.

| MA operated Mortgage Investment Corporations (MIC) during the reporting period: | Totals |

|---|---|

| # MIC mortgages administered | 8,213 |

| $ MIC mortgages administered | $ 4,655,814,228 |

| # of different MIC lenders | 201 |

| MA administered private mortgages during the reporting period: | Totals |

| # of private mortgages administered | 9,131 |

| $ of private mortgages administered | $ 18,569,457,578 |

| # of different private lenders | 5,271 |

Mortgage administrators compliance with the MBLAA

Errors and omissions (E&O) insurance

Under the MBLAA, each mortgage administrator must have Errors and Omissions (E&O) insurance, to protect the administrator from any claims that may arise from the business of administering mortgages (such as negligence or fraud). The coverage must be a minimum of $500,000 per occurrence and $1 million for all occurrences in a year and must be provided by a FSRA-approved insurer.

- 100 per cent of mortgage administrators (205) had the minimum mandatory E&O insurance coverage amounts.

- 23 per cent of mortgage administrators (47) had E&O insurance coverage greater than $2 million for all occurrences.

Financial guarantees

Mortgage administrators must maintain a financial guarantee at all times in an amount equal to $25,000. This guarantee may be unimpaired working capital or another form of financial guarantee acceptable to the FSRA Chief Executive Officer. Mortgage administrators may face regulatory action for failure to comply with the $25,000 financial guarantee requirement, or for repeat infractions of not meeting the requirement at all times.

- greater than 99.5 per cent of mortgage administrators (204) who filed their AIR reported that they complied with maintaining the $25,000 requirement

Trust accounts

If trust funds are managed, mortgage administrators are required to maintain a trust account to hold money received from a borrower or lender in connection with the administration of a mortgage.

- 4 per cent of mortgage administrators (9) reported they did not have a trust account as required under the MBLAA, primarily because they did not manage trust funds during the reporting period

Licensing suitability

The AIR questionnaire requests information from mortgage administrators which assists FSRA in determining suitability for licensing. From this data FSRA is reporting that:

- one mortgage administrator reported that a complaint was made against the administrator to a regulatory body for allegations of fraud, theft, deceit, misrepresentation, or forgery

- one mortgage administrator reported that the administrator was fined or had a monetary penalty imposed on it by a Canadian financial services regulator other than FSRA

- one mortgage administrator reported that the administrator was subjected to a charge laid under the law in a Canadian province or territory

- two mortgage administrators reported a licence it held from another regulatory body / professional organization was revoked or suspended

- 12 mortgage administrators reported the administrator was named in a lawsuit (Statement of Claim, Counterclaim, or Third-party Claim)

Appendix

- Appendix data [XLSX]

1 In 2021, 69 brokerages were sent a Letter of Caution because of the late filing of their AIR. Further regulatory action will be taken against non-filers and repeat late and non-filers.

2 Mortgage brokering sector Supervision Plan 2021-22

3 Subsection 29(2) of Ontario Regulation 188/08, Mortgage Brokerages: Standards of Practice.

4 FSRA MBRCC Code of Conduct Guidance

5 Mortgage Administrators – Responses to Market Disruptions

6 Mortgages that were self-funded by a licensed brokerage, broker, or agent within the brokerage itself.

7 A Mortgage Finance Company is a non-depository financial institution that underwrites and services mortgages sourced through brokers.

8 “Non-bank lenders” is the simplified term used to replace “Non-Bank Financial Intermediaries”, the term used in previous AIR Reports.

9 Private lenders are individuals or non-individuals that lend money working through a mortgage brokerage, as required under the MBLAA.